Normal Saline for Parenteral Use Market Size, Share & Industry Analysis, By Type (Plastic Bottles and Glass Bottles), By Application (Intramuscular Injection and Intravenous Injection), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

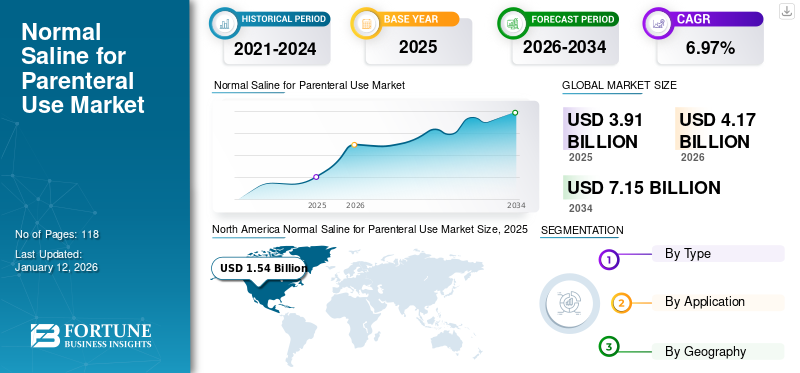

The global normal saline for parenteral use market size was valued at USD 3.91 billion in 2025 and is projected to grow from USD 4.17 billion in 2026 to USD 7.15 billion by 2034, exhibiting a CAGR of 6.97% during the forecast period. North America dominated the normal saline for parenteral use market with a market share of 39.46% in 2025.

Normal saline is used extensively in hospitals for a wide range of conditions such as dehydration, electrolyte imbalance, wound dressing, sepsis, hemorrhage, and others. According to the Victorian Agency for Health Information, neonatal sepsis occurs in 1 to 8 per 1,000 live births in Victoria, Australia. Globally, the condition is diagnosed in around 1 to 50 per 1,000 live births annually. This rising incidence of sepsis among neonates is poised to surge the demand for the solution.

The increasing government guidelines and recommendations for the use of 0.9% sodium chloride and fluid resuscitations in critical conditions are further poised to provide a considerable boost to the market growth. Surviving Sepsis Campaign (SSC), a joint collaboration of the Society of Critical Care Medicine (SCCM) and the European Society of Intensive Care Medicine (ESICM), recommends the use of crystalloid fluids for resuscitation during septic shock, which is adopted by many hospitals and academic associations. Moreover, 0.9% NaCl is one of the most commonly used crystalloid fluids, which is propelling the global normal saline for parenteral use market growth.

Global Normal Saline for Parenteral Use Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 3.91 billion

- 2026 Market Size: USD 4.17 billion

- 2034 Forecast Market Size: USD 7.15 billion

- CAGR: 6.97% from 2026–2034

Market Share:

- Region: North America dominated the market with a 39.46% share in 2025. This is attributed to the strategic presence of key players, the high uptake of 0.9% NaCl solutions, and manufacturers investing in expanding production capacity to address previous shortages.

- By Type: The Plastic Bottles segment is anticipated to hold the dominant market share. This is driven by the rising preference for plastic over glass bottles to prevent breakage during transport and supply, as well as an increase in strategic distribution agreements for saline in plastic bags.

Key Country Highlights:

- Japan: As a key country in the prominent Asia Pacific market, growth is driven by a rising number of hospital admissions, an expanding geriatric population, and a high incidence of conditions such as sepsis, which requires saline for fluid resuscitation.

- United States: The market is fueled by extremely high usage, with around 200 million liters of saline sold annually. Demand is also driven by a high number of hospitalizations for dehydration and severe flu seasons, which led to over 490,000 hospital admissions in a single season.

- China: The market is strongly influenced by major domestic manufacturers, such as the Kelun Group, which holds a leading global position due to its firm hold in the Chinese market and high manufacturing capacity. The country's expanding patient population also drives demand.

- Europe: Market growth is supported by active government support and recommendations from health bodies like the European Society of Intensive Care Medicine (ESICM) for the use of 0.9% sodium chloride. Severe flu seasons, which can cause up to 50 million infections in the E.U. annually, also significantly increase demand.

COVID-19 IMPACT

Decrease in Demand for IV Fluids amid COVID-19 Hampered the Market Growth

The COVID-19 pandemic had a profound impact on the healthcare sector. It increased the burden on healthcare professionals and hospitals. In order to dedicate all the healthcare resources to the management of COVID-19 patients, governments across the globe decided to postpone or cancel elective and non-urgent surgeries.

- According to CovidSurg, over 28.0 million elective surgeries were estimated to have been canceled globally due to the COVID-19 pandemic during the 12-week period of peak disruption. Moreover, the NHS directives led to around 2.1 million operations being postponed in England.

The sharp decline in the number of surgeries has negatively impacted the demand for IV fluids, including normal saline.

- ICU Med’s IV Solutions product line witnessed a decrxease of 10.3% in its revenue in the first six months of 2020 when compared to the same period in 2019.

- Similarly, the medication delivery segment of Baxter reported a decline of 1.6% during the first half of 2020.

