Oncology Clinical Trials Market Size, Share & Industry Analysis, By Phase (Phase I, Phase II, Phase III, and Phase IV), By Type (Breast Cancer, Melanoma, Colorectal Cancer, Prostate Cancer, Lung Cancer, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

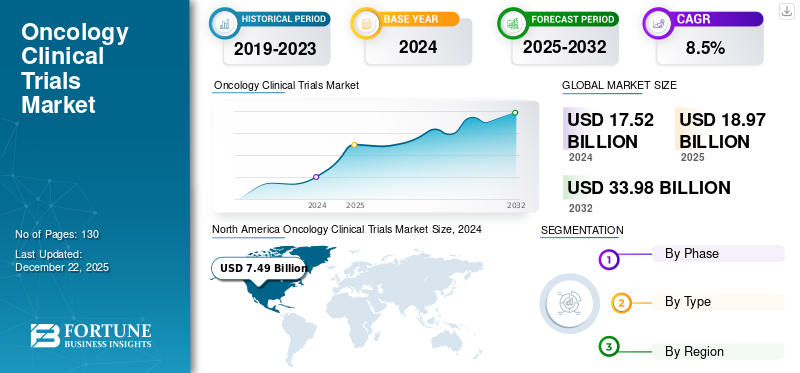

The global oncology clinical trials market size was valued at USD 18.97 billion in 2025. The market is projected to grow from USD 20.55 billion in 2026 to USD 40.49 billion by 2034, exhibiting a CAGR of 8.85% during the forecast period. North America dominated the oncology clinical trials market with a market share of 42.52% in 2025.

Clinical trials are research studies that help in evaluating the safety and efficacy of novel therapeutics, medical devices, and other medical procedures. The burden of cancer has been fueling the demand for effective diagnostics and therapeutic products for disease management. To fulfil this demand, market players have been focusing on conducting clinical trials for the development and launch of effective diagnostics and therapeutics, thereby fueling the number of clinical trials being conducted in the field of oncology.

- For instance, in August 2024, OncoSure Testing, a cancer diagnostic provider, announced the launch of a new rapid cancer screening test. This launch aimed to improve the accessibility of early cancer detection.

Furthermore, the increasing focus of pharmaceutical and other life science companies on outsourcing their clinical trial procedures has also been fueling market growth.

Oncology Clinical Trials Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 18.97 billion

- 2026 Market Size: USD 20.55 billion

- 2034 Forecast Market Size: USD 40.49 billion

- CAGR: 8.85% from 2026–2034

Market Share:

- North America dominated the oncology clinical trials market with a 42.52% share in 2025, driven by the high concentration of CROs, outsourcing of clinical studies by pharmaceutical firms, and robust precision medicine infrastructure.

- By Type, the breast cancer segment held the largest share in 2024 due to increasing trial activity from pharma companies focusing on breast cancer diagnostics and therapeutics.

- By Phase, Phase III dominated in 2024, attributed to the high number and long duration of trials in this segment.

-

Key Country Highlights:

- Japan:Growing government and academic collaboration, as seen in the January 2024 partnership between Parexel International and the Japanese Foundation for Cancer Research (JFCR), is accelerating clinical research in oncology.

- United States: The presence of leading CROs such as IQVIA, Parexel, and ICON, along with initiatives like Thermo Fisher's myeloMATCH trial with NCI, is fueling trial volume and innovation.

- China: Government-backed decentralization efforts and public-private partnerships, like Parexel’s 2021 collaboration with the Chinese Academy of Medical Sciences, are encouraging oncology trial execution.

- Europe (e.g., U.K.): Investments such as AstraZeneca's USD 808.5 billion commitment announced in 2024 are boosting oncology trial capacity and infrastructure across Europe.

MARKET DYNAMICS

MARKET DRIVERS

Growing Prevalence of Cancer, along with the Increasing Number of Clinical Trials, has been Fueling Market Growth

The burden of different types of cancer, such as lung cancer, prostate cancer, etc., has been growing significantly across the globe. For instance, as per the data published by the World Health Organization (WHO), in 2022, there were around 20 billion new cases of cancer globally and 9.7 billion deaths due to cancer. Moreover, there were around 53.5 billion living with cancer from the past 5 years.

Due to such high burden cancer, many life science companies increased their focus on conducting clinical trials for the development of effective diagnosis and treatment options for the disease's treatment.

- For instance, as per the data published by the World Health Organization (WHO), around 5,306 clinical trials were registered for malignant neoplasms in 2024, experiencing a growth of 16.7% from 2010.

Therefore, the growing burden of chronic conditions, along with the increasing number of oncology clinical trials, have been fueling market growth.

MARKET RESTRAINTS

Stringent Regulatory Scenario, Along with Insufficient Funds, has been Restricting Market Growth

The examiners must follow certain administrative, ethical, and regulatory procedures to establish a study site. To ensure the health of the chosen patients, the administrative process is essential. However, suppose the time required to obtain all the approvals is not taken into account at the planning stage. In that case, the entire regulatory process may result in delays in the recruiting and trial conduct.

