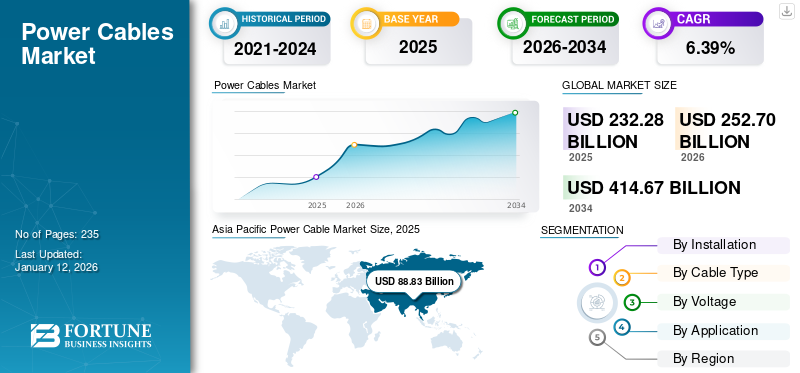

Power Cable Market Size, Share & Industry Analysis, By Installation (Overhead, Underground, and Submarine), By Cable Type (Polyvinyl Chloride (PVC), Polyurethane (PUR), Rubber, XLPE, Thermoset CPE, and Others), By Voltage (Upto 240V, 240V-1KV, 1KV-15KV, 15KV-100KV, 100KV- 250KV, and Above 250KV), By Application (Utility, Residential, Commercial Buildings & Data Centre, Manufacturing, Railways, Automotive, Material Handling, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global power cable market size was valued at USD 232.28 billion in 2025. The market is projected to grow from USD 252.7 billion in 2026 and is expected to reach USD 252.7 billion by 2034, exhibiting a CAGR of 6.39% during the forecast period. Asia Pacific dominated the power cable market with a market share of 38.54% in 2025.

Global electricity consumption is increasing due to industrialization, urbanization, and population growth. The rise in residential, commercial, and industrial power needs is driving investments in power transmission and distribution infrastructure. The shift toward renewable energy requires new transmission lines to connect remote generation sites to urban demand centers.

The rapid rise of solar and wind energy, especially offshore wind, requires extensive use of power cables to connect generation sites to the grid, this factor drives the market share.

Prysmian and Nexans are the major players in offshore wind and solar infrastructure. Their high-voltage and submarine cables are in high demand to connect renewable power to national grids.

MARKET DYNAMICS

MARKET DRIVERS

Rising Global Demand for Electricity to Drive Market Growth

Expanding usage for industry, air conditioning, electrification, and data centers, electricity demand is expected to rise at an average rate of 4% per year between now and 2027. According to a recent IEA study, global electricity consumption is expected to increase at its quickest rate in recent years, with an annual growth rate of about 4% through 2027 as electricity demand increases in a variety of industries throughout the economy.

Since 2020, China's electricity demand has been expanding more quickly than its overall economy. Electricity usage in China increased by 7% in 2024 and is predicted to rise at a rate of about 6% on average between now and 2027. The industrial sector, where the fast-increasing electricity-intensive production of solar panels, batteries, electric vehicles, and related materials played a key role alongside the traditional energy-intensive industries, contributed to the demand growth in China.

Additional factors include data centers, electric car adoption, 5G networks, and air conditioning. Strong networks are necessary for a dependable energy supply in the face of the growth of data centers, cloud computing, and artificial intelligence, which accounted for 2% of the global electricity consumption in 2022.

In April 2025, Orient Cable (NBO) stated that it was given an EPCI contract in conjunction with China Southern Power Grid for a 500 kV extra high-voltage AC (EHVAC), offshore wind subsea cable with a transmission capacity of 1 GW for a project in Guangdong Province, China, that was created by Energy China.

Renewable Energy Expansion to Boost Market Growth

A strong infrastructure is necessary for the growth and modernization of renewable energy, covering areas such as energy storage and distribution, and grid connectivity for wind and solar facilities. Wires and cables are vital for the efficient and seamless transmission of power throughout the system. From solar cables to wind energy cables, many vendors provide a wide variety of cables and wires that may aid in the efficient transmission of electricity. These include water-resistant cables for hydropower applications, solar power application cables and wires, and onshore and offshore wind power application cables and wires. Similar to the solar DC cable and wind cord, their cables are waterproof, extremely durable, and mostly resistant to sunlight.

