Wires and Cables Market Size, Share & Industry Analysis, By Material Type (Metal and Polymer), By Product Type (Power Cables, Hybrid Cables, and Communication Cables), By Installation (Overhead, Underground, and Submarine), By Voltage (Low Voltage, Medium Voltage, High Voltage, and Extra-High Voltage), By End-User (Aerospace & Defense, Construction, IT & Telecommunication, Power Transmission & Distribution, Oil & Gas, Consumer Electronics, Manufacturing, Automotive, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

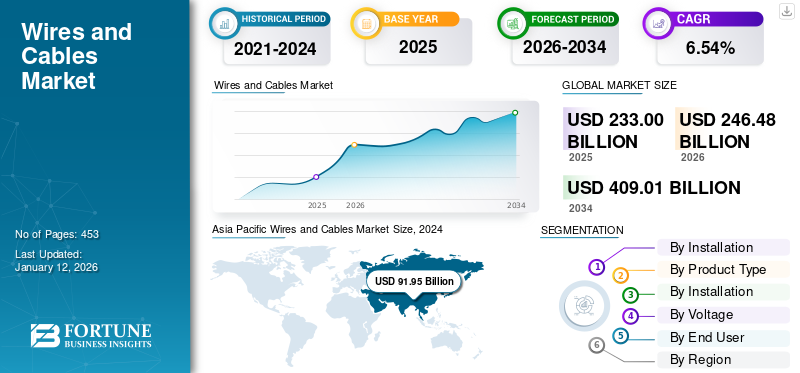

The global wires and cables market size was valued at USD 233 billion in 2025 and is projected to be worth USD 246.48 billion in 2026 and reach USD 409.01 billion by 2034, exhibiting a CAGR of 6.54% during the forecast period. Asia Pacific dominated the global market with a share of 42.10% in 2025.

Electrical cables and wires are considered to be similar in nature. A wire is a single electrical conductor, while a cable is a group or bundle of multiple wires enclosed in a common sheathing. With the growing need for higher voltage, the cable industry is able to create products that are competent, reliable, and cost-efficient, thus driving market growth. The industry is constantly evolving, with innovations in voltage sources to improve performance and efficiency.

Global Wires and Cables Market Overview

Market Size:

- 2025 Value: USD 233 billion

- 2026 Value: USD 246.48 billion

- 2034 Forecast Value: USD 409.01 billion, with a CAGR of 6.54% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific, commanding a 42.11% share in 2025

- Fastest‑Growing Region: Asia Pacific, led by infrastructure and urbanization investments in India and China

- End‑User Leader: The construction sector is the largest based on end‑user demand

Industry Trends:

- Rising construction and commercial real estate projects are boosting demand for power distribution and communication wiring

- Growth in renewable energy infrastructure and smart grid deployments, fueling demand for advanced cabling solutions

- Innovations in cable solutions, such as solar PV cables (e.g., Prysmian PRYSOLAR), supporting utility-scale solar expansion

- Renewed momentum post-COVID, as energy and infrastructure investments rebound from pandemic slowdowns

Driving Factors:

- Boom in residential and commercial construction, requiring robust wiring for buildings and facilities

- Accelerated adoption of renewable energy systems and grid modernization, increasing demand for transmission and distribution cables

- Expansion of data centers and telecom infrastructure, elevating the need for communication-grade cabling

- Technological developments and product launches by major players, such as hybrid and solar‑grade cables

- Strong market dominance of Asia Pacific, driven by government infrastructure investments and increasing electrification demand

Prysmian Group is a leading cable manufacturer specializing in energy and telecom cables. The company has a strong foothold in the cable market, providing advanced solutions for data transmission, power distribution, and telecommunication infrastructure. With its extensive product portfolio and focus on innovation, the company gains a competitive advantage in the market.

