Neurology Drugs Market Size, Share & Industry Analysis, By Indication (Alzheimer's Disease, Multiple Sclerosis, Epilepsy, Parkinson's Disease, and Others), By Drug Class (Cholinesterase Inhibitors, NMDA Receptor Antagonist, Antiepileptic Drugs, Immunomodulatory Drugs, and Others), By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Drug Stores, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

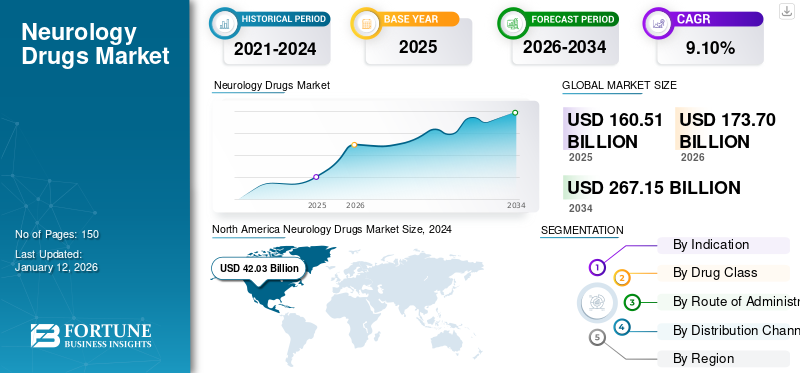

The global neurology drugs market size was valued at USD 160.51 billion in 2025. The market is projected to grow from USD 173.7 billion in 2026 to USD 267.15 billion by 2034, exhibiting a CAGR of 9.10% during the forecast period. North America dominated the neurology drugs market with a market share of 9.47% in 2025.

The neurology drugs market stands at the intersection of scientific innovation and urgent medical demand. The market represents a notable segment within the pharmaceutical industry, driven by factors such as the increasing incidence of neurological disorders, a growing aging population, and rising investments in novel drug development.

The market is also expected to benefit from the increasing demand for drugs, advancements in genetic research, and the rise of personalized medicine. Rapid advancements in biologics, orphan drug development, and digital neurology tools are reshaping the market landscape. However, companies must navigate complex regulatory systems, cost-intensive R&D, and global trade fluctuations to realize the market’s full potential.

Some leading market players operating in the neurology drugs market include Novartis AG, Bayer AG, Pfizer Inc., and Sanofi. A wide product portfolio coupled with a strong global presence has supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Prevalence of Neurological Disorders to Drive Market Growth

Neurological conditions such as Alzheimer's disease, Parkinson's disease, multiple sclerosis, epilepsy, and cerebrovascular diseases are fueling the demand for these drugs. This is one of the significant drivers of the neurology drugs market growth. The prevalence of these diseases, along with others, is growing, resulting in the high demand for neurology drugs for the management of these diseases. In addition, with the constant efforts to increase awareness regarding these diseases, the diagnosis rate is also increasing.

- For instance, according to the data provided by the World Health Organization (WHO) in March 2024, the number of individuals affected by neurological conditions is over 1 in 3.

MARKET RESTRAINTS

High Cost of Treatment to Limit Market Expansion

The high cost of treatment is one of the limiting factors for the market growth. The research, clinical trials, and regulatory drug approval processes for neurology drugs are expensive and time-consuming, making it difficult for smaller pharmaceutical companies to enter the market. This results in a higher cost of the overall products, in turn making it unaffordable to the general population. The increasing out-of-pocket expenses due to treating neurological diseases result in a financial burden to the patients, hindering the overall market growth.

- For instance, as per the American Academy of Neurology data, in 2021, the cost of multiple sclerosis treatment was USD 2,378 annually and is increasing yearly.

NEUROLOGY DRUGS MARKET TRENDS

Advancements in Technology are a Prominent Market Trend

Technological advancements are revolutionizing the treatment of neurological disorders, offering new diagnostic tools, therapeutic options, and rehabilitation strategies. Brain-computer interfaces (BCIs) allow individuals with disabilities to communicate and control external devices, while artificial intelligence (AI) and virtual reality (VR) enhance the diagnostics and rehabilitation process. Gene therapy is highly effective for genetic disorders, and neuroimaging techniques such as MRI and CT scans provide detailed brain views. Furthermore, integrating AI, wearables, and remote monitoring tools to support early diagnosis and adherence tracking in neurology is revolutionizing the market landscape.

Other Trends

Rise in Biologics and Monoclonal Therapies

The growing adoption of biologics due to their targeted action with reduced side effects is another trend witnessed by the market. Novel drugs are being developed targeting inflammatory pathways implicated in Alzheimer’s and Parkinson’s diseases. Additionally, an increase in investments toward rare neurological conditions such as Huntington’s disease, supported by government incentives and exclusive marketing rights, supports market growth.

