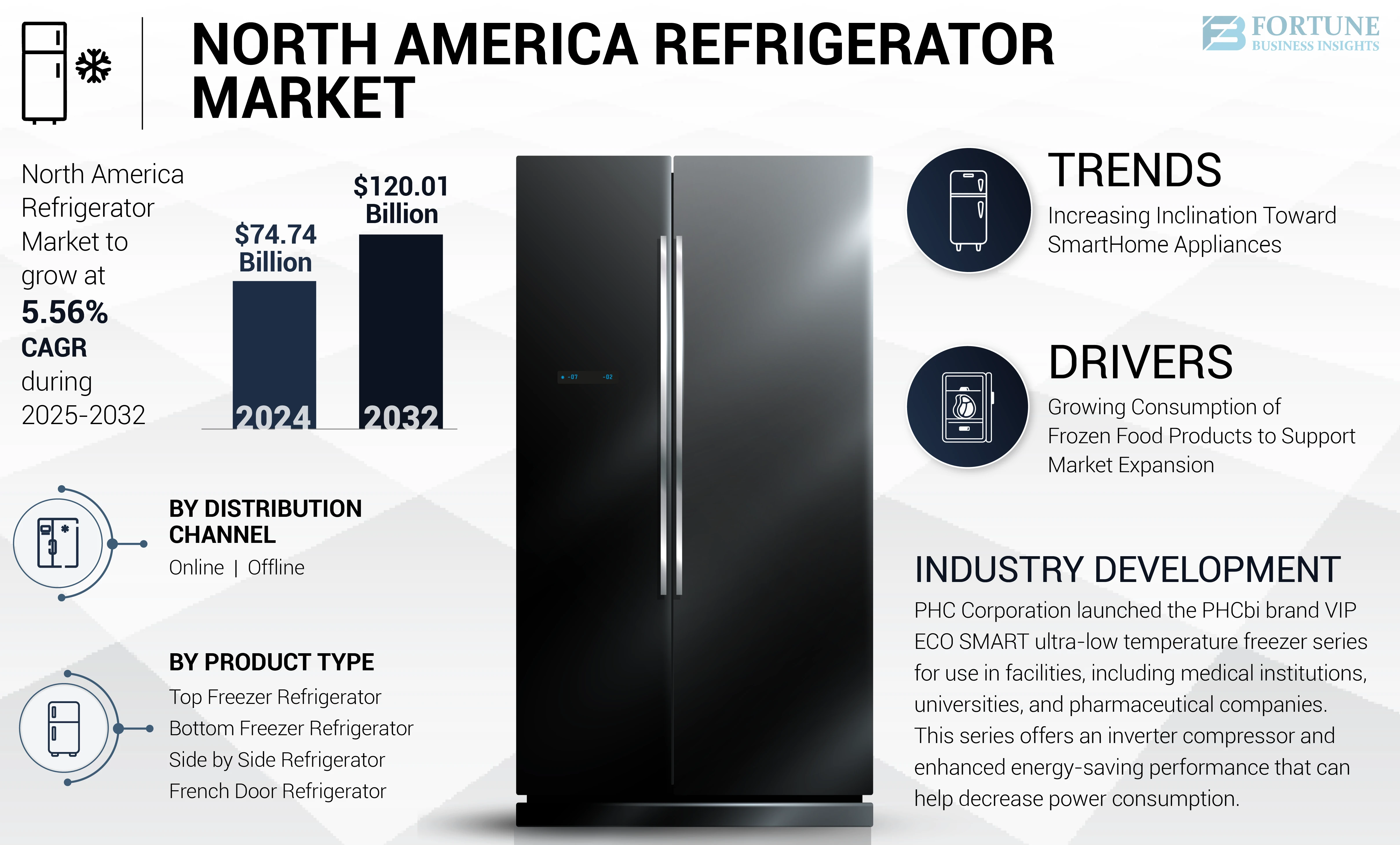

North America Refrigerator Market Size, Share & Industry Analysis, By Product Type (Top Freezer Refrigerator, Bottom Freezer Refrigerator, Side by Side Refrigerator, French Door Refrigerator), By Distribution Channel (Online, Offline), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

North America is the second largest region in the global refrigerator market. The North America refrigerator market size is projected to grow at a CAGR of 5.56% during the forecast period. The global market of refrigerator is projected to grow from USD 74.74 billion in 2024 to USD 120.01 billion by 2032.