MARKET DYNAMICS

MARKET DRIVERS

Growth in Residential Projects and Commercial Structures Drives the Demand for the Product

Construction sites need to adhere to unique electrical standards, and a few electrical companies offer services that do not abide by these special standards and legal obligations. The majority of the demand in this sector comes from residential projects, followed by shops and offices. A reliable electrical system is essential for powering the advanced infrastructure, robust tools, and machinery required during construction. The electrician involved in the construction process must ensure the safety of individuals working, even in a temporary installation process. The manufacturing of cabling, regardless of its importance, should adhere to high standards, covering construction, demolition, electrical panels, sheds, and lighting operations. In 2022, the U.S. engineering and construction industry had a positive start, with a strong 8% growth in construction spending, and the U.S. construction sector was worth around USD 1.8 trillion.

Many leading players operating in the market are researching the development of innovative sustainable products to meet the upcoming requirements of the industry. This has led to an increase in energy consumption from biofuels, geothermal energy, solar energy, and wind energy, mainly in the U.S.

For instance, in April 2023, Chinese state-owned telecommunication companies initiated a USD 500 million project to develop an undersea fiber optic internet cable system network linking Asia, the Middle East, and Europe. This project competes with a similar U.S.-backed initiative, with four parties involved in the deal. The cable, which had cost approximately USD 500 million to complete, was manufactured and laid by China's HMN Technologies Co Ltd, a fast-growing cable firm whose predecessor company was majority-owned by Chinese telecom giant Huawei Technologies Co Ltd.

Technological Advancements and Innovation to Drive Market Growth

Wires and cables are the backbone of the electrical and electronics industry. Government initiatives to promote domestic manufacturing and infrastructure have paved the way for the growth of this sector. Developments, such as ambitious renewable energy targets, expansion in power transmission and distribution, and increasing investments in real estate and transportation (roads, subways, railways, and airways), indicate a promising future for the industry.

All these emerging trends are poised to increase the demand for electrical goods. Manufacturers are gearing up by expanding their facilities and strengthening the supply chain processes to participate actively in this mega-expansion. The industry is witnessing innovations, with companies investing heavily in research and development. From manufacturing technology-oriented products to implementing Industry 4.0, companies are advancing to stay competitive in the international market.

MARKET RESTRAINTS

Fluctuations in the Raw Material Prices Hinder Market Growth

Fluctuations in raw material prices, especially copper, zinc, and aluminum, present a decisive impact on the profit margins of businesses operating in the market. Additionally, the wire and cable industry relies solely on the import of raw materials from Russia, China, UAE, and Japan. Therefore, the exchange rate fluctuations have a significant impact on the industry. Interruptions in the project executions due to a number of required permits and approvals and lack of human resources are restricting the growth of the industry.

Manufacturing serves as a vital component for growing economies and is fundamental to national security. Local and regional regulations affect varied aspects of the manufacturing process, such as utilization of certain materials, disposal of waste, and exposure of workers. Thus, fluctuations in raw material prices can influence investment decisions in the industry. During times marked by high raw material costs, manufacturers may delay or reconsider their expansion plans, resulting in a potential slowdown in wires and cables market growth.

MARKET OPPORTUNITIES

Rising Inclination Toward Renewable Energy Creates Opportunities for the Market

Renewable energy is used for generating electricity and heat in buildings and transporting it is crucial to prevent the increase of average global temperature beyond 1.5°C. The market has witnessed advancement in recent years, with 2022 marking a notable year for renewable energy capacity additions, which reached approximately 340 GW. Countries and regions renowned for advancing renewable energy are leading the expansion of renewable energy power capacity. In 2023, 107 GW of renewable energy was installed across the globe, which accounted for the largest overall increase as compared to recent years.

For instance, China’s 14th Five-Year Renewable Energy Plan, published in 2022, sets ambitious targets for renewable energy use and is expected to boost investment in the coming years. Similarly, in response to the energy challenge, the European Union accelerated the growth of photovoltaic and wind power systems by adding over 50 GW in 2022, marking an almost 45% increase compared to 2021. The growing reliance on renewable energy has led to massive development of renewable energy infrastructure worldwide, leading to an increased demand for wires and cables.