Power cables made to transmit green electricity from renewable sources such as wind turbines, solar panels, biogas, and others have unique features that set them apart from underground burial lines. These cables are designed to withstand severe weather, have a long lifespan, and be extremely reliable. Since a cable failure might result in significant losses, it is imperative that project managers carefully assess the unique characteristics of renewable energy cables. Vendors are offering renewable energy cables, such as the Solar DC Cable and Coaxial Wind Turbine Cable, that are effective at transporting green power and have intrinsic eco-friendly qualities that make them safe, secure, and sustainable. Cables are certified by international organizations to minimize energy loss, health hazards, and environmental contamination since they are constructed of non-hazardous materials. Growth in offshore wind farms, especially in Europe and Asia Pacific, demands specialized submarine cables for long-distance power transmission. For example, Europe aims for 300 GW of offshore wind by 2050, boosting cable needs. In November 2020, the European Commission presented the EU Offshore Renewable Energy Strategy, which sets a target for 300 GW of offshore wind by 2050.

MARKET RESTRAINTS

Complex Installation and Maintenance to Restrain Market Growth

High-voltage direct current (HVDC) or submarine cables, which are used to power offshore wind farms, are particularly challenging to install and require specialized equipment, qualified workers, and sophisticated engineering. Depending on the depth and terrain, laying submarine cables, for instance, might cost between USD 1 million to 2.5 million per kilometer.

Cable installation is more difficult in urban areas with high infrastructure density and in hard terrains, including mountains or the deep sea, which results in delays and higher costs. Weather-related interruptions are common in offshore projects.

Regular upkeep is necessary for aging grid infrastructure and cables in order to avoid failures, which is both expensive and labor-intensive. Underground lines, for example, are more difficult to access and repair than overhead wires, resulting in higher costs and greater downtime.

A global lack of such qualified people, especially in developing nations, might cause project schedules to be delayed. The complexity and expense of projects are increased by the need to adhere to stringent environmental laws and safety norms, particularly in vulnerable ecosystems such as marine environments. These factors increase project budgets and timelines, restraining the power cable market growth.

MARKET OPPORTUNITIES

Rise in Electric Vehicle Production to Offer Growth Opportunities

The EV charging cable is one of the most important, yet often overlooked, parts of the charging environment as the electric vehicle (EV) market continues its unprecedented growth. Industry leaders now consider these sophisticated connections, which connect charging stations to electric cars, to be essential to enhancing the user experience and accelerating the global adoption of EVs, as they are rapidly improving in design, speed, and intelligence. Modern EV users want faster charging times and easy plug-in experiences. In response, firms, including Tesla, ABB, Phoenix Contact, and Siemens, are competing to create high-power charging guns that can handle up to 500kW, which is enough to deliver 300 kilometers of range in less than 10 minutes.

The newest iteration of liquid-cooled charging guns allows for extremely quick charging without overheating, making them perfect for commercial fleets and highway charging stations. In particular, Japan's CHAdeMO is developing its next-generation protocol to maintain its competitive edge. At the same time, the CCS (Combined Charging System) and GB/T standards are being improved to satisfy increasing global demand. The performance of high-voltage automotive cables has greatly benefited from recent advances in materials. The cables' overall weight has been decreased by the usage of lightweight, high-strength materials, which has improved the vehicle's efficiency. Furthermore, the creation of flame-retardant and high-temperature-resistant materials guarantees that these cables can endure the severe environmental conditions inside an EV.

The U.S. Inflation Reduction Act (2022), which allocates USD 369 billion to clean energy, and India's EVOLVE program are examples of policies that encourage the use of electric vehicles (EVs). These initiatives are driving the expansion of EV infrastructure and production, opening up prospects for cable producers.

MARKET CHALLENGES

Fluctuating Raw Material Prices to Restrain Market Growth

Core conductive materials are used in power cables. Their prices are highly sensitive to global supply-demand dynamics, mining output, and geopolitical events. A rapid spike in copper and aluminum prices makes it difficult to maintain consistent production costs. Affects budget forecasts for long-term infrastructure projects. Suppliers often work with fixed price contracts for large-scale grid or renewable energy projects.