The unprecedented increase in demand for refrigeration technology has sparked innovations such as the automated defrost feature and more giant freezers. Product innovation plays an essential role in driving market growth. Modern household technology blends design aesthetics, energy efficiency, and temperature control to keep food from deteriorating. Key players of the market progressively launch technologically advanced products and innovative refrigerators to help attract more consumers. This is likely to increase the consumption rate among people of this region significantly.

- In January 2019, Samsung Electronic Canada launched its next-generation award-winning family hub refrigerator. The product uses Artificial Intelligence (AI) and IoT technology to help ease refrigerator use. The user can monitor and control using their smart device, which helps maintain healthier food management.

Our market research report covers the following countries/regions – the U.S., Canada, and Mexico.

LATEST TRENDS

Increasing Inclination Toward Smart Home Appliances

Household appliances such as refrigerators that work 24 hours a day consumers prefer refrigerators that are energy savers. Accurate size and capacity of appliances are highly considered when buying such appliances as refrigerators, freezers, dishwashers, and others. High efficiency, superior design, and better-insulated appliances are gaining traction in the market. Evolving home remodeling and appliance replacement trends will surge the demand among the region's population, thereby driving the product demand over the forecast period. The rising construction of new homes has fostered the demand for home appliances. Additionally, shifting consumer behavior toward energy-efficient appliances offers newer market growth opportunities. The rising adoption of smartphone-controlled and IOT-based home appliances will accelerate consumer demand for smart fridges.

- Millennials prefer buying ready-to-assemble refrigerators as they can flexibly fit & hide such appliances inside their cabinetry-style kitchen. Additionally, they use fridges for quick curd & ice cube making; increasing consumer trends in at-home cooking and baking support the demand for kitchen appliances. These trends will likely shape the overall market growth.

- According to data presented by the National Council of Home Safety and Security, as of 2020, 47% of U.S. millennials own at least one smart home product.

To know how our report can help streamline your business, Speak to Analyst

DRIVING FACTORS

Growing Consumption of Frozen Food Products to Support Market Expansion

The region is mainly driven the growing consumption of ready-to-eat food products and frozen products, owing to the busy and hectic lifestyle of the consumers in recent times. Moreover, increasing adoption of smart and intelligent home appliances, including smart refrigerators, is also fostering the North America refrigerator market growth during the projected period.

- Moreover, the American people's massive consumption of ice cream is estimated to rise the utilization of refrigerators. It is thus expected to have a crucial impact on market development. It is attributed to refrigerators helping to preserve ice cream for consumption when they long for it.

- According to data presented by the International Dairy Foods Association, in 2019, the U.S. produced 6.4 billion pounds of ice cream and mentions that the average American consumes about 23 pounds of ice cream and frozen desserts yearly.

RESTRAINING FACTORS

Supply Chain Disruptions and Maintenance Costs May Hamper Market Growth

Supply chain disruption due to high costs of commodities such as crude oil that affected logistics is a crucial factor influencing the high prices of home appliances. Major manufacturers such as Whirlpool Corporation, Panasonic, and Samsung are experiencing constraints due to shortage of crucial electrical components, leading to high home appliance prices. The repair or maintenance cost of home appliances such as air conditioners, refrigerators, and washing machines is relatively high, mainly due to the appliance's high manufacturing cost and users' high dependency on the appliances. Many manufacturers provide a warranty to users for repair or maintenance for a specific period.

