Mental Health Apps Market Size, Share & Industry Analysis, By Platform (iOS, Android, and Others), By Application (Depression and Anxiety Management, Meditation Management, Stress Management, Wellness Management, and Others), By End-user (Healthcare Providers, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

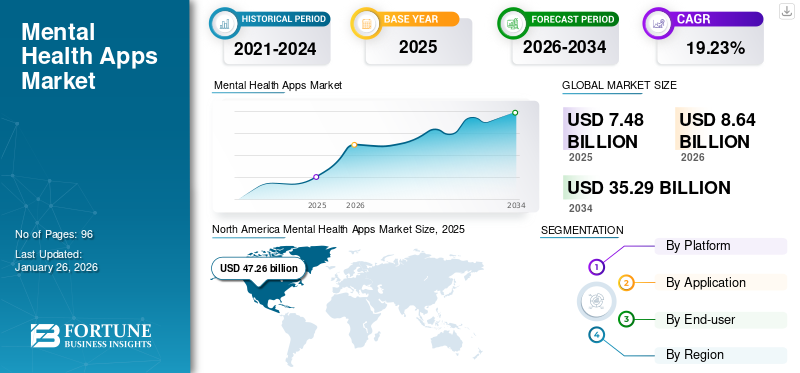

The mental health apps market size was valued at USD 7.48 billion in 2025. The market is projected to grow from USD 8.64 billion in 2026 to USD 35.29 billion by 2034, exhibiting a CAGR of 19.23% during the forecast period. North America dominated the mental health apps market with a market share of 47.26% in 2024.

The global burden of mental disorders, such as depression, anxiety, bipolar disorder, Post-Traumatic Stress Disorder (PTSD), and Schizophrenia is increasing significantly. Mental health applications provide solutions for diagnosing, preventing, and managing these disorders. The increasing prevalence of these diseases has boosted the demand for practical solutions to manage these conditions.

- For instance, as per the data published by the World Health Organization (WHO) in March 2023, around 280 million people across the globe are suffering from depression, accounting for 3.8% of the total population.

Moreover, increasing government initiatives in many countries to create mental health awareness is further augmenting the demand for these apps.

Global Mental Health Apps Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 7.48 billion

- 2026 Market Size: USD 8.64 billion

- 2034 Forecast Market Size: USD 35.29 billion

- CAGR: 19.23% from 2026–2034

Market Share:

- North America dominated the mental health apps market with a 47.26% share in 2025, driven by the rising prevalence of mental health disorders, increased awareness, and the strong presence of key app developers offering innovative mental wellness solutions.

- By application type, depression & anxiety management apps are expected to retain the largest market share owing to the surging demand for accessible, self-help digital tools that address widespread mental health concerns.

Key Country Highlights:

- United States: Increasing collaborations between mental health app providers and digital platforms are enhancing app accessibility, while growing awareness initiatives are fueling adoption.

- Europe: Rising healthcare expenditure on mental health and strong emphasis on early intervention strategies are propelling the demand for digital mental health solutions.

- China: Collaborative efforts between government bodies and global health organizations to educate and promote mental wellness are driving the uptake of mental health apps.

- Japan: Government strategies focusing on integrating digital mental health tools into broader public health initiatives are encouraging adoption across the population

COVID-19 IMPACT:

Increased Deterioration in Mental Health Fueled App Demand During COVID-19 Pandemic

During the COVID-19 pandemic in 2020, the market experienced a significant growth. The mortality rate due to the virus increased considerably. Moreover, several individuals lost their livelihoods and millions fell below the poverty line. These factors severely affected the mental health of the population globally, resulting in an increased prevalence of mental health disorders.

- For instance, as per the data published by the World Health Organization (WHO) in March 2022, after the COVID-19 outbreak, the prevalence of depression and anxiety increased by 25%.

- Moroever, a study conducted by the Psychiatry Society showed that there was an increase of 20% among the population suffering from poor mental health during the early stages of the COVID-19 outbreak in 2020.

The demand for mental health apps grew significantly post-COVID-19 due to increased awareness of mental health issues among the population.

Mental Health Apps Market Trends

Increasing Government Initiatives to Create Awareness Regarding Mental Health

The rising prevalence of mental disorders increased the need for creating awareness to better manage mental health. Governments and regulatory bodies in many countries are focusing on creating awareness to control and manage mental wellness effectively.

- For instance, in November 2022, the Shanghai Institute of Mental Health and the World Health Organization (WHO) collaborated to train and educate people in China about mental health and well-being.