POWER CABLE MARKET TRENDS

EV Charging Network Expansion to Drive the Market

EV charging station deployments have skyrocketed: North America reached ~161,562 public ports early 2023 (up from ~87,352 in 2019), with a national target of 500,000 by 2030. Globally, public charging points are projected to exceed 15 million by 2023, up from ~ 4 million in 2023. Each new station requires robust low, medium, and high voltage cables, dramatically increasing total cable demand.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

President Donald Trump imposed a comprehensive package of tariffs on imports that would have an impact on a variety of sectors, including the wire and cable industry. With greater rates of 20% on European Union products and 34% on Chinese items, the base tariff on all imports under these tariffs is 10%. In addition, a 25% tariff has been imposed on cars manufactured abroad. The action, billed as an attempt to safeguard American businesses and foster economic autonomy, is already causing tremors throughout markets, notably in industries that depend on global supply networks.

These tariffs are predicted to have a large impact on the wire and cable sector, including higher material costs and supply chain disruptions. The wire and cable industry depends on a global supply chain for key raw materials, including copper, aluminum, and fiber optics. Many of these materials are sourced from China, which is now subject to a 34% tariff under the new policy.

SEGMENTATION ANALYSIS

By Installation

Overhead Segment to Lead Market owing to Cheaper Price and Easy Installation

Based on installation, the market is segmented into overhead, underground, and submarine.

The overhead segment holds the largest power cable market share and is expected to dominate the market over the forecast period. Overhead power cables are significantly cheaper to install and maintain compared to underground cables. They require less complex infrastructure, as they use poles or towers rather than extensive trenching and insulation systems needed for underground cables.

Underground cables require less surface space, avoiding the need for wide rights-of-way or tall structures, which is advantageous in crowded cities or environmentally sensitive areas where overhead lines face regulatory or community opposition.

By Cable Type

Lower Cost of Polyvinyl Chloride Over Other Types Aids in Its Leading Position

Based on cable type, the market is segmented as Polyvinyl Chloride (PVC), Polyurethane (PUR), rubber, XLPE, Thermoset CPE, and others.

Polyvinyl Chloride (PVC) dominates the market share of 37.87% in 2026. PVC is significantly cheaper than alternatives such as cross-linked polyethylene (XLPE) or rubber, making it a preferred choice for low-voltage cables (up to 240V and 240V-1kV).

Rapid urbanization, especially in developing regions such as Asia Pacific, is increasing the need for reliable power transmission and distribution systems. XLPE cables are favored for their durability and efficiency in urban power grids. Growing investments in wind, solar, and hydropower projects require high-performance cables, especially XLPE, for efficient power transmission, particularly in high-voltage direct current (HVDC) systems.

By Voltage

Upto 240V Segment Leads Due to Its Widespread Consumption in Residential Sector

Based on voltage, the market is segmented as upto 240V, 240V-1kV, 1kV-15kV, 15kV-100kV, 100kV-250kV, and above 250kV.

The upto 240V segment holds the largest share of the market primarily due to its widespread use in the residential sector, driven by rapid urbanization, population growth, and infrastructure development. These low-voltage cables (upto 240V) are essential for powering homes, small businesses, and modern electronic devices, which have proliferated with increasing urban migration and construction projects.

240V-1kV is the second-dominating segment in the market with a share of 28.9% in 2026. Cables in the 240V-1kV range are used for power distribution in small to medium-sized commercial buildings, industrial facilities, and infrastructure projects.

By Application

To know how our report can help streamline your business, Speak to Analyst

Expansion of Smart Grid and Digital Infrastructures to Enhance Utility Segment

Based on application, the market is segmented into utility, residential, commercial buildings & data centre, manufacturing, railways, automotive, material handling, and others.

The utility segment holds the largest share of the market, contributing 26.67% globally in 2026. Utilities are increasingly adopting XLPE cables for connecting renewable sources, including wind and solar farms, to the grid, given their high-voltage capacity and thermal stability (up to 90°C long-term, 250°C short-circuit).

Residential solar panels and microgrids are boosting demand for XLPE cables to connect rooftop systems to home grids, particularly in North America and Europe. Growth is tied to home renovations, EV charging infrastructure, and solar installations.

