Maleic Anhydride Market Size, Share & Industry Analysis, By Raw Material (N-butane and Benzene), By Application (Unsaturated Polyester Resins (UPR), 1,4-Butanediol (BDO), Additives, Copolymers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

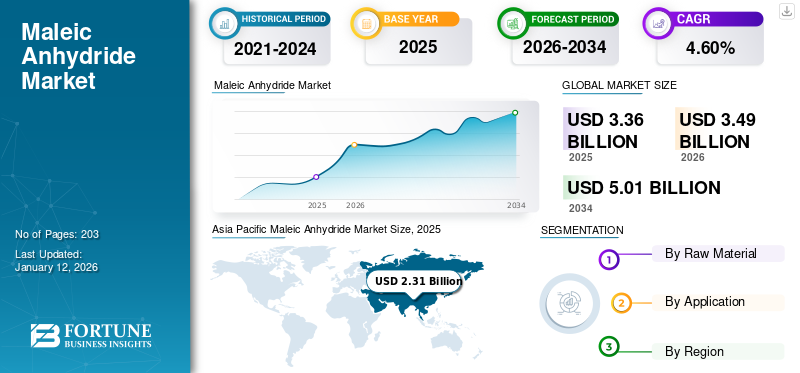

The global maleic anhydride market size was valued at USD 3.36 billion in 2025 and is projected to grow from USD 3.49 billion in 2026 to USD 5.01 billion by 2034 at a CAGR of 4.6% during the 2026-2034 forecast period. Asia Pacific dominated the maleic anhydride market with a market share of 69% in 2025.

Maleic anhydride is the cyclic anhydride of maleic acid and appears as a colorless or white solid characterized by a strong, acrid odor. This compound is produced industrially and is widely used in various applications. Market growth is driven by the increasing demand from end-user industries, particularly in automotive manufacturing, where the product is a crucial raw material for Unsaturated Polyester Resin (UPR) production. These UPRs are essential in various applications across multiple sectors, including automotive, aerospace, and construction, due to their properties, such as durability and resistance to environmental factors.

Huntsman Corporation (U.S.), Lanxess AG (Germany), Nippon Shokubai Co., ltd. (Japan), Mitsubishi Chemical Corporation (Japan), and BASF SE (Germany) are the key players operating in the market.

Global Maleic Anhydride Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 3.36 billion

- 2026 Market Size: USD 3.49 billion

- 2034 Forecast Market Size: USD 5.01 billion

- CAGR: 4.6% from 2026–2034

Market Share:

- Asia Pacific dominated the maleic anhydride market with a 69% share in 2025, driven by rapid industrial growth, extensive end-use applications, and a robust manufacturing base in countries such as China, India, and Japan.

- By raw material, n-butane is expected to retain the largest market share in 2025, supported by its cost-effectiveness, availability, and alignment with the industry’s shift toward sustainable production methods.

Key Country Highlights:

- United States: Demand is supported by strong automotive and construction sectors, with maleic anhydride used in coatings, adhesives, and UPR-based composites for lightweight vehicles.

- China: As the largest manufacturing hub, China drives demand through growing construction, automotive, and industrial output, supported by favorable government policies and domestic consumption.

- Germany: A key exporter in Europe, Germany drives market growth through advanced R&D, demand for lightweight composites, and compliance with stringent EU sustainability regulations.

- Brazil: The automotive and construction sectors in Brazil are expanding, driving demand for UPRs and maleic anhydride-based additives and resins in durable goods and infrastructure.

- Saudi Arabia: Industrialization and infrastructure development under Vision 2030 are boosting demand in construction and automotive sectors, supporting increased use of maleic anhydride in regional manufacturing.

MALEIC ANHYDRIDE MARKET TRENDS

Growing Trend Toward Bio-Based Products to Drive Market Growth

The market is experiencing significant growth, driven by the increasing demand for bio-based alternatives and evolving regulatory landscapes. This trend is largely influenced by a shift toward sustainability and renewable raw materials in various industries.

