Macrolide Antibiotics Market Size, Share & Industry Analysis, By Product (Azithromycin, Clarithromycin, Oleandomycin, Erythromycin, and Others), By Disease Indication (Respiratory Infections, Skin Infections, Sexually Transmitted Diseases (STIs), and Others), By Route of Administration (Oral, Parenteral, and Others), By Age Group (Adults and Pediatrics), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

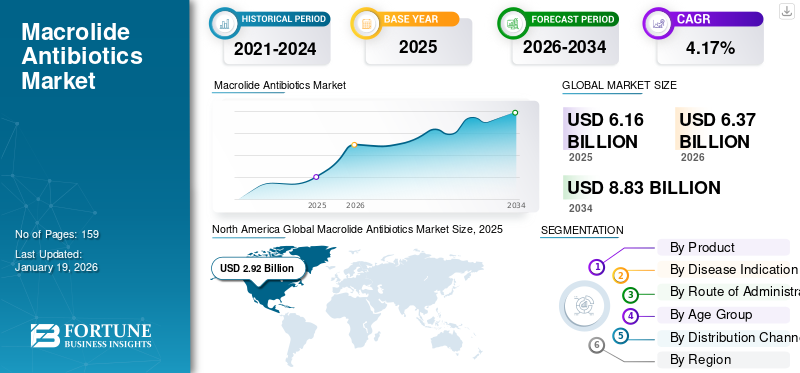

The global macrolide antibiotics market size was valued at USD 6.16 billion in 2025. The market is projected to grow from USD 6.37 billion in 2026 to USD 8.83 billion by 2034, growing at a CAGR of 4.17% during the forecast period. North America dominated the macrolide antibiotics market with a market share of 47.39% in 2025.

Macrolide antibiotics are a class of drugs that inhibit bacterial protein synthesis to manage and treat various bacterial infections. They consist of a group of glycosylated macrocyclic compounds formed by the chain extension of propionates, cyclized into a large (typically 12, 14, or 16) membered lactone ring with deoxy sugars. These drugs inhibit protein synthesis by reversibly binding to the 50S unit of the 70S ribosome of the bacteria. Macrolides are also one of the few available therapies for serious Campylobacter infections in humans, particularly in children, who are not recommended to be treated with fluoroquinolones.

The global macrolide antibiotics market is projected to grow with a significant CAGR during the forecast period, driven by the rising prevalence of bacterial infections and increasing demand for antibiotics with lesser microbial drug resistance. The newer generation of macrolides exhibits greater advantages, including increased bioavailability, longer half-life, and a reduced impact of adverse effects, which is contributing to market growth.

- For instance, in October 2023, Phathom Pharmaceuticals, Inc. announced the approval for the reformulation of vonoprazan tablets for both VOQUEZNA TRIPLE PAK (vonoprazan tablets, amoxicillin capsules, clarithromycin tablets) and VOQUEZNA DUAL PAK (vonoprazan tablets, amoxicillin capsules) by the U.S. Food and Drug Administration (FDA). The drugs are used for the treatment of Helicobacter pylori (H. pylori) infection in adults.

Established players such as Pfizer Inc., Teva Pharmaceutical Industries Ltd., and Merck Co., Inc. are operating in the market and are focusing on providing the essential antimicrobials globally.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence and Prescriptions of Macrolide Antibiotics to Drive Market Growth

The key driver of the global macrolide antibiotics market is the increasing prevalence of bacterial infections worldwide. Macrolides are widely used to treat various infections, such as respiratory tract infections, skin infections, and sexually transmitted infections.

- For instance, in July 2024, as per the data published by the WHO, an estimated 82.4 million new infections with N. gonorrhoeae among adults aged 15 to 49 years were reported. The growing prevalence of these diseases is increasing amongst the vulnerable populations, such as sex workers, men who have sex with men, transgender women and adolescents, and young people in high-burden countries. Such rising cases increase the demand for macrolides such as doxycycline, azithromycin, thus propelling macrolide antibiotics market growth.

Additionally, an increasing number of prescriptions for macrolides is also bolstering market growth.

- For instance, as per the U.S. Department of Health and Human Services, around 105 Prescriptions of macrolides per 1,000 population were dispensed by retail pharmacies in 2023.

