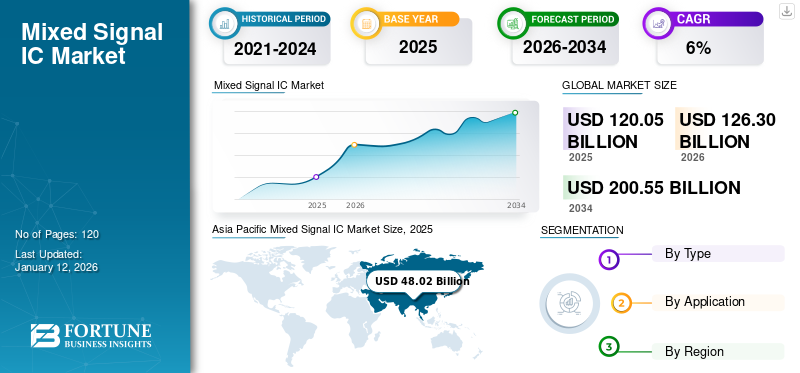

Mixed Signal IC Market Size, Share & Industry Analysis, By Type (Mixed Signal SoC, Microcontroller, and Data Converter), By Application (Consumer Electronics Healthcare and Medical, Automotive, Telecommunications, Military and Defense, and Others), and Regional Forecast, 2026–2034

MIXED SIGNAL IC MARKET SIZE AND FUTURE OUTLOOK

The global mixed signal IC market size was valued at USD 120.05 billion in 2025. The market is projected to grow from USD 126.3 billion in 2026 to USD 200.55 billion by 2034, exhibiting a CAGR of 6.00% during the forecast period. Asia Pacific dominated the market with a share of 40.00% in 2025.

Mixed signal ICs combine analog and digital components on a single semiconductor chip. While traditional analog or digital circuits operate separately, these ICs take full advantage of the benefits of both to provide optimal performance for the chip.

Market growth is expected to be driven by the emergence of 5G networks, increasing demand for consumer electronics, and rising connectivity of devices. According to Cisco, by 2030, 500 billion devices will be connected to the internet. Moreover, advancements in automotive technology and Internet of Things (IoT) are also accelerating the market’s growth.

The COVID-19 pandemic prompted a surge in the deployment of IoT technologies to enhance healthcare responses. Moreover, the necessity to support increased internet traffic and remote connectivity spurred the product demand for mixed signal integrated circuits in networking equipment. This was essential for maintaining communication during lockdowns. Despite the challenges posed by the pandemic, the market revenue grew steadily.

IMPACT OF GENERATIVE AI

Advanced Integration of Generative AI for Designing Mixed Signal ICs to Fuel Market Growth

Generative AI is poised to revolutionize the designing of mixed signal integrated circuits by automating the processes, enhancing modeling accuracy, optimizing designs rapidly, and generating valuable training data. Generative AI techniques are being integrated into the design of analog and mixed-signal circuits to automate circuit sizing and improve performance model accuracy. By utilizing AI algorithms, designers can replace lengthy and costly measurements with simpler ones, streamlining the production testing process. This automation allows for quicker iterations and refinements in circuit design, which is crucial in the fast-paced semiconductor industry.

MIXED SIGNAL IC MARKET TRENDS

Rising Demand for Automotive Technology With Advanced Processing Capabilities to Emerge as Key Market Trend

The sophistication of modern vehicles is on the rise, with the inclusion of Advanced Driver Assistance Systems (ADAS), voice-activated entertainment systems, and autonomous driving capabilities. These features necessitate mixed signal ICs for sensor integration and signal management. The transition to Electric Vehicles (EVs) and the progress made in autonomous driving technologies will increase the need for these ICs for power electronics, battery management, and vehicle-to-everything (V2X) communication. There is an increasing focus on energy efficiency in electronic systems and devices, which will promote the demand for these ICs in power management, optimization, and conversion. The demand for sustainable technologies and renewable energy options will generate prospects for these ICs in fields, such as solar energy systems and energy-saving electronics.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Growing 5G Deployment and Demand for Energy-Efficient Devices to Aid Market Growth