Bio-based maleic anhydride can be produced from renewable sources through fermentation processes that yield butanol, which is then oxidized to produce maleic anhydride. This process offers a sustainable alternative to the conventional catalytic oxidation of benzene, which poses environmental concerns due to its toxicity. With increasing regulatory support and evolving consumer preferences, the application of bio-based products is poised for robust growth, presenting significant opportunities for innovation and expansion within key industrial sectors. Asia Pacific witnessed a growth from USD 2.12 billion in 2023 to USD 2.21 billion in 2024.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Unsaturated Polyester Resins Drives Market Growth

Maleic anhydride is a key raw material in UPR production. UPRs are extensively used in construction, marine, and automotive industries due to their excellent mechanical properties, durability, and resistance to chemicals. These resins are vital in producing fiberglass-reinforced plastics, which are commonly used in products such as tanks, pipes, bathroom fixtures, and automotive body parts.

The construction sector's expansion, driven by infrastructure development globally, is a key contributor to the demand for UPRs. In the automotive industry, UPR-based composites are increasingly used for lightweight applications to improve fuel efficiency. Similarly, the marine industry also relies on UPR for corrosion-resistant and durable raw materials used in boats and other marine structures.

The increasing reliance on UPR in diverse applications ensures steady growth in the market. With ongoing advancements in resin formulations and the expansion of industries, the market is poised for sustained growth globally

MARKET RESTRAINTS

Volatile Raw Material Prices May Limit Market Growth

Maleic anhydride is primarily produced from n-butane, and its prices are subject to volatility based on crude oil market fluctuations. An increase in crude oil prices directly affects the cost of n-butane, leading to higher manufacturing costs for the product. This volatility can deter manufacturers from expanding production capacities or investing in new projects, thereby limiting market growth.

Rising raw material costs can squeeze profit margins for manufacturers. If companies are unable to pass on these costs to consumers through higher product prices, it may lead to reduced profitability and potential cutbacks in production or innovation efforts.

MARKET OPPORTUNITIES

Growth in Automotive Industry Creates an Opportunity in the Market

Maleic anhydride is crucial in producing Unsaturated Polyester Resins (UPR), which are widely used in automotive applications. These resins contribute to the manufacturing of lightweight and durable components such as body panels, fenders, and heat shields. The rising production and sales of passenger and commercial vehicles globally are driving demand for these composites, thereby boosting the market.

Emerging economies such as India, Brazil, and Indonesia are witnessing rapid growth in their automotive sectors due to rising disposable incomes and urbanization. This expansion creates substantial opportunities for product manufacturers to tap into new markets by establishing local production facilities or increasing exports.

MARKET CHALLENGES

Health Hazards Due to Maleic Anhydride and Regulatory Compliance May Hamper the Market

Health hazards associated with the product pose significant challenges for the market, as concerns over safety and regulatory compliance can impact production and usage. Further, increasing government regulations regarding the handling and application of maleic anhydride pose challenges for manufacturers, necessitating investments in safety and compliance measures.

Maleic anhydride is known to be toxic upon ingestion, potentially causing severe burns to the digestive tract. Inhalation can lead to respiratory issues, including irritation of the lungs, headaches, dizziness, and nausea. Higher exposures may result in pulmonary edema, a serious medical condition characterized by fluid accumulation in the lungs. As awareness of health hazards increases, regulatory bodies are likely to impose stricter guidelines on the use of the product. This could lead to increased compliance costs for manufacturers and limit market access for products containing this chemical.

In October 2024, the Bureau of Indian Standards (BIS) implemented a Quality Control Amendment Order mandating that all maleic anhydride products conform to Indian Standard IS 5149:2020. This regulation requires that products bear a Standard Mark under a license from BIS, which serves as the certifying and enforcing authority for these chemicals. The enforcement of these standards is significant as they apply to all manufacturers, importers, and sellers within India, excluding those intended for export. Non-compliance can lead to penalties under relevant legislation, thereby increasing the operational risks for businesses in this sector.

The regulatory landscape is influencing market dynamics significantly. As companies adapt to these compliance requirements, they may need to invest more in quality control processes and research and development to meet evolving standards. The high initial investment required for establishing manufacturing facilities further compounds these challenges, making it difficult for smaller players to compete with established firms that have deeper resources.

