Nylon Fiber Market Size, Share & Industry Analysis, By Type (Nylon 6, Nylon 6,6, and Others), By Application (Textile & Apparel, Automotive, Consumer Goods, Electrical & Electronics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

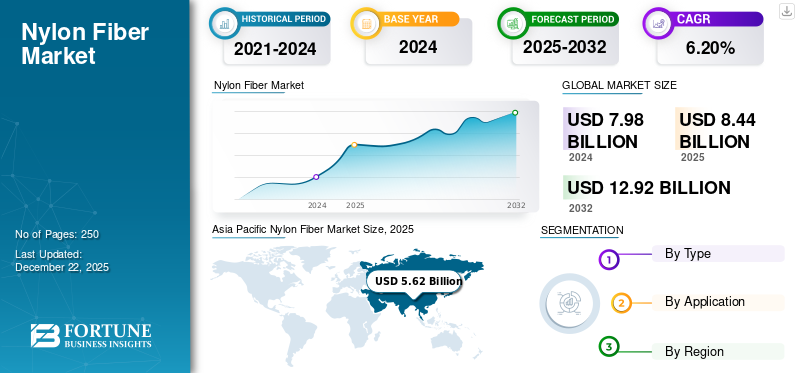

The global nylon fiber market size was valued at USD 8.44 billion in 2025. The market is projected to grow from USD 8.93 billion in 2026 to USD 14.57 billion by 2034, exhibiting a CAGR of 6.20% during the forecast period. Asia Pacific dominated the nylon fiber market with a market share of 67% in 2025.

Nylon fiber is a synthetic polymer material known for its exceptional strength, durability, and elasticity. It is manufactured by converting chemical compounds into long, continuous filaments through processes including melt spinning. Nylon's remarkable resistance to abrasion, chemicals, and temperature fluctuations, combined with its lightweight nature, makes it highly versatile across multiple industries.

The applications span numerous sectors, from textiles where it’s used in activewear, stockings, swimwear, and lingerie, to industrial uses including automotive components, fishing lines, and conveyor belts. In construction, nylon appears in carpeting and reinforcement materials, while the medical field utilizes it for sutures and prosthetics. Other applications include parachutes, ropes, luggage, guitar strings, and food packaging, demonstrating nylon’s remarkable adaptability to diverse requirements.

- According to the latest Textile Exchange Preferred Fiber and Materials Market Report from 2021, Nylon fibers had around 5.4 million tons, a market share of about 5% of the global fiber production market in 2020. In 2020, global nylon fiber production decreased from 5.58 million tons in 2019 to 5.45 million tons in 2020 due to COVID-19.

Key players operating in the market are INVISTA, TORAY INDUSTRIES, INC., BASF SE, Ascend Performance Materials, and Asahi Kasei Corporation.

NYLON FIBER MARKET TRENDS

Increasing High-Performance Nylon Demand to Bolster Market Development

The emergence of high-performance nylon represents a fundamental shift in material engineering priorities. Manufacturers increasingly recognize that traditional nylon properties no longer fully satisfy the extreme demands of cutting-edge applications. By enhancing thermal stability, chemical resistance, and mechanical strength, these advanced formulations enable previously impossible design solutions. The transformation reflects a deeper understanding of molecular structure manipulation, allowing precise tailoring of properties at the polymer level.

- This evolution mirrors the industry’s journey from commodity production to value-driven innovation, where performance characteristics rather than cost alone drive adoption decisions, creating new premium segments with substantially higher margins and technological sophistication.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Athleisure Demand Accelerates Nylon Fiber Adoption in Textiles

The increasing demand for athleisure and performance wear is expected to drive the nylon fiber market growth. As consumers increasingly prioritize comfort, durability, and moisture management in everyday clothing, manufacturers have responded by developing specialized nylon fibers with enhanced stretch, breathability, and antimicrobial properties. This shift from purely functional sportswear to fashion-forward athleisure has expanded the product’s application beyond traditional segments, driving significant production volume increases. Simultaneously, sustainability concerns have pushed textile producers toward recycled nylon alternatives, creating premium, eco-conscious market segments. The resulting innovation cycle has elevated nylon from a basic synthetic material to a premium performance fabric essential to modern wardrobes.

