Natural Absorbable Sutures Market Size, Share & Industry Analysis, By Product (Monofilament and Multifilament/Braided), By Material (Catgut Chromic Sutures and Catgut Plain Sutures), By Application (Gynecology, Orthopedics, Cardiology, General Surgery, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

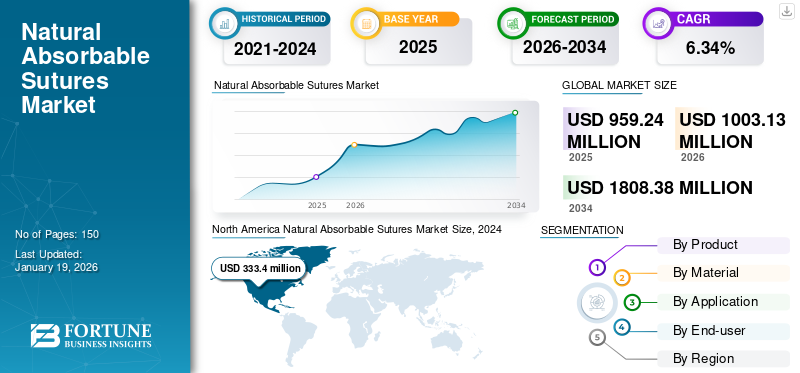

The global natural absorbable sutures market size was valued at USD 959.24 million in 2025. The market is projected to grow from USD 1,003.13 million in 2026 to USD 1,808.38 million by 2034, exhibiting a CAGR of 6.34% during the forecast period. North America dominated the natural absorbable sutures market with a market share of 35.84% in 2025.

The natural absorbable sutures are composed of purified connective tissue derived from the submucosal fibrous layer of healthy sheep intestines. These types of sutures do not require removal by a doctor, making them ideal for internal wounds or surgical sites that are difficult to access after surgery. Due to their biodegradability and higher compatibility with human tissue, these sutures are extensively used in internal surgical procedures such as general surgery, gynecology, cardiovascular, and orthopedic operations.

The global market growth is driven by an increasing number of surgical procedures, including cardiac surgeries, orthopedic surgeries, cosmetic surgeries, and general surgeries worldwide, leading to a robust demand for absorbable sutures.

- For instance, as per the data published by Curvo Labs, Inc. in September 2024, around 737,503 and 765,558 hip replacements were performed in the U.S. in 2021 and 2022, respectively.

The market consists of major players such as Dynek Pty Ltd, Johnson & Johnson Services, Inc., Medico, Dolphin Sutures, and Suture Planet. These companies strongly focus on strategic acquisitions and partnerships to expand their footprints in the global market.

MARKET DYNAMICS

Market Drivers:

Growing Geriatric Population and Rising Number of Surgical Procedures to Drive Market Growth

The increasing geriatric population suffering from chronic diseases plays a key role in driving the Natural Absorbable Sutures market growth. The older population is often undergoing surgeries, including joint replacements, cardiac operations, and others, where natural resorbable sutures are essential for effective wound closure. As the elderly population continues to grow, the volume of elective and emergency surgeries is also increasing, leading to rapid demand for surgical sutures. Furthermore, the rising volume of surgical procedures worldwide is creating a huge demand for natural resorbable sutures, due to their efficiency in providing rapid wound closure.

- For instance, as per the data published by the Australian Institute of Health and Welfare in December 2024, around 12,700 coronary artery bypass grafting (CABG) procedures were performed on patients admitted to hospital in Australia between 2021-22.

- Similarly, as per the data published by the International Society of Aesthetic Plastic Surgery in June 2024, nearly 305,3403 and 352,302 gynecomastia procedures were performed worldwide in 2022 and 2023, respectively.

Therefore, the high burden of chronic diseases, the growing geriatric population, and increasing surgical procedures worldwide are enhancing market growth.

Market Restraints:

Increasing Use of Alternatives to Natural Absorbable Sutures is Likely to Hinder Market Growth

The shift in preference among healthcare professionals toward advanced wound closure techniques is limiting the adoption of natural absorbable sutures. The advanced wound closure techniques include surgical staplers and tissue adhesives that are widely used in various surgeries due to their ability to provide faster application and improve clinical outcomes.

- For example, according to data provided by Unisur Lifecare in October 2024, skin staplers have a shorter operating time, and are often preferred in emergency wound closure, where speed is critical.

On the other hand, alternatives, such as synthetic absorbable sutures made from polyglycolic acid (PGA) and polylactic acid (PLA), offer better predictability and durability, impeding the natural suture adoption.