MARKET CHALLENGES

Technological Advancements Demands Rapid Upgradation Poses a Challenge to Manufacturers

In the rapidly evolving wire and cable industry, manufacturers are confronting unprecedented technological advancements that demand continuous innovation and strategic adoption. The market landscape is being primarily reshaped by emerging technological domains, such as renewable energy, smart infrastructure, and advanced digital communication networks. These sectors require increasingly sophisticated cable solutions that can support complex and high-performing technological ecosystems.

Manufacturers face challenges concerned with investments in research and development to create cables that are not just technologically advanced but also cost-effective, sustainable, and adaptable to rapidly changing market needs. This involves developing materials with enhanced conductivity, improved thermal resistance, and reduced physical footprint. This competitive landscape demands innovations and transformative technological breakthroughs that can redefine industry standards. Moreover, the technological pressure extends beyond product development to encompass entire manufacturing ecosystems.

Download Free sample to learn more about this report.

WIRES AND CABLES MARKET TRENDS

Smart Grid Infrastructure Is Emerging as The Latest Trend in the Market

Smart grid infrastructure is emerging as the latest trend in the wires and cables market, driven by several key technological and economic factors. The increasing need for grid digitalization and energy efficiency improvements across various economies primarily fuels this expansion. Governments and utilities are investing heavily in modernizing transmission and distribution networks to address persistent challenges such as power losses and infrastructure resilience. The deployment of smart grid infrastructure offers significant benefits, particularly in integrating renewable energy sources into existing power grids and supporting hybrid grid formations.

According to the International Energy Agency (IEA), digital infrastructure in electricity grids is growing, with around 7% higher investment in 2022 compared to 2021, and is expected to increase in the coming years. This trend is further supported by the need to adopt emerging technologies, such as electric vehicle charging infrastructure and advanced grid monitoring systems in the market. However, significant investments are needed, with the IEA suggesting that grid investment needs to nearly double and be around USD 600 billion annually by 2030.

IMPACT OF COVID-19

The COVID-19 pandemic had a moderate impact on the market. It hampered the growth in the usage of wires and cables by various end-use industries due to supply chain disruptions in raw materials. The shutdown of manufacturing facilities across the globe caused a decline in the market's revenue. The lockdown in Asia Pacific caused a higher disturbance in the global supply chain due to China being accountable for 10-12% of international trade. Industries using cables, such as power plants and transmission lines, experienced reduced demand during the pandemic, reflecting a broader decline in production and sales.

SEGMENTATION ANALYSIS

By Material Type

Metal Segment Dominates the Market Due to its High Electrical Conductivity

Based on the material type, the market is segmented into metal and polymer.

The metal segment dominates the wires and cables market due to its excellent electrical conductivity with a share of 52.04% in 2026. Copper is preferred for high electricity conductivity applications, while aluminum is valued as a cost-effective and lightweight cable solution. Currently, no major substitute raw material has been developed that can replace metals in wire and cable manufacturing, ensuring continued market growth.

The polymer segment demand is driven by the increasing use of lightweight and flexible cables, especially in automotive, aerospace, and consumer electronics sectors. Moreover, continuous advancements in materials science for polymers, improving their durability against harsh conditions and environmental influences, drive their market expansion.

By Product Type

Power Cable Segment Dominates the Market Due To its Wide Application in the Utility Sector

Based on the product type, the market is divided into power cables, hybrid cables, and communication cables.

The power cable segment dominates the market contributing 82.18% globally in 2026, driven by factors, such as operational voltage, current-carrying capacity, and environmental conditions. The specific requirements for power transmission determine the cable's conductor material, typically copper or aluminum, insulation thickness, and protective sheathing design, which adapts to various applications ranging from low to high-voltage electrical systems.

