Microfinance Market Size, Share & Industry Analysis, By Providers (Banks, Microfinance Institutions (MFIs), Non-Banking Financial Company (NBFC), and Others), By Service Type (Micro-credit, Micro-savings, Micro-insurance, and Others), By End User (Individuals, Small Enterprises, and Micro Enterprises), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

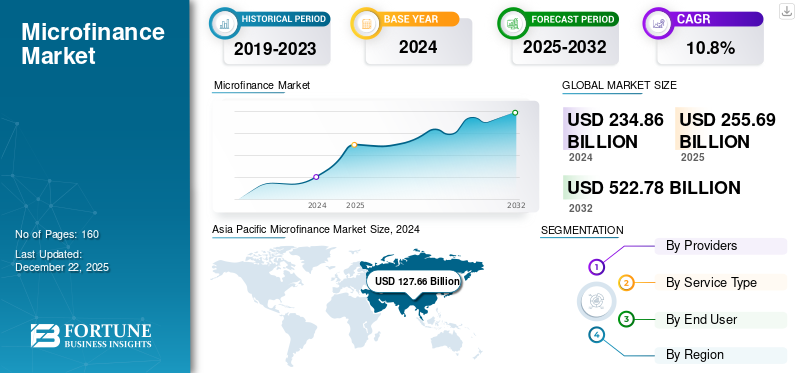

The global microfinance market size was valued at USD 255.69 billion in 2025 and is projected to grow from USD 281.55 billion in 2026 to USD 646.56 billion by 2034, exhibiting a CAGR of 11% during the forecast period. The Asia Pasicfic region dominated the globle maket with a share of 54.90 in 2025.

Microfinance is a financial service that provides small loans and essential banking services to under-banked populations who often lack access to conventional banking options. The market encompasses services such as microcredit, micro-savings, micro-insurance, and digital payment solutions for low-income individuals, small-scale entrepreneurs, and financially or economically marginalized populations.

Institutions in the market track their performance using key indicators such as Gross Loan Portfolio (GLP), number of active borrowers, and loan outstanding loans. Microfinance is offered by a broad set of institutions globally, which can include Microfinance Institutions (MFIs), cooperative societies, non-bank financial companies (NBFCs), and commercial banks with dedicated microfinance divisions. The global financial inclusion gap, integration of digital technology, entrepreneurial activities, growth of SMEs, and economic and social empowerment are substantially driving market growth. Additionally, government policy support through enabling regulatory frameworks is further boosting the growth of the industry.

Leading institutions such as Bank Rakyat Indonesia (BRI), BRAC, CreditAccess Grameen Limited are strategically expanding their reach by offering comprehensive financial services, including microcredit, micro-savings, micro-insurance, and digital payments, promoting financial inclusion. Leading MFIs and banks are strategically building digital infrastructure to expand financial services to unbanked populations while maintaining strong portfolio quality to ensure sustainable market growth.

Key players such as Bank Rakyat Indonesia (BRI), Annapurna Finance Private Limited, Bharat Financial Inclusion Limited, and BRAC are continually innovating their product portfolios and delivery modes. They are also expanding into new geographic markets, which contributes to the growth of the global market.

During the COVID-19 pandemic, essential sectors, including banking and financial institutes, were still operational. However, the market experienced significant challenges, primarily due to increased credit risk, portfolio-at-risk levels, and a rise in non-performing assets. MFIs faced liquidity constraints as funding sources were reduced and mobility restrictions disrupted loan collection mechanisms. Despite post-pandemic challenges, the sector achieved growth by prioritizing client welfare through flexible repayment terms, embracing digitalization, leveraging government-backed moratoriums, diversifying funding sources, fostering resilience, and empowering communities.

Download Free sample to learn more about this report.

