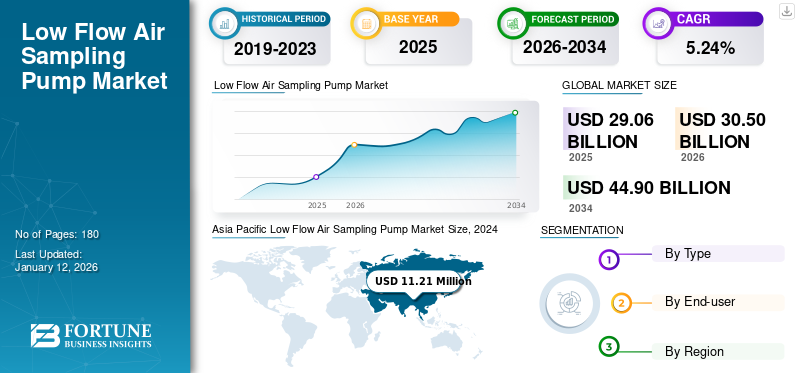

Low Flow Air Sampling Pump Market Size, Share & Industry Analysis, By Type (Portable and Personal), By End-user (Industrial Manufacturing, Health Industry, Environment Industry, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global low flow air sampling pump market size was valued at USD 27.70 million in 2024. The market is projected to grow from USD 29.06 million in 2025 to USD 41.55 million by 2032, exhibiting a CAGR of 5.24% during the forecast period. Asia Pacific dominated the low flow air sampling pump market with a share of 40.46% in 2024.

Low flow air sampling pumps are portable instruments used in environmental monitoring and occupational hygiene that draw air at a regulated, low rate through a filter or sorbent tube to gather airborne pollutants for further analysis. The market growth is driven by increasing environmental pollution concerns and occupational safety laws, as well as technology developments that result in pumps that are more accurate, portable, and easy to use.

SENSIDYNE is the leading player in the market. It is known for its continuous monitoring equipment and precise low-flow air sampling pumps. Their GilAir Plus and BDX series pumps are known for their advanced design, accurate flow control, and data logging features, making them suitable for industrial hygiene applications.

MARKET DYNAMICS

MARKET DRIVERS

Strict Occupational Health and Safety Regulations Drive Demand for the Product

Government and regulatory agencies globally are implementing stricter regulations for workplace air quality monitoring. Employers are required to adhere to these rules to evaluate and manage team member’s exposure to airborne particles, gases, and vapors on a regular basis. Low flow air sampling pumps are crucial instruments used for precisely quantifying these pollutants, guaranteeing adherence to allowable exposure limits (PELs), and safeguarding the health and safety of employees. Different players are investing in dependable air sampling equipment as non-compliance with these regulations can lead to legal repercussions and reputational damage. These factors have driven the low flow air sampling pump market growth in recent years.

- For instance, in October 2023, the European Agency for Safety and Health at Work (EU-OSHA) launched a new campaign called "Safe and Healthy Work in the ‘Digital Age’ to focus on managing workplace risks associated with digitalization, such as the need for better monitoring and assessment of exposure to new airborne hazards in digitalized environments.

MARKET RESTRAINTS

High Initial Cost and Maintenance Expenses to Hamper the Market Growth

For smaller organizations, high-quality pumps with sophisticated features, including data logging, automated flow control, and intrinsic safety, can be costly. In addition, to ensure accuracy and dependability, low flow air sampling pumps need to be calibrated frequently by changing filters and doing repairs. For some customers, the expenses might become a major financial burden over time. Due to this expense, some businesses may put off buying new equipment or choose less expensive options that can compromise accuracy or dependability.

MARKET OPPORTUNITIES

Technological Developments in Wireless Communication and Miniaturization Offers a Lucrative Opportunity for the Market

The market for low flow air sampling pumps is expanding significantly due to technological advancements. Pumps that are smaller, lighter, and more portable can be developed by miniaturization, which improves worker comfort and output. Real-time data transfer, remote monitoring, and smooth integration with cloud-based data management systems are possible through wireless communication, such as Bluetooth or Wi-Fi. These developments expedite processes, increase data accuracy, and speed up decision-making. The incorporation of sensors with higher specificity and sensitivity further improves the capabilities of these pumps.