MARKET RESTRAINTS

Fluctuating Petroleum Prices to Restrict Nylon Fiber Production

High production costs and volatile raw material prices significantly hamper market growth. As petroleum derivatives form the backbone of nylon production, sudden oil price fluctuations directly impact manufacturing margins, creating financial uncertainty for producers. Energy-intensive polymerization processes further compound cost pressures through rising utility expenses. These economic constraints force manufacturers to either absorb margin reductions or pass costs to price-sensitive consumers, ultimately restricting market expansion. Consequently, producers struggle to maintain consistent pricing strategies and long-term investment planning, limiting capacity expansion despite growing demand.

MARKET OPPORTUNITIES

Technical Textile Innovation Expands High-Value Applications for Nylon Fibers

The rapid advancement of technical textiles creates substantial market opportunities for specialized nylon fibers. As industries move beyond conventional applications toward engineered solutions with precise performance requirements, nylon’s inherent strength, durability, and adaptability make it ideal for these demanding contexts. Medical textiles requiring biocompatibility, geotextiles needing exceptional environmental resistance, and protective fabrics demanding flame retardancy are all driving the development of modified nylon formulations. This evolution enables manufacturers to escape commodity pricing pressures by creating differentiated, high-margin products for specialized applications. The resulting technical textile industry growth has transformed nylon from a basic apparel material into an engineered component critical for solving complex industrial challenges.

MARKET CHALLENGES

Environmental Regulation to Hinder Market Growth

Rising environmental concerns over nylon’s non-biodegradability and high carbon footprint are prompting stricter regulations and consumer pushback. As nylon is derived from petrochemicals, its production emits significant greenhouse gases. This pressure manufacturers to seek sustainable products such as bio-based or recycled fibers, thus challenging the demand, especially in fashion and textiles, where eco-conscious choices are increasingly prioritized.

Segmentation Analysis

By Type

Nylon 6 Segment Holds Dominant Share Due to Its Superior Tensile Strength and Durability

Based on type, the market is segmented into Nylon 6, Nylon 6,6, and others.

The Nylon 6 segment dominates the global market share due to its lower production costs and versatility across numerous applications. It's relatively simpler manufacturing process requires fewer raw materials, making it economically advantageous for mass production. The segment continues expanding rapidly in developing regions where cost sensitivity drives material selection decisions.

The Nylon 6,6 segment commands premium positioning with superior heat resistance, dimensional stability, and mechanical properties. Despite higher production costs, it maintains strong demand in high-performance applications requiring exceptional durability and temperature resistance. The automotive and industrial sectors particularly value its enhanced properties for safety-critical components where material failure is unacceptable.

By Application

Textile & Apparel Segment Leads Market Due to Rising Activewear, Swimwear, and Performance Clothing Demands

Based on application, the market is segmented into textile & apparel, automotive, consumer goods, electrical & electronics, and others.

Textile and apparel applications represent the largest consumption segment, driven primarily by activewear, swimwear, and performance clothing demands. The sector’s growth correlates strongly with athleisure trends and technical textile innovations that leverage nylon’s moisture management, durability, and comfort properties. Fast fashion and performance sportswear manufacturers value nylon’s versatility and processing compatibility.

- In 2017, European households consumed about 13 million tons of textile products (clothing, footwear, and household textiles). Synthetic fibers, such as polyester and nylon, comprise about 60% of clothing and 70 % of household textiles.

Automotive applications constitute the fastest-growing segment as manufacturers pursue lightweight materials to improve fuel efficiency and reduce emissions. Nylon fibers provide critical reinforcement in tire cords, airbags, and engine compartment components where temperature resistance and mechanical strength are essential. The growing electric vehicle market further accelerates the product adoption in battery insulation and protection components.

Nylon Fiber Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Nylon Fiber Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest global nylon fiber market share in 2025, generating market revenue worth USD 5.62 billion. The market is driven by China’s manufacturing dominance and rapidly expanding domestic consumption. The region’s competitive production costs, robust consumer goods and textile industries, and growing automotive manufacturing create an ideal environment for continued expansion. Emerging economies such as India and Vietnam are rapidly increasing their nylon production capacity to meet regional demand.

