Oncology Positron Emission Tomography Scan Market Size, Share & Industry Analysis, By Source of Payment (Public and Private Health Insurance/Out-of-pocket), By Service Providers (Hospitals, Diagnostic Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

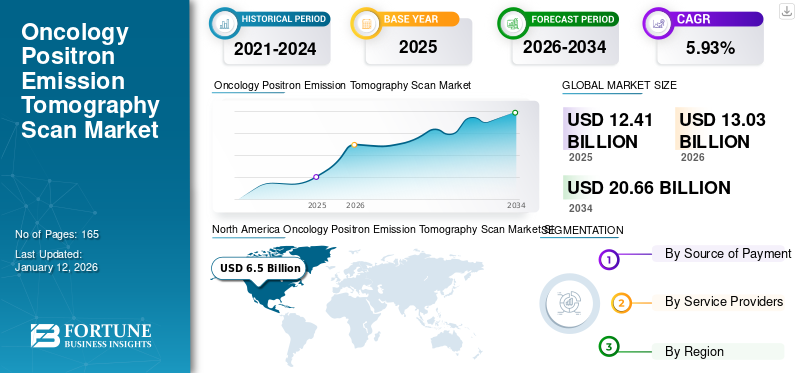

The global oncology positron emission tomography scan market size was valued at USD 12.31 billion in 2025. The market is projected to grow from USD 13.03 billion in 2026 to USD 20.66 billion by 2034, exhibiting a CAGR of 5.93% during the forecast period. North America dominated the oncology positron emission tomography scan market with a market share of 52.40% in 2025.

Oncology Positron Emission Tomography (PET) is a non-invasive and specialized imaging technique used for the detection and analysis of various stages & treatment effectiveness in cancer. The growth of the global oncology positron emission tomography scan market is attributed to the rising global burden of cancer, growing demand for diagnostic accuracy, technological advancements in oncology PET, and substantial investments in new product developments. Furthermore, active involvement by government and healthcare authorities in cancer screening programs is expected to positively impact the oncology positron emission tomography scan market during the forecast period.

- For instance, in March 2025, a team of researchers from the International Agency for Research on Cancer (IARC), in collaboration with the local government of healthcare bodies of Slovenia, announced the launch of its new program called Improving Cancer Screening in Slovenia (ICSIS). The program is focused on implementing strategically, organized population-based lung and prostate cancer screening programs.

Some of the crucial players in the global oncology positron emission tomography scan market include Siemens Healthineers AG, Oncovision, and GE Healthcare. These players are actively pursuing strategic initiatives such as acquisitions to strengthen their market share.

MARKET DYNAMICS

Market Drivers

Rising Burden of Cancer to Boost Market Growth

The substantial rise in cancer patient burden on healthcare systems across the globe is prominently driving the market's growth. This increasing incidence of cancer is also responsible for the surge in the number of cancer screening programs and the installment of novel diagnostic equipment for faster turnaround time and superior imaging quality. This growing burden pushes government and healthcare providers to implement strategic policies, further supporting the oncology positron emission tomography scan market growth.

- For instance, in May 2022, the Society of Nuclear Medicine and Molecular Imaging (SNMMI) and the National Comprehensive Cancer Network (NCCN) updated their prostate cancer diagnostic imaging guidelines. These updated guidelines approved the utilization of new PET imaging agents for prostate cancer, including PYLARIFY, developed by Lantheus Holdings, Inc.

In addition, the rising emphasis on personalized treatment, early disease diagnosis, and adoption of novel technologies is being accelerated by this cancer burden, leading to the growth of the global oncology positron emission tomography scan market. According to data published by the American Cancer Society, in 2025, an estimated 313,780 new cases of prostate cancer are expected to be diagnosed during the year.

Market Restraints

High Cost of PET Scanners to Hamper Market Growth

The high cost associated with oncology positron emission tomography scanners and related diagnostic procedures remains a significant restraining factor for market growth. Along with equipment costs, operational expenditures, including installation, maintenance, radiotracer supply, and staff training, further raise the required investment.

- For instance, according to data published by Block Imaging, the average cost of an entry-level scanner costs around USD 475,000, while a high-end optimized scanner can cost above USD 750,000. Such a high equipment cost makes it difficult for smaller healthcare facilities to afford.