IMPACT OF GENERATIVE AI

Early Fraud Detection and Risk Assessment to Drive Market Development

Banking and financial institutions are undergoing significant transformations due to digital innovation. Generative AI is revolutionizing microfinance operations by automating complex credit assessment processes, real-time credit risk assessment, and improving loan approval accuracy for underserved populations. AI platforms help in analyzing and processing data at a relatively higher speed without any human intervention. For instance, in May 2025, Poonawalla Fincorp announced the implementation of artificial intelligence (AI) technologies into its marketing and compliance operations. These AI-driven tools manage between 80–100 automated retargeting campaigns, enhancing customer engagement and regulatory compliance.

IMPACT OF TARIFFS ON THE MARKET

Domestic Orientation Shields Microfinance Market from Tariff Volatility

Tariff policies impacted the market minimally as they primarily serve small, local businesses and marginal borrowers. With a focus on local customers rather than global trade, these operations remained stable, contributing to community resilience. Microfinance providers focus on basic financial inclusion and supporting subsistence-level economic activities, ensuring that borrower cash flows remain tied to domestic consumption patterns rather than global supply chain dynamics.

MARKET DYNAMICS

Microfinance Market Trends

Digital Transformation to Catalyze Market Growth

Digital transformation is a key driver of global microfinance market growth, improving the accessibility, efficiency, and scalability of financial services for low-income households. Mobile banking, fintech platforms, and digital payment systems have increased the capacity of microfinance institutions (MFIs) to reach populations without traditional geographic or infrastructure limitations, which is particularly notable in rural and unbanked populations. For instance, in 2024, according to the World Economic Forum, real-time payments in the Middle East reached about USD 675 million and are expected to reach USD 2.6 billion by 2027. This growth is driven by governments allowing a young, tech-savvy population to achieve financial inclusion through MFIs that provide faster, more accessible, and cheaper services to underserved populations.

Market Drivers

Increasing Women-Centric Business Ecosystem to Boost Market Growth

The rise of entrepreneurship in developing economies is a substantial driver of growth in the industry. People, mainly in the Asia Pacific and Middle East regions, are pursuing entrepreneurship out of economic necessity and a lack of formal employment opportunities. This surge in entrepreneurism is driving the market as banks often do not serve small entrepreneurs as they lack sufficient collateral, making microfinance a crucial alternative. Microfinance provides underserved people with opportunities to start and grow income generating businesses, thereby improving their standard of living and contributing to economic growth. It also holds tremendous potential to empower women by giving them greater control over their finances and helping them overcome economic barriers. For instance, FINCA Microfinance Bank Limited partnered with CIRCLE Women through CIRCLE Women's Digital Literacy Programme, in April 2023. This partnership is empowering underprivileged women to advance digital literacy and access better financial products and services.

Market Challenges

High Costs and Default Risks Raise Microfinance Interest Rates Hindering Market Growth

Reaching underserved communities requires considerable investment in field operations, staff training, and financial literacy programs. These efforts, combined with the elevated default risk of lending to those without a traditional credit history, naturally increase operational costs for MFIs. These institutions aim to balance their financial sustainability with affordable loans, supporting both their stability and borrowers' empowerment. Although MFIs need to charge interest rates that will return enough revenue to be sustainable, those interest rates are often higher than what low-income borrowers can reasonably afford. Many potential borrowers who need loans to grow their businesses or handle emergencies find themselves trapped by high interest rates, preventing a significant portion of those who most need financial help from accessing credit.

Market Opportunities

Government-Backed Financial Inclusion Initiatives to Create Significant Market Opportunities

Increasing government support for financial inclusion is encouraging MFIs to move beyond traditional lending and offer a broader range of financial services. This shift is creating considerable opportunities for growth in the market. Regulatory frameworks that promote innovation have enabled MFIs to introduce insurance plans, savings accounts, pension schemes, and remittance services, effectively transforming them into full-service financial providers for underbanked communities. Additionally, government-backed guarantee schemes help reduce the lending risk for MFIs, empowering them to explore new market segments. These efforts are focused on serving groups previously excluded from financial services, such as women entrepreneurs and small-scale business owners. For instance, in April 2025, according to the SBI report, MSME lending surged dramatically due to Mudra Initiatives, growing from USD 13.57 billion in FY14 to USD 31.85 billion in FY24, with projections exceeding ~USD 35.02 billion in FY25. MSME credit's share of total bank lending rose from 15.8% to nearly 20% during this period.

