Luxury Watch Market Size, Share, Trends, & Industry Analysis, By Type (Mechanical and Electronic), By Band Type (Strap-based and Chain-based), By Distribution Channel (Offline Stores and Online Channel) and Regional Forecast, 2026-2034

Luxury Watch Market Insights (2026-2034)

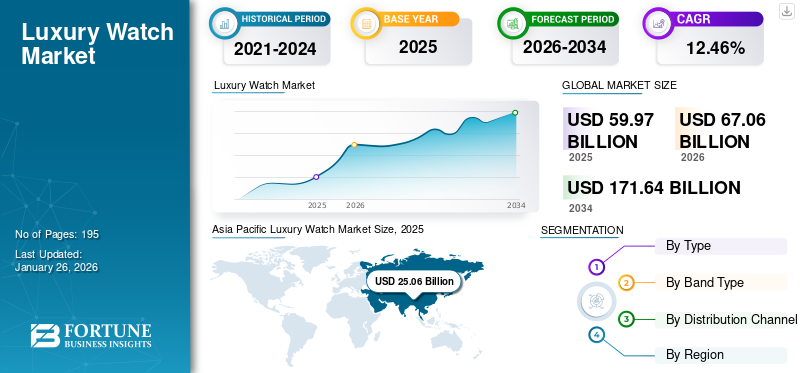

The global luxury watch market size was valued at USD 59.97 billion in 2025 and It is projected to grow from USD 67.06 billion in 2026 to USD 171.64 billion by 2034, exhibiting a CAGR of 12.46% during the forecast period. Moreover, the luxury watch market in the U.S. is expected to grow significantly, reaching USD 19.14 billion by 2032. The demand for high-end timepieces is being driven by the rising trend of collectible watches, premium craftsmanship, and brand prestige. Asia Pacific dominated the luxury watch market with a market share of 41.79% in 2025.

A luxury watch is a high-end timepiece characterized by craftsmanship, customization, and materials. These watches are considered functional timekeeping devices and symbols of status, elite craftsmanship, and style. At a macro level, the rising popularity of pre-owned luxury will create renewed consumer interest in the luxury watches segment across countries in the coming years.

Global Luxury Watch Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 59.97 billion

- 2026 Market Size: USD 67.06 billion

- 2034 Forecast Market Size: USD 171.64 billion

- CAGR: 12.46% from 2026–2034

Market Share:

- Asia Pacific dominated the luxury watch market with a 41.79% share in 2025, driven by rising disposable income, rapid economic growth in countries such as China, Japan, South Korea, and Singapore, and a growing high-income demographic with increasing interest in high-end timepieces.

- By type, mechanical luxury watches are expected to retain the largest market share through 2034, supported by consumer preference for traditional craftsmanship, precision engineering, and the heritage associated with iconic Swiss watchmakers.

Key Country Highlights:

- United States: Expected to reach USD 19.14 billion by 2032, driven by growing demand among affluent consumers, a strong presence of luxury boutiques, and increasing perception of high-end watches as collectibles and status symbols.

- China: Leads regional demand with strong interest in luxury goods, supported by rising upper-middle-class consumers and a trend toward self-expression through luxury fashion and accessories.

- Switzerland: Home to legacy brands like Rolex, Patek Philippe, and Audemars Piguet, Switzerland continues to dominate global production and innovation in mechanical watchmaking.

- United Arab Emirates: High concentration of high-net-worth individuals and tourists has made the UAE a hotspot for luxury watch retail, especially in Dubai and Abu Dhabi.

- France: As a base for LVMH and Bell & Ross, France plays a key role in shaping design trends and distributing high-end watches through major fashion houses and luxury groups.

The expansion of the global market is driven by key industry players, including Rolex, The Swatch Group, and Patek Philippe SA, providing a diverse array of sizes, patterns, colors, and designs. Industry participants present these aspects by incorporating new technology and innovation in their manufacturing processes.

For instance, in July 2023, Omega, a Biel/Bienne, Switzerland-based manufacturer and a subsidiary of The Swatch Group, announced the release of the "Seamaster 300M 'Paris 2024' Special Edition" watches. Aligning with the company's role as the official watch partner of the 2024 Olympics, this limited edition wristwatch showcases an 18-karat Moonshine Gold bezel.

