Oil & Gas Refinery Maintenance Service Market Size, Share & Industry Analysis, By Service Type (Turnaround Maintenance, Preventive Maintenance, and Predictive Maintenance), and Regional Forecast, 2026-2034

Oil & Gas Refinery Maintenance Service Market Size and Future Outlook

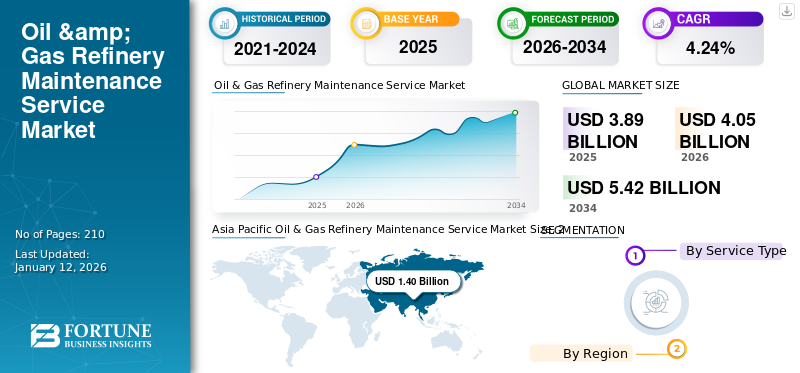

The global oil & gas refinery maintenance service market size was valued at USD 3.89 billion in 2025 and is projected to grow from USD 4.05 billion in 2026 to USD 5.42 billion by 2034, growing at a CAGR of 4.24% during the forecast period. Asia Pacific dominated the oil & gas refinery maintenance service market with a market share of 35.98%% in 2025.

Oil & gas refinery maintenance services are a crucial segment of the energy sector, focusing on the upkeep and repair of oil refineries and associated facilities. These services are vital for ensuring the efficient operation of refineries, which are required for processing crude oil into various byproducts, such as gasoline, diesel, jet fuel, lubricants, and other petrochemicals.

Oil and gas refineries are complex industrial facilities that process crude oil into various refined products. Maintenance & repair of these refineries is essential to ensure they operate efficiently, safely, and in compliance with environmental regulations. Oil & gas refinery maintenance services encompass activities, such as routine inspections, repairs, overhauls, and upgrades.

As refineries face increasing pressure to enhance performance while adhering to stringent environmental regulations, there is a growing demand for advanced maintenance practices such as predictive maintenance and digital transformations through IoT technologies.

Fluor Corporation a leading player in delivering engineering, procurement, construction, and maintenance (EPCM) services to the energy sector, with a notable emphasis on oil and gas refineries. They provide an extensive range of services, including regular maintenance and turnarounds as well as significant upgrades and expansions, offering clients a single point of contact for all their requirements

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Advancements in Aging Infrastructure in Oil & Gas Refineries is Driving Market Growth

Global refinery infrastructure is experiencing unprecedented aging challenges, where the majority of existing refineries are over 30-40 years old. This aging infrastructure represents a critical concern for the energy sector, necessitating substantial investments in its maintenance, upgrades, and technological modernization.

For instance, according to the U.S. Department of Energy's 2023 Refinery Modernization Report, the U.S. has faced significant challenges with aging refinery infrastructure. The average refinery age in the U.S. has reached 45-47 years, with approximately 62% of refineries constructed before 1980.

Moreover, the International Energy Agency's 2023 World Oil Report, which provides a global perspective on refinery infrastructure aging, confirmed that the global refinery infrastructure is predominantly aging, with an average age ranging between 35-40 years across different regions. The IEA emphasized that this aging infrastructure is driving substantial investments in refinery maintenance services, technological upgrades, and modernization efforts. Thus, these factors are driving the oil & gas refinery maintenance service market growth across different regions.

