Microcrystalline Cellulose Market Size, Share & Industry Analysis, By Source (Wooden Based and Non-Wooden Based), By Form (Powdered and Liquid), By Application (Pharmaceutical, Food & Beverages, Personal Care & Cosmetics, Paints & Coatings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

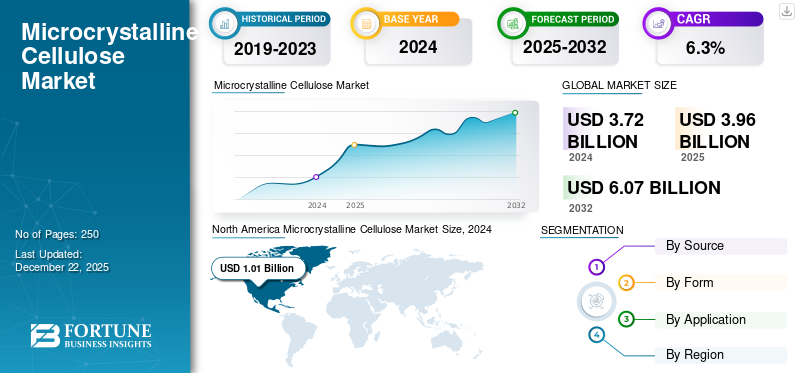

The global microcrystalline cellulose market size was valued at USD 3.96 billion in 2025. The market is projected to grow from USD 4.21 billion in 2026 to USD 6.85 billion by 2034, exhibiting a CAGR of 6.30% during the forecast period. North America dominated the microcrystalline cellulose market with a market share of 27% in 2025.

Microcrystalline Cellulose (MCC) is a purified, partially depolymerized cellulose derived from wood pulp or other plant sources through controlled hydrolysis with mineral acids. It is a white, odorless, tasteless crystalline powder with excellent binding, disintegrating, and flow properties. MCC’s unique combination of compressibility, chemical inertness, and physiological safety makes it an indispensable excipient in pharmaceuticals, food products, cosmetics, and industrial applications. Its tightly controlled particle size distribution, typically 20-200 microns, enables precise functionality in various formulations. Increasing product use as a premier binding and disintegrating agent in the pharmaceutical industry is expected to drive the market growth. ASAHI KASEI CORPORATION, NITIKA PHARMACEUTICAL SPECIALITIES PVT. LTD., Sigachi Industries, Ankit Pulps and Boards Pvt. Ltd., and DFE Pharma are key players operating in the market

Global Microcrystalline Cellulose Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 3.96 billion

- 2026 Market Size: USD 4.21 billion

- 2034 Forecast Market Size: USD 6.85 billion

- CAGR: 6.30% from 2026–2034

Market Share:

- North America dominated the microcrystalline cellulose market with a 27% share in 2025, driven by strong demand from sophisticated pharmaceutical and food processing industries with stringent quality and regulatory standards.

- By application, pharmaceutical is expected to retain the largest market share in 2025, supported by MCC’s critical role as a binder, disintegrant, and flow enhancer in solid dosage formulations.

Key Country Highlights:

- United States: The largest consumer in North America, with demand driven by advanced pharmaceutical formulations and clean-label food products under strict FDA regulations.

- Germany: A leading European market with strong pharmaceutical manufacturing capacity and demand for sustainably sourced MCC in food and drug applications.

- China: Expanding pharmaceutical manufacturing and processed food industries drive significant demand, with opportunities for cost-optimized MCC grades.

- India: Rapid growth in pharmaceutical production and processed food consumption supports rising MCC demand, especially from cost-sensitive markets.

