Medical Nutrition Market Size, Share & Industry Analysis, By Type (Service [Nutrition Assessment, Meal Preparation & Delivery, Feeding Assistance], and Product [Enteral Nutrition, Parenteral Nutrition {Partial Parenteral Nutrition & Total Parenteral Nutrition}]), By Age Group, By Route of Administration (Oral, Nasal, Parenteral), By Form (Powder & Liquid), By Therapeutic Area (Oncology, Neurological Disorders, Gastrointestinal Disorders, Diabetes, Kidney Disorders, Cardiovascular Disorders), By End-user (Hospitals & ASCs, Specialty Clinics, Homecare Settings), & Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

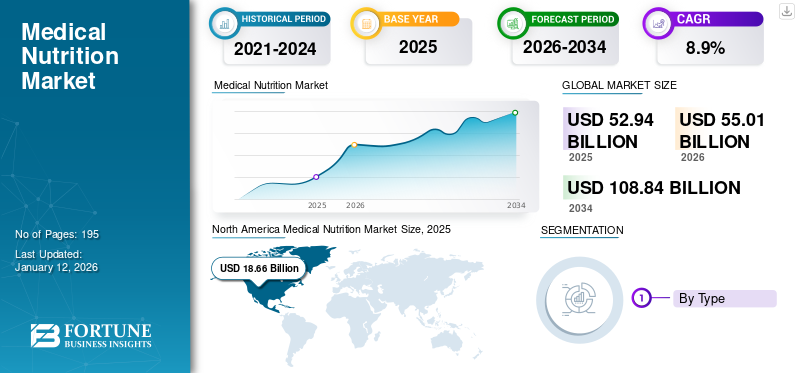

The global medical nutrition market size stood at USD 52.94 billion in 2025. The market is estimated to grow from USD 55.01 billion in 2026 to USD 108.84 billion by 2034, depicting a CAGR of 8.9% over the forecast period. North America dominated the medical nutrition market, accounting for a 35.2% market share in 2025.

Medical Nutrition Therapy (MNT), also known as clinical nutrition, is a nutrition-based treatment for different temporary and long-term health conditions. This therapy uses nutrition education and behavioral counseling to prevent or manage a medical condition. Here, a registered dietitian works with the healthcare team to identify healthcare needs. This nutrition therapy can help manage various medical conditions, including chronic kidney disease, chronic respiratory disease, gastrointestinal disease, diabetes, cardiovascular diseases, and others.

Furthermore, growing awareness about the benefits of clinical nutritional products in terms of meeting the nutrient needs of individuals with various conditions, such as gastrointestinal disorders, bowel disorders, and others, is one of the crucial factors favoring the demand for these products across the globe.

Moreover, the market is semi-consolidated with the presence of key players, such as Abbott, B. Braun SE, Nutricia (Danone), Nestlé, Fresenius Kabi AG, and Reckitt Benckiser Group PLC, among others. The growing focus of market players on receiving regulatory approvals for the launch of different nutrition products is boosting market growth and enhancing the company's share in the global market.

- For example, in April 2023, Nutricia (Danone) launched its memory supplement specifically designed to support memory function through a specialized blend of nutrients that help strengthen synapses in the U.S.

On the other hand, several companies including Addus HomeCare, Morrison Healthcare, and Trinity Health, among others, operate in the global market with a novel service portfolio.

Global Medical Nutrition Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 52.94 billion

- 2026 Market Size: USD 55.01 billion

- 2034 Forecast Market Size: USD 108.84 billion

- CAGR: 8.9 % from 2026–2034

Market Share:

- Region: North America dominated the market with a 35.2% share in 2025. This is due to increasing partnerships among market players, the presence of numerous providers, advanced healthcare infrastructure, and significant investments in nutrition research and development.

- By Type: The Service segment held the largest market share in 2024. Its dominance is attributed to the introduction of new medical facilities providing nutritional therapies and a growing demand for services such as nutrition assessment, counseling, and feeding tube management.

Key Country Highlights:

- Japan: The market is driven by high consumer interest in advanced nutritional solutions, with a recent survey indicating that about 53.0% of the population is interested in personalized nutrition products.

- United States: Growth is fueled by a rapidly aging population, with individuals aged 65 and over representing 17.3% of the total population and projected to reach 22.0% by 2040. This demographic is more susceptible to chronic conditions requiring nutritional support.