The global supply chain faced disruption due to the COVID-19 pandemic, causing a decrease in the production and distribution of various sectors, including the luxury watches industry. Factory shutdowns, movement restrictions, and logistical barriers led to delays and shortages in watch availability. Furthermore, lockdown measures and restrictions on non-essential businesses temporarily closed numerous physical retail stores, including outlets and boutiques, negatively influencing luxury watch sales and the overall consumer experience.

For instance, in March 2020, the National Centre for Biotechnology and Information, a Maryland. U.S.-based government body of the U.S. National Library of Medicine highlighted that governmental responses to the COVID-19 crisis involved closing businesses and various social activities.

Luxury Watch Market Trends

Rising Technical Innovation to Accelerate Product Sales Driving Market Growth

Watches from distinguished manufacturers, including Rolex, LVMH, The Swatch Group Ltd, Financière Richemont SA, and Seiko Watch Corporation, are prominent for their unique designs and features. These industry leaders consistently adopt innovative technologies to enhance the technical aspects of their timepieces. Advances in watchmaking technology have significantly expanded the possibilities for incorporating innovative features and materials. This dedication to innovation reflects the goal of creating timepieces that demonstrate precision and craftsmanship and offer distinctive and advanced functionalities. The increasing consumer perception of these expensive watches as a status symbol also triggers product adoption globally.

The technical features of luxury watches encompass a variety of capabilities, such as step counting, heart rate monitoring, ECG, SOS functionality, automatic date and time adjustment, and fast charging.

For instance, in September 2022, a Geneva, Switzerland-based manufacturer, Rolex, technically innovated THE OYSTER PERPETUAL DAY-DATE, an automatic waterproof chronometer. This innovative timepiece showcases the day of the week in 25 languages, highlighting Rolex's patent for this advancement, including Indonesian, Basque, Finnish, Arabic, Japanese, and Chinese.

- Asia Pacific witnessed luxury watch market growth from USD 25.06 Billion in 2025 to USD 28.07 Billion in 2026.

Download Free sample to learn more about this report.

Luxury Watch Market Growth Factors

Manufacturers’ Expanding Product Ranges to Fuel Market Growth

Prominent manufacturers strategically broaden their product portfolios to align with consumer preferences and current fashion trends across different age groups and market segments, increasing the global luxury watch market share. For instance, Audemars Piguet, a Brassus, Switzerland-based manufacturer, which offers a diverse range of materials, colors, and sizes, catering to a broad customer base and accommodating various wrist sizes, styles, and tastes.

Several driving factors contribute to these expansions, including pricing, material choices, design elements, watch shapes, series, limited editions, craftsmanship, and technological features. By carefully considering these elements, manufacturers can tailor their product offerings to meet consumer needs and effectively target a well-defined and relatable customer base, positively influencing the global luxury watch market trends. This strategic approach enhances market competitiveness and ensures a dynamic and inclusive appeal to many customers.

Growing Demand for Luxury Goods to Favor Market Expansion

Individuals with high incomes display a heightened demand for luxury goods, viewing them as crucial contributors to their social standing and reputation. The possession of such luxury items serves as visible symbols of status and plays a significant role in shaping the reputation of their owners within a sizable portion of society. This phenomenon broadly impacts various demographics, as the association with luxury goods becomes synonymous with success and distinction.

For instance, in May 2022, the National Centre for Biotechnology Information, a Maryland, U.S.-based government unit of the U.S. National Library of Medicine, revealed that individuals in the elite class are strongly motivated to acquire luxury goods to increase their status and wealth.

RESTRAINING FACTOR

Rising Counterfeiting to Hamper Market Growth

Luxury goods, including renowned brands, such as Rolex, LVMH, The Swatch Company, Rado, Tissot, and Audemars Piguet, have become powerful symbols of status and wealth, fueling a widespread desire among individuals to possess these high-end items. The motivation behind this desire stems from the aspiration to showcase a luxurious lifestyle and cultivate a positive reputation. Despite the considerable demand for these products, their premium pricing places them out of reach for a significant portion of the global population, increasing the circulation of counterfeit products, categorized as first copy, second copy, and original copy.

The surge in demand for luxury goods allows counterfeiters to exploit the market and capitalize on consumers' interest in high-end items, hampering the global luxury watch market revenue. Technological advancements play a pivotal role in the proliferation of counterfeit goods. Innovations in manufacturing, printing, and materials empower counterfeiters to produce replicas that closely mimic the appearance and, at times, the quality of authentic luxury items. This technological sophistication challenges consumers and authorities in distinguishing between genuine and counterfeit products, further complicating efforts to curb the spread of fraudulent goods in the market.