IMPACT OF COVID-19

Stalled Automotive Industry Due to Pandemic Hampered Market Growth

The COVID-19 pandemic significantly challenged the market through supply chain disruptions and reduced demand from key sectors such as automotive. However, as markets recover and adapt to new norms, there are positive signs for future growth driven by innovation and an increasing focus on sustainability. The pandemic also prompted innovation and diversification within the industry. Companies are increasingly focusing on sustainability and developing bio-based alternatives to the product market, which could open new avenues for growth as environmental concerns become more prominent among consumers and regulators.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Trade protectionism can impact the market by influencing import-export dynamics, affecting raw material availability, and altering competitive landscapes. Tariffs and trade barriers may lead to increased production costs and supply chain disruptions.

Trade protectionism, particularly in the context of the ongoing trade tensions between the U.S. and China, has led to significant disruptions in the supply chain for the product market. Tariffs and trade barriers can increase costs for manufacturers who rely on imported raw materials or components, thereby affecting production efficiency and pricing strategies.

Uncertainty stemming from geopolitical tensions and trade policies may deter investments in new production facilities or expansions of existing ones. Companies may be hesitant to commit capital in an environment where trade policies are unpredictable and could change rapidly, impacting long-term strategic planning.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

Companies are investing heavily in the development of bio-based products as part of a broader trend toward sustainable raw materials. This includes exploring renewable feedstock and production methods that minimize environmental impact. Companies are forming strategic alliances to bolster their R&D efforts. Collaborations with academic institutions and research organizations are becoming common to accelerate innovation and bring new products to market more efficiently.

SEGMENTATION ANALYSIS

By Raw Material

N-butane Became a Popular Raw Material Due to its Cost-Effectiveness and Availability

Based on raw material, the market is segmented into n-butane and benzene.

The n-butane segment held the largest maleic anhydride market share with 93.70% in 2026. This dominance is attributed to n-butane being the primary feedstock used in the production of maleic anhydride, favored for its cost-effectiveness and availability. The use of n-butane aligns with the industry's shift toward more sustainable production methods, further enhancing its appeal among producers looking to meet environmental standards.

The benzene segment held a notable share of the market. Benzene is now a less preferred option as manufacturers focus on sustainability and regulatory compliance. Rising price fluctuations in benzene have made it less economically viable compared to alternatives such as n-butane.

By Application

To know how our report can help streamline your business, Speak to Analyst

Unsaturated Polyester Resins (UPR) Dominated Due to Their Extensive Applications Across Various Industries

Based on application, the market is segmented into Unsaturated Polyester Resins (UPR), 1,4-butanediol (BDO), additives, copolymers, and others.

Among these, the Unsaturated Polyester Resins (UPR) segment registered a dominating market share with 57.59% in 2026 due to its extensive use in various industries, particularly construction and automotive. UPRs are favored for their durability and high strength, making them ideal for composites and reinforced materials. The demand for UPRs is driven by ongoing infrastructure projects and the automotive industry's need for lightweight materials to enhance fuel efficiency.

- The segment is expected to dominate the market share of 57% in 2025.

1,4-Butanediol (BDO) is another critical application of the product, used primarily in the production of plastics, fibers, and elastomers. The growth in the BDO segment is linked to increasing demand from the textile and automotive sectors. This segment is anticipated to forecast a CAGR of 3.62% during the forecast period.

Additives are expected to witness significant growth in the market during the forecast period. Maleic anhydride is used in various additives that improve performance characteristics in lubricants and coatings. The rising automotive sector's focus on fuel efficiency and emissions reduction is boosting the demand for these additives.

Copolymers are utilized in adhesives, coatings, and sealants due to their excellent bonding properties. The construction industry's expansion contributes to the rising demand for copolymers.

MALEIC ANHYDRIDE MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Maleic Anhydride Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the leading market share in 2026, valued at USD 2.41 billion. The regional market value was USD 2.31 billion in 2025. This dominance is attributed to several factors, including rapid industrial growth, extensive end-use applications, and a robust manufacturing base in countries such as China, India, and Japan. The region is experiencing substantial industrialization and urbanization, particularly in the construction and automotive sectors, which are major consumers of the product market.

- The market value in China is expected to be USD 1.41 billion in 2026.

On the other hand, India is projecting to hit USD 0.18 billion and Japan is likely to hold USD 0.27 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America region is to be anticipated the third-largest market with USD 0.50 billion in 2025.

