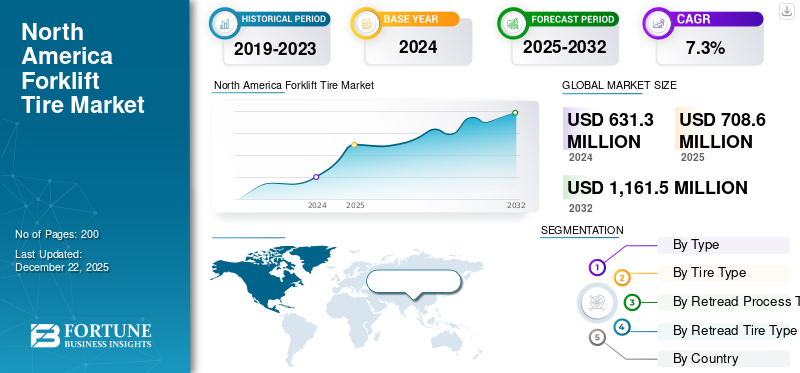

North America Forklift Tire Market Size, Share & Industry Analysis, By Type (New Tire, Replacement Tire, and Retreaded Tire), By Tire Type (Radial, Bias, and Solid), By Retread Process Type (Pre-Cure and Mold-Cure), By Retread Tire Type (Radial, Bias, and Solid), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The North America forklift tire market size was valued at USD 631.3 million in 2024. The market is projected to grow from USD 708.6 million in 2025 to USD 1,161.5 million by 2032, exhibiting a CAGR of 7.3% during the forecast period.

Forklift tires are specialized tires designed precisely for forklifts and other material handling equipment. Forklift tires navigate unique operating environments, including warehouses and distribution centers, construction sites, and distribution centers, while supporting heavy loads and enduring frequent maneuvers. Forklift tires are categorized into two main types: pneumatic and solid.

- Pneumatic Tires: Pneumatic tires are inflatable tires that offer a cushioned ride for forklifts used on both outdoor and uneven surfaces. They are typically made of rubber and feature deep tread patterns for improved traction.

- Solid Tires: Solid tires are made from solid rubber and contain no air. This makes them puncture-proof and ideal for indoor use, especially in warehouse settings. Solid forklift tires are known for their durability and resistance to wear, which contribute to their low-maintenance advantage.

The market has experienced significant growth due to the increasing demand for warehouse automation, logistics optimization, and growth of e-commerce sector. Forklifts are crucial machines in material handling processes across various industries, including tire manufacturing, retail, and construction.

The growth of e-commerce necessitates more efficient and automated warehousing solutions, leading to higher demand for forklift and tire. Innovations in tire technology, such as improved tread designs for enhanced grip and durability, drive market growth.

The forklift tire market is dominated by several key regional players known for their advanced engineering, material innovation, and wide OEM and aftermarket presence. This may include Bridgestone Corporation, Michelin, Goodyear Tire & Rubber Company, and Continental AG.

North America Forklift Tire Market Trends

Increasing Adoption of Smart Tires for Forklift with Sensor Technology is as a Major Technological Trend

The North American market is at the forefront of development of forklift tires due to numerous reasons. One major technological trend in the forklift tire market is increasing demand for electric and hybrid forklifts. For higher efficiency and maintaining sustainability in operations, numerous warehouse operators and end-users are shifting to electric and hybrid forklifts. Increasing environmental regulations, rising demand for automation in warehousing and logistics, and advancements in battery technology are few major reasons due to which demand for electric and hybrid forklifts is growing.

A rise in the demand for electric and hybrid forklifts slightly led to a rise in demand for smart tires equipped with sensor technology to focus on sustainability. This trend is particularly observed in the commercial vehicle sector, where smart tires provide data-driven insights and real-time monitoring for fleet operators.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Cost-saving Advantage Offered by Retread Tire to Logistics Companies and Distribution Centers is Expected to Support Market Growth

One of the major drivers of North America forklift tire market growth is the cost-saving advantage it offers to logistics companies and distribution centers. Retreading tires diminishes the costs of procuring new tires that can sum for a noteworthy portion of operational costs. For instance, a logistics company working with an extensive fleet of forklifts can save up to 55-75% on tire costs by opting for retreaded tires.