Microcrystalline Cellulose Market Trends

Sustainability Drives Innovation in Microcrystalline Cellulose Production

Rising environmental concerns have accelerated the search for sustainable MCC alternatives beyond traditional wood sources. Consequently, agricultural waste materials such as rice husks, cotton linters, and sugarcane bagasse are emerging as viable alternatives. This shift reduces deforestation pressure while creating circular economy opportunities in the pharmaceutical and food industries, where MCC remains a vital excipient and texturizer.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Adoption of Premier Binding and Disintegrating Agents is Driving MCC Demand

The pharmaceutical sector powerfully drives microcrystalline cellulose market growth through multiple mechanisms. Rising global tablet production volumes, particularly in emerging markets, are expanding their pharmaceutical manufacturing capabilities, creating sustained demand for MCC as the premier binding and disintegrating agent. Simultaneously, innovations in controlled-release drug delivery systems increasingly rely on specialized MCC grades with precisely engineered particle sizes and crystallinity profiles. Pharmaceutical manufacturers favor MCC for its exceptional compressibility, chemical inertness, and superior stability across diverse formulations. Additionally, MCC’s well-established safety profile and regulatory acceptance significantly reduce compliance risks in an industry facing increasingly stringent quality standards, creating a substantial barrier for alternative excipients to overcome.

MARKET RESTRAINTS

Raw Material Supply Volatility and Cost-Intensive Processing Requirements to Limit Market Expansion

The market faces significant constraints from unstable pricing and the availability of high-quality wood pulp. Global deforestation concerns, trade restrictions, and competing demands from the paper and packaging industries create supply uncertainties that impact production costs and manufacturing consistency. In addition, MCC production demands sophisticated purification technologies and extensive quality control measures, resulting in capital-intensive manufacturing that limits market expansion in cost-sensitive regions and applications.

MARKET OPPORTUNITIES

Sustainable Sourcing Initiatives are Expected to Positively Impact Market Growth

Sustainable sourcing creates significant new market opportunities by addressing environmental concerns and supply chain vulnerabilities. Innovative manufacturers are developing processes to extract MCC from agricultural waste streams, including sugarcane bagasse, corn stalks, and rice husks, transforming these abundant byproducts into valuable industrial inputs. This approach resonates strongly with pharmaceutical and food companies pursuing sustainability initiatives and carbon footprint reduction goals. Additionally, these alternative cellulose sources often provide more stable pricing than traditional wood pulp, reducing exposure to forestry industry volatility. The development of enzymatic processing techniques further enhances the sustainability profile by reducing chemical consumption and energy requirements in MCC production, opening doors to premium eco-certified market segments and creating differentiation opportunities in an increasingly environmentally conscious marketplace.

MARKET CHALLENGES

Rising Substitutes Hinder Market Growth

The emergence of alternative excipients and texturizers, such as starch derivatives, gums, and synthetic polymers, has dampened the market expansion. As these substitutes offer comparable functionality at competitive prices, manufacturers in the pharmaceutical and food industries are increasingly diversifying their formulations.

Segmentation Analysis

By Source

Consistent Quality Characteristics and Reliable Production Processes Fuel Wooden Based Segment Growth

Based on source, the market is bifurcated into wooden based and non-wooden based.

The wooden based segment dominates the global market. This segment’s prominence stems from the well-established supply chains and processing technologies centered around wood pulp extraction. This MCC benefits from consistent quality characteristics and reliable production processes, making it particularly valuable in pharmaceutical applications where regulatory compliance and batch-to-batch consistency are paramount.

Non-wooden based MCCs are derived from cotton linters, agricultural residues, and innovative sources such as bacterial cellulose. Sustainability initiatives, supply chain diversification strategies, and the development of specialized performance characteristics unique to different plant sources drive the growth of this segment.

- Cotton-derived MCC commands premium pricing due to its exceptionally high purity and low lignin content, while agricultural waste-derived products appeal to cost-sensitive markets and applications emphasizing environmental credentials.

By Form

Versatility Across Diverse Applications Bolsters Powdered Segment Growth

Based on form, the market is bifurcated into powdered and liquid.

The powdered segment holds the largest market share. This dominance reflects the versatility of powder formats across diverse applications, particularly in solid dosage pharmaceutical formulations where MCC serves as a primary excipient. This segment encompasses multiple sub-categories differentiated by particle size, bulk density, and moisture content, with distinct grades engineered for specific applications ranging from direct compression tableting to food texturizing.

