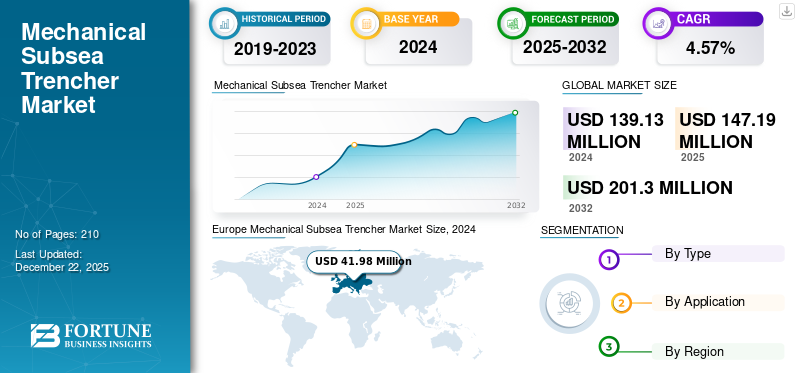

Mechanical Subsea Trencher Market Size, Share & Industry Analysis, By Type (Cutting Wheel/Chain Trenchers, Plough-Type Trenchers, and Combination Trenchers), By Application (Pipeline Burial, Cable Burial, and Umbilical Burial) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global mechanical subsea trencher market size was valued at USD 139.13 million in 2024. The market is projected to grow from USD 147.19 million in 2025 to USD 201.30 million by 2032, exhibiting a CAGR of 4.57% during the forecast period. Europe dominated the global market with a share of 30.17% in 2024.

The market is a specialized segment in global subsea trencher market within the offshore construction and subsea infrastructure industries, driven by the growing demand for cable and pipeline burial in sectors such as offshore wind, oil & gas, and telecommunications, mechanical trenchers. They use cutting tools including chains, wheels, or jets to excavate seabed conditions, from soft sediments to harder clays and increasing pipeline installation. The market growth is propelled by the global expansion of renewable energy projects, especially offshore wind farms, and the requirement to protect critical subsea assets from environmental and human inducted risks.

Royal IHC is a prominent player in the market, particularly known for its innovative Hi-Traq multi-tool trenching vehicle. This vehicle is designed to overcome the challenges of shallow water trenching, offering improved stability, maneuverability, and operational efficiency compared to traditional systems.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Expansion of Offshore Wind Farms to Drive Market Growth

The rapid global expansion of offshore wind farms is one of the major driver of the market. Offshore wind projects require extensive subsea cable networks to connect turbines to onshore grids. These cables must be buried securely to prevent damage from environmental forces and human activities such as fishing and shipping. Mechanical trenchers offer the precision and capability to operate in varying seabed conditions, making them ideal for these projects. Furthermore, the governments across globe setting ambitious renewable energy targets, the demand for offshore wind installations and consequently the need for effective subsea is expected to grow in coming years.

- In February 2025, Ørsted announced commencement of 4 offshore wind farms in Taiwan. The project will have capacity of 920 MW of clean energy which will contribute to the Taiwan’s energy infrastructure.

MARKET RESTRAINTS

High Capital and Operational Costs to Restraint Market Growth

The acquisitions, deployment, and maintenance of mechanical subsea trenchers involves significant high capital investment, requiring advanced engineering, and customized for different seabed conditions. Additionally, operational costs related to skilled labor, vessel support, and maintenance are high which can deter smaller operators or projects with tight budget. Moreover, the financial risk associated with machine downtime or technical failure offshore further complicates investment decisions and restraints the broader adoption technologies.

MARKET OPPORTUNITIES

Increasing Subsea Telecommunication Projects to Create Market Opportunities in Future

Global demand for reliable data services is fueling the growth of new subsea telecommunications cable projects. These fiber optic cables are critical to supporting cloud services, streaming, and international communications, to protect them from damage caused by fishing gears, anchors and natural seabed shifts, burial is essential. Mechanical trenchers provide the precision and control needed for safe cable installation in a range of seabed types. Hence, with growing economies the digital infrastructure and large scale data centers is developing new cable routes, and subsea telecommunication cable, which is further leading to the market growth.