- China: The market is expanding due to a large population base, rapid economic development, and increasing healthcare expenditure, which is driving awareness about the importance of nutrition in disease management.

- Europe: The market is supported by favorable reimbursement policies for medical foods in key countries such as France, Germany, and Spain. Growth is also promoted through strategic collaborations, like the one between Fresenius Kabi AG and the European Society of Intensive Care Medicine (ESICM), to advance clinical nutrition research and education.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Occurrence of Chronic Disorders Propels Market Growth

The increasing occurrence of chronic illnesses, including cancer and Parkinson's disease, is leading to an increased demand for clinical nutrition products among patients who cannot sustain proper nutritional consumption due to temporary or lasting swallowing difficulties, physiological issues associated with their diseases, or treatments, including nausea, reduced appetite, or alterations in taste.

- According to data provided by the American Parkinson Disease Association in January 2023, there will be around 1.3 million people living with Parkinson's by 2030 in North America.

Moreover, the increasing elderly population contributes to the rising occurrence of chronic conditions across the globe. The growing elderly population is susceptible to numerous chronic ailments due to pre-existing health issues, relatively fragile immune systems, and various other additional factors.

- For example, as per the data provided by the Administration for Community Living (ACL) in May 2024, people aged 65 years and above in the U.S. represented around 17.3% of the total population in the country in 2022, and the proportion is predicted to grow to 22.0% by the end of 2040.

- Moreover, as per the data provided by the National Council on Aging, Inc. in May 2024, approximately 94.9% of adults aged 60 and above had at least one chronic condition, and 78.7% had two or more.

Furthermore, there is a rising awareness concerning the advantages of homecare clinical nutrition, such as enhanced physiological health, easing of daily activities, and increased mobility, among others, which is anticipated to drive the demand for nutrition products and services globally.

Other Driving Factors

Growing Awareness about Clinical Nutrition Products and Their Aids Drives Product Adoption

The increasing initiatives undertaken by market players and healthcare organizations to promote awareness about the advantages of homecare enteral nutrition (HEN) and parenteral nutrition products in fulfilling the nutrient requirements of individuals with diverse conditions such as gastrointestinal disorders, bowel issues, and others are the key factors driving the demand for these products across the globe, thereby fueling the market growth.

- For instance, in February 2024, the National Feeding Tube Awareness Week was hosted by the Feeding Tube Awareness Foundation in the U.S. from February 4th to February 10th, 2024, to increase awareness about the lifesaving benefits of tube feeding among the population.

Growing Strategic Initiatives to Enhance Product Launches Boosts Market Growth

The increasing emphasis by market players on research and development to introduce innovative clinical nutrition products is expected to boost market growth.

- For example, in September 2024, Dutch Medical Food B.V., a Netherlands-based medical nutrition company, collaborated with Pristine Pearl Pharma Pvt. Ltd. to introduce a novel line of products aimed at addressing disease-related malnutrition in both adults and pediatric patients.

MARKET RESTRAINTS

Restricted Reimbursement and Lack of Health Technology Assessment for Technologies Related to Clinical Nutrition Hinder Market Growth

The policy associated with the coverage of medical foods or foods for special medical purposes (FSMPs) differs between nations and healthcare settings. For example, as per the data provided by Elsevier in May 2022, some countries, including France, Germany, Spain, and the Netherlands, feature a higher rate of reimbursement for medical food in various healthcare situations, such as hospitals, outpatient facilities, community care centers, and homecare environments. However, the compensation for such products in the U.S. is limited across various healthcare settings.

Furthermore, as per the data provided by the Centers for Medicare & Medicaid Services (CMS) in October 2023, enteral nutrition is covered under the Prosthetic Device benefit (Social Security Act 1861(s)(8)). For patients suffering from temporary gastrointestinal diseases, the orally managed enteral nutrition products and associated supplies & equipment will be rejected and considered as non-covered, with no benefits.

Moreover, the lack of financial incentives for companies to capitalize on clinical research for clinical nutrition technologies may limit new inventions and the capability of the healthcare systems to advance the role of nutritional therapy. Therefore, the factors mentioned above are expected to limit the adoption of clinical nutrition products, thus hindering market growth.