- Similarly, in January 2023, the U.K. government announced strategies to tackle major health conditions effectively in the country. These health conditions included mental illness and other chronic diseases, such as cancer and cardiovascular diseases.

Download Free sample to learn more about this report.

Mental Health Apps Market Growth Factors

Increasing Prevalence of Mental Health Disorders to Fuel Market Growth

The prevalence of neurological diseases has been increasing at a significant rate across the globe. For instance, as per data published by the Alzheimer's Association in 2023, around 6.7 million individuals aged 65 and older in the U.S. have Alzheimer’s. Moreover, as per a research study published by BioMed Central Ltd. in May 2023, around 4.05% of the global population has been suffering from anxiety disorder. This proportion is equal to 324 million individuals worldwide suffering from anxiety.

Many research studies have shown that mental health apps are quite effective in improving mental health disorder symptoms. For instance, as per a research study published by the National Centre for Biotechnology Information (NCBI) in March 2023, digital mental health tools improve mental health symptoms effectively in low and middle-income countries. Thus, these digital tools can help fill the gaps in mental health care in these countries.

Moreover, healthcare researchers have increased the incorporation of apps for managing mental health issues and enhancing access to mental health support. The increasing prevalence of mental health problems, such as neurological disorders, stress, and anxiety, and the rising awareness regarding digital tools have increased the demand for mental health apps, thereby fueling the health apps market growth.

RESTRAINING FACTORS

Challenges Faced While Using These Apps to Hinder the Market Growth

The adoption of apps to manage mental health has been increasing globally at a significant rate. However, certain challenges, such as unexpected app failures and hindrances in data privacy are faced while using these digital tools.

One of the most significant challenges faced while using mental health apps is that the patients may describe themselves as depressed or claim that they are going through certain mental health issues. However, without assessment by a trained healthcare professional, the patient could meet the criteria for a different mental health issue. This would result in an incorrect approach to self-treatment.

Another challenge faced while using these digital tools is that there is no clinical validation regarding the efficiency of these apps. Not many research studies are available on the efficiency and effectiveness of mental health apps..

Furthermore, data privacy is one of the major concerns while using these apps. Several Protected Health Information (PHI) breaches are reported across the globe daily. For instance, as per a study published by the National Center for Biotechnology Information (NCBI) in 2021, around 1.8% of mobile health (mHealth) apps include suspicious codes, 23% of the personal data is shared on unsecured channels, and 45% of these apps rely around on unencrypted communication.

The above-mentioned challenges, such as breach of privacy, lack of clinical validation of these apps, and incorrect assessment are limiting the adoption of these apps and hindering the market growth.

Mental Health Apps Market Segmentation Analysis

By Platform Analysis

Cheaper Mental Health App Subscriptions on Android Platforms Boosted Their Adoption

On the basis of platform, the market is segmented into iOS, android, and others.

The android segment dominated the market in 2024. Subscription plans for mental health apps are comparatively cheaper on Android devices as compared to iOS devices. Due to this, downloads are comparatively higher on Android devices. Moroever, as per the data published by Demandsage, in 2023, there would be around 3.3 billion Android users worldwide. Therefore, the availability of subscription plans at a cheaper cost and the maximum number of people using Android mobile phones are responsible for the segment’s dominance. The android segment is expected to lead the market, contributing 49.84% globally in 2026.

Moroever, the iOS segment is expected to record a significant CAGR during the forecast period. The growth of the segment is attributed to the availability of advanced technologies in these devices and increasing number of iPhone users across the world.

- For instance, as per the data published by Semrush Inc., in 2023, the number of iPhone users reached 1 billion, showing an increase of 22.85% from 2017.

To know how our report can help streamline your business, Speak to Analyst

By Application Type Analysis

Increasing Prevalence of Anxiety and Depression Fueled the Demand for Mental Health Apps

Based on application, the market is segmented into depression & anxiety management, meditation management, stress management, wellness management, and others.

The depression & anxiety management segment dominated the market in 2024. The increasing prevalence of depression and anxiety across the globe fostered the demand for effective options for treating these mental health issues. The depression and anxiety magement segment will account for 35.07% market share in 2026.

- For instance, as per the data published by the National Center for Biotechnology Information (NCBI) in November 2022, around 9.2% of Americans experienced severe depressive episodes in 2020, and it was more common in young adults.

The stress management segment accounted for a significant share of the market in 2024. The incidence of stress-related disorders is increasing due to work-life imbalance, long-term health conditions, and many other factors. This factor has increased the demand for practical ways to manage stress, thereby accelerating the segment’s growth.s

By End-user Analysis

Use of Mental Health Apps Increased in Homecare Settings Due to Rising Awareness

Based on end-user, the market is segmented into healthcare providers, homecare settings, and others.

