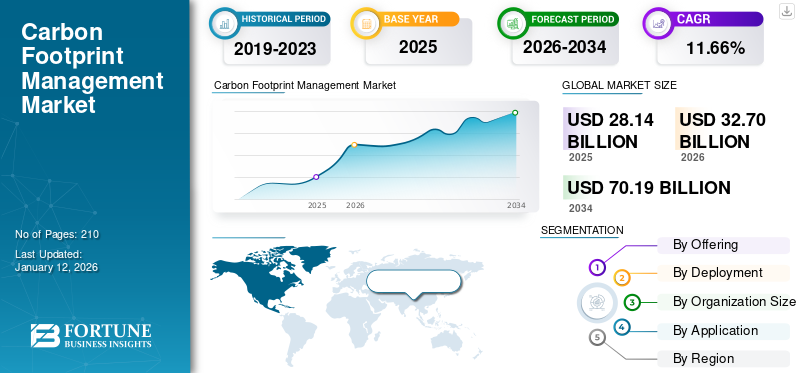

Carbon Footprint Management Market Size, Share & Industry Analysis, By Offering (Solutions and Services), By Deployment (On-Premises and Cloud), By Organization Size (Large Enterprises and Small & Medium Enterprises (SMEs)), By Application (Energy & Utilities, Manufacturing, Transportation, Healthcare & Pharmaceuticals, and Others), and Regional Forecast, 2026-2034

Carbon Footprint Management Market Size and Future Outlook

The global carbon footprint management market size was valued at USD 23.73 billion in 2024. The market is projected to grow from USD 28.14 billion in 2025 to USD 60.90 billion by 2032, exhibiting a CAGR of 11.66% during the forecast period. Moreover, North America accounts for the largest market revenue share owing to the presence of stringent carbon emission regulations in the region.

The carbon footprint management market refers to the ecosystem of technologies, software platforms, and professional services designed to measure, monitor, analyze, and reduce greenhouse gas (GHG) emissions generated by organizations across their operations, supply chains, and product life cycles.

The market growth is driven by a confluence of regulatory mandates requiring carbon reporting, growing corporate commitments to sustainability and ESG initiatives, and increasing investor and stakeholder demand for transparent environmental data related to industrial and commercial buildings. Key accelerators include technological advancements such as AI and big data analytics, which enable more accurate emission tracking and management, alongside rising global awareness of climate change and the associated corporate accountability for emissions.

- According to the European Environment Agency (EEA), the European Union achieved an 8.3% reduction in greenhouse gas emissions in 2023, the largest annual drop in decades (excluding 2020), bringing emissions to 37% below 1990 levels while the EU economy grew by 68%.

SAP SE is a prominent company in the carbon footprint management (CFM) market, offering a comprehensive suite of cloud-based, Enterprise Resource Planning (ERP)-centric solutions. Its position is supported by strong analyst ratings, strategic product integrations, and its ability to help large enterprises and smaller businesses manage complex carbon accounting and reporting requirements.

MARKET DYNAMICS

MARKET DRIVERS

Stringent Global Regulations and Disclosure Mandates are Driving Market Growth

The market is experiencing strong growth as governments and regulatory bodies globally impose stricter rules on emissions disclosure and climate reporting. Policies such as the European Union’s Corporate Sustainability Reporting Directive (CSRD), the U.S. Securities and Exchange Commission (SEC) climate disclosure requirements, and country-specific net-zero commitments are forcing organizations across industries to adopt advanced carbon management solutions. These mandates ensure that businesses track, verify, and disclose their greenhouse gas emissions with greater transparency and accountability.

- In July 2024, India adopted detailed regulations for its planned compliance carbon market under the Carbon Credit Trading Scheme (CCTS). These regulations form a foundational step in establishing a structured domestic carbon market for emissions control and trading.

Compliance has become a fundamental business necessity to avoid financial penalties, reputational risks, and restricted access to capital. As a result, companies are investing heavily in carbon tracking software and consulting services, driving sustained market demand.

Technological Advancements and Automation in Emission Tracking to Boost Market Growth

The adoption of advanced technologies such as artificial intelligence (AI), machine learning, Internet of Things (IoT), and blockchain is revolutionizing the market. These innovations are enabling organizations to automate emissions data collection, integrate real-time monitoring, and enhance accuracy in carbon accounting. Smart sensors, connected devices, and digital twins allow businesses to measure energy use, transportation emissions, and supply chain impacts with precision.