MARKET RESTRAINTS

Increasing Product Recalls to Hamper Market Growth

Product recalls are one of the factors hampering brand image and customers’ trust, thus significantly restraining market growth.

Manufacturing defects in the pharmaceutical industry can significantly damage a company’s reputation and erode public trust. These events lead to substantial financial losses, potential lawsuits, and regulatory penalties, all of which negatively impact a company's profitability. Such conditions make a challenging environment for pharmaceutical companies and highlight the critical importance of robust quality control measures and effective recall management strategies.

- For instance, in February 2025, the Government of Singapore Health Sciences Authority recalled Clarithromycin Eberth 500 mg powder for solution, manufactured by Novem Healthcare Pte Ltd., due to sterility testing issues.

- In December 2023, the Medicines and Healthcare Products Regulatory Agency, U.K., recalled Strandhaven Ltd t/a Somex Pharma, Clarithromycin 250mg and 500mg film-coated tablets, due to a Class 4 medical defect.

Such cases lead to erosion of trust and thus hamper product adoption.

MARKET OPPORTUNITIES

Rising Government Focus on Indigenous Drug Development to Offer Lucrative Growth Opportunity

Emerging markets, particularly in Asia, Africa, and Latin America, offer significant opportunities for market expansion. These regions have a high disease burden due to poor sanitation, limited access to clean water, and overcrowded living conditions, boosting the demand for affordable, less expensive drug options. Additionally, increasing antimicrobial resistance in these countries propelled the demand for the development of antibiotics to combat resistance.

Moreover, government authorities are focused on developing indigenous drugs, which improve accessibility and reduce healthcare costs, to fulfill the unmet needs of the growing population.

- For instance, in November 2024, Union Minister of India Dr. Jitendra Singh, in collaboration with Wockhardt, launched Nafithromycin with support from the Biotechnology Industry Research Assistance Council (BIRAC). Nafithromycin, marketed as Miqnaf, is designed to target Community-Acquired Bacterial Pneumonia (CABP) caused by drug-resistant bacteria. Such advancements and product launches by regional companies increase access to treatment and are expected to boost market growth during the forecast period.

MARKET CHALLENGES

Adverse Drug Effects Associated with Macrolide Antibiotics to Challenge Market Growth

One of the major challenges associated with the macrolide antibiotics market is the occurrence of adverse effects. Common adverse effects such as nausea, vomiting, abdominal pain, and diarrhea are observed. Macrolide acts as motilin agonists, which increases the risk of gastrointestinal upset and side effects.

Additionally, the macrolides also tend to prolong the QT and QTc interval in the cardiac cycle, with this tendency being pronounced in erythromycin. QT prolongation puts the patients at risk of developing cardiac arrhythmias such as Torsades de pointes, ventricular tachycardia, and ventricular fibrillation. Such significant effects associated with the long-term usage of macrolides pose a significant challenge to the market.

MACROLIDE ANTIBIOTICS MARKET TRENDS

Advancements in Drug Development are a Key Trend in the Market

Various ongoing research and development initiatives are being undertaken to stop the bacterial resistance associated with antibiotics. Various studies are being conducted to discover a potential drug combination that can disrupt bacterial cell function, helping to fight infectious diseases and making it much harder for bacteria to evolve resistance. Such development is expected to decrease antimicrobial drug resistance, reduce drug wastage, and economic burden on the healthcare systems across the globe.

- In July 2024, researchers at the University of Illinois Chicago investigated a new class of dual-action antibiotics called macrolones. These drugs are unique as they simultaneously target two critical bacterial processes at the same concentration that is protein production by inhibiting the ribosome, with macrolides such as erythromycin, and DNA replication by disrupting DNA gyrase, similar to fluoroquinolones such as ciprofloxacin. This dual targeting makes it exceptionally difficult for bacteria to develop resistance, as they would need to evolve defenses against both mechanisms simultaneously, thereby significantly reducing the likelihood of resistance development.

Such advancements in drug development are expected to act as a prominent trend in the global macrolide antibiotics market during the forecasted timeframe.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product

Azithromycin Segment Dominates due to its Benefits

Based on product, the market is divided into azithromycin, clarithromycin, oleandomycin, erythromycin, and others.