Moreover, reimbursement scenarios for PET procedures remain inconsistent and often insufficient in several countries. In many developing economies, PET scans are not fully covered under public insurance schemes, discouraging patient access and utilization. Even in developed markets, limited coverage for repeat scans or certain oncology indications restricts the frequency of these procedures. These financial and policy-related barriers will deter market growth by 2032.

Market Opportunities

Integration of Artificial Intelligence and Image Quantification Tools to Bolster Market Development

The growing integration of artificial intelligence (AI) and advanced image quantification tools into oncology PET imaging presents a significant opportunity for market expansion. AI algorithms are increasingly being developed to enhance lesion detection, quantify tumor burden, differentiate between benign and malignant uptake, and more accurately assess therapy. Such capabilities improve diagnostic precision and streamline workflow, allowing radiologists and nuclear medicine specialists to make faster, more informed decisions.

- For instance, in June 2023, Siemens Healthineers introduced Biograph Vision, a next-generation positron emission tomography/computed tomography (PET/CT) scanner. This system offers the industry’s fastest time-of-flight, improving image quality.

Additionally, continuous advancements, integration of predictive analytics modules, and increasing regulatory approvals of AI-enabled PET software are driving growing commercial interest in such technologies. As AI becomes more accessible, its adoption for workflow optimization is likely to accelerate, further supporting market growth.

Market Challenges

Radiotracer Availability and Supply Chain Constraints to Obstruct Industry Development

Radiotracer availability and persistent challenges in the supply chain offer considerable obstacles for the oncology PET market. Radiotracers such as FDG have a very short half-life, requiring immediate use post-synthesis. This time-sensitive nature imposes strict logistics requirements, including proximity to a cyclotron facility and efficient transportation systems. Any obstructions in the supply chain or delays in raw material availability can lead to longer waiting times for diagnostic procedures.

- For instance, according to data published by the Royal College of Radiologists, U.K., in 2024, 92% of cancer patients waited for at least 31 days for their screening. Additionally, around an estimated 53,000 patients experienced delays of over a month to receive cancer screening outcomes in the U.K.

Additionally, global dependence on a few major suppliers for specific medical isotopes increases vulnerability to disruptions caused by geopolitical issues, maintenance outages, or regulatory interventions.

Oncology Positron Emission Tomography Scan Market Trends

Rising Shift Toward Theranostics and Personalized Oncology Imaging to Accentuate Market Growth

Growing awareness of theranostics, a combination of therapeutics and diagnostics aimed at achieving personalized imaging solutions, is the key trend in the oncology PET market. Continual research & development activities are propelling the introduction of novel theranostic agents for cancers such as prostate cancer and neuroendocrine tumors. Radiolabeled biomarkers, such as PSMA-based agents in prostate cancer, are increasingly used for PET diagnostics and therapeutic isotopes, marking a remarkable shift from conventional imaging techniques. This approach enhances diagnostic specificity and enables real-time monitoring of therapeutic efficacy. Moreover, increasing investments by market players are further expected to boost theranostics applications in the coming years.

- In October 2024, GE Healthcare, in collaboration with the University Medicine Essen, announced the establishment of the new center of excellence for theranostics. The new center would focus on expanding theranostics applications and developing new tracers for personalized medicine.

Personalized oncology imaging, driven by precision medicine initiatives, highlights the use of imaging biomarkers for various applications such as disease prediction, therapy optimization, and overall improvement of workflows. The introduction of novel PET tracers also fuels this trend, offering deeper insights into tumor metabolism, receptor status, and microenvironment characteristics.

Download Free sample to learn more about this report.

Impact of COVID-19

The supply chain disruptions and lockdowns across the globe during the COVID-19 pandemic had a substantial impact on oncology PET market dynamics. Travel restrictions reduced cancer screening procedures and testing. These delays in screening further led to disease advancement and increased the burden on healthcare functionalities.

- As per the International Atomic Energy Agency survey in June and October 2020, the global market saw a 65.6% decline in the number of PET scans in June 2020, with a reduction of around 40% in October 2020. Similar declines were observed in prostate and lung cancer screenings during this period.