AI-driven analytics further help identify inefficiencies, predict emission trends, and recommend reduction strategies. Blockchain is increasingly being used to provide secure, transparent, and verifiable records for carbon credits and offsets. By reducing manual processes, minimizing errors, and ensuring compliance with global standards, technological automation is making carbon management more scalable, efficient, and accessible, significantly boosting carbon footprint management market growth.

MARKET RESTRAINTS

High Implementation and Maintenance Costs Restraints Market Growth

The adoption of carbon footprint management solutions often requires significant investment in software, consulting, training, and ongoing maintenance. For many organizations, especially small and medium-sized enterprises (SMEs), these costs create barriers to entry despite regulatory pressure. Additionally, integrating these systems with existing enterprise platforms adds further expenses. While large corporations can absorb such costs, limited budgets among smaller firms slow down widespread adoption, making affordability a critical restraint for overall market growth.

MARKET OPPORTUNITIES

Expansion of Carbon Removal & Offset Integration to Create Market Opportunities

The future of the market lies in expanding integration with carbon removal and offset mechanisms. Organizations are increasingly seeking solutions that not only track emissions but also connect with carbon capture, utilization, and storage (CCUS) projects or verified offset markets. This creates opportunities for platforms offering end-to-end functionality measurement, reduction, and neutralization. By enabling transparent, verifiable offset transactions, such systems will help businesses achieve net-zero commitments and regulatory compliance efficiently.

- For instance, in October 2025, Duke Energy announced its 2025 North Carolina carbon-reduction plan, pushing major renewable energy projects and coal plant retirements to the 2040s. It nearly doubles battery storage, plans more natural gas plants, and expects emissions to peak in 2036 before declining toward 2050.

MARKET CHALLENGES

Data Collection and Integration processes are key Market Challenges

One of the key challenges in the market is the difficulty of collecting and integrating accurate emissions data across diverse operations and supply chains. Many organizations rely on manual reporting or fragmented systems, leading to inconsistencies and errors. Limited digital infrastructure and lack of standardization further complicate seamless integration, affecting reliable carbon accounting and compliance.

CARBON FOOTPRINT MANAGEMENT MARKET TRENDS

Integration of Real-Time Monitoring and Predictive Analytics Emerging as a Key Trend

The market is increasingly adopting real-time monitoring and predictive analytics to enhance emissions tracking and decision-making. With the use of IoT sensors, connected devices, and AI-powered tools, organizations can collect accurate data on energy use, logistics, and supply chains instantly.

- In July 2024, the MicroCarb satellite launched the first high-precision carbon dioxide monitoring satellite. Developed by France’s CNES and the U.K. Space Agency, it maps global CO2 emissions and absorption with unprecedented accuracy, aiding climate change tracking and policy efforts.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

The impact of tariffs on the global market includes increased costs for importing essential components such as sensors and software, potentially slowing adoption due to higher prices and disrupted supply chains. Tariffs may cause delays in project timelines and push companies toward domestic manufacturing, leading to additional investments and complexity. Trade tensions and retaliatory measures could strain international cooperation, which is vital for accelerating clean-energy investments and climate action. While tariffs may initially reduce carbon emissions through slowed economic activity, long-term impacts could hinder clean technology deployment and global emissions reduction efforts.

SEGMENTATION ANALYSIS

By Offering

Solutions are expected to Dominate Market Due to Increasing Demand for Predictive Analysis

Based on offering, the market is segmented into solutions and services.

In 2024, the solutions are expected to dominate the market with a market share of 59.28%. The demand for carbon footprint management solutions is rising as businesses prioritize transparent emissions tracking, compliance with global climate regulations, and ESG reporting. Advanced software tools enable accurate monitoring, predictive analysis, and integration with enterprise systems, driving efficiency, cost savings, and sustainable growth across industries globally.

- In June 2025, Thrust Carbon launched the NetZero Forecaster, a dynamic tool helping organizations strategically plan and model pathways to net-zero business travel emissions. It integrates live emissions data, tests carbon reduction strategies, forecasts costs, and enhances stakeholder confidence without external consultants.