Expansion of Offshore Exploration Activities to Meet the Increasing Demand for Energy is Driving Market Expansion

The expansion of offshore exploration activities is fundamentally reshaping the oil & gas refinery maintenance services market, driven by escalating global energy demands and technological advancements. The complexity of offshore infrastructures necessitates comprehensive maintenance strategies that go beyond traditional service models. Modern offshore platforms require integrated maintenance solutions that incorporate predictive technologies, real-time monitoring systems, and advanced diagnostic capabilities with increased investments.

According to the International Energy Agency (IEA), offshore exploration investments are projected to reach USD 150 billion annually by 2025, with key regions including the Gulf of Mexico, Brazilian offshore zones, and the North Sea witnessing unprecedented exploration activities. Moreover, major energy companies, such as Shell, BP, and ExxonMobil, are highly investing in the development of specialized maintenance technologies that can operate in extreme maritime conditions. This surge is attributed to technological breakthroughs enabling extraction from deeper and more challenging maritime, thus driving the demand for maintenance services in refineries.

MARKET RESTRAINTS

Strict Environmental Regulations are Expected to Hamper Market Growth

Environmental regulations are becoming increasingly stringent, creating substantial operational challenges for refineries. These environmental regulations may increase operational costs, compelling refineries to invest heavily in emission reduction technologies, advanced monitoring systems, and sustainable infrastructure modifications. This financial burden can increase operational expenses by 15-25%, creating substantial pressure on refinery maintenance service providers to develop more efficient and environmentally friendly solutions.

For instance, in the U.S., the environmental regulations for refineries are comprehensively governed by multiple federal legislations. The Environmental Protection Agency (EPA) plays a pivotal role through the Clean Air Act, Clean Water Act, and Resource Conservation and Recovery Act. These regulations mandate stringent emissions control, waste management, and pollution prevention standards. The landmark 2015 EPA regulation specifically targeting petroleum refineries aims to eliminate smoking flare emissions, reduce toxic air pollutants by 5,200 tons annually, and decrease volatile organic compound emissions by 50,000 tons per year.

MARKET OPPORTUNITIES

Predictive Maintenance Technologies are Gaining Traction and are Expected to be an Opportunity for Market Growth

Artificial Intelligence and Machine Learning are revolutionizing maintenance strategies by enabling real-time equipment performance monitoring, predictive failure analysis, and optimization of maintenance schedules. Research and studies show that predictive maintenance technologies offer transformative economic benefits and reduce maintenance costs by 20-30%, decreasing unexpected equipment failures and extending equipment lifecycle. By implementing sophisticated data analytics and machine learning algorithms, refineries can achieve unprecedented levels of operational efficiency and reliability.

Leading companies, including Shell, BP, and Chevron, are developing comprehensive digital transformation strategies to leverage these advanced technologies. For instance, in March 2022, Shell demonstrated its AI predictive maintenance capabilities by successfully scaling the technology to monitor 10,000 pieces of equipment. In June 2021, Shell and C3 AI renewed their strategic agreement to accelerate AI and machine learning deployment. By March 2022, Shell had achieved its milestone of monitoring over 10,000 pieces of critical equipment using AI-powered predictive maintenance technologies across its manufacturing and integrated gas assets.

MARKET CHALLENGES

Technological Integration Complexity is a Challenge for Emerging Players in the Market

The oil & gas refinery maintenance services market is experiencing unprecedented technological integration challenges that reshape operational strategies. Companies face complex barriers in implementing advanced digital technologies, including legacy system incompatibility, significant investment requirements, and workforce skill gaps.

The integration process involves merging traditional maintenance approaches with cutting-edge technologies, such as artificial intelligence, the Internet of Things (IoT), and advanced predictive analytics, creating a multifaceted technological transformation ecosystem.

Many oil and gas companies operate with machinery designed in previous decades, creating substantial obstacles in technological integration. These systems lack the connectivity and visibility required for modern digital solutions, presenting complex modernization challenges. Outdated monitoring technologies put safety and operational efficiency at a significant risk, hampering the overall growth of the market.