Luxury Watch Market Segmentation Analysis

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Demand for Traditional Craftsmanship Products to Trigger Demand in Mechanical Segment

Based on type, the global market is bifurcated into mechanical and electronic.

The mechanical segment is expected to dominate the global market with a share of 75.80% in 2026. These products are considered artistic productions due to the intricate craftsmanship involved in their creation. Skilled artisans and watchmakers meticulously assemble these watches by hand, showcasing precision and attention to detail. Moreover, several brands have a rich history and heritage, often spanning several decades or centuries. Consumers are drawn to the tradition and legacy of these brands, making them a status symbol.

The electronic segment will likely progress at the fastest CAGR during the forecast period, owing to the increasing demand for pieces featuring modern materials and technologies. These watches showcase the latest materials science and engineering innovations, from high-performance alloys and ceramics to advanced anti-reflective coatings on crystals. Moreover, several electronic watches are designed for specific activities, such as diving, aviation, or racing, with features including water resistance, altimeters, tachymeters, and heart rate monitoring tools that cater to enthusiasts and professionals engaged in these activities. In this respect, the increasing participation in outdoor activities globally has a direct and positive influence on the global luxury watch market growth.

By Band Type Analysis

Rising Demand for Metal Bracelets to Drive Adoption of Chain-based Watches Augmenting Chain-Based Segment Growth

By band type, the global market is segmented into chain-based and strap-based.

The chain-based segment emerged as the largest with a share of 59.77% in 2026, driven by its durability and raw material versatility. Chain-based watches typically refer to watches with metal bracelets, commonly made of stainless steel, precious metals including gold or platinum, or a combination of materials. Moreover, several products, notably limited editions, may feature unique bracelet designs that complement the overall theme or concept of the watch.

The strap-based segment is forecast to witness considerable growth throughout the forecast timeframe. The strap-based products feature various elements that contribute to their overall design, comfort, and functionality. Straps are often the preferred choice for formal occasions or dress watches, as they display a sense of sophistication and can complement various dress codes. Moreover, the ease of strapping out enables wearers to tailor their watches to different styles or occasions. This interchangeability increases versatility and allows for a personalized touch, contributing to the global adoption of strap-based products.

By Distribution Channel Analysis

Professional Services at Physical Outlets to Increase Product Sales through Offline Stores Driving Segment Growth

Based on distribution channel, the global market is segmented into offline and online.

The offline segment dominates the global market with a share of 81.48% in 2026. Specialty stores are popular offline distribution channels for luxury product sales. These stores are often associated with a strong brand image and a sense of prestige. By selling through offline stores, brands can control the retail environment and create an exclusive and luxurious shopping experience that increases the perceived value of their timepieces. Moreover, after-sales service is a critical aspect of the global industry. Offline Stores, especially those authorized by the brand, can provide specialized maintenance and repair services, ensuring that customers receive expert care for their high-end timepieces.

REGIONAL INSIGHTS

Asia Pacific Luxury Watch Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Geography categorizes the global market into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific is expected to dominate the global market during the forecast period as Asian countries, including China, South Korea, Japan, and Singapore, have experienced rapid economic growth over the past few decades, leading to an increase in disposable income and a growing high-income group. Asia Pacific dominated the global market in 2025, with a market size of USD 25.06 billion. As a result, consumers in these markets have shown an increased interest in luxury goods, including high-end watches. The Japan luxury watch market is projected to reach USD 3.69 billion by 2026, the China luxury watch market is projected to reach USD 14.53 billion by 2026, and the India luxury watch market is projected to reach USD 1.42 billion by 2026.

North America

North America is the fastest-growing market, driven by economic factors, consumer behavior, cultural influences, and an elite customer base. Major cities in North America, such as New York, Los Angeles, and Miami, have a concentration of luxury boutiques and authorized dealers. The U.S. luxury watch market is projected to reach USD 9.31 billion by 2026.

Europe

Europe is a major market for luxury products as they hold cultural significance in several European cultures. Watches are considered symbols of tradition and craftsmanship. The cultural appreciation for fine timepieces creates a consistent demand for European luxury watches. The UK luxury watch market is projected to reach USD 3.82 billion by 2026, while the Germany luxury watch market is projected to reach USD 2.89 billion by 2026.

