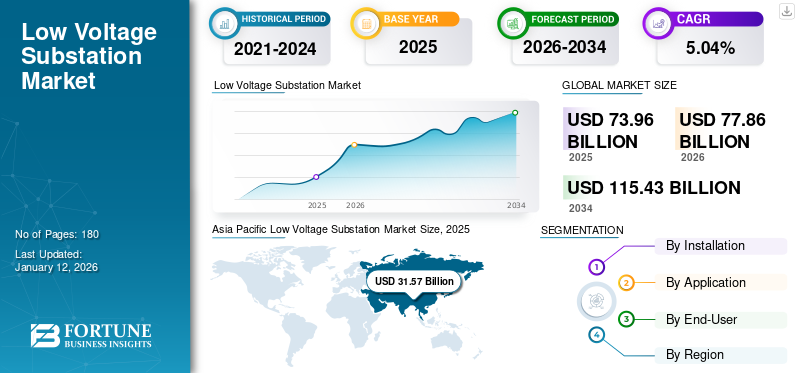

Low Voltage Substation Market Size, Share & Industry Analysis, By Installation (Outdoor and Indoor), By Application (Transmission and Distribution), By End-User (Utilities and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global low voltage substation market size was valued at USD 73.96 billion in 2025. The market is projected to grow from USD 77.86 billion in 2026 to USD 115.43 billion by 2034, exhibiting a CAGR of 5.04% during the forecast period. Asia Pacific dominated the low voltage substation market with a share of 42.68% in 2025.

A low voltage substation is a device used in electricity transmission that typically handles voltages of up to 1,000 volts AC or 1,500 volts DC. This device helps optimize power flow within the network, decreasing losses and enhancing overall system efficiency. Low voltage substations are primarily used to step down medium voltage (MV) to the lower voltages needed for offices, homes, and other buildings.

Low voltage substation are used in urban areas for residential, commercial, and industrial applications. The growing need for efficient electricity transmission and distribution is driving global demand for the market.

General Electric (GE) is one of the key players in the market, along with competitors such as Schneider Electric, Siemens, ABB, and Eaton. The market growth is being driven by growing demand for energy-efficient and reliable power distribution solutions.

MARKET DYNAMICS

MARKET DRIVERS

Advancements In Technologies to Boost the Market Growth

The industrial sector is one of the central pillars of the global economy, driving a wide range of applications. This influence is owing to the advancements in technologies associated with industrial devices. As a result, the sector is experiencing global expansion, attracting investments from well-established businesses.

For instance, in September 2023, Eaton announced an investment worth USD 500 million to expand its manufacturing capacity for electrical solutions across the utility, commercial, healthcare, industrial, and residential markets. This strategic move aims to meet the growing demand for Eaton’s electrical solutions by strengthening its manufacturing and operational footprints in North America.

MARKET RESTRAINTS

High Investment Cost to Hinder Market Growth

Substations are integrated with transmission and distribution lines that support the flow of electricity. The entire process needs heavy-duty equipment, including substations, which are often costly to deploy initially. Moreover, transmission and distribution projects demand heavy investments owing to their large-scale implementation globally. This particular factor may hinder the market growth for low-voltage substations in many countries. The challenge is particularly significant in developing countries, where limited financial resources make it difficult to undertake such high-investment infrastructure projects.

MARKET OPPORTUNITIES

Alteration of the Grid Technology to Create New Opportunities Globally

In recent years, the smart grid concept has been trending owing to the growing requirements for a more efficient, sustainable, and resilient electricity grid capable of handling rising energy demand. In addition, the integration of renewable energy sources into the grid is a major advancement in the energy sector, contributing to reduced environmental impact. Hence, businesses are continuously working on grid technology that can be integrated with substations and other energy-efficient products. On May 26, 2023, Mitsubishi Electric Corporation announced that its Taipei-based partner, Shihlin Electric & Engineering Corporation, received a contract from Taiwan Power Company to deliver Taiwan's first static synchronous compensator (STATCOM) for the application of power grid stabilization. The STATCOM, supplied by Mitsubishi Electric, will be installed at the Nanke Substation in Tainan and will be a part of the substation specifically designed to blend seamlessly with the surrounding landscape and community.