OIL & GAS REFINERY MAINTENANCE SERVICE MARKET TRENDS

Growing Adoption of Modular Refineries in Developing Regions is an Emerging Trend, Reshaping Market Growth

The global energy landscape is experiencing a remarkable transformation, with modular refinery technologies emerging as a pivotal solution for emerging markets in Africa, Southeast Asia, and Latin America. These innovative technological platforms are strategic instruments of economic empowerment and energy independence.

For instance, African countries, including Nigeria and Ghana, are pioneering technological revolution, and the Nigerian government has issued 25 domestic refining licenses, signaling a profound shift toward localized energy production. These modular facilities are capable of processing 1,000-30,000 barrels per day and provide unprecedented flexibility compared to traditional large-scale refineries. Southeast Asian countries, including Indonesia and Malaysia, are also embracing this technology, which is driven by rapid industrialization and focuses on energy security objectives.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic significantly disrupted the oil and gas refinery maintenance services market by causing widespread shutdowns and reduced operational capacity due to safety protocols. With a decline in fuel demand and fluctuating oil prices, many refineries postponed or scaled back their maintenance activities to conserve resources. This shift not only impacted short-term maintenance planning but also initiated a trend toward more resilient and adaptive maintenance strategies in response to future uncertainties.

SEGMENTATION ANALYSIS

By Service Type

To know how our report can help streamline your business, Speak to Analyst

Turnaround Maintenance Segment Dominates due to its Critical Role in Ensuring Safe, Efficient, and Compliant Refinery Operations

Based on the service type, the market is segmented into predictive maintenance, preventive maintenance, and turnaround maintenance.

Turnaround maintenance services dominates the market as it involves the complete shutdown of refinery operations to perform comprehensive repairs, upgrades, and inspections. It involves high capital investment due to complete shutdown. Although it is expensive and time-consuming, turnaround maintenance is necessary to address major issues that preventive and predictive maintenance services cannot resolve. This segment held 53.72% of the market share in 2026.

Predictive maintenance is the second leading segment in the oil & gas industry as it represents a transformative approach to equipment management, leveraging advanced technologies such as AI, machine learning, and IoT to monitor and predict potential equipment failures proactively. By using sophisticated data-driven methods, companies can detect anomalies, optimize maintenance schedules, and prevent unexpected downtime, ultimately enhancing operational efficiency, safety, and equipment lifespan.

Preventive maintenance in oil & gas refinery maintenance services is growing due to its proactive approach to minimizing equipment failures and ensuring operational efficiency. It involves systematic, routine inspections and maintenance activities designed to prevent equipment deterioration and potential failures in oil and gas facilities. It is highly preferred due to its cost-effectiveness, ability to reduce unplanned downtime, and compliance with safety and environmental regulations.

OIL & GAS REFINERY MAINTENANCE SERVICE MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Oil & Gas Refinery Maintenance Service Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Oil Exploration Activities Enable Proactive Maintenance Approaches Across Expanding Refinery Ecosystems

Asia Pacific dominated the market with a valuation of USD 1.40 billion in 2025 and USD 1.46 billion in 2026. The Asia Pacific region dominates the oil & gas refinery maintenance service market share as it demonstrates the most dynamic regional market, characterized by rapid infrastructure expansion and technological adoption. China is leading the growth, with significant investments in refinery capacity and its maintenance capabilities. The region is experiencing substantial growth in refinery maintenance services, driven by increasing fuel demand, strategic infrastructure development, and a national focus on optimizing refinery potential. Technological advancements in predictive maintenance and IoT-enabled monitoring are particularly prominent in this region. India is poised to grow with a value of USD 0.20 billion in 2026, while Japan is expected to reach USD 0.13 billion in the same year.

China

Increasing Refinery Capacity and Technological Advancements to Propel Market Growth in China

China's refinery maintenance services sector is demonstrating remarkable technological advancement and strategic sophistication, positioning itself as a global leader in industrial optimization. In 2024, state refineries implemented cutting-edge predictive maintenance technologies, with an increase in planned maintenance activities targeting infrastructure modernization and operational efficiency.