Moreover, services are expected to grow at a CAGR of 7.30%. The demand for carbon footprint management services is growing as organizations seek expert guidance in emissions auditing, reporting, and strategy development.

By Deployment

Cloud Expected to Dominate Market Due to Rising Demand for Remote Carbon Monitoring Solutions

Based on the deployment, the market is segmented into on-premises and cloud.

In 2024, the cloud is expected to dominate the market with a carbon footprint management market share of 54.27%. Cloud platforms allow real-time data integration, collaboration across global operations, and automated reporting, enabling organizations of all sizes to enhance transparency, streamline compliance, and achieve sustainability targets with greater flexibility.

- In May 2025, Microsoft launched new sustainability solutions in its Azure cloud platform to help users manage and reduce their carbon footprint. These include carbon emissions analysis in Azure Migrate for migration planning and a carbon optimization feature for continuous emissions monitoring and AI-driven reduction recommendations.

The market is witnessing significant growth in on-premises deployment, driven by large enterprises prioritizing data security, regulatory compliance, and customized solutions for managing complex, sensitive emissions data across operations.

By Organization Size

Large Enterprises Expected to Dominate Market Due to Net Zero Commitments being Large-scale

Based on the organization size, the market is segmented into large enterprises and small & medium enterprises (SMEs).

In 2024, the large enterprises are expected to dominate the market with a market share of 66.46%. Large enterprises are driving significant demand in the market as they face stricter regulatory obligations, investor scrutiny, and global net-zero commitments.

- In September 2024, Sage launched a Carbon Measurement API to help banks support SME customers achieve net zero. Integrates with SME accounting software using AI/ML for streamlined reporting and facilitates green lending, helping reduce banks' financed emissions.

Moreover, small & medium enterprises (SMEs) emerged as the fastest-growing segment with a CAGR of 14.63%. Affordable cloud based carbon management solutions and consulting services are making emissions tracking accessible, enabling SMEs to meet sustainability targets, attract eco-conscious partners, and enhance competitiveness in global markets.

By Application

Manufacturing Segment to Dominate Market Owing to Carbon Emissions targets from Production Processes Globally

Based on the application, the market is broadly categorized into energy & utilities, manufacturing, transportation, healthcare & pharmaceuticals, and others.

Manufacturing accounted for the largest market of 32.26% in 2024. With high carbon intensity in production processes, manufacturers leverage advanced tools for real time monitoring, predictive analytics, and reporting, driving operational efficiency while aligning with sustainability and net-zero commitments.

- In September 2024, Glassdome and LG Electronics launched a project using Glassdome's SaaS platform for Product Carbon Footprint (PCF) calculation and ISO 14067 verification. The platform uses real factory data to simplify emissions monitoring and compliance, supporting automotive supply chain carbon neutrality goals.

The transportation sector is witnessing the fastest growth in carbon footprint management adoption, driven by rising fuel costs, stricter emission standards, and supply chain decarbonization goals. Companies are leveraging tracking tools to optimize routes, cut emissions, and meet sustainability commitments.

To know how our report can help streamline your business, Speak to Analyst

CARBON FOOTPRINT MANAGEMENT MARKET REGIONAL OUTLOOK

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

The North America market emerged as the largest market with a valuation of USD 7.25 billion in 2024. The U.S. Securities and Exchange Commission (SEC) climate disclosure requirements, Canada’s carbon pricing mechanisms, and state-level policies in California and New York are driving mandatory carbon accounting and transparent reporting.

- In January 2025, the U.S. Department of Energy announced up to USD 100 million in funding for pilot-scale carbon conversion projects. These projects focus on technologies converting captured CO2 into sustainable products such as fuels, chemicals, and building materials through biological, catalytic, and mineralization pathways. Such Developments are expected to fuel market growth in the coming years.

Europe

After North America, the Europe carbon footprint management industry was valued at USD 8.89 billion in 2024 and is estimated to reach USD 10.51 billion in 2025. The European Union leads globally with regulations such as the Corporate Sustainability Reporting Directive (CSRD), the EU Green Deal, and the EU Emissions Trading System (ETS). These frameworks compel businesses to measure, disclose, and reduce emissions, significantly driving demand for carbon management solutions.