This affordability is particularly attractive in businesses such as manufacturing, warehousing, and retail, where higher volumes of forklifts are in operation. Moreover, retreading extends the lifespan of tires, subsequently motivating companies to maximize their investment over multiple cycles. The natural benefit of lessening waste and keeping up sustainability acts as a boost to the forklift tire market growth, altering corporate social responsibility objectives.

As the global push toward sustainability increases, companies are incentivized to select retreaded tires. Numerous OEMs are readily investing in development and incorporation of services that encompass the retreading of tires to generate additional revenue.

In August 2024, Purcell Tire & Rubber Co.’s unveiled the acquisition of Jack’s Tire and Oil Management Co. Inc. which is said to be the company’s sixth acquisition in the past four years. Furthermore, in May 2020, Purcell Tire acquired Wilson Industrial Tires Inc., an independent tire dealership in Missouri that supplied tires for material handling solution (truck), plus farm, forestry and lawn service equipment.

Market Restraints

Safety and Quality Perception of Retread Tires to Restrain Market Growth

The North America forklift tire market is expected to face significant restraints due to safety and quality concerns. End-users are concerned about the reliability and performance of retreaded tires, especially under difficult circumstances including demanding operational conditions or heavy loads. For instance, a forklift operating in a high-temperature environment or carrying heavy loads could experience safety issues if the retreaded tire fails prematurely.

These operational restraining incidents can lead to major accidents, increased liability, and equipment downtime, making companies highly stringent to shift completely to retreaded tires. However, inconsistent retreading quality control and standards across manufacturers can challenge preference among end-users. Regulatory agencies and industry standards, from the Tire Retread & Repair Information Bureau (TRIB), highlight the major importance of stringent quality measures, but a lack of uniform enforcement can hinder market growth.

Market Opportunities

Increased Growth of E-commerce and Surging Demand for Warehousing and Logistic Services Offer Expansion Opportunities

Increased warehouse expansions, growing industrial activity, and a booming emphasis on cost efficiency are creating market expansion opportunities. These major trends are leading to the rise in demand for tires and growing the appeal of retreading as a major environmentally friendly and cost-effective alternative as compared to new tires.

The growth of e-commerce and demand for warehousing and logistics services is leading to an expansion of fulfillment facilities and distribution centers. This is resulting in a higher demand for forklifts, which in turn leads to increased need for new tires and makes retreading a more preferred option. Expanding industries, including construction, manufacturing, and mining, are also driving up forklift usage. These sectors majorly prioritize cost efficiency and opt for retreading to lower their operational expenses.

Market Challenges

Volatility in Raw Material Prices May Hamper Market Growth

Fluctuations in the costs of rubber and synthetic materials impact the overall tire pricing and profitability. Tires are made from a complex blend of materials, largely rubber, and various synthetic compounds, carbon blacks, and reinforcing agents. Manufacturers of forklift tires are directly affected by the fluctuating prices of raw materials. The cost of rubber, for instance, can be influenced by factors such as natural disasters affecting rubber plantations, geopolitical tensions in major producing countries, and shifts in global supply and demand dynamics. When raw material prices spike unpredictably, manufacturers may face increased production costs. Thus, the volatility in raw material prices may hamper the overall forklift tire market growth in North America.

Segmentation Analysis

By Type

Increasing Demand of Electric Forklifts Support the Growth of New Tire Segment

The market is segmented into new tire, replacement tire, and retreaded tire, based on type.

The new tire market segment held the largest share and is expected to increase over the forecast period. The segmental growth is attributed to growing demand for electric forklift, the expansion of e-commerce and logistics, and the adoption of automation and robotics in warehouses.