The pandemic also decreased patient volumes in specialty clinics and care centers, resulting in fewer hospital admissions. These factors negatively impacted the market growth.

Normal Saline for Parenteral Use Market Trends

Increased Demand for Saline Due to the Flu Season to Boost the Market Growth

There is an increased demand for intravenous saline products, which are used to hydrate and deliver medications to patients hospitalized during the flu season. Flu seasons that have H3N2 as the more predominant strain of the Influenza A virus as compared to H1N1 lead to more severe complications and result in a considerable increase in flu-related hospitalizations.

As per European Centres for Disease Prevention and Control (ECDC) estimates in 2022, the worst season of influenza is estimated to cause up to 50 million infections and leads to around 70,000 deaths in the European Union each year. During 2018-2019, 35.52 million influenza infection cases were reported in the U.S., resulting in a total of 490,561 hospital admissions. Prolonged flu season, particularly in the U.S., is expected to increase the demand for normal saline for parenteral use to multiple folds.

Download Free sample to learn more about this report.

Normal Saline for Parenteral Use Market Growth Factors

Increasing Usage of Normal Saline for Dehydration and Sepsis to Propel the Market Growth

IV fluids are one of the most common medical interventions used globally. Saline has become the IV fluid of choice in hospital settings for the management of various conditions such as dehydration, vomiting, diarrhea, and management of fluid resuscitation in various critical conditions. Moreover, 0.9% NaCl is by far the most commonly used IV fluids. Furthermore, among neonates, administration of 0.9% sodium chloride is the first step in the management of sepsis, hyponatremia, hypernatremia, and fluid deficits or imbalances due to certain medical conditions.

According to the National Center for Biotechnology Information, in the U.S., around 200 million liters of saline are sold annually. In addition, over 1 million liters of 0.9% sodium chloride are administered to patients across the globe daily. This increasing uptake of saline across various medical specialties in hospitals and clinics is a major factor bolstering the market growth.

Rising Number of Hospital Admissions and Surgical Procedures to Foster Market Growth

The increasing number of hospital admissions in ICUs and NICUs has resulted in an increased demand for normal saline for parenteral use. Moreover, the majority of in-patients are administered with saline solutions during their stay in hospitals. According to the NHS, there are more than 5.0 million acute hospital admissions annually, and it is expected that the majority of the patients are exposed to intravenous fluid therapy.

According to the Admissions and Transitions Optimization Program, more than half a million hospital admissions annually in the U.S. are for dehydration. Thus, growing hospital admissions coupled with the increase in the number of surgeries are anticipated to fuel the market growth.

RESTRAINING FACTORS

Studies Suggesting Replacement of Saline with Balanced Fluids May Hinder the Market Growth

Various studies have shown that using balanced IV fluids instead of saline reduces the risk of death and kidney damage significantly among hospitalized patients. For instance, in February 2019, one such study estimated that switching from saline to balanced IV fluids can result in around 60,000 fewer deaths and 100,000 fewer cases of kidney failure in the U.S. Another study conducted by Vanderbilt University concluded that for every 100 hospitalized patients that were given balanced fluids instead of saline, there was one fewer death or severe kidney problem, which is a huge impact in the context of over 35.0 million hospitalizations that happen in the U.S. annually.

The usage of balanced fluids in healthcare facilities has also increased due to the growing awareness about the harm saline can do to a patient’s kidneys.

- According to an article published by Cureus in April 2021, Shaw et al. stated results in a retrospective observational study of approximately 30,000 patients undergoing major abdominal surgery. The in-hospital mortality was 5.6% in the group who received isotonic saline with common complications, including acute kidney injury, postoperative infections, and acidosis.

Thus, the gradual shift towards balanced fluids is anticipated to hamper the market growth.

Normal Saline for Parenteral Use Market Segmentation Analysis

By Type Analysis

Growing Preference for Plastic Bottles for Breakage Prevention to Impel the Segment Growth

With respect to type, the market is categorized into glass bottles and plastic bottles.

The plastic bottles segment is anticipated to dominate the market, accounting for 89.33% of the global share in 2026 during the forecast period. The rising preference for plastic bottles over glass to prevent breakage during supply and increasing strategic collaborations for IV fluids are the primary reasons for the growth of this segment. For instance, in March 2018, Grifols S.A. announced a distribution agreement with Henry Schein Inc. As per the terms of the agreement, Henry Schein marketed and distributed Grifols normal saline bag in the U.S. The product is currently manufactured in Grifols manufacturing unit in Spain, having a production capacity of 50.0 million units per year.

The glass bottles segment is expected to grow at a considerable CAGR during 2025-2032. The growth is attributed to high potential advantages of glass bottles such as low solution contamination, environmental benefits, among others over plastic bottles. This, coupled with the rising incidence of dehydration and the increasing number of NICUs, is projected to propel the growth of the glass bottles segment.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Intravenous Segment Dominated Owing to Growing Prevalence of Vomiting

On the basis of application, the market is divided into intramuscular injection and intravenous injection. The intravenous segment accounted for the major portion of the market with a share of 97.45% in 2026. Intravenous injection is the most preferred route of administration for normal saline, which is the primary reason for the dominant share of the segment. Apart from this, the rising incidence of vomiting, diarrhea, and food poisoning is expected to proliferate the intravenous segment growth.