Communication cables are the second leading segment in the market. Among these, particularly twisted pair cables are driven by factors such as signal transmission efficiency, resistance to crosstalk, and external noise. The number of insulated copper wire pairs, flexibility, and ease of installation are key considerations, with these cables. They are commonly used for local area networks and telephone cabling.

By Installation

Overhead Segment Accounts For the Largest Market share Owing to Its Low Cost and Easy Installation

Based on installation, the market is segmented into overhead, submarine, and underground.

The overhead segment is dominating the market accounting for 78.32% market share in 2026, due to its easy application and low-cost installation. Overhead installations incur less cost for repairs and upgrades, which makes them preferable to an underground installation system.

The underground installation segment is also expected to grow at the highest rate over the forecast period. Underground installations incur lower transmission losses and are less vulnerable to damage by natural calamities, hence sustaining the power loads. However, this installation system is not suitable for extremely rocky and difficult terrain. The demand for underground cables is increasing in various sectors, such as automotive, telecom, energy, and power.

By Voltage

Low Voltage Segment Dominates the Market Owing to its Feasibility and Enormous Benefits

Based on the voltage, the market is segmented into high voltage, low voltage, medium voltage, and extra high voltage.

The low voltage segment holds the highest wires and cables market share of 54.31% in 2026 among other segments. Low voltage is feasible in infrastructure, automation, lighting, security, and other operations. They require less power to operate, which can save energy and cost. They are also smaller and more flexible than traditional cables, making it easier to install and route through a building. Low voltage cables are less likely to cause interference with other electronic equipment.

The medium voltage segment holds the second largest market share among other voltage segments. Its applications range from mobile substation equipment to commercial buildings, hospitals, universities, and institutions, propelling the segment’s growth. These cables are further used in power distribution in high voltage mains power supply, low voltage applications, and utility companies to connect residential and industrial complexes or renewable energy sources, such as wind and solar farms, to the primary grid.

To know how our report can help streamline your business, Speak to Analyst

By End-User

Increasing Demand from Residential and Commercial Sectors is impacting the Growth of the Construction Segment

By end-user, the market is segmented into aerospace & defense, construction, IT & telecommunication, power transmission & distribution, oil & gas, consumer electronics, manufacturing, automotive, and others.

The construction segment accounted for the highest market share in the year 2024. The construction segment is further bifurcated into two subsegments, namely residential and commercial. The demand from the construction sector is increasing owing to the surging electrical applications in residential and commercial establishments. There is also a growing demand for power generation from commercial structures, leading to higher voltage requirements. The wires used in these settings usually have an additional level of insulation.

The power transmission & distribution segment contributed to the second highest share of the market in 2024. Electric power can be transmitted or distributed either by overhead transmission systems or by underground cables. Cables are mainly designed for specific requirements, whereas power cables are mainly used for power transmission and distribution purposes. It is an assembly of one or more individually insulated electrical conductors, usually held together with an overall sheath. During the forecast period, increasing investment in grid expansion and refurbishment projects is anticipated to propel the segment growth.

WIRES AND CABLES MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Wires and Cables Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Infrastructure Development and Increasing Energy Demand is Driving the Market in the Region

Asia Pacific dominates the global market and is expected to maintain a steady growth rate, particularly fueled by significant urbanization and infrastructure development in emerging economies, such as China and India. This growth is essential for powering buildings, transportation systems, and industries. There has also been a growing focus on renewable energy generation in the region. This has increased the demand for specialized cables used in solar and wind energy projects. The Japan market is projected to reach USD 10.28 billion by 2026, and the India market is projected to reach USD 10.66 billion by 2026.

China

China Has a Robust and Extensive Manufacturing Capacity, Which Drives Market Growth in the Country

China dominates the Asia Pacific market as it has a robust and extensive manufacturing capacity for wires and cables. The country is home to numerous large and well-established cable manufacturers, including state-owned and private enterprises. These manufacturers produce a wide range of cables for various applications, from power transmission to telecommunications. China is a leader in the deployment of advanced telecommunications networks, including 5G technology. This has driven substantial demand for high-quality cables and fiber-optic products. The China market is projected to reach USD 52.87 billion by 2026.