- In March 2025, Meta announced plans to develop undersea cable project named “Waterworth” to increase digital connectivity between U.S., Brazil, India, South Africa, and other regions.

MECHANICAL SUBSEA TRENCHER MARKET TRENDS

Technological Innovations to Drive the Market Growth

Technological innovations are playing pivotal role in driving growth of the market. Advancements such as hybrid trenching systems combining mechanical cutting and jetting enable efficient operations across varying seabed conditions. The integration of automation, robotics, and real time monitoring systems enhances precision, reduces operational risks, and lowers reliance on manual intervention. Artificial intelligence and machine learning are being leveraged for route optimization, predictive maintenance, and performance analytics, improving efficiency and reducing downtime.

Segmentation Analysis

By Type

Superior Performance in Hard and Mixed Seabed Conditions to Drive Cutting Wheel/Chain Trenchers Segment Growth

Based on type, the market is segmented into cutting wheel/chain trenchers, plough-type trenchers, and combination trenchers.

Cutting wheel/chain trenchers is expected to dominate the market, followed by plough-type trenchers, and then combination trenchers. These type of trenchers are favored for their ability to quickly and effectively cut through various soil types and materials. They are particularly efficient in hard ground and rocky areas. The cutting mechanism typically involves a toothed wheel or a chain with cutting blades. While all three are used for excavating trenches underwater, the speed and efficiency of cutting wheels/chain trenchers make them highly adoptable.

By Application

Increasing offshore oil and gas exploration to Boost pipeline Burial Growth

Based on application, the market is segmented into pipeline burial, cable burial, and umbilical burial.

The pipeline burial segment is expected to dominate the market owing to the application in oil & gas transportation pipelines. These trenchers are particularly suited for pipeline burial in diverse seabed conditions, including hard clays and consolidated soils where other methods such as jet trenching may be less effective.

- In April 2025, Viettel Networks announced commissioning of largest submarine internet connection with station in province of Binh Dinh, Vietnam.

Moreover, the demand for subsea trenchers is expected to grow significantly in cable burial application owing to the rapid expansion of offshore wind farms, interconnector projects, and subsea telecommunications networks. Subsea power cables are critical for transmitting electricity from offshore wind turbines to onshore grids. Hence, it is expected to contribute to the mechanical subsea trencher market growth over forecast period.

Mechanical Subsea Trencher Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Europe Mechanical Subsea Trencher Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

In North America, the market is supported primarily by offshore oil and gas activities in the Gulf of Mexico and the emerging offshore wind industry along the U.S. East Coast. The U.S. government’s major investments in renewable energy is expected to create demand for subsea cable & pipeline installation and protection. However, strict environmental regulations and high operating costs will also restrict the market growth in the region.

- In April 2025, LS Cable announced investment of USD 681 million for development of manufacturing facility for underwater cables. The plant will be located in Chesapeake, Virginia, U.S.

Furthermore, Canada’s subsea projects, through smaller in scale, also contribute, particularly in Atlantic regions. Hence, the market in North America is expected to witness robust growth in near future.

Europe

Europe is expected to dominate the market for mechanical subsea trenchers, underpinned by its well established offshore wind sector and strong oil and gas activities in the North Sea. Countries such as U.K., Germany, Denmark, and Netherlands are leading offshore wind expansion, driving high demand for cable burial services. Europe’s strict environmental standards also favor mechanical trenchers that offers precision and minimal sea bed disruption

- In February 2025, European Commission announced plans to launch Joint Communication initiative to increase the security and resilience of subsea cables.

With ambitious renewable energy agenda and large installed base, Europe is expected to maintain its dominant position in the market over forecast period.