- Manufacturing innovations in this segment focus on enhancing flowability, compressibility, and controlled release properties through sophisticated particle engineering and surface treatments.

Liquid MCC (colloidal microcrystalline cellulose) represents a smaller but faster-growing segment. This form combines MCC with soluble cellulose derivatives or other hydrocolloids to create stable suspensions with thixotropic properties. The liquid segment primarily serves food and beverage applications as emulsion stabilizers, texturizers, and rheology modifiers. Growing demand in consumer preference for clean-label ingredients in food products is accelerating the adoption of liquid MCC as a natural alternative to synthetic stabilizers and thickeners.

- Technological innovations in this segment focus on improving suspension stability and developing specialized formulations for dairy alternatives, plant-based products, and other expanding food categories.

By Application

MCC Role as a Critical Excipient in Tablet Formulations Propels Pharmaceutical Segment Expansion

Based on application, the market is segmented into pharmaceutical, food & beverages, personal care & cosmetics, paints & coatings, and others.

Pharmaceutical applications constitute the largest and most valuable segment in the market. MCC is a critical excipient in tablet formulations, providing essential functionality as a binder, disintegrant, and flow enhancer. This segment exhibits the highest quality requirements and regulatory scrutiny, creating significant barriers to entry and premium pricing opportunities. Growth of this segment is driven by expanding global pharmaceutical production, particularly in emerging markets, alongside innovations in controlled-release drug delivery systems requiring specialized MCC grades with precisely engineered performance characteristics.

Food and beverage applications represent the second-largest segment in the market, with the fastest growth trajectory among major application categories. In food products, MCC functions as a texturizer, stabilizer, anti-caking agent, and bulking agent across diverse categories, including dairy products, baked goods, sauces, and processed foods. The clean-label movement has significantly accelerated MCC adoption as food manufacturers reformulate products to replace synthetic additives with natural alternatives.

- Plant-based food innovations, particularly meat and dairy alternatives, create substantial new opportunities for MCC as a critical texture-enhancing ingredient that improves mouthfeel and structural integrity.

Microcrystalline Cellulose Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Microcrystalline Cellulose Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest microcrystalline cellulose market size of 1.08 in 2025 as sophisticated pharmaceutical and food processing industries demand premium-grade materials. Stringent FDA regulations and quality standards heavily influence the region’s market, creating high barriers for suppliers to enter the market. The U.S. dominates regional consumption, with a particularly strong demand for advanced pharmaceutical formulations and clean-label food products. Regional growth is driven by innovations in controlled-release drug delivery systems and the expansion of natural food ingredients, while major manufacturers focus on developing specialized grades with enhanced functionality for specific applications.

Europe

The European market is characterized by strict regulatory frameworks governing pharmaceutical and food applications and growing consumer preference for natural, sustainably sourced ingredients. Germany, France, and the U.K. represent the largest markets within the region, with substantial pharmaceutical manufacturing capacity driving consistent demand. This region’s growth is accelerated by innovations in sustainable MCC production from agricultural waste streams and the expansion of plant-based food categories requiring specialized cellulose-based texturizers.

Asia Pacific

China and India drive the Asia Pacific microcrystalline cellulose market growth by expanding pharmaceutical manufacturing capacity and rapidly developing processed food industries. The region exhibits significant price sensitivity compared to Western markets, creating opportunities for cost-optimized grades and alternative raw material sources. Technical capabilities vary substantially across the region, with Japan and South Korea focused on high-performance specialized grades while emerging markets emphasize cost-effective production for standard applications. This region’s growth is further accelerated by expanding middle-class populations, driving increased pharmaceutical and processed food consumption.

Latin America

The region’s pharmaceutical industry drives consistent demand for tablet excipients while growing food processing capabilities create new application opportunities. Agricultural waste streams abundant in the region, particularly sugarcane bagasse, provide compelling opportunities for sustainable MCC production with reduced raw material costs. Regional growth faces challenges from economic volatility and import dependencies for specialized grades through localized production, which is gradually expanding to serve regional markets more efficiently.

