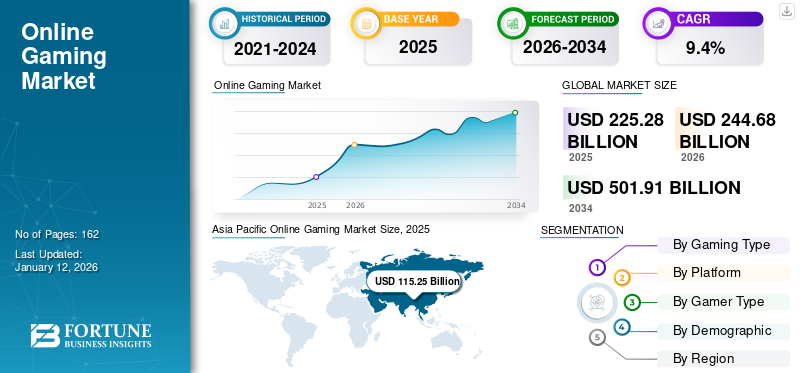

Online Gaming Market Size, Share & Industry Analysis, By Gaming Type (First-Person Shooter Game, Multiplayer Online Battle Arena Games, Massively Multiplayer Online Role-Playing Games, Battle Royale Games, Real-time Strategy Game, Online Casino Games), By Platform (Mobile Phone, PCs, Consoles), By Gamer Type (Casual & Hardcore Gamers, Professional & Social Gamers), By Demographic (Kids , Teens, Young Adults, Adults, Middle-Aged, Seniors), and Regional Forecast, 2026-2034

ONLINE GAMING MARKET SIZE AND FUTURE OUTLOOK

The global online gaming market size was valued at USD 225.28 billion in 2025 and is projected to grow from USD 244.68 billion in 2026 to USD 501.91 billion by 2034, exhibiting a CAGR of 9.4% during the forecast period. Asia Pacific dominated the global market with a share of 51.2% in 2025.

Online gaming involves playing video games via the internet, alongside or in competition with other players. Online games can be accessed on various devices, including dedicated game consoles, such as PlayStations, Xboxes, and Nintendo Switches, as well as PCs, laptops, and mobile phones. This enables players to test themselves against opponents of different skill levels, improving their gaming experience and offering a feeling of accomplishment.

Moreover, market growth has given rise to the concept of microtransactions, where players can purchase in-game items or upgrades, contributing to the financial success of game developers. It also allows for continuously releasing updates and downloadable content, ensuring that games remain relevant and engaging long after their initial release.

Key players such as Activision Blizzard, Electronics Arts (EA), and Tencent stand out in the market due to their strong intellectual property portfolios and focus on innovation, which gives them an edge over other companies.

IMPACT OF GENERATIVE AI

Implementation of Generative AI Capabilities to Fuel Market Growth

Integrating generative AI in online gaming enhances game creation and player engagement. AI systems can create intricate environments, levels, characters, and even complete storylines, decreasing the time and expenses involved in game development. This enables developers to concentrate on more imaginative elements, creating engaging game environments. For instance,

- In March 2024, Ubisoft introduced 'NEO NPC,' marking its inaugural generative AI prototype aimed at players. It can change how players engage with non-playable characters (NPCs) and open fresh gameplay avenues incorporating generative AI elements.

Thus, generative helps provide more dynamic, engaging, and efficient gaming experiences. Such benefits of generative AI boost the online gaming market growth.

Online Gaming Market Trends

Growth in Cloud Gaming to be a Key Trend in the Market

Cloud gaming is transforming the gaming landscape by eliminating the need for expensive gaming hardware. Traditionally, players require powerful consoles or PCs to run the latest high-end games. However, with cloud gaming services, players can stream games directly to their devices, including smartphones, tablets, and smart TVs. For instance,

- In November 2024, Samsung introduced the debut of a mobile cloud gaming platform in North America. The platform enables users of Samsung Smart Galaxy Smartphones to stream and play native Android games via the cloud, eliminating the need to download them onto their devices.

As cloud gaming and game streaming continue to develop, more partnerships and collaborations between game developers and streaming services are expected.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rising Adoption of Smartphones Set to Boost Market Growth

With developments in mobile technology, modern smartphones are now equipped with powerful processors, high refresh rate displays, and advanced GPUs, which support high-quality graphics and engaging gaming experiences.

For instance,

- In November 2024, ASUS Republic of Gamers (ROG) launched their new ROG Phone 9. The phone combines Qualcomm Snapdragon 8 Elite Mobile Platform and ROG GameCool 9 cooling system.