Asia Pacific

Asia Pacific is expected to emerge as fastest growing market, fueled by robust offshore wind developments in China, Taiwan, South Korea, and Japan. China is investing heavily in offshore renewable energy to meet carbon neutrality targets by 2060. In addition to renewables, regional investments in subsea telecommunications infrastructure and oil & gas fields, especially in Australia and Southeast Asia, are contributing to the market growth.

Latin America

In Latin America, the mechanical subsea trencher market share is expected to grow at moderate rate driven by oil and gas developments, particularly in Brazil’s pre-salt fields. Subsea pipelines connecting production units to onshore facilities require effective trenching solutions for protection. In addition, the region’s focus on developing offshore wind potential-especially in Brazil, Colombia, and Argentina is expected to create new opportunities over forecast period.

Middle East & Africa

The Middle East & Africa is expected to emerge as lucrative market, supported by offshore oil and gas exploration in countries such as Saudi Arabia, UAE, and others. The subsea pipeline protection is crucial in these regions where energy infrastructure investment remains high. Moreover, the regional government’s efforts to diversify their energy sources and investment in offshore infrastructure development will fuel the market growth over the forecast period.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies are acquiring New Subsea Contracts through Latest Technologies to Expand Market Share

The global mechanical subsea trencher market is fragmented with companies such as Global Marine, Seatrench AS, CSS Subsea SA, Modus Subsea Services Limited, and others, which account for a significant market share. For instance, In June 2024, Enshore Subsea secured inter-array trenching contract with seaway 7 for an offshore wind farm located off the US coast. The company will utilize T3200 hard ground trencher for the operations. The market players are focused on the latest technological advancements in areas that support the companies’ share in the market.

LIST OF KEY MECHANICAL SUBSEA TRENCHER COMPANIES PROFILED

- Global Marine (U.K.)

- Seatrench AS (Norway)

- CSS Subsea SA (Switzerland)

- Modus Subsea Services Limited (U.K.)

- Trident Group (Russia)

- IKM Subsea AS (Russia)

- Jan De Nul (Netherlands)

- Helix Energy Solutions (U.S.)

- Sea SRL (Italy)

- Forum Energy Technologies Inc. (U.S.)

- Oceaneering International (U.S.)

- Royal IHC (Netherlands)

- Mastenbroek Limited (U.K.)

- Deepocean Group Holding AS (Norway)

- Osbit (U.K.)

- Seatools BV (Netherlands)

- Barth Hollanddrain (Netherlands)

- Soil Machine Dynamics (U.K.)

- Allseas Group SA (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Van Oord announced addition of latest trencher to its fleet for cable burial work following the successful test in the North Sea.

- August 2023: 23 D announced completion of subsea cable trenching in Europe. The project included burial and trenching operation on three submarine export cables with power of 225 kV.

- November 2022: Aratellus deployed new trenching system which supports Taiwan wind farm construction. The trencher named “Leviathan subsea trenching system” is used for burial of export and inter-array cables in offshore wind through four-track trenching configuration.

- September 2021: Royal IHC announced deployment of Hi-Traq Mk 1 which is multipurpose trenching vehicle. The trencher is equipped with 1,600-horsepower vehicle which was deployed in Gulf of Mexico.

- April 2021: Jan De Nul signed agreement with UK offshore technology supplier Osbit for development of new subsea trenching vehicle including design and construction. The trencher name “Swordfish” which is powered by two 300kW power units and 300kW electric high pressure jet pumps.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.57% from 2025-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 139.13 million in 2024 and is projected to reach USD 201.30 million by 2032.

In 2024, the market value stood at USD 41.98 million.

The market is expected to exhibit a CAGR of 4.57% during the forecast period.

The pipeline burial segment led the market by application.

The key factor driving increasing demand for subsea cables and pipelines across globe

Global Marine, Seatrench AS, CSS Subsea SA, Modus Subsea Services Limited, and others are the top players in the market.

Europe region dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us