North America accounted for substantial market growth in 2024. The region features mature markets with slower growth rates compared to Asia Pacific. The automotive and industrial sectors significantly influence demand, but higher production costs limit growth potential. In addition, the U.S. construction sector, one of the largest globally, continues to boost demand for the product market due to its applications in coatings and adhesives. The U.S. market size is estimated to reach USD 0.48 billion in 2026.

Europe

Europe is anticipated to account for the second-highest market size of USD 0.39 billion in 2025, exhibiting the second-fastest growing CAGR of 3.37% during the forecast period.

Similar to North America, Europe has a mature market with slower growth. However, countries such as Germany are significant exporters of maleic anhydride, driven by demand in the automotive and construction industries. With ongoing investments in research and development aimed at enhancing product applications and sustainability, Europe remains a vital region for maleic anhydride market growth. The market value in U.K. is expected to be USD 0.04 billion in 2026.

- On the other hand, Germany is projecting to hit USD 0.12 billion in 2026, and France is likely to hold USD 0.08 billion in 2025.

Latin America

Latin America is also registering a notable share in the global market. Increasing product demand in the region is considerably growing due to expanding automotive and construction sectors. Brazil and Mexico are expected to drive the demand as industrialization progresses.

Middle East & Africa

The Middle East & Africa region is also considered a positive growth in the market with increasing product demand, driven by industrialization and population growth. Saudi Arabia is likely to see significant developments in various sectors that will boost the market. The region is witnessing significant industrialization, particularly in the Gulf Cooperation Council (GCC) countries, which are investing heavily in infrastructure and manufacturing capabilities. This development is expected to boost demand for the product market in the construction and automotive sectors.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Development of Novel Additives is the Key Strategy Adopted by the Companies to Gain Competence

Huntsman Corporation (U.S.), Lanxess AG (Germany), Nippon Shokubai Co., ltd. (Japan), Mitsubishi Chemical Corporation (Japan), and BASF SE (Germany) are the key players in the market. Major investments by companies in developing additives that address evolving demands for sustainability and performance are expected to drive market growth.

LIST OF KEY MALEIC ANHYDRIDE COMPANIES PROFILED

- HUNTSMAN CORPORATION (U.S.)

- LANXESS AG (Germany)

- NIPPON SHOKUBAI CO., LTD. (Japan)

- MITSUBISHI CHEMICAL CORPORATION (Japan)

- POLYNT-REICHHOLD GROUP (Italy)

- CHANGZHOU YABANG CHEMICAL CO., LTD. (China)

- ZIBO QIXIANG TENGDA CHEMICAL (China)

- Ashland (U.S.)

- BASF SE (Germany)

- I G Petrochemicals Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- August 2024 – BASF entered into a Memorandum of Understanding (MoU) with UPC Technology Corporation (UPC). This collaboration centers on developing plasticizer alcohols and catalysts for phthalic anhydride and maleic anhydride.

- November 2023: Jiangsu Shenghong Petrochemical Co., Ltd (Shenghong Petrochemical) acquired Clariant’s SynDane catalyst for its upcoming facility that will manufacture maleic anhydride for biodegradable plastics. The new plant, which is expected to begin operations in 2025, will have an annual production capacity of 200,000 tons, making it one of the largest maleic anhydride production plants globally.

- June 2023 – PETRONAS Chemicals Group Berhad (PCG) announced its purchase of the 113 kilo-tonnes per annum (ktpa) maleic anhydride facility located in Gebeng, Kuantan, from BASF PETRONAS Chemicals Sdn. Bhd. (BPC).

- June 2022 – Polynt announced plans to build a new esterification plant in Atlacomulco, Mexico, to produce plasticizers and trimellitates, aiming to meet the growing demand in the automotive and electrical industries.

- July 2020 – Polynt-Reichhold Group revealed plans to construct a 50,000-ton maleic anhydride plant at its site in Morris, Illinois.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, raw materials, and applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Growth Rate |

CAGR of 4.6% from 2026 to 2034 |

|

Segmentation |

By Raw Material

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 3.36 billion in 2025 and is projected to record a valuation of USD 5.01 billion by 2034.

Recording a CAGR of 4.6%, the market is slated to exhibit steady growth during the forecast period of 2026-2034.

The Unsaturated Polyester Resins (UPR) application segment led the market in 2025.

Asia Pacific held the highest market share in 2025.

Rising demand for UPRs is expected to drive market growth.

Rising demand for bio-based maleic anhydride to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us