Wearable Sensors Market Size, Share & Industry Analysis, By Sensor Type (Motion & Position Sensors {Boilers Accelerometers, Gyroscopes, Magnetometers, & (IMUs)}, Physiological/Medical Sensors {Optical Sensors, Electrophysiological Sensors, Temperature Sensors, Pressure & Force Sensors, and Chemical/Biochemical Sensors}), By Device Type (Wristwear, Patches & Smart Fabrics, Eyewear, Earwear, Footwear, Neckwear & Accessories), By End-user (Consumers, Healthcare Providers, Industrial Users, Sports & Fitness Organizations, and Government & Defense Agencies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

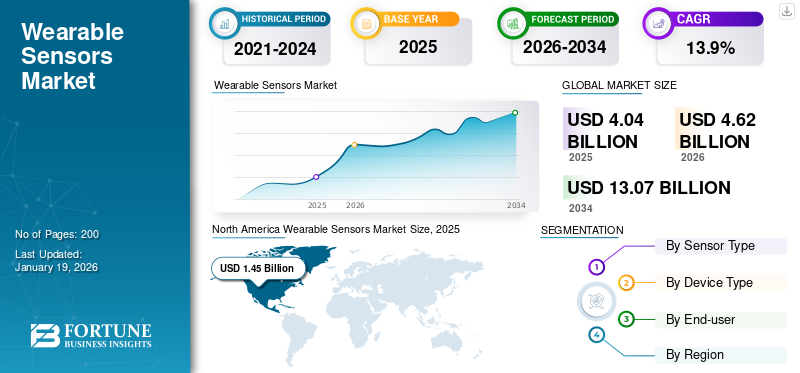

The global wearable sensors market size was valued at USD 4.04 billion in 2025 and the market is projected to grow from USD 4.62 billion in 2026 to USD 13.07 billion by 2034, exhibiting a CAGR of 13.9% during the forecast period. North America dominated the wearable sensors market with a market share of 35.9% in 2025.

Wearable sensors are lightweight and compact devices incorporated into wearable technology military to create a tool that can monitor and collect real time data of an individual’s body and environment. These devices help in capturing physiological parameters including heart rate, body temperature, and movements. This system is providing real-time analysis of health, fitness, and daily activities.

The market is expanding significantly attributed to growing consciousness regarding health & fitness among populations. The prevalence of chronic disease and rising adoption of advancement in sensor technology and artificial intelligences are propelling market growth.

Few key players operating in the market are TDK Corporation, Analog Devices, Inc., Robert Bosch GmbH, STMicroelectronics N.V., Texas Instruments Incorporated, NXP Semiconductors N.V., and others.

MARKET DYNAMICS

Market Drivers

Rising Demand for Personalized Health & Fitness Monitoring Impel the Market Expansion

Growing expansion of usage of sensors in several industrial safety and defense sectors is one of the major opportunities for market growth. These technologies are improving safety in various sectors by assisting real-time monitoring of personnel, and preventing ergonomic grievances. This also supports detecting exposure of persons to risky substances and tracking worker location. The devices offer body worn cameras and smart helmets for defense purposes to enhance communication and provide troops with improved coordination and safety in defense missions.

In addition, the increasing popularity of fitness tracking devices worldwide is augmenting market growth. The demand for wearable sensors is amplified by consumers with growing consumer consciousness regarding health, is impelling market growth. For instance, according to the National Center for Health Statistics, the percentage of people using wearable gadgets has increased from 12.8% to 21.0% during the period of 2016 to 2019.

Market Challenges

Lower Battery Life and Power Constraints Hampers the Market Growth

One of the key restraining factors for market impediment is the limited battery life of the devices. This lower battering life is posing barriers in many wearable sensors as it is prone to hamper their usability. This power constraints impact on effectiveness of devices in real-world applications is discouraging adoption of the tools, hence hindering market growth.

Market Opportunities

Increasing New Use Cases in Industrial Safety, Defense, and AR/VR Create Growth Opportunities

Growing expansion of usage of sensors in several industrial safety and defense sectors is one of the major opportunities for market growth. These technologies are improving safety in various sectors by assisting real-time monitoring of personnel, and preventing ergonomic grievances. This also supports detecting exposure of persons to risky substances and tracking worker location. The devices offer body-wear cameras and smart helmets for defense purposes to enhance communication and provide troops with improved coordination and safety in defense missions.

Furthermore, the integration of augmented reality (AR) and virtual reality (VR) into the systems is presenting great options for market growth. The growing adoption of devices including VR headsets and AR glasses are offering high accessibility and user-friendly tools to consumers. They are providing more immersive and interactive experiences that are drawing the attention of customers and fostering market growth.