MARKET OPPORTUNITIES

Growing Focus on R&D Activities to Develop and Launch Novel Products Provides Huge Opportunities for Market Growth

Due to several benefits provided by clinical nutrition products, prominent market players are shifting their focus toward research and development activities to develop and introduce novel products in the market. Additionally, the growing demand for customized clinical nutrition products specific to the needs of an individual among patients is further augmenting the market growth.

In addition, the growing demand for products related to clinical nutrition is driving the focus of key players toward integrating artificial intelligence (AI) to develop disease-specific clinical nutrition. It is likely to support the growing adoption of these products in the global market.

- For instance, according to the annual report published by Abbott in 2023, the company capitalized USD 2,741.0 million in activities related to R&D in the market. Similarly, it was reported that Abbott is directing its research and development investments toward platforms that cover both pediatric and adult nutrition, with a focus on areas such as gastrointestinal and immune health, brain health, mobility, and metabolism in patients.

- Moreover, as per the data provided by the International Journal of Nutrition Research and Health in October 2024, artificial intelligence (AI) plays an important role in optimizing nutrition delivery for critically ill patients. AI-driven systems can calculate the accurate nutritional requirements of patients, monitor their intake, and ensure that they receive the appropriate nutrients for their condition.

Furthermore, the increasing emphasis of market players on clinical trials to recognize potential contenders for the treatment of various medical conditions is also anticipated to aid the rising frequency of product entries across the market.

MARKET CHALLENGES

High Cost of Producing Clinical Nutritional Products Challenges Market Players

The development and manufacturing of specialized nutritional products require significant financial investment due to various factors, such as research and development (R&D), regulatory compliance, and sourcing high-quality ingredients. These increased production costs can create barriers to accessibility and affordability for specific patient populations. As production costs rise, pharmaceutical companies often pass these increased costs onto consumers in the form of higher retail prices. This can make nutritional products unaffordable for low-income patients or those without insurance, leading to reduced access to the necessary treatments.

Overall, the high production costs associated with specialized nutrition products not only impact patient access but also present a challenge for manufacturers in balancing profitability with the need for broader market reach and patient affordability.

MEDICAL NUTRITION MARKET TRENDS

Rising Shift Toward Development of Disease-specific Products is an Emerging Market Trend

Clinical nutrition delivers essential macro and micronutrients to individuals who have difficulties in achieving adequate oral intake to fulfill their nutritional requirements. It is essential for various conditions in patients, including diabetes, neurological disorders, and cardiovascular diseases, among others. The growing focus of key companies on the development and launch of nutritional products with clinical benefits for the management of specific disease conditions is a significant market trend.

- For instance, in April 2022, Abbott announced the release of metabolic nutrition formulas, including the specialty product Similac PM 60/40, at the request of the U.S. Food and Drug Administration (FDA). Similac PM 60/40 is an infant formula with low iron designed for feeding infants who are at risk of hypocalcemia due to hyperphosphatemia or those with renal issues that require reduced mineral consumption.

Other Market Trends

Growing Patient Preference Toward Personalized Nutrition Therapy is Considered a Notable Market Trend

Advancements in genetic research and a wider understanding of individual nutritional needs are creating opportunities for personalized nutrition plans tailored to specific patient profiles. Companies that are heavily investing in R&D activities to offer personalized medical nutrition solutions are likely to gain a competitive edge in the market.

Rising Focus on Preventive Healthcare is Considered a Significant Market Trend

There is an increasing focus on preventive healthcare, with clinical nutrition being vital in lowering the risk of chronic diseases. Nutritional interventions are being more frequently acknowledged as effective methods for preventing diseases and promoting health.

Download Free sample to learn more about this report.

Impact of COVID-19

The global medical nutrition market observed slower development during the COVID-19 pandemic in 2020 due to disturbances in the supply chain, postponements in treatment, and product shortages, among others. Key players providing nutritional products reported declining revenues due to supply chain issues. On the other hand, the market players providing nutrition services experienced considerable growth in 2020 compared to FY 2019, owing to increased demand for home healthcare services.

- For instance, in FY 2020, Danone generated a revenue of USD 7,783.5 million 2020 from its specialized nutrition segment. The company experienced a decline of -4.8% in its revenue generated by the specialized nutrition segment in 2020 compared to revenue generated in 2019.