Download Free sample to learn more about this report.

MARKET OPPORTUNITIES

Growing Adoption of Personalized Medicine is Expected to Influence Market Growth

Personalized medicine is one of the emerging aspects of the market and is anticipated to create lucrative opportunities for market players. Targeting treatments to the specific underlying causes of a disease, rather than a "one-size-fits-all" approach, can lead to effective results and reduced side effects. This has shifted the focus of operating players to invest in research & development of personalized medicines for neurological disorders. Tailoring therapies to an individual's specific needs and preferences can increase adherence and overall quality of life.

MARKET CHALLENGES

Complexity of Neurological Disorders to Hamper Market Growth

Understanding the mechanisms of neurological disorders and finding effective targets for neurology drug development is challenging, as neurological conditions can be complex and individual patient responses vary. Inadequate healthcare infrastructure in developing countries can hinder access to essential medicines, further impacting the market. The complexity of these conditions can make diagnosis and treatment challenging, thus requiring specialized care and advanced diagnostic tools.

Furthermore, due to complexity, patient recruitment, particularly for rare diseases and pediatric conditions, is difficult and slows the development cycle, resulting in slower market growth. Effective delivery of drugs into the brain due to its complex nature is another scientific challenge, leading to lower treatment efficiency.

Segmentation Analysis

By Indication

Growing Awareness Initiatives and Campaigns to Support Alzheimer's Disease Segment Growth

Based on indication, the global market is divided into Alzheimer's Disease, Multiple Sclerosis, Epilepsy, Parkinson's Disease, and others.

The Alzheimer's disease segment is anticipated to dominate the global market over the forecast period. The growing prevalence of Alzheimer’s disease, coupled with increasing awareness initiatives & campaigns resulting in growing disease diagnosis and treatment, has boosted the segment growth.

- For instance, according to Alzheimer’s Association, the number of individuals living with the disease is estimated to be around 7.2 million in the U.S.

The multiple sclerosis segment is projected to grow at a notable CAGR during the projected period. The growth is driven by key players' rising focus on research & development for innovative drugs.

By Drug Class

Wide Availability of Cholinesterase Inhibitors to Support Segmental Growth

Based on drug class, the market is segmented into cholinesterase inhibitors, NMDA receptor antagonist, antiepileptic drugs, immunomodulatory drugs, and others.

The cholinesterase inhibitors segment is anticipated to lead the global market during the study period. Some factors influencing the segment growth include recent product launches and high drug usage.

- For instance, in June 2021, ADUHELM was approved by the U.S. FDA for the control of the disease progression in Alzheimer’s patients.

The NMDA Receptor Antagonist segment is expected to grow substantially over the projected period, driven by increasing R&D initiatives using advanced technologies. Increasing product availability and new launches are also expected to boost the segment growth.

By Route of Administration

Easy Administration of Oral Drugs Boosted Segment Growth

In terms of route of administration, the market is divided into oral and parenteral.

The oral segment accounted for the largest share of the market in 2024. This is due to the high patient compliance, easy administration, and increased treatment adherence for long-term plans offered by oral drugs. Additionally, increasing approvals for new therapies for treating various neurological disorders are expected to propel the growth of the segment in the market. For instance, most currently available drugs for neurological disorders are administered orally.

On the other hand, the parenteral segment is expected to grow at a notable CAGR during the forecasted period. The increasing number of products that can be administered parenterally is projected to fuel segment growth.

By Distribution Channel

Increase Investment in Research Activities Boosted Hospital Pharmacies Segment Growth

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies & drug stores, and online pharmacies.

The hospital pharmacies segment dominated the market in 2024. Easy drug availability through hospitals and increasing prescriptions due to high patient count contributed to the segmental growth. With the growing awareness about neurological diseases, the number of patients seeking medical attention is also increasing. This is leading to growth in the distribution of drugs through hospital pharmacies, leading to the segment’s dominance.

The retail pharmacies & drug stores segment is anticipated to witness considerable growth in the coming years, fueled by a growing number of pharmacies offering these drugs. Furthermore, online pharmacies are expected to show notable growth in the coming years.

Neurology Drugs Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Middle East & Africa, and Latin America.

North America

North America Neurology Drugs Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest neurology drugs market share in 2024. This region's dominance can be attributed to a high prevalence of Alzheimer’s disease, ongoing regulatory approvals for new, innovative drugs, and a strong research base in developing innovative products for disease management.

U.S.

The U.S. remains the core contributor due to the early adoption of new neurology drugs and high per capita drug spending. Some key factors influencing the market include the high number of individuals affected by neurological disorders, the presence of well-established companies, and the availability of a strong research base in the country. The U.S. market is projected to reach USD 86.82 billion by 2026.