For instance, in June 2024, Amazon announced that the company adopted autonomous forklifts into its warehousing and distribution operations to enhance efficiency and streamline logistics. In Amazon's fulfilment centers, autonomous forklifts play a crucial role in optimizing the flow of goods. They reduce the need for manual labor, minimize human error, and increase precision in material handling. This development upsurges the demand for new forklift tires.

The retreaded tire segment held a significant share of the market. The segment’s growth is attributed to the increase in demand for customized and specialized tires tailored to specific applications and operational conditions, such as off-road usage, extreme temperatures, or hazardous environments. The demand for specialized tire leads to increased demand for the product.

By Tire Type

Solid Tires Dominate Owing to their Rising Demand in Construction, Metal Fabrication and Mining Industries

This market is segmented into radial, bias, and solid, based on tire type.

The solid segment dominated the forklift tire market in 2024. Industries such as construction, metal fabrication, and recycling require heavy-duty equipment capable of withstanding challenging usage. Solid tires excel in these applications due to their strength and ability to handle major weight, making them the preferred choice for heavy-duty forklifts.

In July 2024, Hyster introduced its new range of lithium-ion battery-powered forklifts, delivering performance levels on par with Internal Combustion Engine (ICE) lift trucks. The Hyster J2.0-3.5XTLG series supports loads of up to 3.5 tons. These types of solid tires are designed for versatile use in both indoor and outdoor environments. They offer a durable and flexible solution while eradicating exhaust emissions, making them an eco-friendly choice for numerous industrial applications.

The radial segment held a significant North America forklift tire market share. Increasing awareness of environmental sustainability is prompting the tire selection process. Radial tires typically offer lower rolling resistance, which can lead to reduced fuel consumption and lower carbon emissions.

To know how our report can help streamline your business, Speak to Analyst

By Retread Process Type

Cost Efficiency and Performance of Retread Tires Drive Pre-Cure Segment Growth

Based on retread process type, the segment is segregated into pre-cure and mold-cure.

The pre-cure segment held the highest market share and is expected to grow at the highest rate owing to its cost efficiency and performance. The pre-cure retread process offers excellent cost value. They can match the lifespan of a new tire, typically lasting 50% -60 %, as long as it costs significantly less. Robust quality control ensures consistent tread thickness and performance.

The mold cure segment holds the second position in the market owing to the growth in off-road and industrial tires. Construction, mining, ports, and agriculture increasingly demand specialized tires. Mold cure is better suited to these sectors because of its thick tread profiles, high heat tolerance, and greater wear protection.

By Retread Tire Type

Increasing Demand of Solid Retreaded Tires in Industrial and Warehousing Sector Drives Segment Growth

Based on retread tire type, the market is segmented into radial, bias and solid.

The solid segment held the largest market share and is expected to depict the highest growth rate fueled by high demand in the industrial and warehousing sectors. North America has a huge warehousing, logistics, and manufacturing base, especially in the U.S. and parts of Canada. The forklifts used in these facilities often operate indoors or on smooth concrete, where solid tires are ideal due to no risk of flats or punctures, superior stability for lifting heavy loads, and consistent traction on smooth floors.

The radial segment is the second-largest in the market boosted by longer tread life and retread potential. Radial tires generate less internal heat, which preserves the casing better, enabling multiple retread cycles, which is especially important for high-usage forklift fleets. Enhanced casing durability makes radial tires a cost-effective long-term investment, especially when retreaded rather than replaced.

NORTH AMERICA FORKLIFT TIRE MARKET REGIONAL OUTLOOK

The market covers four major countries, mainly the U.S., Canada, and Mexico.

U.S.

The forklift tire market in the U.S. region is leading with a valuation of USD 458.2 million in 2024 owing to the increasing demand for e-commerce industry. For instance, in December 2024, Amazon announced the company adopted autonomous forklifts into its warehouse and distribution operations as part of its commitment to innovation and efficiency. These forklifts, equipped with advanced sensors and artificial intelligence (AI), navigate complex warehouse environments to perform critical tasks, including material transportation, inventory management, and product loading and unloading.