- Additionally, according to the 2020 annual report, Addus HomeCare, Inc., a homecare service-providing company, generated a revenue of USD 16.2 million in 2020. The company experienced a growth of 12.3% in its revenue in 2020, as compared to revenue generated in 2019.

Moreover, the market regained regularity during the post-pandemic phase due to the resumption of all the services. Furthermore, the market witnessed considerable growth in 2022, 2023, and 2024 due to an increase in the launch of new clinical nutrition products that can be used directly at patients' homes and healthcare facilities to manage chronic disease conditions.

SEGMENTATION ANALYSIS

By Type

Introduction of New Medical Facilities Providing Nutritional Therapies Boosted Service Segment Growth

Based on type, the market is divided into service and product. This is further divided into meal preparation & delivery, feeding assistance, nutrition assessment, and others. Furthermore, the product segment is categorized into enteral nutrition and parenteral nutrition. The parenteral nutrition segment is further sub-segmented into partial parenteral nutrition (PPN) and total parenteral nutrition (TPN).

The service segment dominated the market contributing 65.48% globally in 2026 and is expected to grow at a significant CAGR from 2026-2034. The dominance of this segment is attributed to the introduction of new medical facilities providing nutritional therapies.

- For example, in September 2024, Memorial Hospital Pembroke launched the first comprehensive clinical nutritional therapy center in South Florida, U.S.

Moreover, the growing demand for clinical nutrition services, such as nutrition assessment, nutrition counseling, and feeding tube management, among others, further results in the growing adoption rate for these services in the market. The growing geriatric population opting for clinical nutrition services at their homes supplements the growth of the service segment.

The product segment is projected to grow considerably throughout the estimation period. The growth of this segment is majorly due to rising demand for parenteral and enteral nutrition products which leads to the rising focus of the key players toward strategic initiatives, including acquisitions and mergers among the other players to strengthen their product portfolio in the market.

- For instance, in May 2024, Danone acquired Functional Formularies, one of the major players in the whole foods tube feeding business, with an aim to strengthen its presence in the U.S. Thus, a growing number of acquisitions and mergers among the other players supports the segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By Age Group

Increasing Adoption of Medical Nutrition Products by Adult Population Boosted Segmental Growth

Based on age group, the market is divided into adults and pediatrics.

The adults segment held a dominant medical nutrition market share with a share of 72.3% in 2026 and is estimated to grow at a considerable CAGR from 2026-2034. The growth is majorly due to the growing occurrence of chronic ailments such as cardiovascular ailments and neurological issues, among others, resulting in the rising adoption of clinical nutrition products among the adult population. This, along with increasing awareness about the benefits of parenteral and enteral nutrition, is likely to boost the demand for products, thereby backing the growth of the segment in the market.

- For example, as per the data provided by the Alzheimer's Association, in September 2024, nearly 7.0 million Americans were living with Alzheimer's. This number is projected to rise to nearly 13.0 million by the end of 2050.

On the other hand, the pediatrics segment is expected to grow at the highest CAGR during the forecast period, owing to the increasing launch of nutritional products that pediatric patients can use for disease-related malnutrition.

- For instance, in October 2023, Nutricia, a division of Danone, revealed its inaugural nutritional beverage featuring a balanced blend of genuine fruit and vegetable components specifically designed for the dietary management of disease-associated malnutrition and stunted growth in pediatric patients. It is prepared for drinking and is nutritious, containing ingredients sourced from natural origins, offering one-third of the suggested daily intake of fruits and vegetables.

By Route of Administration

Increasing Launch of Oral Medical Nutrition Products Augmented Segmental Growth

Based on the route of administration, the market is segregated into oral, nasal, parenteral, and others.

The oral segment dominated the market with a share of 40.7% in 2026 and is projected to grow at the highest CAGR during the forecast period. The dominance of this segment is largely due to increasing product launches which can be administered via oral route.

- For example, in November 2023, FrieslandCampina Ingredient (FCI) launched a microparticulated whey protein that can be used in clinical nutrition therapies. This protein enables the development of superior oral nutritional supplements to help improve patient outcomes.

Furthermore, the parenteral segment accounted for the second-largest share of the market in 2024, owing to increasing regulatory approvals and product launches. The growth of the segment is mainly attributed to its preference by the patients who are unconscious and not able to take nutritional products via the oral route.