The azithromycin segment holds the leading market share, owing to its advantages over the previous generation macrolides. It also provides antimicrobial properties against the broad spectrum strains of pneumococcus. The growth of the segment is attributed to its longer half-life, which allows less frequent dosing and causes fewer gastrointestinal side effects. A rise in the prescriptions of azithromycin in many countries has contributed to its significant market share.

- For instance, in 2022, according to the data by ClinCalc, the estimated number of prescriptions in the U.S. for Azithromycin alone was 8,770,185 prescriptions, with the estimated number of patients being nearly 7,146,386.

The clarithromycin segment is expected to hold a substantial share of the global market. The growth of the segment is due to its effectiveness against H. Pylori. Talicia, in combination with clarithromycin, is intended for first-line H. pylori eradication therapy.

- For instance, in December 2021, RedHill Biopharma Ltd. showcased results from the study titled "Pitfalls of Physician-Directed Treatment of Helicobacter pylori: Results from Two Phase 3 Clinical Trials and Real-World Prescribing Data", published in the Journal of Digestive Diseases and Sciences. The study reported high prescription rates of clarithromycin-based regimens for patients with persistent H. pylori infection.

Erythromycin also accounted for a substantial global macrolide antibiotics market share in the global market. The drug is administered to prevent and treat different infections such as respiratory tract infections, skin infections, and sexually transmitted infections. It is also indicated for the treatment of ear infections in pediatrics. Additionally, generic launches of erythromycin reduced the cost of the antibiotic, supporting its adoption and growth of the segment.

- For instance, in May 2021, Teva Pharmaceuticals launched its 250 mg and 500 mg strength generic Erythromycin tablets from Arbor Pharmaceuticals. The tablets were indicated to treat a variety of bacterial infections and to prevent initial or recurrent attacks of rheumatic fever in patients allergic to penicillin.

The oleandomycin and others segment is expected to grow with a stable CAGR during the forecast period. The rising prevalence of infections and increasing research and development activities to launch new macrolides are expected to bolster the segment’s growth during the forecasted timeframe.

By Disease Indication

Respiratory Tract Infections Leads due to Rising Number of Cases

Based on disease indication, the market is divided into respiratory infections, skin infections, sexually transmitted diseases (STIs), and others.

The respiratory tract infections segment captures the leading share of the market. Respiratory tract infections are affecting the majority of the population, with prominent respiratory indications including pneumonia, sinusitis, pharyngitis, tonsillitis, and diphtheria. The increasing number of cases every year, and macrolides are widely recommended for their treatment.

- For instance, in February 2024, the World Health Organization (WHO) released new guidelines for clinical management of diphtheria, a bacterial infection affecting the mucous membranes of the nose and throat, which recommends the use of as the first line of treatment.

The sexually transmitted diseases segment is expected to grow significantly during the forecast period. The number of cases of Chlamydia and Gonorrhoea increases the demand for these drugs and thus propels the segment’s growth in the market.

- For instance, according to the Public Health Agency of Canada (PHAC), around 104,426 cases of chlamydia were reported across all 13 Canadian provinces and territories in 2021, resulting in a rate of 273.2 cases per 100,000 people. Such an increase in the number of patients who have chlamydia on an annual basis drives the segment’s growth.

The skin infections and others segment are expected to grow with a moderate CAGR during the forecast period. The increasing number of cases of acne vulgaris, skin and soft tissue infections, particularly caused by Staphylococcus aureus, is boosting the demand for macrolide antibiotics and thus is expected to propel the segment’s growth.

By Route of Administration

Oral Segment Dominated due to their Easy Availability

Based on route of administration, the market is segmented into oral, parenteral, and others.

The oral segment held the dominant share of the global market during the forecast period. The oral tablets are easier to use and are available in all pharmacy retail stores. Thus, many pharmaceutical giants emphasize the manufacture of oral tablets over injections.

- For instance, in March 2023, Zydus Lifesciences Ltd. announced that it received final approval from the United States Food and Drug Administration (U.S. FDA) for oral erythromycin tablets USP, 250 mg, and 500 mg, which are used to treat a wide variety of bacterial infections. Such factors reinforce the growth of the segment in the global market.

The parenteral segment is expected to account for a considerable market share due to an increase in demand for quick action in emergencies in hospitalized patients. Additionally, increasing product launches with parenteral formulations are expected to propel the segment’s growth.