The intramuscular injection segment is expected to grow at a substantial CAGR owing to high advantages as compared to intravenous injections such as ease of administration, low invasiveness, among others.

REGIONAL INSIGHTS

North American

North America Normal Saline for Parenteral Use Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American market stood at USD 1.65 billion in 2026. Factors attributed to the dominant share of the region are the strategic presence of key players and the rising uptake of 0.9% NaCl. According to the FDA database, even after two years of Hurricane Maria, hospitals in the U.S. faced a shortage of saline solutions. The dearth of normal saline created an opportunity for manufacturers to invest in expanding their production capacities. This factor is expected to boost the market growth in North America. The U.S. market is projected to reach USD 1.57 billion by 2026.

Asia Pacific

The Asia Pacific market is anticipated to hold a second prominent position during the forecast period. The market in Asia Pacific is anticipated to grow primarily due to the rising number of hospital admissions, growing geriatric population, and an expanding patient population. According to the Asia Pacific Sepsis Alliance, the estimated national sepsis incidence in the region ranges from 120 up to 1,600 per 100,000, which is poised to propel the regional growth. The Japan market is projected to reach USD 0.7 billion by 2026, while the China market is projected to reach USD 0.08 billion by 2026, and the India market is projected to reach USD 0.08 billion by 2026.

Europe

European market growth is driven by active support from governments through the recommendations from the National Institute of Health and Care Excellence (NICE) and the European Society of Intensive Care Medicine (ESICM) on 0.9% sodium chloride administration. The UK market is projected to reach USD 0.08 billion by 2026, while the Germany market is projected to reach USD 0.11 billion by 2026.

Rest of the World

The markets in Latin America and the Middle East & Africa are projected to grow owing to the improving healthcare infrastructure, the high prevalence of dehydration in Sub-Saharan Africa, and a significant increase in the number of hospitals.

KEY INDUSTRY PLAYERS

Baxter Held a Leading Position Owing to the Strong Distribution Network

In terms of revenue, Baxter held a dominating position in the market in 2024. The company is a leader in IV fluids and has an established distribution network and customer base. This is one of the key factors for the prominent position of the company in the market. On the other hand, a firm hold in China and high manufacturing capacity are factors responsible for the second leading position of the Kelun Group.

Moreover, manufacturers such as ICU Medical, Fresenius Kabi AG, SSY Group Limited, and others are focusing on R&D and strategic collaborations to strengthen their market position. This is expected to intensify market competition and boost their global normal saline for parenteral use market share during the forecast period.

List of Top Normal Saline for Parenteral Use Companies:

- Baxter (U.S.)

- Kelun Group (China)

- B. Braun Melsungen AG (Germany)

- Fresenius Kabi AG (Germany)

- SSY Group Limited (China)

- ICU Medical (U.S.)

- Double-Crane Pharmaceutical Co., Ltd. (China)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- Cisen Pharmaceutical Co., Ltd. (China)

- Pharmally International Holding Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- August 2022 - Assure Infusions, Inc., announced the construction of a manufacturing plant in Bartow, Florida. The center is fully automated with advanced robotics to make IV fluids that are in high demand in the U.S. healthcare system.

- February 2022 - B. Braun SE, a German infusion therapy company received the FDA’s approval to begin operations at its new I.V. saline solution manufacturing facility in Daytona Beach, Florida.

- October 2020 - The Laugfs Holdings Limited announced its planning to commence operations of its intravenous (IV) solution (saline) manufacturing plant located in the Koggala Export Processing Zone (EPZ) in Sri Lanka.

- February 2020 - Eurolife Healthcare Pvt. Ltd., announced the acquisition of intravenous infusion business of TEVA Pharmaceutical Industries Ltd., in Hungary, for the development and commercialization of intravenous infusions plant in the U.S. and European markets.

- July 2019 - Eurolife Healthcare Pvt Ltd, a specialty pharmaceuticals company, acquired Isreal-based Teva's intravenous infusion (IV) unit in Hungary for the expansion of its operations in the Europe and U.S. market.

REPORT COVERAGE

The report includes an elaborative analysis of numerous factors affecting the global market. Information on trends, drivers, opportunities, threats, and restraints of the market can further help stakeholders gain valuable insights into the market. The report also offers a detailed competitive landscape by presenting information on key players, market share by manufacturers, and their strategies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.97% from 2026-2034 |

|

Unit |

Value (USD Billion), and Volume (Units) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 3.91 billion in 2025.

Fortune Business Insights says that the market is projected to reach USD 7.15 billion by 2034.

The value of the North America market was USD 1.54 billion in 2025.

The market is projected to grow at a CAGR 6.97% during the forecast period (2026-2034).

Based on type, the plastic bottles segment is the leading segment in the market.

An increase in the usage of normal saline for dehydration and sepsis and the growing number of hospital admissions and surgical procedures are the key factors driving the global market growth.

Baxter and Kelun Group are the top players in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us