- For example, in May 2024, Baxter received the U.S. Food and Drug Administration (FDA) approval of an expanded indication for Clinolipid (Lipid Injectable Emulsion) to be used in pediatric patients. Clinolipid is used to provide calories and essential fatty acids in parenteral (intravenous) nutrition (PN) when oral or enteral nutrition is not possible, insufficient, or contraindicated.

On the other hand, the nasal and others segments are projected to grow considerably during the forecast period. The growth of the segment is mainly due few patient’s inability to gain clinical nutritionals via oral and parenteral routes, preferring nasal and other routes.

By Form

Increasing Liquid Product Launches for Medical Nutrition Therapies Led to Segment Growth

The market is categorized into powder and liquid, on the basis of form.

The liquid segment led the market with a share of 66.24% in 2026. This growth is due to to different advantages of products related to liquid clinical nutrition, such as effective digestion, higher nourishment and hydration, and increased bioavailability, among others. Moreover, the growing focus of market players on the development and launch of liquid components to produce liquid nutritional products also contributes to segmental growth.

- For instance, in October 2023, Otsuka Pharmaceutical Factory, Inc. launched a concentrated liquid diet product, "HINEX RENUTE," to provide protein and energy for early resumption of nutrition.

On the other hand, the powder segment is set to grow at a considerable CAGR over the forecast period. The rising number of innovations in powder clinical nutrition products and lower cost, among others, are a few factors that support the segmental growth.

By Therapeutic Area

Increasing Prevalence of Cancer Boosted Oncology Segment Growth

Based on therapeutic area, the market is segmented into neurological disorders, oncology, kidney disorders, gastrointestinal disorders, cardiovascular disorders, diabetes and others.

The oncology segment led the global market in 2024. The growing occurrence of various types of cancer, including lung and breast cancer, among others, depicts that a huge part of the patient population suffers from malnutrition. The rising patient population suffering from chronic illnesses, including cancer, necessitates the need for clinical nutrition products and services, enhancing segmental growth. Moreover, the increasing focus of key players on the development of modified enteral and parenteral offerings based on specific patient requirements, thus enhancing segmental growth.

- For example, as per the data provided by the Journal of America Cancer Society in January 2025, around 2,041,910 new cancer cases are projected to occur in the U.S. by the end of 2025.

On the other hand, the gastrointestinal disorders segment is expected to grow moderately over the forecast period. The growing occurrence of gastrointestinal ailments, including inflammatory bowel disease, bowel obstruction, and ulcerative colitis, among others, is resulting in an increasing number of patients globally.

- For example, as per the data provided by the National Center for Biotechnology Information (NCBI) in September 2023, around 320,000 people in Canada were living with inflammatory bowel disease (IBD), and this number will increase to 470,000 by the end of 2035.

The neurological disorders segment is anticipated to grow at the third largest CAGR over the forecast period. This growth is attributed to the enhanced occurrence of neurological illnesses among patients, resulting in a growing need for clinical nutrition products. Also, the growing research and development activities to launch novel products are supplementing the segmental growth.

- For instance, according to the data published by the National Health Service (NHS) in March 2023, in the U.K., 438,213 patients had a recorded diagnosis of dementia in February 2023, an increase of 6,368 patients since January 2023.

Furthermore, the diabetes segment is expected to grow at a considerable CAGR during the forecast period, owing to a high burden of diabetes across the globe requiring nutritional assessments and counseling.

Moreover, the kidney disorders segment is expected to grow at a stagnant CAGR from 2025-2032. The rising prevalence of kidney disorders, particularly chronic kidney disease (CKD), is a major driver of the segment. CKD necessitates specialized dietary interventions and nutritional supplements to manage the condition and its complications. These are the major factors boosting segmental growth throughout the forecast period.

By End-user

Hospital & Clinics Segment Dominated Market Due to Growing Number of Hospitalizations

In terms of end users, the market is divided into hospitals & ASCs, specialty clinics, homecare settings, and others.

The hospitals & clinics segment dominated the global market in 2024, owing to increasing hospitalizations for nutritional deficiencies.