WEARABLE SENSORS MARKET TRENDS

AI/ML Integration for Real-Time Wearable Analytics Has Emerged as a Key Market Trend

The growing integration of artificial intelligence and machine learning technologies is one of the latest market trends. This technological advancement permits for collecting and analyzing large amounts of data that leads to enhanced accuracy and customized insights for users is fostering market growth. These sensors allow users to monitor physiological parameters in real-time and are boosting market growth. For instance, STMicroelectronics collaborated with 221e srl to provide new AI software and ISPU Smart Sensors, in February 2023.

Furthermore, the rising recognition of several wearable gadgets in the healthcare sectors is boosting market growth. For instance, in June 2023, the University of Hawaii demonstrated a unique sweat collector build using 3D printing processes. This led to the development of affordable body-sensing technologies propelling wearable sensors market growth.

Impact of Gen AI

Generative AI Has Positively Influenced Market Growth by Improving Capability and Functionality of Devices

Generative AI is transforming the wearable sensors market significantly. This is enhancing the functionalities and capabilities of numerous wearable gadgets by powering features such as real-time health monitoring, seamless connectivity across several fields. Furthermore, this Gen AI is also enabling devices to tailored recommendation and personalized content to improve user experiences.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product Type

Being Fundamental and Low-Cost Components Boosts Motion & Position Sensors Segment Growth

Based on the product type, the market is segmented into motion & position sensors, physiological/medical sensors, and others. Motion & position sensors are further sub-segmented into accelerometers, gyroscopes, magnetometers, and inertial sensors (IMUs). Physiological/medical sensors into optical sensors, electrophysiological sensors, temperature sensors, pressure & force sensors, chemical/biochemical sensors, and others sub-segment include image sensors, and others. The Accelerometers segment is forecast to represent 42.12% of total market share in 2026.

In 2024, motion & position sensors segment held the largest wearable sensors market share and with a revenue share of USD 0.53 billion. This dominance is attributed to their fundamental and low-cost components attracting various applications. These components are integrated into majority consumer wearables including fitness trackers and smartwatches.

Physiological/medical sensors are expected to grow at the highest CAGR of 15.66% over the forecast period. This is due to rising demand for constant health monitoring and chronic disease management, these devices are expanding in the market caused by rising regulatory acceptance of medical grade wearables.

By Device Type

Growing Demand for Multipurpose Health Tracking Tools to Drive the Wristwears Segment Growth

Based on device type, the segment is divided into wristwear, patches & smart fabrics, eyewear, earwear, footwear, neckwear & accessories, and others. The other sub-segment includes headwear and others.

Among these, the wristwear segment leads in the market with a revenue share of USD 0.66 billion in 2024. It is growing due to widespread adoption of smartwatches and fitness bands among populations. They offer affordable and multifunctional health and lifestyle tracking that attracts numerous consumers, thus boosting the segment growth. The Wristwear segment is forecast to represent 50.82% of total market share in 2026.

The patches & smart fabrics are projected to grow at the highest CAGR of 17.05% in this market. This segment growth is driven by their extensive use in constant health monitoring and growth in personalized medical applications.

By End-user

To know how our report can help streamline your business, Speak to Analyst

Rising Adoption of Wearable Gadgets by Consumers boost the Consumers/General Public Segment Growth

Based on the end-user, the market is divided into consumers/general public, healthcare providers, industrial & enterprise users, sports & fitness organizations, and government & defense agencies.

Consumers/general public segment held the highest market share in 2024 with a revenue share of USD 0.70 billion. This segment growth is driven by high adoption of fitness trackers, smartwatches, and wellness-focused devices by customers. The Consumers/General Public segment is forecast to represent 54.45% of total market share in 2026.

The healthcare providers segment is projected to grow with a highest CAGR of 16.78% over the forecast period. This is due to high expansion of telehealth and growing adoption of remote patients monitoring systems. The adoption of wearable sensors by hospital and home care are supporting segment growth.

WEARABLE SENSORS MARKETREGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

North America Wearable Sensors Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America is the leading in the market with a revenue size of USD 1.45 billion in 2025, driven by high adoption of wearable devices. Growing advanced healthcare infrastructure and existence of top technology firms are supporting market growth. The U.S. dominates the North American wearable sensors market with an expected revenue share of USD 0.0.98 billion in 2026. This growth is owing to the rising demand for wearable devices amid the consumer products sector. For instance, North-western University researchers developed small, sticker-like wireless biosensors, which can monitor vital signs without the utilization of huge equipment or wires.

Europe

The European market witnesses substantial market growth and holds a considerable revenue share of USD 0.96 billion in 2025. This is attributed to the presence of robust healthcare systems and imposition of favorable regulations. Additionally, growing strong adoption of medical and fitness wearables are encouraging market growth. The UK market is projected to reach USD 0.27 billion by 2026, while the Germany market is projected to reach USD 0.23 billion by 2026.

Asia Pacific

Asia Pacific is predicted to expand with the highest CAGR of 16.42% over the forecast period to reach USD 1.22 billion in 2025. This regional growth is due to rising spending incomes of the population. Growing health awareness among individuals and being hubs of manufacturing of large-scale consumer electronics are fueling market growth. The Japan market is projected to reach USD 0.34 billion by 2026, the China market is projected to reach USD 0.40 billion by 2026, and the India market is projected to reach USD 0.27 billion by 2026.