North America

North America maintains a significant market presence through technological advancements and leadership in specialty formulations and high-performance applications. The region’s focus on technical textiles, aerospace, and defense applications creates a stable demand for premium nylon fibers. Recycled nylon initiatives are particularly advanced in this region, responding to consumer sustainability concerns.

Europe

Europe emphasizes high-value applications with stringent performance requirements, particularly in automotive, medical, and industrial contexts. The region’s circular economy regulations increasingly influence material selection, creating opportunities for bio-based and recycled nylon fibers. German automotive manufacturing remains a crucial demand driver for high-performance formulations.

Latin America

Latin America shows moderate growth, primarily through textile and industrial applications. Brazil and Mexico represent the largest consumption centers, with automotive manufacturing expansion creating new demand sources. The region’s vulnerability to polymer price fluctuations creates market volatility, with manufacturers often prioritizing cost over performance characteristics.

Middle East & Africa

The Middle East & Africa region represents emerging opportunity markets with increasing textile manufacturing capacity and growing automotive assembly operations. The region’s developing industrial base creates new application channels, though economic uncertainty constrains growth rates. Strategic investments in local production capacity aim to reduce import dependence on basic nylon formulations.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Sustainability and Traceability to Redefine Market Landscape

The market is transforming, driven by a growing demand for sustainability and transparency. Companies are adopting bio-based raw materials to reduce reliance on fossil fuels and lower carbon emissions. Simultaneously, advanced recycling technologies are being developed to enable circular product systems. Digital and physical traceability solutions are gaining traction, allowing end-to-end visibility across the supply chain. These innovations are reshaping the industry toward more responsible and future-ready operations.

LIST OF KEY NYLON FIBER COMPANIES PROFILED

- INVISTA (U.S.)

- TORAY INDUSTRIES, INC. (Japan)

- BASF SE (Germany)

- Ascend Performance Materials (U.S.)

- Asahi Kasei Corporation (Japan)

- Domo Chemicals (Belgium)

- UBE Corporation (Japan)

- Highsun Holding Group (China)

- HYOSUNG (South Korea)

- Radici Partecipazioni SpA (Italy)

KEY INDUSTRY DEVELOPMENTS

- February 2025 – Toray launched recycled nylon 6 fiber in Japan using depolymerization tech and waste, including fishing nets. The move supports circular economy goals and meets the rising demand for sustainable nylon in apparel and industry.

- August 2024 - INVISTA Nylon Chemicals (China) Co. completed a USD 240 million expansion of its nylon 6,6 plant in Shanghai, doubling capacity to 400,000 tons/year. The site uses energy-efficient polymerization tech and strengthens INVISTA’s nylon supply chain.

- April 2024 – UBE launched U-BE-INFINITY, a new brand for eco-friendly materials, including bio-based, recycled, and recyclable nylon. This initiative, driven by younger employees, aims to cut emissions and support sustainability through innovative nylon solutions and other low-impact products.

- April 2024 – RadiciGroup introduced the first physical and digital nylon traceability system, embedding an inorganic tracer in yarns and utilizing QR codes for full supply chain transparency, enhancing sustainability, and combating counterfeiting.

- March 2022 – Asahi Kasei and Genomatica partnered to commercialize renewably-sourced nylon 6,6 using Genomatica’s bio-based hexamethylenediamine (HMD) derived from plant sugars. This initiative aims to reduce reliance on fossil fuels and support Asahi Kasei’s carbon neutrality goals.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2024-2034 |

|

Historical Period |

2021–2024 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 6.20% during 2026-2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 8.93 billion in 2026 and is projected to reach USD 14.57 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 5.62 billion.

The market is expected to exhibit a CAGR of 6.20% during the forecast period of 2026-2034.

The textile & apparel application leads the market by application.

Expansion of the textile industry drives market growth.

INVISTA, TORAY INDUSTRIES, INC., BASF SE, Ascend Performance Materials, and Asahi Kasei Corporation are the top players in the market.

Asia Pacific dominated the nylon fiber market with a market share of 67% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us