POWER CABLE MARKET REGIONAL OUTLOOK

Based on region, the market has been studied across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Power Cable Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific Shift Toward Renewable Energy Sources Dominates Market

Asia Pacific is the dominating region of the market. Rapid urbanization and industrialization in China and India are driving significant investments in infrastructure projects, including power generation and distribution systems. The growing population and economic development in the region have led to a higher demand for electricity, necessitating the expansion and modernization of power networks. Many governments in Asia Pacific are implementing policies and initiatives aimed at enhancing energy efficiency and promoting renewable energy sources, which require advanced solutions.

After the launch of a Chinese-made cable that supports 8K wired connections in April 2025, the Thunderbolt cable seemed as outdated as a VGA cable. The 8K-capable cable is intended to manage both ultra-high-resolution material and significant power transmission at the same time, which might make installations easier for gamers, streamers, and power users. The Japan market is forecast to reach USD 9.75 billion by 2026, the China market is set to reach USD 48.44 billion by 2026, and the India market is likely to reach USD 15.72 billion by 2026.

China

Rapid Grid Expansion and Ultra High Voltage Projects to Soar Market Growth

China is investing around USD 800 million through 2030 to upgrade its transmission grid, including a massive UHVAC and UHVDC interregional line. These high-voltage systems transfer power from remote, renewable-rich regions, driving demand for thick, highly engineered cables.

China dominates the Asia Pacific market. The Chinese government has been investing heavily in infrastructure projects, including transportation, energy, and utilities. These projects require extensive power cabling to ensure reliable electricity distribution. China is a global leader in renewable energy installations, especially in wind and solar power.

North America

Combination of Infrastructure Needs, Energy Transitions, and Rising Electricity Demand to Drive Market Growth

The North American market, including cross-linked polyethylene (XLPE) cables, is growing due to a combination of infrastructure needs, energy transitions, and rising electricity demand. Much of the U.S. and Canada’s power grid, built decades ago, requires upgrades to replace outdated cables prone to failures. XLPE cables are favored for their durability and efficiency in modernizing distribution and transmission networks. In August 2023, Southwire entered into a partnership with NKT to Supply Underground Cables for the Champlain Hudson Power Express Project. As the company continues its focus on strategic growth and sustainability, Southwire has been awarded the supply of a portion of the underground power cables for Champlain Hudson Power Express (CHPE) by NKT. The U.S. market is expected to reach USD 41.96 billion by 2026.

U.S.

Initiatives such as U.S. Infrastructure Investment and Jobs Act to Propel Market Growth

Initiatives such as the U.S. Infrastructure Investment and Jobs Act (2021) and the Department of Energy’s Grid Resilience and Innovation Partnerships (GRIP) allocate billions for grid upgrades, directly boosting demand. Growing urban centers, particularly in the U.S. Southwest (e.g., Texas, Arizona) and Canadian cities (e.g., Toronto), require expanded grid capacity, driving XLPE cable installations.

Europe

Rapid Urbanization and Government Initiatives for Smart City Projects to Increase Product Demand

European cities, particularly in Western and Northern Europe, prioritize underground cables to reduce outages and improve urban aesthetics. Underground 240 V to 1 kV XLPE cables are growing, similar to North America’s 7% annual underground growth (EIA, 2023). EU directives and national policies (e.g., Germany’s Energiewende) encourage undergrounding for grid resilience, with XLPE dominating due to its moisture resistance and durability. The UK market is estimated to reach USD 5.44 billion by 2026, and the Germany market is anticipated to reach USD 8.1 billion by 2026.

In April 2025, the EU Net-Zero Industry Act designated NKT's expansion of its high-voltage submarine power cable factory in Karlskrona, Sweden, as the first European net-zero strategic project, giving it national priority for expedited administrative treatment and quicker licensing. Germany leads Europe’s market share due to its renewable energy ambitions and industrial base, compared to the U.K.’s offshore wind focus or France’s nuclear reliance.

Latin America

Surge in Infrastructure and Urbanization to Boost Market Growth

Many Latin American countries are investing in upgrading and expanding their electrical infrastructure. This includes the construction of new power plants, transmission lines, and distribution networks, all of which require significant amounts of power cabling.

Latin America has vast renewable energy resources, particularly in solar, wind, and hydroelectric power. The expansion of these energy sources requires extensive cabling to connect generation facilities to the grid and distribute electricity effectively.