Canada

The region held a significant North America forklift tire market share. Improvements in retreading technology and the development of high-performance retreaded tires are further enhancing the market’s growth.

Mexico

The market’s growth in Mexico is attributed to heavy infrastructure investment and growing manufacturing zones driving forklift fleet expansion and aftermarket retreading demand. The Mexican government’s inter-oceanic corridor initiative is boosting industrial development, growing demand for material handling equipment and forklifts, including retreaded tires.

COMPETITIVE LANDSCAPE

Key Industry Players

Strategic Integrations by key players in the landscape

Key players in this market continuously innovate to meet evolving industry demands, expand product offerings, and strengthen their market presence through strategic collaborations and acquisitions. Several prominent companies dominate the North America forklift tire market, leveraging advanced technologies, extensive distribution networks, and strong brand recognition. The major players in the market include Bridgestone Corporation, Michelin, Goodyear Tire & Rubber Company., and Continental AG.

LIST OF KEY FORKLIFT TIRE COMPANIES IN NORTH AMERICA

- Bridgestone Corporation (Japan)

- The Goodyear Tire & Rubber Company (U.S.)

- Continental AG (Germany)

- Camso, Inc. (Canada)

- Setcosolid Tire & Rim Assembly (U.S.)

- Superior Tire & Rubber Corp. (U.S.)

- Oliver Rubber Company (U.S.)

- Parrish Tire Company (U.S.)

- Treadwright (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Bridgestone Americas introduced the new Bridgestone R273 Ecopia regional tire for the steer position and the Bridgestone Duravis M705 for mixed fleet vehicles in pick-up and delivery (P&D) and last-mile delivery (LMD) fleets. Both are debuting at the 2025 Technology & Maintenance Council (TMC) Annual Meeting & Transportation Technology Exhibition. Both all-new tires feature the company’s next-generation ENLITEN technology, designed to help expand performance capabilities to new levels while also elevating focus toward sustainability.

- December 2024: CEAT Ltd. unveiled the acquisition of Camso brand from Michelin Group. The Camso line includes off-highway construction tracks and tires and also has been part of the Michelin group since 2018. The contract is expected to be worth around USD 225 million.

- July 2024: Bridgestone Americas (Bridgestone) presented the new BDR-AD3 retread, Bandag’s premier solution for the requesting challenges of Package & Delivery and Last-Mile Delivery applications. The BDR-AS3 is planned with impressive durability and expanded traction in mind, no matter the season or condition.

- June 2024: The Michelin X Works D pre-mold drive position retread is the latest offering with Michelin Retread Advances on-road/off-road line and is planned to be the next-generation retread optimized for enhanced wear performance, durability, and traction in mixed applications.

- July 2022: Oliver Rubber Company unveiled the launch of Vantage Max Drive II, a latest drive position retread. The Vantage Max Drive II meets current SmartWay requirements for line-haul and regional applications and benefits from 26% more tread depth than its predecessor, the Vantage Max Drive.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, tire types, and leading product applications. Besides this, the report offers insights into the market trends and highlights vital industry developments. In addition to the factors above, the report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Estimated Year |

2025 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.3% over 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type · New Tire · Replacement Tire · Retreaded Tire |

|

By Tire Type · Radial · Bias · Solid |

|

|

By Retread Process Type · Pre-Cure · Mold-Cure |

|

|

By Retread Tire Type · Radial · Bias · Solid |

|

|

By Country · U.S. · Canada · Mexico |

Frequently Asked Questions

Fortune Business Insights says that North Americas market size was USD 631.3 million in 2024 and is projected to reach USD 1,161.5 million by 2032.

In 2024, the U.S. market size stood at USD 458.2 million.

The market is projected to grow at a CAGR of 7.3% and exhibit steady growth during the forecast period.

Cost-saving advantage offered to logistics companies and distribution centers is a key factor for the market’s substantial growth.

Key players in this market include Bridgestone Corporation, Michelin, Goodyear Tire & Rubber Company., and Continental AG.

The U.S. dominated the market share in 2024.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us