As a result, the rising inclination of healthcare providers toward alternatives to natural resorbable sutures, such as synthetic resorbable sutures, surgical staples, adhesive tapes, and tissue sealants, is anticipated to hinder market growth over the forecast period.

Market Opportunities:

Expanding Medical Infrastructure in Developing Nations to Offer a Substantial Opportunity for Market Growth

The rapidly developing healthcare infrastructure, especially in developing nations, creates considerable growth opportunities for the natural absorbable sutures market. This is primarily driven by a rise in surgeries and the growing adoption of natural sutures for wound closure. Furthermore, the increasing government support for establishing new hospitals and specialty clinics in developing countries is the key factor supporting the market growth.

- For example, the government of New South Wales invested USD 723.3 million to develop the Tweed Valley Hospital. This new hospital was opened in May 2024 to serve patients across Australia.

These developments are leading to a higher volume of surgical procedures, ultimately increasing the demand for natural absorbable sutures and enhancing market growth.

Market Challenges:

Complications Associated with Natural Resorbable Sutures Pose a Challenge to Market Expansion

One of the major challenge affecting the growth of natural absorbable suture is its susceptibility to infection. The natural absorbable sutures are made from animal-derived materials such as catgut, which are prone to inflammatory response and become the medium for microbial growth, compared to synthetic sutures. This risk can lead to post-operative complications such as suture-associated infection, suture-associated hypersensitivity reactions, and tissue reactions including granuloma formation. These complications affect the adoption of natural resorbable sutures among healthcare providers. This limitation impacts the adoption of sutures made up of natural origin, especially in advanced healthcare settings where infection control is highly prioritized.

Moreover, the occurrence of post-operative complications is influencing the medical professional to adopt alternative solutions such as synthetic absorbable sutures. This shift toward alternative solutions is hampering market growth throughout the forecast period.

Stringent Regulatory Approval Processes are Affecting the Launch of Novel Sutures

The natural absorbable sutures market faces considerable challenges due to stringent regulatory requirements imposed by authorities such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA). These regulatory bodies demand extensive clinical validation and detailed documentation to ensure product safety and efficacy. This results in prolongation of development timelines and an increase in product development costs; creating a burden on small manufacturers. In addition, the variation in regulatory standards across regions adds another layer of complexity by creating significant barriers to market access.

NATURAL ABSORBABLE SUTURES MARKET TRENDS

Rising Adoption of Chromic Catgut Sutures for Surgical Procedures is an Emerging Market Trend

Chromic catgut suture is the new wound care standard for several reasons. One of the major reason for the wider adoption of chromic catgut suture is its ability to hold the wound together better and help to speed up the healing process. The chromic catgut suture is less likely to cause infection, as chromic salt solution is used to treat the intestine that helps kill bacteria.

Furthermore, the chromic catgut sutures including ORICHROME are less expensive than other types of sutures, as it is made from animal intestines, a natural product. Therefore, the chromic catgut suture is rapidly becoming the new standard in wound care. Its resistance to infection and ability to dissolve over time make it an ideal choice for various surgical procedures.

Increasing Demand for Natural Absorbable Sutures in Minimally Invasive Surgeries is Another Market Trend

The increasing use of natural absorbable sutures in minimally invasive surgeries is emerging as a significant trend in the market. This trend is primarily driven by the growing preference for biocompatible and biodegradable materials that promote faster healing with minimal tissue reaction, essential in the delicate and precision-based surgeries.

In minimally invasive surgeries, such as laparoscopic procedures, gynecological surgeries, and some cardiac interventions, surgeons increasingly opt for natural sutures including chromic catgut due to their ability to degrade naturally in the body, eliminating the need for suture removal. These sutures are especially suitable for closing internal tissue closures, where long-term tensile strength is not essential and smooth absorption is critical.

Therefore, this rising adoption reflects the broader market shift toward environmentally safe sutures, reshaping the market growth.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product

The Multifilament/Braided Segment to Dominate the Market Due to its Wide Advantages

On the basis of product, the market is categorized into monofilament and multifilament/braided.

The multifilament/braided segment is anticipated to dominate the market over the forecast period. Due to superior handling characteristics and knot security, multifilament resorbable sutures are most commonly preferred in specific surgical scenarios. These sutures, composed of multiple braided or twisted strands, offer greater flexibility and pliability, making them easier to manipulate during intricate procedures. This is expected to increase their adoption, driving the segment's growth during the forthcoming years.

- For instance, as per an article published by Peters Surgical in July 2024, braided multifilament sutures are most frequently used in cardiovascular surgeries due to their superior tensile strength.