5G is being increasingly integrated into high-frequency switching circuits. These types of switching circuits are prevalent in mixed signal integrated circuits. The need for high-frequency switching circuits is increasing due to the widespread adoption of 5G and other wireless technologies. Moreover, the rising disruption of frequency, losses, and distortion results in reduced performance. Mixed signal integrated circuits can provide tailored solutions necessary for challenges of this kind. These ICs are also employed in the manufacturing of consumer electronics. Integrated circuits are present in a range of electronic devices, such as smartphones, LED drivers, tablets, laptops, and others.

There is a growing demand for products that use minimal power. The functioning of a mixed signal integrated circuit enables the analog and digital circuits to utilize a common power supply. These are commonly encountered by consumers on electronic devices. Other benefits of these ICs include enhanced performance, more compact design, and reduced costs, all of which play crucial roles in the global market.

Market Restraints

Increased Design Complexity and Trade Barriers to Hinder Market Expansion

The integration of both analog and digital circuits into a single IC is technically challenging and time-consuming, leading to higher development costs. This complexity can deter smaller companies from entering the market or competing effectively. Recent trade barriers and geopolitical tensions have disrupted supply chains and manufacturing processes, particularly in regions heavily reliant on semiconductor production. These disruptions have led to delays and increased costs in the production of these ICs. All these factors are hampering the mixed signal IC market growth.

Market Opportunities

Increasing Emphasis on Healthcare and Medical Devices to Create Lucrative Market Opportunities

The rising popularity of health monitoring wearables, such as fitness trackers and medical devices, will generate the need for mixed signal integrated circuits to facilitate sensor integration and data processing. The development of diagnostic devices and remote patient monitoring technologies will fuel the demand for these ICs for precise data collection and signal processing. To improve the healthcare system, portable, wearable, and interconnected medical devices are crucial for diagnosing, monitoring, and treating illnesses. These ICs are essential for enhancing medical devices as they are affordable, and quiet devices are essential for advancing the healthcare system.

SEGMENTATION ANALYSIS

By Type

Exceptional Capabilities of Mixed Signal SoC for Electronic Systems Boosted Its Demand

Based on type, the market is segmented into mixed signal SoC, microcontroller, and data converter.

In terms of share, the mixed signal SoC segment dominated the market share by 56.55% in 2026. The segment’s growth reflects broader trends toward miniaturization, integration, and enhanced functionality across various industries. As technology continues to evolve, particularly with advancements in AI and machine learning, the demand for these integrated solutions is expected to rise sharply, positioning mixed signal SoCs as pivotal components in future electronic systems.

The data converter segment is anticipated to register the highest CAGR during the forecast period. The growth of the segment is fueled by the increasing demand for devices that bridge the gap between the analog and digital worlds in a wide range of applications.

By Application

Consumer Electronics Segment Dominated Market With Ongoing Innovation and Growing Interest in Interconnected Devices

To know how our report can help streamline your business, Speak to Analyst

Based on application, the market is categorized into consumer electronics, healthcare & medical, automotive, telecommunications, military & defense, and others.

In 2024, the consumer electronics segment dominated the mixed signal IC market share. The rising demand for portable computing gadgets featuring extended battery life and high performance has enhanced the necessity for efficient mixed signal integrated circuits. The need for these ICs is fueled by ongoing innovation and growing consumer interest in sophisticated, interconnected devices. Consumer electronics segment is projected to acquire 27.45% of the market share in 2026.

The automotive segment is expected to record the highest CAGR of 8.83% during the forecast period due to technological advancements and evolving consumer demands. As vehicles become more automated and connected, mixed signal ICs will continue to be at the forefront of enabling these innovations, driving both market expansion and technological progress in the industry.