SEGMENTATION Analysis

By Providers

Dedicated Service Models and Grassroots Expertise Positions MFIs as Leading Providers

By providers, the market is classified into banks, Microfinance Institutions (MFIs), Non-Banking Financial Companies (NBFCs), and others (small finance banks and cooperative societies). Microfinance Institutions dominated the market in 2024, commanding the largest market share, followed by Banks, NBFCs, and other financial service providers.

The dominant position of MFIs is due to their dedicated focus on serving low-income populations, coupled with a deep-rooted understanding of grassroots financial needs. Traditional banks do not consider microfinance as a core business area, MFIs have built their operational structure entirely around reaching under-served communities with their financial products and services. These entities have set up an extensive network of field offices and hired local staff who are culturally aware of the community dynamics. Thus, they adopt an extremely flexible lending methodology that perfectly suits the capacity to repay and the winding income streams of their target segment.

During the forecast period, enhanced integration of digital technologies at the platform level will open substantial market opportunities for microfinance organizations, particularly MFIs. These advancements will help decrease operational costs while expanding geographical coverage and improving customer acquisition strategies. Nevertheless, traditional banks have begun noticing the potential of such sectors. They have started widening their scope of such services by setting up a dedicated microfinance division and strengthening partnerships with existing MFIs.

The growing entrepreneurial aspirations of youth in developing countries, along with the emerging regulatory policies on financial inclusion and digital transformation, are driving the growth of the market.

By Service Type

Microcredit Held the Highest Market Share, Driven by Credit Gaps and Adoption of Digital Lending Platforms

By service type, the market is segmented into micro-credit, micro-savings, micro-insurance, and others (remittance services and leasing). The micro-credit segment dominated the market in 2024 with the highest share and emerged as the fastest-growing segment, followed by micro-savings, micro-insurance, and other ancillary financial services.

The emergence of micro-credit is quickly growing due to the credit gap in underserved markets, where traditional banks struggle to provide adequate lending support to small-scale entrepreneurs and low-income households. Small business owners, agricultural workers, and informal sector participants require access to liquidity, especially for working capital, inventory purchases, equipment upgrades, and operational costs tied to seasonal or sustenance activities.

The increase in entrepreneurial activities across emerging economies, combined with strong government support for small business development, is further increasing the demand for microcredit. Additionally, the adoption of digital lending platforms, along with simplified application processes has increased accessibility, boosting market share and growth rate of microcredit services compared to other segments. The microcredit segment accounted for 81.61% of the total market share in 2026.

Micro-savings promote small, periodic deposits which contribute to long-term financial resilience as a safety mechanism and help low-income individuals grow their savings gradually for use in future investments or emergencies.

Micro-insurance products are proving to be vital, as insurances serve to restrain borrowers' ability to slip lower into poverty whenever unexpected crises arise.

By End User

To know how our report can help streamline your business, Speak to Analyst

Individuals Segment Led the Market Owing to Growing Credit Demand From Low-Income Households

By end user, the market is segmented into individuals, small enterprises, and micro enterprises.

The individual segment accounted for the largest microfinance market share at approximately 79.26% in 2025, driven by growing credit demand from low-income households and solo entrepreneurs. These individuals often need financing for household expenses, agricultural activities, and small-scale businesses.

Small enterprises represent the fastest-growing segment during the forecast period. This growth is supported by growing entrepreneurial activity, increased government support for small businesses, and the availability of accessible digital lending platforms tailored to meet working capital needs.