South America

South America is emerging as one of the prominent global markets. The emergence of a middle and upper class in certain South American countries, such as Brazil and Columbia, has created a consumer base with an increasing demand for luxury products.

Middle East & Africa

The Middle East & Africa are two of the growing markets driven by countries such as the United Arab Emirates (UAE), Qatar, Saudi Arabia, and South Africa, which have a high concentration of high-net-worth individuals who are prominent consumers of luxury goods, including watches.

List of Key Companies in the Luxury Watch Market

Watch Companies Participate in Industry Events to Showcase their Latest Designs

Key players operate across domestic and international markets. Leading manufacturers actively participate in prestigious watch exhibitions and events, such as Baselworld (now Watches & Wonders) and SIHH (Salon International de la Haute Horlogerie). These platforms allow them to showcase their latest creations to a global audience.

List of Top Luxury Watch Market Companies:

- ROLEX.ORG (Switzerland)

- The Swatch Group Ltd (Switzerland)

- Financière Richemont SA (Switzerland)

- PATEK PHILIPPE SA (Switzerland)

- Audemars Piguet (Switzerland)

- Seiko Watch Corporation (Japan)

- Breitling (Switzerland)

- LVHM (France)

- Richard Mille (Switzerland)

- Bell & Ross (France)

KEY INDUSTRY DEVELOPMENTS

- January 2024: The Swatch Group, a Biel/Bienne, Switzerland-based manufacturer, introduced a new addition to the product portfolio by collaborating with subsidiary brands Blancpain and Swatch, introducing a watch inspired by a new ocean, joining the existing five watches representing five oceans.

- March 2023: PATEK PHILIPPE SA, a Geneva, Switzerland-based manufacturer, unveiled a new addition to its Calatrava collection, which is a luxury timepiece with a rose-gold case, navy blue dial, and strap. This travel watch features the renowned Travel Time dual time zone function with a 24-hour display and is driven by the innovative caliber 31-260 PS FUS 24H self-winding movement.

- August 2023: Breitling, Grenchen, Switzerland-based manufacturer, launched a limited edition of ultralight sports watches in celebration of the 2023 IRONMAN World Championship and IRONMAN 70.3 World Championship triathlon events.

- April 2023: LVMH, a Paris, France-based manufacturer under its subsidiary brand, including Hublot, TAG Heuer, and Zenith, presented their latest timepieces at the 2023 Watches and Wonders fair in Geneva, Switzerland.

- January 2022: Seiko Watch Corporation, a Tokyo, Japan-based manufacturer, reintroduced the King Seiko Collection with five new timepieces, expanding their mechanical watch offerings. These watches will be available starting February 2022 at Seiko Boutiques and select retailers worldwide.

REPORT COVERAGE

The luxury watch market report analyzes the market in depth and highlights crucial aspects such as prominent companies and product types. The research report also provides insights into market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR 12.46% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Band Type

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global luxury watch market size was valued at USD 59.97 billion in 2025. It is projected to grow from USD 67.06 billion in 2026 to USD 171.64 billion by 2034.

Ascending at a CAGR of 12.46%, the global market will exhibit steady growth over the forecast period (2026-2034).

The luxury watch industry is driven by increasing consumer demand for status-symbol products, growing interest in collectible and heritage timepieces, and a rise in disposable income in emerging economies. Technological innovations and brand collaborations also play a key role in market expansion.

Asia Pacific dominates the global luxury watch market, accounting for a 25.06 market share in 2025, driven by rising high-net-worth individuals in China, Japan, and South Korea, along with increased demand for branded luxury goods.

Key trends include the rise of smart luxury hybrid watches, limited edition launches, sustainable manufacturing, and growing popularity of the pre-owned luxury watch segment. Participation in global watch events like Watches & Wonders is also a critical trend for brand visibility.

Major players in the global luxury watch industry include Rolex, Patek Philippe SA, The Swatch Group, Audemars Piguet, Seiko Watch Corporation, Breitling, LVMH, and Richard Mille. These companies are known for craftsmanship, heritage, and innovation.

Counterfeiting poses a significant threat to brand equity and consumer trust in the luxury watch industry. Advanced replication technologies and global grey markets enable the sale of convincing fakes, challenging legitimate manufacturers and harming overall market revenue.

Mechanical watches remain popular due to their heritage craftsmanship, complex internal mechanisms, and timeless appeal. Consumers value them as collectibles and heirlooms, especially when produced by iconic Swiss watchmakers with a long legacy.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us