- According to the Consumer Electronics and Appliances Manufacturers Association (CEAMA), the price of home appliances such as washing machines and refrigerators rose by 5% to 12% in 2022 due to the surge in raw material cost, shortage of electronic components, and rise in freight cost.

Average Repair Cost of a Refrigerator in the U.S. in 2022

|

Appliance |

Cost |

|

Refrigerator |

USD 200 to USD 330 |

KEY INDUSTRY PLAYERS

In terms of the competitive landscape, Samsung Group, Haier Inc., Whirlpool Corporation, and LG Corporation are the key players in the North America refrigerator market share. This is due to their diversified product offerings and active involvement in R&D investments to accelerate product launches and approvals in the forecast period.

Other prominent players such as Electrolux AB, Hitachi, Ltd., and Voltas Limited lead the market due to their robust distribution network and diverse product portfolio. Other significant players are Panasonic Holdings, Sharp Corporation, and Toshiba Corporation. These companies are focused on strengthening their product portfolio and distribution network through strategic collaboration and partnerships to increase their market share in North America.

LIST OF KEY COMPANIES PROFILED:

- Haier Inc. (China)

- LG Corporation (South Korea)

- Samsung Group (South Korea)

- Whirlpool Corporation (U.S.)

- Voltas Limited (India)

- Electrolux AB (Sweden)

- Panasonic Holdings Corporation (Japan)

- Sharp Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Toshiba Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: PHC Corporation launched the PHCbi brand VIP ECO SMART ultra-low temperature freezer series for use in facilities, including medical institutions, universities, and pharmaceutical companies. This series offers an inverter compressor and enhanced energy-saving performance that can help decrease power consumption.

- January 2023: Samsung presented the Bespoke Home 2023 lineup of home appliances featuring innovative technologies with aesthetic customization to meet consumer preferences and set a new standard for personalized, smart home living. The Bespoke 4-Door Flex Refrigerator with Family Hub+ features an immersive 32-inch screen and is expected to launch in North America and Korea in the first half of 2023.

- January 2023: LG Electronics launched its new MoodUP refrigerator, featuring LED door panels that can change color with a button on LG’s ThinQ app.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report provides qualitative and quantitative insights into the market and a detailed analysis of the North America market size & growth rate for all possible segments in the market. The report elaborates on the market dynamics and competitive landscape. The report presents various key insights: an overview of the number of procedures, an overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships, and the impact of COVID-19 on the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.56% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Product Type, Distribution Channel, and Country/Sub-Region |

|

By Product Type |

|

|

By Distribution Channel |

|

|

By Country/ Sub-Region |

|

Frequently Asked Questions

According to Fortune Business Insights, the North America refrigerator market is projected to grow at a CAGR of 5.56%, with the global market expanding from USD 74.74 billion in 2024 to USD 120.01 billion by 2032.

Growing at a CAGR of 5.56%, the market will exhibit steady growth in the forecast period (2025-2032).

Key trends include a surge in smart home appliance adoption, rising demand for energy efficient refrigerators, and aesthetic customization through products like Samsung Bespoke lineup and LG MoodUP refrigerator.

Rising consumption of frozen and ready to eat foods, increasing smart appliance adoption, and home remodeling trends are the primary drivers of refrigerator demand across the U.S., Canada, and Mexico.

Refrigerators run 24/7, so energy efficient models help lower electricity bills and reduce carbon footprints. Consumers are prioritizing appliances that are ENERGY STAR certified and IoT enabled for better power control.

Smart refrigerators featuring AI, IoT, and app control are increasingly popular, offering features like remote monitoring, touchscreens, and food inventory management, making them appealing to tech-savvy consumers.

Supply chain disruptions, rising raw material costs, and high repair and maintenance expenses are key challenges. Average refrigerator repair costs in the U.S. range between USD 200 to USD 330.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us