Middle East & Africa

The region’s pharmaceutical manufacturing capacity is concentrated in specific markets, including Saudi Arabia, UAE, Egypt, and South Africa, with significant reliance on imported materials. The growth of this region is driven by expanding healthcare infrastructure, government initiatives to develop domestic pharmaceutical production, and increasing processed food consumption in urban centers. MCC as an additive in pharmaceuticals and processed food products will surge in the Middle East & Africa market. The region presents long-term growth potential as healthcare access expands and food processing capabilities develop, though market development requires navigating complex regulatory environments and building technical expertise.

COMPETITIVE LANDSCAPE

Key Industry Players

Sustainable Manufacturing Practices and Plant-Based Raw Material Sourcing by Key Companies Resulted in Their Dominating Positions

In the market, leading manufacturers emphasize product functionality innovation to suit evolving end-use requirements, particularly in pharmaceuticals, food, and personal care. There is a strong push toward sustainable manufacturing practices and plant-based raw material sourcing. Key players in the market are also focusing on regulatory compliance and certifications to enhance market credibility and access. Additionally, efforts are underway to optimize supply chains and expand production capacities to meet increasing global demand.

LIST OF KEY MICROCRYSTALLINE CELLULOSE COMPANIES PROFILED

- ASAHI KASEI CORPORATION (Japan)

- NITIKA PHARMACEUTICAL SPECIALITIES PVT. LTD. (India)

- Sigachi Industries. (India)

- Ankit Pulps and Boards Pvt. Ltd. (India)

- DFE Pharma (Germany)

- SEPPIC (France)

- Apollo Scientific (U.K.)

- International Flavors & Fragrances Inc. (U.S.)

- JRS PHARMA (Germany)

- Roquette Frères (France)

KEY INDUSTRY DEVELOPMENTS

- March 2025 - IFF Pharma Solutions showcased next-gen excipients at CPHI Japan 2025, including low-nitrite microcrystalline cellulose (Avicel PH LN), linking directly to the MCC market.

- February 2024 - Asahi Kasei introduced Ceolus, a pharmaceutical-grade Microcrystalline Cellulose (MCC), aiming to reduce the risk of carcinogenic nitrosamine impurities in medications. Additionally, the company commenced operations at a second Ceolus production facility in Mizushima, Japan, enhancing supply capacity and stability.

- October 2023 - Roquette Pharma Solutions unveiled three new excipient grades at CPHI Barcelona 2023 to enhance moisture protection in pharmaceuticals and nutraceuticals. The additions include LYCATAB CT-LM (a low-moisture pregelatinized starch) and MICROCEL 103 SD and 113 SD (microcrystalline cellulose variants), all designed to stabilize moisture-sensitive formulations and improve manufacturing efficiency.

- February 2023 - Asahi Kasei completed a second Ceolus microcrystalline cellulose (MCC) plant at its Mizushima Works in Okayama, Japan, to meet rising global demand for high-performance grades such as Ceolus KG and UF.

- September 2022 - Roquette completed its acquisition of India-based excipient manufacturer Crest Cellulose. This move enhances Roquette’s global presence in plant-based pharmaceutical excipients, particularly microcrystalline cellulose (MICROCEL), to meet rising demand in Asia and worldwide.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.30% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Source

|

|

By Form

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 4.21 billion in 2026 and is projected to reach USD 6.85 billion by 2034.

In 2025, the North American market value stood at USD 1.08 billion.

The market is expected to exhibit a CAGR of 6.30% during the forecast period of 2026-2034.

By source, the wooden based segment leads the market.

The key factor driving the market is the increasing adoption of premier binding and disintegrating agents.

Asahi Kasei Corporation, Nitika Pharmaceutical Specialties Pvt. Ltd., DFE Pharma, and International Flavors & Fragrances Inc. are the top players in the market.

North America dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us