MICROFINANCE MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Asia Pacific

Asia Pacific Microfinance Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the market due to high demand for credit in underserved communities, rising entrepreneurial activities, and rapid adoption of digital lending platforms, with the market size valued at USD 140.36 billion in 2025 and increasing to USD 155.37 billion in 2026. The dominance is further supported by key factors such as the large rural population, rising demand for financial inclusion initiatives, increasing governmental support for microfinance programs, and the presence of the largest number of MFIs. Moreover, cultural acceptance of group lending and community-based financial services in the region fits well with traditional microfinance approaches. This fit has facilitated the widespread adoption of such practices and contributed to lower delinquency rates.

India is expected to capture a large share of the market due to its vast rural population, the surge in entrepreneurial activity, the larger number of MFIs, and governmental initiatives such as the Pradhan Mantri Mudra Yojana scheme, which has facilitated billions in lending to micro and small enterprises. The Japan market is projected to reach USD 5.74 billion by 2026, the China market is projected to reach USD 26.79 billion by 2026, and the India market is projected to reach USD 64.19 billion by 2026.

Europe

Market growth in Europe is expected to be the slowest among other regions during the forecast period. This is due to the presence of a well-developed financial services sector, regulations restrictions on NGOs, and the predominance of microcredit over a broader suite of microfinance services. Europe's mature banking and finance system made it fairly simple for individuals and small businesses to obtain conventional credit and financial services, therefore, reducing the need for microfinance. The UK market is projected to reach USD 0.36 billion by 2026, while the Germany market is projected to reach USD 0.44 billion by 2026.

North America

In North America, the market growth is likely to remain stagnant during the forecast period. The region’s strong banking system and regulatory environment make it challenging for microfinance providers to grow in the market. MFIs in North America are subject to the same regulations as commercial banks, including usury laws and capital requirements, which makes it challenging for them to offer competitive interest rates and maintain profitability. In the U.S, while financial exclusion is less prevalent than in developing nations, according to Federal Reserve (FDIC) 2023 survey 4.2% (5.6 million households) of U.S households were unbanked and 14.2% (19 million households) were underbanked which showed a significant portion of Americans has no bank account or insufficient access to banking services, creating a need for microfinance services. Also, microfinance targets the vast number of microenterprises in the U.S., which employ millions but often face challenges accessing traditional credit. The US market is projected to reach USD 6.39 billion by 2026.

Middle East and Africa

Large unbanked population, increasing demand for financial inclusion, and government support for small businesses boosting the market in the Middle East and Africa (MEA). Digital platforms and mobile banking solutions make credit processing faster and convenient for young demographics, especially for women and rural communities. For instance, in May 2025, Emirates Development Bank (EDB) launched EDB 360, a free digital banking service, aimed at supporting the UAE's economic growth. EDB 360 offers significant economic development opportunities for entrepreneurs and micro, small, and medium enterprises (MSMEs) and provides access to financial services, including USD 12 million in Sharia-compliant microloans, with 60% eligibility for women-led MSMEs to ignite their economic growth and success.

Latin America

Latin America is experiencing significant growth in the market, as a large portion of the population lacks access to traditional banking services, especially in rural and remote locations. The increasing popularity of mobile technology and smartphones among the population is helping MFIs to reach underserved customers with micro-loans and financial services. The region is home to a large number of small entrepreneurs and informal businesses that struggle to meet traditional bank lending requirements. Government initiatives to promote financial inclusion and the rise of fintech companies are driving innovation in credit lending delivery and enabling MFIs to serve clients more efficiently and cost-effectively.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players Focus on Strategic Partnerships to Enhance Outreach and Efficiency

Key players in the market are considerably diversified, comprising a wide range of institutional participants, including MFIs, commercial banks, and NBFCs. Several leading players are actively investing in technology infrastructure and digital lending platforms while introducing comprehensive financial service offerings to underserved borrowers. Collaborative strategies such as partnerships with local community organizations, government agencies, and technology providers are further boosting the market presence of key players across different regions.