The homecare settings segment dominated the mental health apps market share in 2024. The segment's growth is attributed to the increasing number of active mental health app users and rising awareness about these apps in homecare settings across the world. The homecare settings segment is forecast to represent 48.26% of total market share in 2026.

- For instance, as per a research study published by the National Center for Biotechnology Information (NCBI), in 2022, monthly mental health app downloads reached around 10,000, with several thousands of them being monthly active users.

The healthcare providers' segment is anticipated to register a significant CAGR during the forecast period. The growth of the segment is attributed to the increasing adoption of these mobile health apps by healthcare professionals to assess the mental health of their patients and assist them in managing their mental health issues effectively.

REGIONAL INSIGHTS

Increasing Prevalence of Mental Health Disorders is Responsible for Market’s Growth in North America

North America

North America Mental Health Apps Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2024 by accounting for a significant share, worth USD 3.08 billion. The growth of the market in North America is attributed to the increasing prevalence of mental health disorders in the region and strong presence of key market players, such as Headspace Inc., BetterHelp, and Happify, Inc., and others. The U.S. market is expected to reach USD 3.73 billion by 2026.

- For instance, as per data published by the Agency for Healthcare Research and Quality in February 2022, around 50% of the population in the U.S. is anticipated to be diagnosed with some form of mental illness during their lifetime.

Europe

Europe accounted for a substantial global market share in 2024. The growth of the market in Europe is attributed to the increasing prevalence of mental health disorders and rising healthcare expenditure on mental health. The UK market is anticipated to reach USD 0.48 billion by 2026, while the Germany market is estimated to reach USD 0.47 billion by 2026.

- For instance, as per data published by the National Center for Biotechnology Information (NCBI) in August 2023, 28 European Union (EU) countries spent around 4% of their GDP on mental health disorders.

Asia Pacific

The market in Asia Pacific is expected to record a significant CAGR during the forecast period. The growth of the market in the region is attributed to the increasing number of government initiatives to create awareness regarding mental health and effective approaches to manage the same. The Japan market is forecast to reach USD 0.93 billion by 2026, the China market is set to reach USD 0.3 billion by 2026, and the India market is poised to reach USD 0.12 billion by 2026.

Rest of The World

The market in Latin America and the Middle East & Africa is expected to register a substantial CAGR during the forecast period. The growth of the market in these regions is attributed to the rising demand for effective ways to manage the growing burden of mental health disorders in these regions.

Key Industry Players

Innovative Offerings by Leading Players to Lead to Strong Brand Penetration in Market

Key players, such as Calm, Headspace Inc., and Happify, Inc. accounted for a significant mental health apps market share in 2024. The strong growth of these companies in the market is attributed to their high focus on partnerships with other companies to increase the accessibility of their offerings to the global population.

- For instance, in July 2023, Calm partnered with Spotify, a music app, to provide its mental wellness services on the music streaming platform to increase its accessibility to users.

Moreover, other players, such as Mindscapes, MoodMission, and Sanvello Health are focusing on expanding their presence in the global market with advanced service offerings.

List of Top Mental Health Apps Companies:

- Mindscapes (France)

- Calm (California)

- MoodMission (Australia)

- Sanvello Health (U.S.)

- Headspace Inc. (U.S.)

- BetterHelp (U.S.)

- Happify, Inc. (U.S.)

- Talkspace (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – Headscape Inc. announced the unification of all its service offerings under one brand, named Headspace Care, to increase its accessibility to its users.

- February 2023 – Talkspace launched Talkspace Engage to provide companies with mental well-being services.

- January 2023 – Headspace Inc. announced the expansion of its services outside the U.S. in the international market.

- October 2022 – Calm launched Calm Health, a mental healthcare service for effectively managing physical as well as mental health.

- September 2022 – Headspace Inc. announced the acquisition of Shine App, a mental wellness app, to expand its services in the global market.

REPORT COVERAGE

The global mental health apps market report provides detailed information on its competitive landscape. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on crucial areas, such as service launches in the market. Furthermore, the report covers regional analysis of different segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. It also consists of quantitative and qualitative insights that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.23% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Platform

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market value stood at USD 7.48 billion in 2025.

In 2025, the market value in North America stood at USD 3.54 billion.

The market is predicted to exhibit a CAGR of 19.23% during the forecast period of 2026-2034.

By platform type, the android segment led the market.

The rising prevalence of neurological disorders and increasing number of mental health apps on the App Store and Play Store are driving the market.

Headspace Inc., Calm, and Mindscapes are the top players in the market.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us