MIXED SIGNAL IC MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Mixed Signal IC Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region accounted for USD 48.02 billion in 2025. In 2026, Asia Pacific market size stood at USD 50.51 billion. Asia Pacific held a major market share in 2024 due to its dominant role in electronics manufacturing, rapid advancements in 5G, IoT, and automotive technologies, and growing demand for integrated, high-performance solutions. The region’s leading economies, such as China, Japan, South Korea, and India, are investing heavily in semiconductor technologies, further solidifying the region’s position as a key hub for mixed signal integrated circuit production and consumption. The growth of the market in this region will continue to be influenced by technological innovations, demand for energy-efficient solutions, and increasing adoption of connected devices across various industries.

The Chinese government vigorously encourages the implementation of IoT technologies through programs, such as "Made in China 2025" and "Internet Plus." These policies focus on advanced technology sectors, such as IoT and promote research and innovation, greatly improving the development and incorporation of mixed signal ICs in multiple industries. The market in China is estimated to be USD 17.76 billion in 2026.

India’s market size is foreseen to be valued at USD 6.94 billion and Japan’s likely to be USD 11.49 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America to be anticipated the second-largest market with USD 36.5 billion in 2026, recording the second-largest CAGR of 6.11% during the forecast period. The rising acceptance of innovative technologies and substantial increase in the sales of consumer electronics in North America have played major roles in the market's growth. The expansion of the healthcare and medical sectors, along with the consumer electronics industry, will aid the market's progress.

The U.S. stands as a frontrunner in this market due to its robust technological framework, government support, and increasing consumer demand for connected gadgets. As sectors continue to adopt digital transformation technologies, the product significance will grow and become essential in enabling this transition toward a more connected world. The U.S. market size is expected to reach USD 26.08 billion in 2026.

South America

South America is at an early stage in this market but shows promising growth prospects due to the increasing demand for consumer electronics, automotive technologies, IoT, and industrial automation. While the region faces challenges related to economic conditions, supply chain constraints, and limited local manufacturing, there are opportunities in emerging sectors, such as smart cities, electric vehicles, and renewable energy. With increasing regional investments and the push toward local semiconductor manufacturing, the market in South America could expand further in the coming years.

Europe

Europe region is to be anticipated the third-largest market with USD 25.52 billion in 2026. Europe is estimated to grow at the highest rate during the forecast period due to strong demand for ICs for various applications. European manufacturers are also focusing on electrification and autonomous driving technologies, leading to greater product adoption for motor control, power regulation, and sensor data processing. According to an industry expert, by 2025, 95% of the U.K. population will own smartphones, further increasing the demand for integrated solutions that enhance functionality and efficiency. The market in U.K. is estimated to be USD 5.33 billion in 2026.

The Germany’s market size is foreseen to be valued at USD 5.05 billion in 2026. and France’s likely to be USD 2.93 billion in 2025.

Middle East & Africa

The Middle East & Africa region is to be anticipated the fourth-largest market with USD 9.22 billion in 2026. The Middle East & Africa is projected to register a significant growth rate in the global market during the forecast period as the region is witnessing increasing investments in technology and infrastructure. As countries in this region modernize their telecommunications and automotive sectors, the adoption of mixed signal technologies is expected to rise significantly.

The GCC market is expected to hit USD 3.28 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players to Use Merger & Acquisition, Partnership, and Product Development Strategies to Expand Business Reach

Major players operating in the market are providing advanced mixed signal ICs by offering cost-effectiveness and flexibility in their product portfolio. These companies are focusing on signing acquisition agreements with small and local firms to increase their business operations. Moreover, partnerships, mergers & acquisitions, and key investments will also boost the demand for these ICs.

Long List of Mixed Signal IC Companies Studied:

- Broadcom (U.S.)

- Texas Instruments Incorporated (U.S.)

- Analog Devices, Inc. (U.S.)

- Infineon Technologies AG (Switzerland)

- Microchip Technology Inc. (U.S.)

- Marvell Technology Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Intel Corporation (U.S.)

- STMicroelectronics (Netherlands)

- Renesas Electronics Corporation (Japan)

- EnSilica Ltd. (U.K.)

- Semtech Corp. (U.S.)

- Silicon Laboratories (U.S.)