- For example, according to a 2023 study by the National Center for Biotechnology Information (NCBI), the lengthy and complicated regulatory licensing process was a barrier to conducting clinical trials in Brazil, and a lack of clinical understanding caused poor recruitment levels. Due to delayed regulatory approvals, this may make it impossible for clinical research to obtain the desired sample size within the allotted time.

Such delays in the conduction of clinical trials due to stringent regulatory scenarios limit the number of oncology clinical trials being conducted globally, thereby limiting market growth.

MARKET OPPORTUNITIES

Growing Focus of the Pharmaceutical Companies, Academic & Research Institutes on the Development of Novel Therapeutics Will Fuel Market Growth

The growing burden of cancer has fueled the healthcare industry to conduct research studies for the development and launch of effective therapeutics. Such growing focus of the life science companies and research instituted on conducting research studies for the development of effective therapeutics is expected to create a huge opportunity for the oncology clinical trials market growth in the coming years.

- For instance, Shandong Suncadia Medicine Co., Ltd. initiated a phase II clinical trial in April 2025 to study the safety and efficacy of HRS-7058 in combination with antitumor drugs in patients suffering from advanced malignant tumors. The expected completion date of the study is in October 2027.

- Similarly, LaNova Medicines Limited initiated a phase II clinical study in October 2024 to assess the safety and tolerability of LM-299 in subjects with advanced solid tumors. The expected study completion date is in July 2027.

MARKET CHALLENGES

High Costs of Oncology Trials Restrict Pharmaceutical Companies on Conducting Clinical Trials in Developed Countries

Conducting clinical trials in developed countries such as the U.S., U.K, and Germany, among others, is quite expensive and complex due to stringent regulatory scenarios. Moreover, oncology trials are among the most expensive, often requiring longer timeframes, complex protocols, and specialized infrastructure.

The factors mentioned above act as a challenge to pharmaceutical and biotechnology companies in conducting clinical trials in developed countries.

Patient Recruitment & Retention Issues Affect Efficiency of Clinical Trials

Oncology trials face high dropout rates and difficulties in enrolling suitable patients due to eligibility criteria, treatment side effects, and trial length. Moreover, many potential patients are unaware of the ongoing clinical trials and the benefits of participating in these clinical trials.

Sometimes, the patients also have misconceptions about clinical trials and concerns about safety, which discourage potential participants.

All these factors restrict patient recruitment and retention, thereby acting as a challenging factor for market players to conduct clinical trials.

Download Free sample to learn more about this report.

Oncology Clinical Trials Market Trends

Increasing Trend of Decentralized Clinical Trials (DCTs)

DCTs are transforming patient engagement by using telemedicine, mobile apps, wearable tech, and at-home diagnostics. This increases participation, especially among patients in rural or underserved areas.

Growing Adoption of Artificial Intelligence (AI) and Integration of Big Data

Artificial intelligence (AI) is being used to identify ideal patient cohorts, accelerate patient matching, and predict trial outcomes. Big Data analytics enhances monitoring, forecasting, and adaptive trial design.

Increasing Focus of the Regulatory Bodies on Conducting Fast-track Clinical Trials

Regulatory bodies such as the Food and Drug Administration (FDA) and European Medicines Agency (EMA) are increasingly offering fast-track, orphan drug, and breakthrough therapy designations, making oncology trials more appealing for investment.

Segmentation Analysis

By Phase

Growing Number of Clinical Studies in Phase III Resulted in Segment’s Dominance

Based on phase, the market is segmented into phase I, phase II, phase III, and phase IV.

The phase III segment dominated the global market and accounted for the largest revenue share in 2024. The segment’s growth is due to the growing number of clinical trials registered for phase III study per year along with the longer duration of studies, which is responsible for the segment’s dominance.

- For instance, as per the data published by the World Health Organization (WHO) in 2024, around 418 phase III clinical trials were registered for malignant neoplasms, experiencing a growth of 114.4% from 2000.

Moroever, the phase II segment is expected to grow at the fastest CAGR during the forecast period. The segment’s growth is attributed to the growing focus of small and mid-sized pharmaceutical companies on outsourcing their research studies to contract research organization (CRO) service providers.

By Type

Growing Focus of Pharmaceutical Companies on R&D for New Product Launches is Responsible for Breast Cancer Segment’s Dominance

Based on type, the market is segmented into breast cancer, melanoma, colorectal cancer, prostate cancer, lung cancer, and others.

The breast cancer segment dominated the market in 2024 due to the increasing focus of pharmaceutical biotechnology companies in conducting clinical trials for breast cancer.

- For instance, Integro Theranostics initiated a phase Ib/II clinical trial in July 2023 to study the use of LS301-IT, a fluorescence imaging agent used for picturing tumor margins and SLNs in female patients with stage I-II primary invasive breast cancer. The expected completion of the trial is in July 2025.