- For instance, in March 2025, researchers from the Department of Clinical Genomics and the Mayo Clinic's Center for Individualized Medicine launched an innovative study on rare neurological diseases.

Europe

Europe is the second-largest market due to the presence of several key players and increasing awareness about neurological diseases. These factors have resulted in a growing demand for neurology drugs in the region. Additionally, Germany, the U.K., and France lead in neurologist infrastructure and patient awareness programs, propelling the regional market growth. The UK market is projected to reach USD 5.04 billion by 2026, while the Germany market is projected to reach USD 7.58 billion by 2026.

- For instance, Brain Awareness Week (BAW) was celebrated by the European Brain Council to increase public awareness about the progress and benefits of brain research.

Asia Pacific

The Asia Pacific region is anticipated to grow at the fastest CAGR during the study period. The region is emerging as a key market for neurology drugs, owing to various factors such as increasing government initiatives and campaigns to increase disease awareness and the increasing number of patients. Additionally, expanding healthcare access, rising elderly populations, and increased chronic disease prevalence in China and India supplement the regional market growth. The Japan market is projected to reach USD 7.2 billion by 2026, the China market is projected to reach USD 10.44 billion by 2026, and the India market is projected to reach USD 5.02 billion by 2026.

- For instance, according to a research study published in May 2025, in 2021, in China, approximately 1 out of 3 people were affected by neurological disorders.

Latin America and Middle East & Africa

The Latin America and Middle East & Africa markets are expected to grow slowly in the coming years. However, factors such as the increasing prevalence of neurological disorders, improvements in reimbursement scenarios, and increasing government investment in public neurology programs are anticipated to propel market growth in these regions.

COMPETITIVE LANDSCAPE

Key Industry Players

Strong Focus of Key Companies on Research & Development to Expand Their Market Reach

The market space for neurology drugs is highly competitive and represents a fragmented structure. These encompass several entities, such as Novartis AG, Bayer AG, Pfizer Inc., and Sanofi. These players lead with both branded and pipeline drugs targeting neurodegenerative and psychiatric disorders. The dominance of these companies is attributed to a strong product base coupled with an increasing focus on developing innovative therapies for various neurological diseases. Additionally, their strong geographical presence across key countries is a major factor contributing to their dominance in the market.

- In November 2024, Novartis AG acquired Kate Therapeutics to expand its presence in neurology drugs.

Furthermore, other major players operating in the market include Eisai Co., Ltd., Biogen Inc., Johnson & Johnson Services, Inc., Merck KGaA, and others. These entities are focused on investments in R&D and strategic partnerships to enhance their market presence.

LIST OF KEY NEUROLOGY DRUG COMPANIES PROFILED

- Eisai Co., Ltd. (U.S.)

- Biogen Inc. (U.S.)

- Bayer AG (Germany)

- Pfizer Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Novartis AG (Switzerland)

- Merck KGaA (Germany)

- Sanofi (France)

- AbbVie Inc. (U.S.)

TRADE PROTECTIONISM & POLICY IMPACT

The U.S. policy directed toward local drug manufacturing may disrupt global neurology drug supply chains and raise prices. Additionally, stricter intellectual property laws influence how generics and biosimilars enter markets such as India and China.

KEY INDUSTRY DEVELOPMENTS

- May 2025: Sanofi acquired Vigil Neuroscience, Inc. to expand its neurology pipeline. The acquired company is focused on developing novel therapies for neurodegenerative diseases.

- October 2024: The U.S. FDA provided Ionis Pharmaceuticals, Inc.’s Zilganersen a Fast Track designation for treating children and adults with Alexander disease (AxD).

- September 2024: The U.S. FDA offered Miplyffa (arimoclomol) approval to treat Niemann-Pick disease, type C (NPC). This is the first drug approved for this disorder.

- February 2024: Hoffmann-La Roche Ltd launched Ocrevus - a disease-modifying therapy (DMT) drug for multiple sclerosis in India.

- March 2023: The U.S. FDA approved Acadia Pharmaceuticals’ DAYBUE (trofinetide) to treat Rett Syndrome in pediatric and adult patients.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.10% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Indication

|

|

By Drug Class

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 173.7 billion in 2026 and is projected to reach USD 267.15 billion by 2034.

In 2024, the market value stood at USD 42.03 billion.

The market is expected to exhibit a CAGR of 9.10% during the forecast period of 2026-2034.

The hospital pharmacies segment led the market by distribution channel.

The key factors driving the market are the rising awareness regarding the disease symptoms, the growing prevalence of neurological diseases, and frequent new product launches.

Novartis AG, Bayer AG, Pfizer Inc., and Sanofi are some of the prominent players in the market.

North America dominated the neurology drugs market with a market share of 9.47% in 2025.

Increased research and development activities and advancements in treatment paradigms are a few factors expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us