- For example, as per the data provided by the Guardian News & Media Limited in January 2025, the number of people admitted to hospital in England had increased in past years due to a lack of vitamins or minerals. In fiscal year 2023-24, there were 191,927 admissions, the main reason being a lack of iron, which was up 11.0% from 2022-23. The figure is almost 10 times the 20,396 hospital admissions for lack of iron in 1998-99.

The specialty clinics segment is expected to grow moderately during the forecast period. The launch of new specialty clinics providing nutritional therapies along with nutritional counseling is boosting segmental growth.

Furthermore, the homecare settings segment is expected to grow at the second largest CAGR during the forecast period. Growing preference toward clinical nutrition services at home is driving the key service providers to focus on the initiative to offer novel home healthcare services globally, thereby supplementing the segmental growth.

- For instance, as per the data provided by the National Center for Biotechnology Information (NCBI) in August 2024, the U.S. Food and Drug Administration (FDA) launched the Healthcare At Home initiative with an aim to address healthcare needs in patients' homes. Thus, the rising number of initiatives to promote homecare services for clinical nutrition is likely to support the growing adoption rate for these services in the market.

On the other hand, the others segment is expected to grow at a stagnant CAGR throughout the forecast period, owing to increasing utilization of nutritional products at academic and research institutes for research proposes.

MEDICAL NUTRITION MARKET REGIONAL OUTLOOK

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Medical Nutrition Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2025, accounting for USD 18.66 billion of the global market. The increasing partnerships among market players for the development of novel clinical nutrition products are one of the main factors driving market growth in North America. Furthermore, the growing focus of market players on the launch of novel products at medical conferences creates product awareness, fueling the medical nutrition market growth in the U.S.

- For example, in December 2022, Baxter introduced ExactaMix Pro, a next-generation automated nutrition compounder, at the American Society of Health-System Pharmacists (ASHP) 2022 held in Las Vegas, U.S. This helped the company to strengthen its brand image in the market.

In addition, the presence of a large number of players providing both products and services for clinical nutritional needs, advanced healthcare infrastructure, and significant investments in nutrition research and development are some of the additional factors supplementing market growth throughout the forecast period. The U.S. market is projected to reach USD 17.71 billion by 2026.

Europe

The market in Europe accounted for the second-largest share in 2024, owing to increasing collaborations among market players and government authorities to enhance research & education and promote nutrition products globally.

- In February 2024, Fresenius Kabi AG continued its collaboration with the European Society of Intensive Care Medicine (ESICM) to promote clinical nutrition through initiatives such as the ESICM-Fresenius Kabi Clinical Nutrition Award and fellowships for a specialized eCourse on nutrition in critical illness. This partnership enhanced research and education in critical care nutrition and supported advancements in homecare nutrition.

Moreover, market growth in this region is supplemented by strong government support, well-established healthcare systems, and a growing emphasis on preventive healthcare and therapeutic nutrition. The region's aging population and the growing prevalence of chronic diseases further propel the demand for clinical nutrition products. The UK market is projected to reach USD 2.39 billion by 2026, while the Germany market is projected to reach USD 2.69 billion by 2026.

Asia Pacific

The market in Asia Pacific is expected to grow at a moderate CAGR from 2025-2032. This is mainly due to the rising number of geriatric population suffering from various chronic conditions requiring nutritional therapies. Moreover, the increasing demand for personalized nutrition products, coupled with a growing consumer preference for tailored dietary solutions, is prompting key industry players to develop offerings that cater to individual needs. This trend is significantly contributing to the market growth in this region. The Japan market is projected to reach USD 2.85 billion by 2026, the China market is projected to reach USD 3.8 billion by 2026, and the India market is projected to reach USD 1.54 billion by 2026.

- For instance, as per the data provided by Nutraingredients in August 2024, a survey-based study was conducted by Rem3dy Health in Japan in 2024. The results of the study indicated that about 53.0% of the population is interested or somewhat interested in personalized nutrition products in Japan.

Furthermore, market growth in this region is fueled by a large population base, rapid development, and increasing healthcare expenditure. Countries such as China, India, and Japan are witnessing significant growth due to rising awareness about the importance of nutrition in disease management and overall health.

Latin America and Middle East & Africa

The market in Latin America and the Middle East & Africa are expected to grow steadily throughout the forecast period. This is attributable to their developing healthcare infrastructure for clinical nutrition therapies, growing awareness about nutrition's benefits, the growing burden of chronic diseases, and ongoing efforts to enhance healthcare access and education, which are fostering market growth in this region.