Asia Pacific

The Asia Pacific carbon footprint management market emerged as the fastest-growing market with a valuation of USD 5.56 billion, driven by a combination of regulatory, economic, and technological factors that are accelerating decarbonization and energy transition in the region. The China market is estimated to reach USD 2.27 billion in 2025.

Middle East & Africa

The market for carbon footprint management in the Middle East & Africa is driven by Investments in solar, wind, and green hydrogen projects across MEA, which require robust carbon accounting tools to measure avoided emissions and strengthen climate financing opportunities. Furthermore, the Latin America market is experiencing a significant CAGR of 6.69%. Emerging regulatory frameworks, such as Mexico’s climate reporting initiatives and Chile’s carbon tax, are encouraging industries to adopt carbon management solutions to meet compliance requirements and avoid financial penalties.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players are Engaged in Strategic Collaboration and Partnership to Increase Market Share

The competitive landscape is fragmented, and the key competitive players include IBM, Microsoft, SAP, and Schneider Electric, focusing on AI-powered solutions, cloud deployment, and industry-specific applications. Increasing regulatory pressure, corporate sustainability commitments, and technological advancements in emissions tracking and reduction tools drive the market.

For instance, in September 2025, Frontier Infrastructure, with partners Gevo and Verity, launched North America’s first integrated rail-based carbon management platform for ethanol. It connects 200+ ethanol plants to permanent CO₂ sequestration in Wyoming’s Sweetwater hub, bypassing pipeline constraints, enabling faster carbon credit access, and integrating digital emissions tracking. The Granger Carbon Terminal, operational by 2027, will handle 500,000 metric tons of CO₂ annually, expandable to 2 million tons, supporting ethanol sector decarbonization and compliance. The market is shaped by a drive to reduce emissions and operational costs, leading to a competition of innovative carbon emission monitoring solutions.

List of the Key Carbon Footprint Management Companies Profiled:

- Microsoft (U.S.)

- SAP SE (Germany)

- IBM (U.S.)

- Schneider Electric (France)

- ENGIE / ENGIE Impact (U.S.)

- Intelex Technologies (Canada)

- Salesforce, Inc. (U.S.)

- Carbon Direct (U.S.)

- Carbon Footprint Ltd (U.K.)

- Dakota Software (U.S.)

- Locus Technologies (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In September 2025, Watershed launched an AI-powered Product Footprints solution that quickly assesses the carbon footprint of products by tracing materials and processes, improving accuracy, speed, and enabling actionable scenario analysis for sustainability teams.

- In August 2025, Lenovo launched TruScale Device as a Service (DaaS) for Sustainability, offering lifecycle carbon footprint reduction for IT devices through features such as carbon impact insights, certified refurbishing, emissions offset services, and asset recovery solutions.

- In August 2025, Gravity launched an Energy Management Marketplace, using AI and carbon data from its platform to identify cost saving in energy utilities projects, match customers with vetted providers, and offer financing options, achieving USD 16 million in lifetime savings.

- In October 2024, Net0 announced expansion with a Dubai office, bringing its AI-driven carbon management platform to help enterprises and governments in the Middle East automate emissions measurement, enhance sustainability reporting, and support net-zero goals across regions.

- In June 2024, SCS Consulting Services partnered with Sustain.Life, Inc. to launch new carbon accounting management software, streamlining GHG measurement, science-based target tracking, supplier engagement, and regulatory-compliant reporting for organizations globally.

REPORT COVERAGE

The global market report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies in the market. Besides, the report offers regional insights and global market trends & technology, and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

| ATTRIBUTE | DETAILS |

| Study Period | 2019-2032 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2032 |

| Historical Period | 2019-2023 |

| Growth Rate | CAGR of 11.66% from 2025 to 2032 |

| Unit | Value (USD Billion) |

| Segmentation |

By Offering

|

|

By Deployment

|

|

|

By Organization Size

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 23.73 billion in 2024.

The market is projected to grow at a CAGR of 11.66% over the forecast period.

The manufacturing segment is expected to lead the market over the forecast period.

The market size of the North America stood at USD 7.25 billion in 2024.

Stringent global regulations and disclosure mandates are driving the market growth.

Some of the top players in the market are IBM, Microsoft, SAP, and Schneider Electric, among others.

The global market size is expected to reach USD 60.90 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us