LOW VOLTAGE SUBSTATION MARKET TRENDS

Integration of Renewable Energy and Digital Technologies will boost the Market Growth in Future

The low voltage (LV) substation market growth is driven by increasing electricity demand, infrastructure development, and the integration of renewable energy sources. This growth is further fueled by the adoption of digital substations, which enhance operational efficiency and reliability through advanced technologies like IoT and AI. Moreover, digital substations, utilizing technologies like IoT, AI, and machine learning, are becoming increasingly prevalent. They offer enhanced monitoring, control, and automation capabilities, leading to improved grid stability and efficiency.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Installation

Outdoor Segment Dominates Owing to Rising Demand in Remote Areas

Based on installation, the market is divided into indoor and outdoor.

The outdoor segment is dominating the global low voltage substation market share owing to the growing demand in remote areas. The need for outdoor substations in developing countries to support transmission and distribution lines is driving the outdoor segment.

The indoor segment has experienced slower growth in recent years owing to its applications and small and compact design. These designs are deployed in the areas where space is the primary concern. For instance, in April 2023, Bharat Bijlee, a pioneer in electrical engineering in India, constructed an indoor substation within an airport terminal in a major Indian city. The project complied with all statutory approvals laid down by AAI, Petroleum, Central Electricity Authority (CEA), and Explosives Safety Organisation (PESO).

By Application

Expansion of Electricity Distribution Network to support the Segment’s Growth

By application, the global market is bifurcated into transmission and distribution.

The distribution segment is dominating the global market owing to the rapid expansion of electricity distribution networks all over the world. Moreover, it is one of the main components of the overall power infrastructure, and the segment holds more than 50% share of the total application.

In October 2024, L&T Electrical & Automation secured multiple contracts to design and build essential grid infrastructure, including substations and transmission lines, which reinforce the importance of a robust transmission and distribution network in a unified electricity network.

Transmission is the second largest segment, driven by the growing demand for transmission lines in remote rural areas. The growing transmission line projects have been influencing the low voltage substation in recent years.

By End-User

Adoption of Renewable Energy to Fuel the Segment Expansion of Utilities in Coming Years

By end-user, the global market is divided into utilities and industrial.

The utilities segment dominates the market globally owing to the wide range of transmission and distribution lines that serve both urban and rural areas. The majority of the substations are used in utility operations, making them a key component.

Industrial is the fastest-growing segment, driven by the expansion of industrial sectors. Growth in this sector is supported by the adoption of renewable sources, grid technology, and advancements in operation.

LOW VOLTAGE SUBSTATION MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Low Voltage Substation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific is the dominating region globally and holds the maximum share in the low-voltage substation market. The demand is influenced by rapid economic growth in key countries such as India and China. In addition, the population shift towards remote areas is likely to increase the consumption of electricity in both industry and residential sectors.

In July 2023, Hitachi Energy announced the successful deployment and commissioning of its RTU560 solution for the Metropolitan Electricity Authority (MEA) in Thailand. This initiative was part of a project to enhance the power network in Bangkok and its nearby regions. The deployment of an RTU560 at each of the 28 substations in MEA’s working region is aimed at attracting its monitoring and control competencies and providing connectivity to ensure a reliable power distribution network.

North America

North America is the fastest-growing region owing to the availability of numerous manufacturers in the region and a strong product and services portfolio for transmission and distribution applications.

The rising demand for low-voltage substations is also fueled by the region's exploration operations.

The U.S. is the dominant country in North America, owing to the extensive adoption of technology in the country. In addition, the government's push toward grid stabilization is increasing the demand in the market. For Instance, in August 2024, the Department of Energy announced USD 2.2 billion in funding for eight new projects across 18 states aimed at reinforcing the electrical grid. The investment would help build over 600 miles of new transmission lines and the upgrade of 400 miles of current lines.

Europe

Europe is experiencing slow growth owing to the multiple macro and microeconomic factors. Unbalanced geopolitics in the European region are challenging the industrial expansion. Despite this, emerging countries such as Germany, France, and the U.K. are continuously focusing on energy-efficient products such as substations to expand transmission lines in these countries. In December 2023, GE Vernova and MYTILINEOS, a Greece-based Industrial company, announced plans to provide engineering works and technology for the two VSC HVDC converter stations. Low voltage substation serve as terminals for HVDC cable and convert direct current to alternating current, enabling the transmission of electricity into the onshore transmission network.