The monofilament segment is anticipated to grow at a considerable CAGR during the forecast period. The monofilament sutures are widely used in vascular and microvascular surgeries due to their lower friction coefficient, making them easy to pass through tissues. This advantage increases their adoption and supports the segment's growth.

By Material

Rising Usage of Catgut Chromic Sutures by Healthcare Providers for Deep Tissue Injuries Leads to its Dominance

Based on material, the market is divided into catgut chromic sutures and catgut plain sutures.

The catgut chromic sutures segment dominated the market in 2024 and is expected to grow at the highest CAGR throughout the forecast period. Healthcare providers widely utilize catgut chromic sutures for deep tissue and slow-healing wounds due to their slower absorption rate and extended tensile strength. These are some of the important factors driving the segmental growth.

The catgut plain sutures segment is anticipated to grow considerably during the forecast period, due the rising utilization of plain catgut sutures for closing superficial wounds.

By Application

Orthopedic Segment Dominates due to Rise in Number of Orthopedic Surgeries Worldwide

Based on application, the market is divided into gynecology, orthopedics, cardiology, general surgery, and others.

The orthopedics segment dominated the market in 2024 and is anticipated to grow at the highest CAGR during the forecast period. The segment’s dominance was mainly due to rise in volume of orthopedic surgeries across the globe.

- For example, according to data published by Journal of Orthopedic Case Reports in July 2024, the total number of joint replacement surgeries increased from 16,308 in 2020 to 17,440 in 2021 in India.

The gynecology segment is expected to grow substantially during the forecast period, owing to increasing birth rates by cesarean section. Additionally, the rising number of gynecological surgeries, such as hysterectomy, myomectomy, and tubal ligation, requiring the usage of absorbable sutures, is further supplementing the segmental growth.

- For instance, as per the data provided by the World Health Organization (WHO) in June 2021, more than 1 in 5 (21.0%) of all childbirths were performed by cesarean section globally in 2020. This proportion of childbirths by cesarean section is expected to increase to 29.0% by the end of 2030.

The general surgery segment is projected to grow at a moderate CAGR during the forecast period. The growing demand for natural resorbable sutures for surgeries such as cholecystectomy, appendectomy, and hysterectomy is enhancing the segmental growth.

- For example, as per the data provided by the Annals of the Royal College of Surgeons of England in April 2024, in the U.K., over 60,000 laparoscopic cholecystectomies are performed each year.

The cardiology segment is estimated to grow at the second-largest CAGR during the forecast period, owing to the rising volume of cardiac surgeries globally.

- For instance, according to the data published by the National Center for Biotechnology Information (NCBI) in August 2023, about 400,000 coronary artery bypass graft surgeries are performed every year worldwide.

By End-user

Increasing Hospitalizations for Surgical Procedures Contributes to Dominance of Hospitals & ASCs Segment

Based on end-user, the market is segmented into hospitals & ASCs, specialty clinics, and others.

The hospitals & ASCs segment is projected to dominate the market during the forecast period, owing to the rising hospitalizations for surgical procedures and advanced care.

- For instance, as per the data published by the Australian Institute of Health and Welfare in December 2024, around 1,800 carotid endarterectomy procedures were performed on patients admitted to hospital in Australia between 2021-22.

The specialty clinics segment is anticipated to grow moderately over the forecast period. The opening of new specialty clinics that provide specialized care for particular medical conditions enhances the segmental growth.

- For instance, in September 2024, Rehasport announced the opening of its fifth orthopedic center in Wrocław, Poland.

The others segment is anticipated to grow considerably throughout the forecast period, owing to increasing usage of natural absorbable sutures in nursing homes.

NATURAL ABSORBABLE SUTURES MARKET REGIONAL OUTLOOK

On the basis of regions, the global market can be divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Natural Absorbable Sutures Market Size, 2024 (USD million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2026 with a market size of USD 356.54 million. The region accounted for 36.2% of the natural absorbable sutures market share in 2024. The established healthcare infrastructure and high volume of surgical procedures across the region are projected to fuel the regional market growth in the coming years.

The rising number of medical events occurring in the U.S., that includes the participation of market players showcasing natural absorbable sutures, is expected to enhance the market growth across the country.

- For example, in June 2025, Dolphin Sutures was present at the FIME 2025, a medical event held in Florida, U.S., from 11th to 13th June 2025. During the event, the company showcased its surgical products, including natural dissolvable sutures, to create brand awareness among the healthcare professionals.