Moreover, growing strategic alliances between major players for the development and launch of clinical nutrition products are supplementing market growth in these regions.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Increasing Focus of Market Players on Strategic Alliances to Enhance their Product Offerings Contributes to Companies' Revenue Growth

The global medical nutrition market is semi-consolidated, with three major players, Nestlé, Abbott, and Nutricia (Danone), operating in the global market with a novel product portfolio.

Nestlé led the global clinical nutrition products market in 2024. This dominance is due to the growing focus of the firm on research and development activities for clinical nutrition products. Furthermore, the growing emphasis of Nestlé on strategic collaborations with other players to create awareness about clinical nutrition is also supporting the increasing share of the company.

- In January 2024, Nestlé collaborated with Global Shapers, an initiative by the World Economic Forum, and Accenture to support youth innovation to accelerate their breakthrough ideas. This helped the company to increase its brand presence in the market.

On the other hand, the increasing number of launches by Nutricia (Danone), Abbott, and Baxter to enhance their portfolio for parenteral and enteral nutrition products is leading to the enhanced market share of the company.

- In September 2024, Nutricia launched its reformulated Nutrison core range tube feeds at the 46th European Society for Parenteral and Enteral Nutrition (ESPEN) Congress on Clinical Nutrition and Metabolism in Milan.

Similarly, increasing focus of other key players such as Reckitt Benckiser Group PLC, Ajinomoto Co., Inc., and others toward inorganic growth strategies, including attending conferences campaigns, among others, to increase their brand presence, is likely to support the growth of the market for homecare clinical nutrition products globally.

LIST OF KEY MEDICAL NUTRITION COMPANIES PROFILED

- Abbott (U.S.)

- B. Braun SE (Germany)

- Nestlé (Switzerland)

- Nutricia (Danone) (Netherlands)

- Baxter (U.S.)

- Fresenius Kabi AG (Germany)

- Reckitt Benckiser Group PLC (U.K.)

- Addus HomeCare, Inc. (U.S.)

- Medtrition Inc. (U.S.)

- Ajinomoto Co., Inc. (Japan)

KEY INDUSTRY DEVELOPMENTS

- August 2024 - Ajinomoto Health & Nutrition North America, Inc. partnered with Shiru, Inc. to develop sweet proteins using AI to address global health issues such as diabetes, obesity, and cardiovascular disease with an aim to strengthen its product portfolio.

- January 2024 - Nutricia partnered with a digital oncology company, Resilience, with an aim to provide better nutritional care for patients with cancer.

- January 2024 - Abbott launched the PROTALITY brand, a high-protein nutrition shake with an aim to support adults on their weight loss journey. This helped the company to widen its product portfolio for nutritional products.

- June 2023 - Nestlé Health Science and Seres Therapeutics, Inc. announced that they have signed an agreement to acquire the VOWST (fecal microbiota spores, live-brpk) capsules business. This will help the company develop innovative clinical nutrition products.

- February 2022 - Medtrition Inc. presented its first case series demonstrating the effectiveness of an oral nutrition supplement containing collagen dipeptides and L-Citrulline on healing chronic wounds at the American Professional Wound Care Association's Wound Week 2022. This helped the company to increase its brand presence globally.

REPORT COVERAGE

The medical nutrition market analysis report provides a detailed competitive landscape and market insights. It focuses on key aspects such as company profiles, device types, and end-users. In addition to the medical nutrition market size, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors that have contributed to the growth of the advanced market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth rate |

CAGR of 8.9% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Type

|

|

By Age Group

|

|

|

By Route of Administration

|

|

|

By Form

|

|

|

By Therapeutic Area

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 52.94 billion in 2025 and is projected to record a valuation of USD 108.84 billion by 2034.

In 2025, North America stood at USD 52.94 billion.

The market is expected to exhibit steady growth at a CAGR of 8.9% during the forecast period of 2026-2034.

Based on type, the service segment held a leading position in the market in 2025.

The increasing prevalence of chronic diseases and growing awareness about medical nutrition therapies are the key factors driving the market growth.

Abbott, Nestlé, Nutricia (Danone), Baxter, and Fresenius Kabi AG are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us