Latin America

Latin America holds a notable share of the low voltage substation market, despite relatively slow growth in the region. However, emerging countries such as Brazil and Mexico have established strong industrial bases owing to rapid industrialization. This has led to the efficient deployment of substations across various industries. For instance, on March 06, 2024, Mexico’s federal power company had over 13 transmission projects underway as part of its efforts to reinforce power lines and substations across the country before President Andrés Manuel López Obrador ended his term in October. These developments are boosting demand for reliable and efficient power distribution in the region.

Middle East & Africa

The Middle East & Africa demonstrated slight growth due to the adoption of new technologies and electrification efforts. Countries such as the UAE, Saudi Arabia, and Qatar are actively expanding their transmission and distribution lines. In September 2023, Saudi Arabia announced that L&T Electrical & Automation would connect various regions of the national electricity network via high voltage direct current (HVDC) links. Moreover, L&T would establish ±500 kV HVDC transmission links and has received instructions for a 380 kV gas-insulated substation and two 380 kV overhead transmission lines. These large-scale infrastructure developments are expected to create demand for low voltage substation.

KEY INDUSTRY PLAYERS

COMPETITIVE LANDSCAPE

Expansion in the Industrial Sector to Boost the Substation Demand Globally

The market is highly competitive, with major players like Siemens Schneider Electric, ABB, Eaton, and GE actively developing advanced technologies and forming strategic partnerships to expand their market presence. For Instance, On January 9, 2023, Siemens Energy, which has a strong presence in the Asia Pacific market, shipped off the first of the three Offshore Transformer Modules to be deployed on the 950 MW Moray East wind farm offshore Scotland. The scope includes the complete onshore substation, including three SVC PLUS (STATCOM) and three offshore substation platform topsides. Moreover, Siemens Energy will deploy a 35-kilometre underground export wiring to the onshore substation at New Deer in Aberdeenshire.

List of the Key Companies Profiled in the Report

- GE (U.S.)

- NR Electric Co., Ltd. (China)

- Siemens (Germany)

- Hitachi ABB Power Grids (Switzerland)

- Schneider Electric (France)

- Eaton (Ireland)

- Efacec (Portugal)

- Rockwell Automation (U.S.)

- Emerson (U.S.)

- Belden (U.S.)

- L&T Electrical & Automation (India)

KEY INDUSTRY DEVELOPMENTS

- January 2025- L&T secured an agreement for a critical 380 kV substation in Saudi Arabia, aimed at facilitating solar power integration into the grid. Likewise, in Kuwait, the company will start work on a 400 kV substation to strengthen regional grid infrastructure.

- November 2024- The 66 and 145-kilovolt (kV) disconnectors with ice-breaking capacity have been installed at the Leh, Khalsti, Drass, and Kargil substations possessed by the Power Grid Corporation of India. These enhancements support reliable operation in extreme climates.

- October 2024- Schneider Electric industrialized a specialized SF6-free kiosk pad substation featuring internal arc containment for improved safety. This is one of the first inside arc-rated SF6-free kiosk designs in the market, delivering the capability to create a greener network across Australia.

- March 2024- Nigeria's Federal Government announced the addition of 625 MW to the national grid, raising its total capacity to 4800 MW. This milestone was achieved through the deployment of two Siemens mobile substations in Lagos and Kebbi states. According to the Minister of Power, these strategically placed substations are expected to ease transmission capacity restraints by over 1300MV on a domestic level.

- July 2023- POWERGRID, India’s Central Transmission Utility, reported ownership of around 63,000 km of transmission lines and 107 substations with a transmission capacity of 63,000 MVA. The utility maintains a grid utility by 99%, highlighting its adherence to best practices and operational excellence.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product type, and competitive landscape. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 5.04% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Installation

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 73.96 billion in 2025.

In 2025, the market value stood at USD 31.57 billion.

The market is expected to exhibit a CAGR of 5.04% during the forecast period.

By end-user, the utilities segment leads the market.

Advancements in technologies are key factors driving the market growth.

Some of the major key players in the market are Siemens, Hitachi ABB Power Grids, and Schneider Electric.

Asia Pacific dominates the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us