South America and Middle East & Africa

The market of South America is expected to grow at a slower rate with a market share of USD 0.22 billion in 2025. This growth is driven by economic constraints and presence of relatively less customer expenses on advanced wearable devices. Middle East & Africa are projected to grow at the second largest CAGR with market share of USD 0.18 billion in 2025. It is attributed to rising government investment in digital health and defense applications from a small base. GCC countries are predicted to have a market share of USD 0.06 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Key Players on Expenditure in R&D Leads to their Dominating Market Positions

The global wearable sensors industry is highly fragmented with different market players operating in the market. These include STMicroelectronics N.V., Apple Inc., Garmin Ltd., Samsung Electronics Co., Ltd., and others. These firms are utilizing several market strategies including spending on R&D activities, mergers, acquisitions, alliances, and partnerships to strengthen their market presence.

LIST OF KEY WEARABLE SENSORS COMPANIES PROFILED:

- Robert Bosch GmbH (Germany)

- TDK Corporation (Japan)

- STMicroelectronics N.V. (Switzerland)

- Analog Devices, Inc. (U.S.)

- Texas Instruments Incorporated (U.S.)

- NXP Semiconductors N.V. (Netherlands)

- Apple Inc. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Garmin Ltd. (Switzerland)

- Masimo Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025- IdentifyHer unveiled a new device, Peri at CES 2025. This is designed as a wearable for perimenopause that assists users track and manage perimenopause symptoms. It also assists to identify the transitional phase before menopause by giving objective data on symptoms, sleep, and lifestyle.

- January 2025- LG introduced an ambassador program, LG Schools. The objective of this program is to offer accessibility of commercial display technologies at K-12 educational institutions. The initiatives allow schools to test and deploy technologies including LG CreateBoard digital whiteboards, LED displays, and UltraGear monitors.

- January 2025- JNCASR launched wearable stress-detecting systems. This device is inspired by human pain perception and developed using a silver wire network. This device enables adaptive, intelligent sensing for healthcare and robotics applications.

- December 2024- TE Connectivity Ltd announced acquisition of Sense Electronica Ltda, a Brazilian manufacturer of process and factory automation sensors. The aim of this acquisition is to complement TE’s portfolio of capacitive and inductive position sensors, valve automation products, photoelectric sensors, and connectivity solutions.

- August 2024- Huawei unveiled its new system, the HUAWEI TruSense System to power upcoming wearables. This innovative system is considered a milestone in bringing accurate, science-based health and fitness tech to users.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the wearable sensors market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 13.9% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

| Segmentation |

By Sensor Type · Motion & Position Sensors o Accelerometers o Gyroscopes o Magnetometers o Inertial Sensors (IMUs) · Physiological/Medical Sensors o Optical Sensors o Electrophysiological Sensors o Temperature Sensors o Pressure & Force Sensors o Chemical/Biochemical Sensors o Others (Image Sensors, etc.) |

|

By Device Type · Wristwear · Patches & Smart Fabrics · Eyewear · Earwear · Footwear · Neckwear & Accessories · Others (Headwear, etc.) |

|

|

By End-user · Consumers/General Public · Healthcare Providers · Industrial & Enterprise Users · Sports & Fitness Organizations · Government & Defense Agencies |

|

|

By Region · North America (By Sensor Type, Device Type, End-user, and Country/Sub-region) o U.S. (By End-user) o Canada (By End-user) o Mexico (By End-user) · Europe (By Sensor Type, Device Type, End-user, and Country/Sub-region) o U.K. (By End-user) o Germany (By End-user) o France (By End-user) o Italy (By End-user) o Spain (By End-user) o Russia (By End-user) o Benelux (By End-user) o Nordics (By End-user) o Rest of Europe (By End-user) · Asia Pacific (By Sensor Type, Device Type, End-user, and Country/Sub-region) o China (By End-user) o Japan (By End-user) o India (By End-user) o South Korea (By End-user) o ASEAN (By End-user) o Oceania (By End-user) o Rest of Asia Pacific · South America (By Sensor Type, Device Type, End-user, and Country/Sub-region) o Argentina (By End-user) o Brazil (By End-user) o Rest of South America · Middle East & Africa (By Sensor Type, Device Type, End-user, and Country/Sub-region) o Turkey (By End-user) o Israel (By End-user) o GCC (By End-user) o North Africa (By End-user) o South Africa (By End-user) o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 4.62 billion in 2026 and is projected to reach USD 13.07 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 13.9% during the forecast period.

Rising demand for personalized health & fitness monitoring drives the market growth.

Robert Bosch GmbH, TDK Corporation, Texas Instruments Incorporated, and NXP Semiconductors N.V. are some of the top players in the market.

The North America region held the largest market share.

North America was valued at USD 1.45 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us