For instance, In February 2024, OilChem reported a pivotal shift in China's refinery maintenance strategy, highlighting an 18% increase in planned maintenance activities across state refineries. State-owned refineries' Crude Distillation Unit utilization rates were expected to grow to 77.02%, while planned throughout decreased by 5.21%. This nuanced approach reflected China's sophisticated method of balancing operational efficiency with infrastructure optimization, demonstrating a calculated management of production capacities across state and independent refineries. China is expected to hold USD 0.70 billion in 2026.

North America

Technological Innovation and Regulatory Compliance Driving Maintenance Strategies for Aging Refinery Infrastructure

North America is the third largest market set to gain USD 0.79 billion in 2026. Aging infrastructure and technological advancements are driving North America's oil & gas refinery maintenance services market. The region experiences significant maintenance activities, particularly on the Gulf Coast (PADD 3), with refineries facing challenges, such as weather-related disruptions and issues in planned maintenance. Other key drivers include the adoption of proactive maintenance strategies, advanced predictive technologies, and a focus on optimizing aging refinery systems. The market is particularly sensitive to seasonal maintenance periods, with notable shutdowns at major facilities, including Motiva Port Arthur and Marathon Galveston Bay refineries, during non-seasonal maintenance duration.

U.S.

High Maintenance Services to Fuel Market Growth in the U.S.

The U.S. oil & gas refinery maintenance services sector is a critical component of the nation's energy infrastructure, characterized by complex operational dynamics and technological evolution. According to the U.S. Energy Information Administration (EIA), the U.S. maintains approximately 129 operating petroleum refineries with a combined crude oil processing capacity of about 18 million barrels per day as of 2023. The sector is particularly robust in regions, such as the Gulf Coast (PADD 3), which accounts for approximately 45% of the nation's refining capacity. The U.S. market is set to reach USD 0.71 billion in 2026.

Europe

Technological Innovations in Predictive Maintenance and Digital Transformation are Driving the Market in Europe

Europe is the second leading region expected to acquire USD 0.90 billion in 2026, exhibiting a CAGR of 2.97% during the forecast period (2025-2032). Stringent emission standards and a growing emphasis on operational efficiency primarily drive European oil and gas refinery maintenance services. The Russian market is anticipated to hold USD 0.66 billion in 2025. Europe is likely to focus on technological innovations, particularly in predictive maintenance and digital transformation. European refineries are increasingly adopting advanced maintenance techniques to optimize performance, reduce downtime, and meet increasingly strict environmental regulations. Germany is foreseen to be valued at USD 0.08 billion in 2026, while Italy is anticipated to hold USD 0.07 billion in 2025.

Latin America

Rapid Adoption of Advanced Maintenance Technologies is Propelling Market Growth in Latin America

Emerging market dynamics drive the maintenance services of Latin American oil and gas refineries, as the region is focusing on infrastructure development, operational efficiency improvements, and the gradual adoption of advanced maintenance technologies. Other key drivers include the need to modernize existing facilities, optimize production capabilities, and meet evolving industry standards.

Middle East & Africa

Strategic Investments in Infrastructure Modernization to Fuel Market Growth in Middle East & Africa

The Middle East & Africa is poised to grow with value of USD 0.57 billion in 2026. This region is experiencing a growth in oil and gas refinery maintenance service driven by expanding refinery capacities and strategic investments in infrastructure modernization. The market in the region is oriented toward technological upgrades, efficiency improvements, and adapting to emerging energy transition requirements. Saudi Arabia market is anticipated to hold Usd 0.14 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Comprehensive Service Portfolios to Fuel Market Revenue

The global oil and gas refinery maintenance services market is characterized by intense competition driven by technological innovation, digital transformation, and strategic service differentiation. Major players, including Halliburton, Schlumberger, Baker Hughes, and TechnipFMC, are competing through advanced predictive maintenance technologies, comprehensive service portfolios, and AI-driven solutions.

List of the Key Oil & Gas Refinery Maintenance Service Companies Profiled:

- Baker Hughes (U.S.)