- For instance, in April 2022, Nexus Pharmaceuticals, Inc. announced the generic launch of Erythromycin Lactobionate for Injection, USP, in 500mg/vial single-dose vials.

The other segment comprises topical route of administrations and is expected to grow at a stable CAGR during the forecast period. The growth of the segment is attributed to site-specific applications and the effective results demonstrated by these macrolides.

By Age Group

Growing Usage of Macrolides for Adults to Drive the Growth of the Pediatric Segment

Based on age group, the market is divided into pediatric and adult. The pediatric segment captures the dominant share of the market. Although a number of the macrolide antibiotics are approved for consumption by adults, a significant number of the macrolide antibiotics currently in use are prescribed for children.

- For instance, in January 2020, the U.S. FDA approved Merck’s DIFICID (fidaxomicin) for the treatment of Clostridioides difficile in children aged six months and older. DIFICID is a macrolide antibiotic indicated in adults and pediatric patients aged 6 months and older for the treatment of Clostridioides difficile.

The adult segment is expected to account for a considerable market share due to increasing research and development and consequent product launches to cater to the growing need for macrolides in adults. Additionally, approvals from various regulatory bodies to further boost segment growth.

- For instance, in May 2022, Phathom Pharmaceuticals, Inc. received approval from the U.S. FDA for VOQUEZNA TRIPLE PAK and VOQUEZNA DUAL PAK for the treatment of Helicobacter pylori (H. pylori) infection in adults.

By Distribution Channel

High Volumes of Prescriptions from Medical Practitioners Boosted the Retail Pharmacies & Drug Stores Segment Growth

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies & drug stores, and online pharmacies.

The retail pharmacies & drug stores segment accounted for the largest macrolide antibiotics market share during the forecast period. The segment’s growth is attributed to ease of access, convenience for customers, and personalized care.

Furthermore, increasing dispensing of antibiotic prescriptions via these channels is further contributing toward the growth of the segment.

- For instance, as per the data published by the CDC, around 93.0% of outpatient prescriptions for any medication are dispensed from retail pharmacies nationally, of which around 36.1 million prescriptions of macrolide antibiotics were dispensed in the U.S. in 2022.

The substantial market share of hospital pharmacies is attributed to the fact that macrolide antibiotics are used as a first-line treatment in hospital settings for some respiratory infections and STIs. This leads to increasing antimicrobial prescriptions by medical practitioners in the hospital pharmacy.

The online pharmacies are expected to grow with a significant CAGR over the forecast period. The growth of these online pharmacies is attributed to the convenience offered by them, coupled with benefits such as cost-saving, privacy, and heightened accessibility to favor their easy adoption. Many key players are shifting their focus to these online pharmacies to streamline resources toward market expansion.

- For instance, in October 2024, Amazon announced the opening of 20 new online pharmacies in 2025 in the U.S. that will allow same-day delivery of drugs to almost 45% of U.S. shoppers. This will further fuel the growth of the online distribution channel for macrolide antibiotics.

MACROLIDE ANTIBIOTICS MARKET REGIONAL OUTLOOK

By region, this market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Global Macrolide Antibiotics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 2.83 billion in 2024 and is anticipated to dominate the global market during the forecast period. The high market share is due to a rising number of infections, such as MRSA, the presence of advanced healthcare infrastructure, and numerous funding activities aimed at developing effective macrolides. The region also benefits from robust infrastructure and extensive research and development initiatives, further propelling growth in the region.

- For instance, in May 2024, TAXIS Pharmaceuticals received a USD 2.7 million grant from the National Institute of Allergy and Infectious Diseases (NIAID). The company’s Expanded Program On Immunization (EPIs) showcased a resurgence in effectiveness of multiple classes of antibiotics, including macrolides, cephalosporins, tetracyclines, and fluoroquinolones. Such factors drive the growth of macrolide antibiotics in the region.

The U.S. is expected to dominate the market in the North American region. The high regional share of the country is due to heavy investment in research capabilities and active funding for the development of indigenous macrolides. In response to the presence of several antibiotic-resistant strains, various pharmaceutical companies are launching generic macrolides to meet rising demand, which is expected to drive market growth in the country further.

Europe

Europe accounted for the second-largest share of the global macrolides market. The growth is attributed to the increasing demand for broad-spectrum antibiotics across the various countries in Europe. Various studies have reported the increased demand for macrolides in Europe.