North America

Increasing Investments in Renewable Energy Drives the North American Market

Renewable energy plays an important role in U.S. energy security and in reducing greenhouse gas emissions. Using renewable energy can help to reduce energy imports and fossil fuel usage, which is the largest source of U.S. carbon dioxide emissions. Growing investments in renewable energy development coupled with rising commercial and manufacturing development activities across the U.S. and Canada majorly contribute to regional growth. For instance, the Canadian energy sector is leading with significant opportunities for U.S. companies driven by existing assets and plans for further development. Around 60% and 70% of power generation facilities are in the process of being replaced or upgraded in the next 10-15 years. Wires and Cables Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 49.76 billion by 2032.

U.S.

Increasing Investments and Infrastructure Development Drive the Market in the U.S.

The U.S. is dominating the North American market. Increasing investments in power transmission & distribution and the construction sector are primarily expected to drive the U.S. wires and cables market during the forecast period. The United States market is projected to reach USD 35.3 billion by 2026.

In 2023, the U.S. conventional hydroelectricity generation accounted for about 6% of total U.S. utility-scale electricity generation. It had about 23,167 MW of total pumped-storage hydroelectricity generation capacity in 18 states. Hydroelectricity's percentage share of total annual U.S. electricity generation from 2001 to 2022 averaged about 6.7%. The growing preference for hydroelectricity percentage is influencing the cables and wires market through the transmission of electricity.

Europe

Availability Of Renewable Resources and Increasing Focus on Improving Renewable Infrastructure is Driving Demand in the Region

Europe has an abundance of renewable energy sources, and its countries, in recent years, are leading in driving the deployment of renewable technologies. There are ongoing efforts to increase the sustainability of energy systems in Europe, with countries focusing on renewable energy generation. For instance, Europe installed 15 gigawatts (GW) of new wind farms in 2022, which was one-third more than in 2021. In terms of new capacity installation, Germany, Sweden, and Finland are leading the way, followed by Spain and France. These factors are driving demand in the European wires and cables market. The United Kingdom market is projected to reach USD 7.4 billion by 2026, while the Germany market is projected to reach USD 12.17 billion by 2026.

Latin America

Increasing Investments in Power Generation is Driving Demand for Wires and Cables in the Region

Latin American countries are highly investing in infrastructure development, including transportation, energy, and telecommunications. These projects often require extensive wiring and cabling solutions for power distribution, communication, and data transmission. A few Latin American countries are expanding their renewable energy capacity, particularly in solar and wind power generation. This trend is driving the demand for specialized power transmission and distribution cables in renewable energy projects.

Middle East & Africa

Development of New Projects with Increasing Investments is Driving the Market in the Region

The Middle East & Africa region is undergoing important infrastructure development, comprising the construction of residential and commercial buildings, transportation networks, and energy infrastructure. This is driving the demand for various types of wires and cables for power transmission, communication, and construction. In February 2020, Nexans was allocated a purchase order to supply around 180 km of 230 kV cables for the offshore Marjan increment development mega-project on the eastern coast of the Arabian Gulf. Nexans had supplied two lengths of 90 Km of 230 kV HVAC three-core submarine power cables with an internal fiber optical element.

COMPETITIVE LANDSCAPE

Key Industry Players

Development of Advanced Wires and Cables for Upgradation Drives the Competitive Landscape

Companies are currently pursuing the development of new wires and cable projects. This shift in focus is driven by the increasing demand for green energy solutions and advancements in wire technology. Ongoing infrastructure development, comprising the construction of residential and commercial buildings, transportation networks, and energy infrastructure, has stimulated the demand for various wires and cables for power transmission and distribution, communication, and construction.