- Schlumberger Limited (U.S.)

- Shell (U.K.)

- MedEuropa Refining Group (Malta)

- CHIYODA (Japan)

- CIC Group Inc (U.S.)

- Fluor Corporation (U.S.)

- Petrofac Limited (Germany)

- KBR Inc, (U.S.)

- Saipem S.p.A (Italy)

- Intertek Group Plc (U.K.)

- Pioneer Industrial Corp. (U.S.)

- STI Group (U.S.)

- Turner Industries Group (U.S.)

KEY INDUSTRY DEVELOPMENTS:

November 2024- Baker Hughes and SOCAR signed an environmental partnership at COP29 to reduce emissions at Azerbaijan's Heydar Aliyev Oil Refinery. The project aimed to recover 7 million cubic meters of methane annually, potentially cutting CO2 emissions by 11,000 tons per year. It represents a significant commitment to ending routine flaring by 2030 through innovative emissions abatement technologies.

October 2024- HOTECC, a subsidiary of Tripple-E, secured a five-year maintenance contract from Kuwait National Petroleum Company (KNPC) for the Mina Abdullah refinery. The contract covered maintenance services for electrical, firefighting, and siren systems, highlighting HOTECC's continued collaboration with Kuwait's petroleum sector.

April 2022- Saipem received a maintenance contract from Coral FLNG S.A., a Mozambique-based special purpose entity comprising international energy partners such as Eni, ExxonMobil, CNPC, GALP, KOGAS, and ENH. The contract covered maintenance services for the Coral Sul Floating Liquefied Natural Gas (FLNG) facility located offshore Mozambique, representing a strategic collaboration in the region's emerging LNG infrastructure development.

October 2021- Baker Hughes initiated the construction of a 300,000 sq meter Oilfield Services hub at King Salman Energy Park, creating 120 jobs and employing 70% Saudi nationals. The project underscored the company's strategic commitment to regional energy sector development and technological innovation in the Middle East. The facility is the largest assembly, maintenance, and overhaul hub for Baker Hughes' Oilfield Services business in the Eastern Hemisphere.

February 2020- Bharat Petroleum Corporation Limited (BPCL) contracted Fluor Corporation to manage a comprehensive refinery upgrade in Kochi, Kerala. The project has developed six new process units to produce specialized petrochemical compounds, enhancing the company's manufacturing capabilities and reducing import dependencies.

Investment Analysis and Opportunities

- Strategic investments in maintaining oil and gas refineries, especially expansions, are expected to significantly fuel market growth for upcoming years. Enhancing current infrastructure to accommodate higher throughput and integrating advanced technologies will improve operational efficiency and profitability. These expansions generate possibilities for specialized service providers, equipment makers, and technology innovators, promoting a competitive environment and encouraging market growth.

- For instance, In February 2023, PetroChina started the Guangdong Petrochemical Project with an investment of USD 9.2 billion in China's Southern industrial landscape. This state-of-the-art refinery marks a significant milestone in China's petrochemical sector, boasting the capacity to process 400,000 barrels of crude oil daily. The project strategically positions PetroChina to meet growing regional energy demands while simultaneously advancing technological capabilities through sophisticated partnerships with global technology providers, including Honeywell UOP.

REPORT COVERAGE

The global oil & gas refinery maintenance service market report provides a detailed market analysis. It focuses on key market aspects, such as market players, as well as leading service types. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report also encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.24% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the oil and gas refinery maintenance service market size was worth USD 4.05 billion in 2026.

The market is likely to grow at a CAGR of 4.24% over the forecast period.

The segment of the service type leads the market due to the development of oil & gas refinery maintenance services globally.

The market size stood at USD 1.46 billion in 2026.

Aging infrastructure in the oil and gas refinery sector, as well as the expansion of offshore exploration activities, are driving market growth.

Some of the top players in the market are Baker Hughes, Shell, MedEuropa Refining Group, and others.

The global market size is expected to reach USD 5.42 billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us