Long List of Key Microfinance Companies Studied (including but not limited to)

- Grameen America Inc. (U.S.)

- Bandhan Bank Limited (India)

- BRAC (Bangladesh)

- Bank Rakyat Indonesia (BRI) (Indonesia)

- KIVA (U.S.)

- Annapurna Finance Private Limited (India)

- Al-Baraka Group (Bahrain)

- ASA International (Bangladesh)

- BNP Paribas (France)

- CreditAccess Grameen Limited (India)

- FINCA International, Inc. (U.S.)

- Accion International (U.S.)

- Bharat Financial Inclusion Limited (India)

- Ujjivan Small Finance Bank (India)

- Jana Small Finance Bank (India)

- Micro Bank (Spain)

- Banco do Nordeste do Brasil S.A. (Brazil)

- MIBANCO - BANCO DE LA MICROEMPRESA S.A. (Peru)

- Equitas Small Finance Bank (India)

- ESAF Small Finance Bank (India)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Utkarsh Small Finance Bank has announced that it's selling off a portfolio of non-performing assets and written-off loans to an Asset Reconstruction Company. This portfolio, which includes unsecured loans from stressed MFIs, had a total outstanding principal of around USD 42.4 million as of September 30, 2024. The transaction was finalized at a reserve price of about USD 6.1 million, encompassing cash and security receipts. This move aims to improve the bank's asset quality and cut down its stressed loan book.

- September 2024: Annapurna Finance Pvt. Ltd., an Indian NBFC-MFI, signed a landmark credit guarantee agreement with British International Investment (BII) and FinReach Solutions. The deal, boosts Annapurna’s loan book by USD 11.94 million, enabling it to provide financial services to over 4,000 underserved micro and small enterprises (MSEs), particularly in Eastern India.

- March 2024: Kotak Mahindra Bank, an Indian private sector bank, acquired Sonata Finance Private Limited for USD 64.56 million. This acquisition would help Kotak Mahindra strengthen its position in the financial services sector by integrating Sonata Finance's operations and leveraging its existing market reach.

- September 2023: Al Tadamun Microfinance Foundation, a prominent source of microfinance for female entrepreneurs, re-established a credit facility agreement valued at USD 3.88 million with First Abu Dhabi Bank Egypt to enhance its financial offerings for women-owned micro-enterprises.

- January 2023: Scienaptic AI, an artificial intelligence platform for credit decision-making, has announced that CreditAccess Grameen Ltd. has partnered with it. The company seeks to benefit from the collaboration by enhancing its risk management strategies and streamlining inefficient loan application processes. The implementation signifies a commitment to utilize advanced AI technologies to enhance financial decision-making and potentially distribute more access to credit.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, providers, service type, and end user of the services. Besides, the report offers insights into the market’s key trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Providers

By Service Type

By End User

By Region

|

|

Companies Profiled in the Report |

BRAC (Bangladesh), Bank Rakyat Indonesia (BRI) (Indonesia), CreditAccess Grameen Limited (India), Annapurna Finance Private Limited (India), Grameen America Inc. (U.S.), Bandhan Bank Limited (India), Bharat Financial Inclusion Limited (India), MIBANCO - BANCO DE LA MICROEMPRESA S.A. (Peru), Micro Bank (Spain), Banco do Nordeste do Brasil S.A.(Brazil), etc. |

Frequently Asked Questions

The market is projected to reach USD 646.56 billion by 2034.

In 2025, the market was valued at USD 255.69 billion.

The market is projected to grow at a CAGR of 11% during the forecast period.

Increasing entrepreneurial aspiration is a key factor driving market growth.

Bank Rakyat Indonesia (BRI), BRAC, and CreditAccess Grameen Limited are a few of the top players in the market.

Asia Pacific holds the highest market share.

By service type, the microcredit segment led the market.

By end user, the individual segment led the market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us