- In September 2023, Casella launched the Vortex3 Pro Air Sampling Pump, which demonstrates the trend of miniaturization and wireless integration in the air sampling pump market. It has improved data logging capabilities, bluetooth connectivity and has a more compact design.

LOW FLOW AIR SAMPLING PUMP MARKET TRENDS

Reducing Sample Variation and Enhanced Automation are the Current Markert Trends

The recent advancements in the low flow air sampling pump, such as improving the sensitivity and reducing the sample variation, are becoming quite popular. The integration of micro-electro-mechanical systems (MEMS) in these pumps makes them ideal for monitoring air quality in diverse environmental conditions. Also, machine learning (ML) algorithms are used to process the data from MEMS sensors, leading to accurate and reliable measurements. In addition, advanced analytical techniques with time-of-flight mass spectrometry, thermal desorption (TD), and low flow sampling rate air samplers have become quite popular.

- For instance, Geographic Information Systems (GIS) are being implemented in the low flow air sampling pumps to analyze the data from a network of samplers. This allows for better prediction of inoculum dispersal and source identification.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Portable Pumps Dominate the Market Owing to their Adaptability and Wide Range of Applications

Based on type, the market is classified into portable and personal.

Portable pumps dominate the market owing to their adaptability and broader range of uses, which include monitoring industrial hygiene in various contexts and evaluating indoor air quality. Their ability to sample in different locations and independence from stationary power sources are a few other factors that make them viable for a variety of sampling requirements.

For personal low flow air sampling pumps, demand is increasing as worker safety and occupational health laws increase. As industries place a higher priority on precise and representative data on team member inhalation dangers, demand is being driven by personal pumps, which are specifically made for individual worker exposure monitoring.

By End-user

Environmental industry Leads the Market Due to Supportive Government Programs and Initiatives

Based on end-users, the market includes Industrial manufacturing, health industry, environment industry, and others.

The environment industry leads the market, propelled by government programs encouraging pollution control and remediation activities, growing environment health and safety rules emphasizing air quality monitoring, and increased public awareness of the health effects of air pollution.

Industrial manufacturing is the second leading end-user. In the industrial sector, air sampling is used to monitor exposure to hazardous compounds and for adherence to occupational health standards due to worker safety requirements and concerns. Key elements include maintaining a healthy working environment and preventing occupational diseases.

In the health industry, to preserve sterility and safeguard patients and demand from healthcare industry personnel, airborne pollutants are monitored in hospitals, labs, and pharmaceutical plants. It is essential to maintain air quality in delicate areas and stop the development of infectious diseases. This has led to an increase in demand for low flow air sampling pumps in the healthcare sector.

Low Flow Air Sampling Pump Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

Asia Pacific Low Flow Air Sampling Pump Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

In North America, the market share is growing steadily owing to strict occupational health and safety laws, especially in sectors such as manufacturing, mining, and construction, which are major drivers of the market. The market in this region is highly competitive, with major manufacturers concentrating on innovation and adherence to new environmental standards.

In the U.S., these pumps are widely used owing to the rapid growth in the industrial and manufacturing sectors. For instance, industries, namely manufacturing, chemicals, and pharmaceuticals, have shown increased demand for low flow air sampling pumps as they help in monitoring the worker's exposure to hazardous environments.

Europe

The market in the Europe region has shown significant growth owing to increasing awareness of worker exposure to dangerous substances, including asbestos and volatile organic compounds (VOCs), which is a major factor leading to the market growth in the region. The Carcinogens and Mutagens Directive is constantly updated and revised by the European Commission, which has an impact on monitoring procedures and, consequently, the use of suitable air sampling technology. For instance, in October 2023, the European Commission unveiled the fourth update of the carcinogens and mutagens directive. This update further restricts the use of hazardous substances in the workplace and requires industries to invest in sophisticated air monitoring systems, such as low-flow air sampling pumps.

Asia Pacific

Asia Pacific accounted for the dominant low flow air sampling pump market share. Across Asia Pacific, industrialization in developing countries, along with stricter occupational health and safety laws, are driving a noticeable demand for low-flow air sampling pumps. Moreover, the region is experiencing high growth in new installations as industries establish or expand their operations. This has resulted in increased demand for more affordable yet reliable, low flow pumps, often prioritizing ease of application.