For instance, in April 2023, Sumitomo Electric Industries, Ltd. planned to establish a new plant in Scotland, U.K., in response to the significant demand for wires and cables in the European market. This move aligns with the U.K. vision to lead power cables and plans for several offshore wind power projects to achieve the Scottish government's net zero by 2045.

List of Key Wires and Cables Companies Profiled:

- Prysmian Group (Italy)

- Furukawa Electric Co., Ltd. (Japan)

- Southwire Company (U.S.)

- Nexans (France)

- Fujikura Ltd. (Japan)

- Sumitomo Corporation (Japan)

- Belden Inc. (U.S.)

- LS Cable & System (South Korea)

- KEI Industries Ltd. (India)

- Cords Cable Industries Ltd. (India)

- NKT A/S (Denmark)

- Amphenol (U.S.)

- Finolex Cables Ltd (India)

- Polycab (India)

- Encore Wire Corp (U.S.)

- Habia Cable (Sweden)

KEY INDUSTRY DEVELOPMENTS

- August 2023 - Fujikura Ltd. reduced the weight and diameter of the wiring harnesses for automobile side airbags, offering new patterns that are 30% lighter weight and 10% smaller in diameter while maintaining the same trauma resistance as PVC tubing. This innovation increases flexibility in cable routing and contributes to reducing the weight of the side airbag system.

- July 2023 - Sumitomo Electric Industries, Ltd. improved the transmission loss of terrestrial fiber optic cables using PureAdvanceTM-110, a low-loss, wide effective area (Arms) fiber with a pure silicon core. These cables were selected for a DCI (Data Center Interconnect) project, and delivery was recently completed.

- July 2023 - Prysmian Group launched Prysmian PRYSOLAR, the most innovative cable solution for solar power generation. Solar cables, also called solar photovoltaic cables, play a crucial role in photovoltaic systems by transmitting electrical energy generated by solar modules and ensuring efficient and safe flow of electricity throughout the circuit.

- June 2023 - Nexans led technological advancement with next-generation high-voltage cables for the decarbonization of aerospace, achieving higher efficiency than the previous generation. This marks a crucial step toward the aerospace industry's carbon neutrality target by 2050.

- May 2023- Japanese firm Sumitomo Electric Industries (SEI) announced to set up a subsea electric cable production facility in the Scottish Highlands. The facility is expected to generate almost USD 260 million in investment and to create 150 job employments for people in the region.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The growing investments in renewable energy development, coupled with rising commercial and manufacturing development activities across the U.S. and Canada, majorly contribute to regional growth. Moreover, the total investment in the power generation sector is forecasted to reach USD 290 billion by 2030, with more than USD 195 billion allocated to power generation stations and the remainder dedicated to the transmission and distribution segments.

On 15th May 2023, the U.K. produced its trillionth kilowatt hour (kWh) of electricity generated from renewable sources, which is sufficient to power U.K. homes for 12 years based on average consumption. The U.K. Government has allocated USD 30 million for a series of innovative projects, including the development of new technologies for renewable energy storage and capture. Storing energy is crucial as the U.K. transitions toward cheap, clean, and domestically produced renewable energy. Maximizing the potential of renewable sources will help lower energy costs and boost the U.K.’s energy security and independence. Moreover, increasing renewable energy projects in the country drives the market growth.

REPORT COVERAGE

The global wires and cables market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the above factors, the report encompasses several aspects and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.54% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material Type

|

|

By Product Type

|

|

|

By Installation

|

|

|

By Voltage

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was worth USD 233 billion in 2025.

The market is likely to grow at a CAGR of 6.54% over the forecast period (2026-2034).

The construction segment leads the market based on end-user.

The Asia Pacific market size stood at USD 98.11 billion in 2025.

The increase in investments in renewable energy development and the surge in rising commercial and manufacturing development activities are fueling targeted investments aimed at the development and expansion of the market growth.

Some of the top key players in the market are Prysmian Group, Southwire Company, Fujikura Ltd, Nexans, and Belden Inc.

The global market size is expected to reach USD 409.01 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us