Europe

The Europe region accounted for a significant share of the market in 2024 and is expected to grow at the second-largest CAGR during the forecast period. The high burden of chronic diseases and the rise in number of surgeries, including cardiac surgeries, orthopedic surgeries, general surgeries, and others, are enhancing the market growth across European countries.

- For example, as per the data published by the British Orthopedic Association in May 2022, more than 42,000 orthopedic operations were performed in England in 2022.

Asia Pacific

The market in the Asia Pacific region is projected to grow at the highest CAGR during the forecast period. The growing medical tourism and a rise in number of surgical procedures, including cosmetic surgeries, orthopedic surgeries, and cardiac surgeries, among others, drive the region's market growth.

Latin America and Middle East & Africa

The market in Latin America and the Middle East & Africa are anticipated to grow at a stagnant CAGR during the forecast period. The growth of the natural absorbable sutures market in these regions is primarily attributed to the rise in surgical procedures, resulting in increasing the usage of natural absorbable sutures. Furthermore, as the natural resorbable sutures are less expensive than synthetic sutures, they are widely utilized in healthcare settings across these nations.

COMPETITIVE LANDSCAPE

Key Industry Players:

Rising Focus of Market Players on Participating in Medical Events to Enhance Brand Visibility Among Healthcare Providers

The market consists of key players, such as DemeTECH Corporation, Johnson & Johnson Services, Inc., Dynek Pty Ltd, and ORION SUTURES INDIA PVT. LTD, among others, who are involved in providing natural resorbable sutures across the globe. These key players are focusing on attending medical conferences to create product awareness among consumers and enhance their position in the global market.

- For example, in October 2024, ORION SUTURES INDIA PVT., a manufacturer of surgical sutures, was present at Africa Health 2024, a medical event held in South Africa. The company was present at stall no. H2.E17 to showcase its absorbable sutures and create product awareness among consumers.

The other companies operating in the market include Healthium Medtech Limited, Dolphin Sutures, Suture Planet, and Medico. These market players on focusing on strategic acquisitions and partnerships to expand their footprints in the global market.

List of Key Natural Absorbable Sutures CompaniesProfiled:

- Johnson & Johnson Services, Inc. (U.S.)

- DemeTECH Corporation (U.S.)

- Medtronic (Ireland)

- Dolphin Sutures (India)

- Lotus Surgicals Pvt Ltd (India)

- Suture Planet (India)

- Medico (China)

- Healthium Medtech Limited (India)

- ORION SUTURES INDIA PVT. LTD. (India)

- Unisur Lifecare (India)

- Dynek Pty Ltd (Australia)

KEY INDUSTRY DEVELOPMENTS:

- January 2025 - ORION SUTURES INDIA PVT. LTD. announced its presence at Arab Health 2025. This medical conference was conducted in Dubai, UAE. During the event, the company showcased its sutures to create awareness among the healthcare professionals.

- October 2024 - ORION SUTURES INDIA PVT. LTD. was present at Africa Health 2024, a medical conference held in South Africa. During the event, the company was present at stall number H2.E17 to create awareness about its braided dissolvable stitches among consumers.

- September 2023 - Johnson & Johnson Services, Inc. received the Healthcare Industry Resilience Collaborative (HIRC) Transparency Badge for its Ethicon suture products. This badge demonstrates the company's transparent and resilient supply chain for its customers.

- November 2022 - Dolphin Sutures participated in the MEDICA 2022 conference held in Düsseldorf, Germany. The company exhibited at stall no. 6F30 to showcase its resorbable sutures to create product awareness among consumers.

- June 2021 - Genesis Medtech acquired a China-based suture company, Horcon, to expand its surgical product portfolio.

REPORT COVERAGE

The global natural absorbable sutures market report provides a detailed competitive landscape and market insights. In addition to the global natural absorbable sutures market size, it covers regional analysis of different market segments, profiles of key market players, and market dynamics. Moreover, the market report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.34% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product, Material, Application, End-user, and Region |

|

By Product |

|

|

By Material |

|

|

By Application |

|

|

By End-user |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1,003.13 million in 2026 and is projected to reach USD 1,808.38 million by 2034.

In 2025, the market value stood at USD 343.79 million.

The market will exhibit steady growth at a CAGR of 6.34% during the forecast period (2026-2034).

By product, the multifilament/braided segment led the market.

The growing geriatric population and the rising number of surgical procedures worldwide are important factors driving market growth.

Healthium Medtech Limited, Johnson & Johnson Services, Inc., Medico, ORION SUTURES INDIA PVT. LTD., Dolphin Sutures, and DemeTECH Corporation are the key players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us