Segmentation Analysis

By Source of Payment

Increasing Preference for Premium-Quality Cancer Care Services Drives Private Health Insurance/Out-of-Pocket Segment Growth

On the basis of the source of payment, the market is bifurcated into public and private health insurance/out-of-pocket. The private health insurance/out-of-pocket segment dominates the market and is expected to grow extensively during the forecast period. The growth is attributed to the increasing preference for rapid, personalized, and premium-quality cancer care services. Private healthcare systems play a dominant role in countries such as the U.S., Japan, India, and Brazil, offering quicker access to PET scans and minimizing the delays often associated with public systems. In addition, the increasing overall cost of cancer treatment is also estimated to positively impact the segment growth during the forecast period.

- According to data published by the Journal of Medical Economics in October 2023, the cost of cancer care in the U.S. is projected to increase to USD 246 billion by 2030 from USD 183 billion in 2015.

The public segment held a considerable share of the market in 2024, attributed to rising cancer incidence and increasing government efforts to strengthen oncology care infrastructure. As cancer becomes a top healthcare priority globally, public health systems are expanding diagnostic capabilities and integrating PET scans into standard cancer management protocols for staging, treatment response, and recurrence evaluation. Moreover, aging populations in developed nations and the rising burden of chronic illnesses are driving systemic health care reforms aimed at supporting cancer diagnostics under public funding. These shifts are expected to contribute significantly to the segment's expansion within the oncology PET market in the coming years.

By Service Providers

Hospital Segment to Dominate due to Availability and Accessibility to Advanced Imaging Technologies

In terms of service providers, the market is segregated into diagnostic centers, hospitals, and others. The hospitals segment is set to account for the highest market share over the projected period due to dedicated trained personnel, availability, and accessibility to advanced imaging technologies, and implementation of coordinated care.

- For instance, in January 2024, Royal Free London installed the UK’s first positron emission tomography (PET) scanner worth USD 10.7 million. According to authorities, the scanner is 30 times more efficient than the currently existing scanners in healthcare systems.

The diagnostic centers segment is expected to rise at the fastest CAGR over the forecast period, owing to specialized expertise, cost-effectiveness, shorter waiting times, and patient convenience. In addition, growing investments by diagnostic centers to acquire highly advanced PET scanners are also likely to positively influence the segment growth.

ONCOLOGY POSITRON EMISSION TOMOGRAPHY SCAN MARKET REGIONAL OUTLOOK

Based on geography, the market is divided into Latin America, Europe, Asia Pacific, North America, and the Middle East & Africa.

North America

North America Oncology Positron Emission Tomography Scan Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The oncology positron emission tomography scan market is dominated by North America and was valued at USD 6.5 billion in 2025 and USD 6.82 billion in 2026. The growing prevalence of cancer, technological advancements, and growing focus on installing cutting-edge equipment are key factors driving market growth.

- For instance, in October 2024, Arizona-based Kingman Regional Medical Center installed an Omni Legend 32 PET/CT system. The medical center becomes the first in Arizona to install such a highly advanced PET scanner.

Substantial investments by healthcare facilities and the rising demand for novel technologies are also likely to boost market expansion.

In the U.S. robust healthcare infrastructure, along with extensive focus on research and development activities to boost market growth by 2032.

In Canada, the rising focus on early disease detection, enhanced cancer treatment monitoring, and consolidation of policies against cancer disease are projected to offer a favorable environment for market growth. For instance, in May 2025, the collaboration of the Canadian Cancer Society and MaRS Discovery District announced the launch of a nationwide program to increase cancer screening of the population, especially in remote and rural regions of the country.

Europe

The European market for oncology positron emission tomography scan held a substantial share in 2024, owing to the increasing prevalence of chronic diseases such as cancer and cardiovascular diseases, growing demand for multi-modal PET scanning, and emphasis on personalized treatment. Furthermore, the expansion of PET imaging agents is also projected to propel market growth during the study period.

- For instance, in April 2025, Telix Pharmaceuticals Limited received approval for its prostate cancer PET imaging agent, Illuccix, from the Swedish MPA. Illuccix is used with gallium-68 for the detection of prostate cancer.