Latin America

The market in Latin America is growing at a considerable pace as it is heavily impacted by its vast resource extraction industries, especially mining and oil and gas. For instance, the increase of pre-salt oil exploration in Brazil necessitates the monitoring of worker exposure to particulate matter and volatile organic compounds (VOCs) during drilling and processing. In October 2024, the Andean Community of Nations (CAN) announced a pilot program for harmonized air quality monitoring standards across member states Colombia, Ecuador, Peru, and Bolivia, requiring standardized low flow pump usage for personal and area sampling in mining operations.

Middle East & Africa

In the Middle East & Africa, the market is growing at a steady rate driven by the oil and gas industry, which dominates many countries. Large-scale projects in petrochemical facilities, refineries, and gas processing plants necessitate stringent air quality monitoring, particularly for detecting hazardous gases such as hydrogen sulfide (H2S) and volatile organic compounds (VOCs). Moreover, increased awareness regarding worker safety regulations, as enforced by national labor ministries and international standards, is also driving companies to invest in portable and personal air sampling pumps for team member exposure monitoring.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in their Dominating Positions in the Market

The global low flow air sampling pump market is concentrated with companies such as SENSIDYNE SKC Ltd., among others, accounting for a significant market share. SKC is a well-established manufacturer known for its wide range of air sampling pumps and accessories. They offer robust and reliable pumps catering to various industrial hygiene and environmental monitoring applications, often emphasizing ease of use and data logging capabilities.

Additionally, AP BUCK, SIBATA, GASTEC CORPORATION, GL Sciences, TSI Incorporation, AC, Sperhi, and Thermo Fisher Scientific Inc. are among the other major players in the market. Growing focus on significant investments in the research & development of innovative products has supported the companies’ enhanced share in the market.

LIST OF KEY LOW FLOW AIR SAMPLING PUMP COMPANIES PROFILED

- AP BUCK (U.S.)

- SKC Ltd (U.K.)

- SIBATA (Japan)

- GASTEC CORPORATION (Japan)

- GL Sciences (Japan)

- TSI Incorporation (U.S.)

- AC-Sperhi (France)

- Thermo Fisher Scientific Inc. (U.S.)

- SENSIDYNE (U.S.)

- Perkinelmer (U.S.)

- NextTexh (Romania)

KEY INDUSTRY DEVELOPMENTS

- May 2024- Thermo Fisher Scientific announced the commencement of its newest manufacturing facility of Air Quality Monitoring System (AQMS) analyzers in India. The analyzers will be designed, manufactured, and validated at Thermo Fisher’s facility in Nasik, Maharashtra.

- March 2024- Sensidyne launched an improved version of its BDX series personal air sampling pumps. The primary enhancement is a longer battery life, which enables extended continuous sampling times. This upgrade was significantly designed for market needs, especially for sampling conducted remotely or over prolonged periods.

- May 2023- Gilian's GilAir Plus air sampling pump, distributed by Air Met Scientific, received a CE marking, confirming its adherence to the European Union's rigorous safety, health, and environmental protection mandates. This accomplishment allows Air Met Scientific to expand the reach of the GilAir Plus, making it accessible to a wider range of professionals and organizations throughout the European Economic Area (EEA).

- April 2022- QED Environmental Systems Inc. launched its Well Wizard ST1000, which provides high sample accuracy and proven reliability for QED’s Well Wizard dedicated bladder pumps in a smaller diameter format.

- October 2021- TSI Incorporated launched its newest addition, AirAssureTM 8144-2, which is a two-gas model that assists in comprehending and controlling typical indoor air contaminants. With the use of TSI LinkTM Solutions' cloud-based sensor technology connection, this model continuously monitors indoor air conditions such as particulate matter (PM), carbon dioxide (CO2), total volatile organic compounds (tVOC), and other factors using inexpensive sensor technology.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.24% from 2025-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 27.70 million in 2024 and is projected to reach USD 41.55 million by 2032.

In 2024, the market value stood at USD 11.21 million.

The market is expected to exhibit a CAGR of 5.24% during the forecast period.

By End-users, the environment industry segment leads the market.

The key factor driving the market is strict occupational health and safety regulations driving demand.

AP BUCK, SKC Ltd, and SIBATA are the top players in the market.

Asia Pacific dominated the market in 2024.

Technological developments in wireless communication and miniaturization are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us