- Diodes Inc. (U.S.)

- Lattice Semiconductor Corp. (U.S.)

- Mixed Signal Integration (U.S.)

- Awinic Technology (China)

- MaxLinear Inc. (U.S.)

- Maxim Integrated (U.S.)

- Asahi Kasei Microdevices Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Microchip Technology introduced the PIC64HX family of microprocessor units (MPUs). The latest addition to Microchip's 64-bit lineup, the PIC64HX is a high-performance 64-bit multi-core RISC-V MPU capable of advanced AI/ML processing. It is designed with built-in Ethernet Time-Sensitive Networking (TSN) connectivity to meet defense and post-quantum security levels. With eight 64-bit RISC-V processor cores, the SiFive Intelligence X280 comes with vector extensions that enable mixed-criticality, high-performance computing, virtualization, and vector processing to accelerate AI workloads.

- June 2024: NXP Semiconductor and Vanguard International Semiconductor Corporation announced the launch of a manufacturing joint venture with VisionPower Semiconductor Manufacturing Company Pte Ltd. that can construct a new 300mm semiconductor wafer fab in Singapore. The joint venture manufacturing facility can produce power management, mixed-signal, and analog products from 130nm to 40nm, targeting the industrial, consumer, automotive, and mobile end markets. The fundamental method technologies are to be transferred and licensed from TSMC to the joint venture.

- March 2024: Marvell Technology, Inc. expanded its collaboration with TSMC to develop the 2nm semiconductor manufacturing technology platform optimized for high-speed infrastructure. The 2nm platform will enable Marvell to deliver highly differentiated mixed-signal, analog, and commodity IP solutions to create an accelerated infrastructure capable of realizing the potential of AI.

- January 2022: Omni Design Technologies and EnSilica announced a partnership agreement. As part of the agreement, the two companies had worked together to leverage EnSilica's turnkey ASIC solutions and Omni Design's advanced data converter solutions to meet the needs of customers, thereby developing the next generation of innovative products.

- February 2021: Dialog Semiconductor Plc and Renesas Electronics Corporation announced that they had reached an agreement on the terms of a proposed acquisition by Renesas of all of Dialog's issued and to-be-issued share capital in cash for a total capitalization of approximately USD 5 billion.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The global market is seeing significant investment interest due to its crucial role across a wide range of sectors. As the demand for Electric Vehicles (EVs), 5G infrastructure, autonomous driving, smart devices, and industrial IoT continues to grow, mixed signal integrated circuits are poised to play an integral role in these emerging technologies. This makes the market a highly attractive area for investment. For instance,

- Oculii: A startup that develops AI-driven radar solutions for autonomous vehicles and robotics using mixed signal integrated circuits. The company raised USD 50 million in Series B funding in 2022.

- Axon: A company developing mixed signal integrated circuits for biometric sensors used in healthcare and security applications, secured USD 20 million in venture funding.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Type, Application, and Region |

|

Segmentation |

By Type

By Application

By Region

|

|

Companies Profiled in the Report |

Broadcom (U.S.) Texas Instruments Incorporated (U.S.) Analog Devices, Inc. (U.S.) Infineon Technologies AG (Switzerland) Microchip Technology Inc. (U.S.) Marvell Technology Inc. (U.S.) NXP Semiconductors (Netherlands) Intel Corporation (U.S.) STMicroelectronics (Netherlands) Renesas Electronics Corporation (Japan) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 200.55 billion by 2034.

In 2025, the market was valued at USD 120.05 billion.

The market is projected to record a CAGR of 6.00% during the forecast period.

By type, the mixed signal SoC segment led the market in 2026.

Growing 5G deployment and demand for energy-efficient devices will aid the market’s expansion.

Broadcom, Texas Instruments Incorporated, Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Marvell Technology Inc., NXP Semiconductors, Intel Corporation, STMicroelectronics, and Renesas Electronics Corporation are the top players in the market.

Asia Pacific held the highest market share in 2025.

By application, the automotive segment is expected to record the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us