Moreover, the prostate cancer segment is expected to grow at the fastest CAGR during the forecast period. The growing burden of prostate cancer has been fueling the demand for effective diagnostics and therapeutics, and this factor is responsible for the segment’s growth during the forecast period.

Oncology Clinical Trials Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Oncology Clinical Trials Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the largest share of 42.52% of the global oncology clinical trials market in 2025. The market’s growth in the region is attributed to the growing number of pharmaceutical and biotechnology companies outsourcing their clinical studies to CROs for cost-effective and time-efficient completion of the studies. Furthermore, the increasing focus of the market players on enhancing their service offerings is responsible for the market’s dominance in the region.

- For instance, in February 2021, Parexel International Corporation announced its collaboration with NeoGenomics, Inc., a cancer genetics testing and information service provider, to expand the application of precision medicine in oncology clinical trials with the implementation of real-world genomics data to speed up patient matching and optimize trial design, clinical development, site selection, and translational research.

The oncology clinical trials market in the U.S. is expected to grow significantly due to the strong presence of contract research organization (CRO) service provider companies such as IQVIA Inc., Thermo Fisher Scientific Inc., and Parexel International (MA) Corporation, among others in the country.

Europe

Europe also generated a significant portion of the market share in 2024. The market’s growth in the region is attributed to the increasing focus of pharmaceutical companies on increasing their R&D investment in the region.

- For instance, in March 2024, HM Treasury announced that AstraZeneca planned to invest around USD 808.5 billion for the research, development, and manufacture of pharmaceuticals in the U.K.

Asia Pacific

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. The increasing burden of cancer in the region, growing focus on developing personalized medicines and devices for cancer patients, increasing patient demand for effective drugs for treating cancers, and rising government funding to promote clinical studies for cancer, among others, are some factors propelling the growth of the segment.

- According to the 2023 data published in the “Cancer Research Funding Report” published by Cancer Australia, the total investment in cancer research by the Australian government has increased more than 3-fold from USD 202.0 billion in 2003–2005 to USD 647.0 billion in 2018–2020.

Rest of the World

The market in the rest of the world is expected to grow substantially during the forecast period. Pharmaceutical and biotechnology companies prefer conducting clinical trials in Latin America, Middle East & Africa as cost of conducting clinical trials in these regions is comparatively cheaper as compared to the developed countries. Moreover, government regulations are relatively less complex in these regions. These factors are responsible for the market growth in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus of Market Players on Partnership for New Product Launches is Responsible for their Revenue Growth

Market players such as IQVIA Inc., ICON plc, and Charles River Laboratories are among the major players in the market, accounting for a significant portion of the oncology clinical trials market share in 2024. The focus of these players on enhancing their service offerings is responsible for their revenue growth.

- For instance, in June 2024, IQVIA Inc. announced the launch of One Home for Sites. This technology software combines multiple applications and portals to help clinical research sites manage their tasks effectively.

Moreover, other pharmaceutical companies, such as Parexel International Corporation, Syneos Health, and Medpace, have been focusing on the development of novel therapeutics to strengthen their presence in the market.

LIST OF KEY ONCOLOGY CLINICAL TRIAL COMPANIES PROFILED

- IQVIA Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Parexel International Corporation (U.S.)

- Medpace (U.S.)

- ICON plc (Ireland)

- Charles River Laboratories (U.S.)

- Fortrea (U.S.)

- Syneos Health (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2024: Thermo Fisher Scientific Inc. partnered with the National Cancer Institute (NCI) to accelerate the myeloMATCH (Molecular Analysis for Therapy Choice) precision medicine umbrella trial.

- June 2024: Charles River Laboratories, as a part of its Cell and Gene Therapy (CGT) Accelerator Program (CAP), along with Captain T Cell, announced a plasmid DNA and retrovirus vector production program agreement.

- March 2024: Bayer AG and Thermo Fisher Scientific Inc. collaborated for the development of next-generation sequencing (NGS)-based companion diagnostic assays (CDx).

- January 2024: Parexel International Corporation collaborated with the Japanese Foundation for Cancer Research (JFCR) with an aim to accelerate the oncology clinical trials in Japan.

- July 2021: Parexel International Corporation partnered with Cancer Hospital Chinese Academy of Medical Sciences for the development of patient-centric protocol designs and methodologies for decentralized clinical trials in China.

REPORT COVERAGE

The global oncology clinical trials market report provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of chronic conditions in key regions/countries, key industry developments, new service launches, details on partnerships, mergers & acquisitions, and the number of clinical trials registered annually in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.85% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Phase

|

|

By Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 18.97 billion in 2025 and is projected to reach USD 40.49 billion by 2034.

In 2025, the market value stood at USD 8.06 billion.

The market is expected to exhibit a CAGR of 8.85% during the forecast period of 2026-2034.

The Phase III segment led the market by phase.

The key factors driving the market are the growing burden of cancer diseases along with the increasing number of oncology clinical trials.

IQVIA Inc., ICON plc, and Charles River Laboratories are the top players in the market.

North America dominated the market with a share of 42.52% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us