- For instance, in November 2024, the Annual Epidemiological Report highlighted large increases in the consumption of broad-spectrum and last-line antibiotics between 2019-2021.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The region's growth can be attributed to the increasing life expectancy and better healthcare facilities in the developing countries. This may lead to an increase in the demand for macrolides, propelling regional market growth. Emerging economies such as India, the Philippines, and Bangladesh are making significant strides in this market.

- For instance, in April 2024, Rockville, MD, a Bangladesh-based company, received prequalification for azithromycin 500mg film-coated tablets by the World Health Organization (WHO). The drug is recommended for treatment and mass distribution administration to control blinding trachoma, a condition classified as a neglected tropical disease (NTD). Such developments are expected to drive the market further.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa accounted for moderate market share during the forecast period due to the increasing prevalence of bacterial infections in the region.

Furthermore, to meet the rising demand for antimicrobials in the region, various key operational entities enter into strategic collaborations with international organizations such as the WHO.

- For instance, in June 2022, Pfizer Inc. donated Zithromax to the World Health Organization (WHO) for trachoma. The development is a critical part of SAFE, a four-part strategy developed by WHO to eliminate trachoma as a public health problem. Trachoma remains a public health threat for 125 million people living in hyper-endemic areas of Africa, Latin America, Asia, Australia, and the Middle East. Such factors are expected to boost the growth of macrolides in the region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Investments to Bolster their Market Position

The market holds a semi-consolidated structure featuring prominent players such as Pfizer Inc., Teva Pharmaceutical Industries Ltd., and Merck & Co., Inc. These companies are investing in the macrolide antibiotics market and offering a wide range of product to strengthen their market positions.

Generic manufacturers of macrolide antibiotic drugs also account for a major share. Other notable players in the global market include Lupin, Sun Pharmaceutical Industries Ltd., and others. These companies prioritize new generic product launches and collaborations to boost their market share during the forecast period.

LIST OF KEY MACROLIDE ANTIBIOTICS COMPANIES PROFILED

- Pfizer Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Crescent Pharma Ltd. (U.K.)

- Wellona Pharma (India)

- Zydus Group. (India)

- Merck & Co., Inc. (U.S.)

- Alkem (India)

- Azurity Pharmaceuticals, Inc. (U.S.)

- Lupin (India)

- Sun Pharmaceutical Industries Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- January 2025- Hunan Jiudian Pharmaceutical Co., Ltd announced the successful on-site inspection of the production site of clarithromycin granules.

- February 2022- Alembic Pharmaceuticals Limited received the final approval from the U.S. FDA for the company’s Abbreviated New Drug Application (ANDA) of Clarithromycin tablets USP, 250 mg, and 500 mg.

- December 2022: Amneal Pharmaceuticals, Inc. launched 26 new generic products in 2022. In the fourth quarter of 2022, the Company launched 8 new generic products, including antibiotic portfolio of the company.

- July 2018- Aurobindo Pharma received U.S. FDA approval for manufacturing Azithromycin tablets, used for the treatment of patients with mild to moderate infections.

- January 2021- The U.S. FDA’s Center for Veterinary Medicine and the Veterinary Drugs Directorate of Health Canada, approved Mycoplasma hyopneumoniae to the approved label indications for Aivlosin (tylvalosin) Water Soluble Granules (WSG).

REPORT COVERAGE

The global report comprises a complete market analysis, emphasizing key aspects such as research and development, ongoing studies, and the regulatory environment. The report also analyzed the key industry trends in the macrolide antibiotics alongside notable industry developments, including mergers, partnerships, and acquisitions. Furthermore, it also provides a detailed analysis of market drivers, restraints, opportunities, and a regional analysis of various segments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.17% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Disease Indication

|

|

|

By Route of Administration

|

|

|

By Age Group

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 6.16 billion in 2025 and is projected to reach USD 8.83 billion by 2034.

In 2025, North America stood at USD 2.92 billion.

Registering a CAGR of 4.17%, the market will exhibit rapid growth over the forecast period (2026-2034).

Based on disease indication, the respiratory tract infections segment is leading the market.

The increasing adoption of the product in STIs is a key factor driving market growth.

Pfizer Inc. and Teva Pharmaceuticals Industries Ltd. are the major players in the global market.

North America is poised to dominate the market with a share of 47.39% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us