Asia Pacific

The market in Asia Pacific is projected to register the highest CAGR over the projected period, attributed to increasing consciousness of cutting-edge imaging systems, substantial investments for the consolidation of healthcare infrastructure, favorable reimbursement policies, and active government involvement. In addition, an increasing number of strategic partnerships and collaborations are also contributing to market growth.

- For instance, in October 2024, Curium announced a strategic partnership with PeptiDream for the clinical development and commercialization of prostate cancer-specific agents in Japan. The agents 177Lu-PSMA-I&T and 64Cu-PSMA-I&T target prostate cancer cells.

Latin America

The Latin American market is set to rise at a significant CAGR in the coming years. Increasing incidence of cancer and rising investments by leading companies are likely to boost market growth. In addition, the launch of innovative products is also likely to accelerate market growth.

- For instance, in October 2024, Claritas NucMed Tech Brazil S.A. received approval from ANVISA to commercialize Claritas iPET in Brazil. The advanced software reduces scan time and isotope dosages during imaging.

Middle East & Africa

The Middle East & Africa region is predicted to record a notable CAGR in the coming years due to the rising disposable incomes and increasing healthcare expenses.

- For instance, in February 2025, Saudi Arabia announced the opening of its new Oncology Center of Excellence for cancer care. The new center would focus on a patient-centric care approach aligned with its Vision 2030.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on New Product Launches to Reinforce Their Market Presence

The global oncology positron emission tomography scan market share is majorly held by important players such as GE Healthcare, Siemens Healthcare Limited, Oncovision, Koninklijke Philips N.V., and Canon Medical Systems in 2024.

The share of these oncology positron emission tomography scan companies is attributed to new product launches, strong emphasis on novel PET technologies, tactical partnerships for product developments, and constant research & development.

- For instance, in November 2023, Siemens Healthcare Limited received FDA approval for its Biograph Vision X. The newly launched imaging system can provide comprehensive anatomical details.

Alliance Medical Limited, Dignity Health, and other small & medium-sized players are some other companies in the market. They emphasize several strategic efforts, such as collaborations, partnerships, and others, to reinforce their market presence.

LIST OF KEY ONCOLOGY POSITRON EMISSION TOMOGRAPHY SCAN COMPANIES PROFILED

- GE Healthcare (U.S.)

- Sonic Healthcare Limited (Australia)

- Oncovision (Spain)

- Koninklijke Philips N.V. (Netherlands)

- Apex Radiology (Australia)

- Alliance Medical Limited (U.K.)

- Novant Health (U.S.)

- Canon Medical Systems (Japan)

- Dignity Health (U.S.)

- Concord Medical (China)

- Siemens Healthcare Limited (Germany)

- Mediworks (China)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Telix Pharmaceuticals Limited received FDA approval for its new prostate cancer agent, Gozellix.

- March 2025: Guadalupe Regional Medical Center announced the offering of Illuccix, a PET imaging tracer for the diagnosis of prostate cancer. The newly launched tracer is capable of identifying the presence of cancer cells throughout the body.

- November 2024: In collaboration with healthcare authorities, Newfoundland and Labrador announced the addition of new PET CT systems at two hospitals. These additions were based on expert committee recommendations to improve cancer care services across the region.

- September 2024: Clarity Pharmaceuticals received FDA approval for its new imaging tracer Cu-SAR-bisPSMA to diagnose prostate cancer.

- July 2022: Radialis Inc. secured FDA clearance for its innovative Radialis PET Imager, an advanced PET system featuring open-targeted imaging capabilities that mark a new era in precision diagnostics.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.93% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Source of Payment

|

|

By Service Providers

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 13.03 billion in 2026 and is projected to reach USD 20.66 billion by 2034.

In 2025, the market value stood at USD 12.41 billion.

The market is expected to exhibit a CAGR of 5.93% during the forecast period (2026-2034).

The private health insurance/out-of-pocket segment leads the market by source of payment.

The key factors driving the market are the increasing burden of cancer and technological advancements in diagnostic products.

GE Healthcare, Siemens Healthcare Limited, Oncovision, Koninklijke Philips N.V., and Canon Medical Systems are the top players in the market.

North America dominated the oncology positron emission tomography scan market with a market share of 52.40% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us