Middle East & Africa

Growing Population and Rapid Urbanization to Necessitate Product Demand

The Middle East & Africa region has abundant renewable energy resources, particularly solar and wind. Saudi Arabia, UAE, and South Africa are making substantial investments in renewable energy projects, necessitating new cables to connect these facilities to the grid.

In February 2025, Ooredoo Group unveiled plans to develop one of the largest submarine cable systems in the Gulf Cooperation Council (GCC) region at Capacity Middle East 2025. Through a modern network intended to meet rising data demands, the new Fiber in Gulf (FIG) submarine cable will connect seven nations: Qatar, Oman, the UAE, Bahrain, Saudi Arabia, Kuwait, and Iraq. Ooredoo has signed an agreement with French manufacturer Alcatel Submarine Networks (ASN) to deploy the system.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Manufacturers are Investing to Make More Effective & Durable Solutions, Driving Market Growth

The global market is mostly fragmented, with key players operating in the industry. Globally, Prysmian, a cable systems company headquartered in Italy, is dominating the market. In May 2025, Prysmian boosted its transmission business with the completion of the expansion works at its subsea power cable factory in Finland and the naming ceremony for the newest addition to its cable laying vessel (CLV) fleet.

List of Key Power Cable Companies Profiled

- Prysmian (Italy)

- ABB (Switzerland)

- Nexans (France)

- NKT A/S (Denmark)

- Encore Wire Corporation (U.S.)

- Finolex Cables (India)

- Tratos (Italy)

- Bahra Electric (Saudi Arabia)

- Brugg Cables (Switzerland)

- Riyadh Cables Group Company (Saudi Arabia)

- Polycab India Limited (Saudi Arabia)

- KEI Industries (India)

- Furukawa Electric Co., Ltd. (Japan)

- Sumitomo Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- March 2025: To improve the reliability of power cable grids, NKT introduced a novel cable monitoring solution: a platform that combines technologies and integrates numerous sensors to offer a complete picture of the state of power cables.

- December 2024: The engineering, procurement, construction, installation, and commissioning (EPCI) of submarine power cable connections. Prysmian has a Framework Agreement with the French TSO, Réseau de Transport d'Électricité (RTE). These connections will link two offshore wind farms, each with a potential capacity of 750 MW, to the French transmission network, encompassing both the land and underwater components (including landfall activities).

- December 2024: ABB announced acquiring Solutions Industry & Building (SIB), a top producer of high-end cable glands and building products for the construction industry that are used to safeguard vital electrical equipment in railway, industrial, and hazardous environments. With the acquisition of SIB, ABB's footprint in the railway, mining, OEM, and specialized markets throughout Europe, the Middle East, and North America has increased.

- June 2024: A new line of power cables from Nexans is intended to link solar panels to inverters and is targeted at EPCs and solar panel installers. Nexans stated that the new ENERGYFLEX wires, which are distinguished from the current market offering by technical criteria known to be the most advanced in the industry, are based on these standards.

- May 2024: Prysmian stated that it signed a binding merger agreement to purchase Encore Wire for USD 290.00 cash per share. The Transaction represents a premium of around 20% over the 30-day volume weighted average share price (VWAP), and approximately 29% over the 90-day VWAP.

INVESTMENT ANALYSIS AND OPPORTUNITIES

In February 2024, Riyadh Cables Group signed a deal with Larsen & Toubro (L&T) to provide a high-voltage alternating current (HVAC) cable system for a significant solar project in Dubai. As per the contract worth USD 43.5million, Riyadh Cables is tasked with the production, provision, and oversight of a 260km HVAC cable system for the sixth phase of the Mohammed bin Rashid Al Maktoum Solar Park project (MBR Solar Park)

REPORT COVERAGE

This global market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations offering thermoplastic pipes. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.39% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

| Segmentation |

By Installation

|

|

By Cable Type

|

|

|

By Voltage

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 232.28 billion in 2025.

The market is likely to grow at a CAGR of 6.39% over the forecast period.

The overhead segment leads the market.

The market size of Asia Pacific stood at USD 88.83 billion in 2025.

Rising global demand for electricity to drive the market growth

Prysmian, ABB, and Nexans are some of the markets top players.

The global market size is expected to reach USD 414.67 billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us