This has enabled developers to create console-like gaming experiences on mobile devices, attracting casual and hardcore gamers. For instance,

- In January 2024, Microsoft revealed its plan to integrate touch controls into Xbox mobile applications, enabling users to remotely manage their consoles and enjoy gaming on smartphones and tablets.

The above bar graph shows that rising smartphone use will continue to drive significant demand in the online gaming industry, making mobile gaming one of the largest revenue-generating segments in the gaming ecosystem.

Market Restraints

Cybersecurity and Data Privacy Issues in Online Gaming Can Hamper Market Growth

As online gaming becomes more popular, cybersecurity and data privacy issues have emerged as significant challenges for gamers and game developers. Cybercriminals frequently exploit security vulnerabilities to access user accounts unlawfully, resulting in identity theft, financial scams, and personal information breaches. For instance,

- According to Norton LifeLock, 75% of gamers in India have experienced a cyberattack on their gaming accounts. Of these, 35% detected malicious software on their gaming device, and 29% detected unauthorized access to a gaming account.

Fake websites, impersonation scams, and malware attacks commonly steal sensitive data from unsuspecting users. Additionally, cheating in online games through hacking tools or unauthorized software compromises fair play, negatively affecting the gaming experience. For instance,

- According to industry reports, from July 2022 to July 2023, more than 4 million cyber-attacks were launched on the global gaming community. Among them, 30,685 were the file names of popular games, cheats, mods, and other game-related software. It affected more than 192,000 gamers globally.

Market Opportunities

Blockchain and Play-to-Earn (P2E) Gaming to Create Lucrative Market Opportunities

Blockchain technology has introduced Play-to-Earn (P2E) models, offering a new opportunity in the gaming market by allowing players to earn real-world rewards, such as cryptocurrencies or NFTs, through their gameplay. For instance,

- In November 2024, Hedera Guild Game (HCG) launched a major update for SlimeWorld (Blockchain P2E game). The game features slime characters that defend against attacks from dark slimes in infinity mode using their NFTs. The game has achieved 3 million downloads across the globe.

This financial incentive has attracted millions of players, particularly in regions with limited opportunities to earn income, offering them a unique way to participate in the digital economy.

SEGMENTATION ANALYSIS

By Gaming Type Insights

MMORPGs Held Dominance in the Market as They Offer Gamers Expansive and Intricate Virtual Worlds

Based on gaming type insights, the market is categorized into first-person shooter game (FPS), multiplayer online battle arena (MOBA) games, massively multiplayer online role-playing games (MMORPGs), battle royale games, real-time strategy game (RTS), online casino games and others (player versus environment (PvE)).

Massively Multiplayer Online Role-playing Games (MMORPGs) held the highest market share in 2025, providing gamers with expansive and intricate virtual worlds where individuals can investigate, accomplish quests, battle, discover weapons, or create their own items. Forums and communities are built around that universe, with constant experience exchange and collaboration.

Multiplayer online battle arena (MOBA) games are anticipated to grow with the highest CAGR during the forecasted period as they incorporate new features, such as improved graphics, complex gameplay, and realistic physics. The genre’s strong community engagement and competitive nature drive its popularity. Moreover, innovations in cross-platform play and in-game monetization are expected to accelerate its growth further.

To know how our report can help streamline your business, Speak to Analyst

By Platform Insights

Mobile Phones to Command the Market Owing to Their Easy Accessibility

By platform type, the market is bifurcated into mobile phone, PCs, consoles, and others (AR/VR).

Mobile phones registered the highest market share in 2025 and are projected to grow with the highest CAGR during the studied period as they provide widespread accessibility, affordability, and technological advancements. The ease of gaming while traveling, combined with the growing capabilities of mobile devices, has allowed for high-quality gaming experiences that compete with conventional platforms. The segment is likely to gain 36.35% of the market share in 2026. Additionally, the increasing number of mobile gamers also reinforces this trend. For instance,

- According to the industry report, in 2023, there were more than 1.90 billion mobile games users globally. By 2027, this demographic is expected to reach 2.30 billion, leading to an increase of 398 million.

Consoles are anticipated to grow with a significant CAGR of 9.88% during the forecast period as they have advanced features such as net connectivity, a touch screen, and a built-in camera. The Increasing demand for high-performance gaming hardware, coupled with advancements in graphics technology and seamless cross-platform integration, further fuels their adoption.

By Gamer Type Insights

Rising Focus on Relaxation or Entertainment Fostered the Casual Gamers Segment Growth

By gamer type, the market is segmented into casual gamers, hardcore gamers, professional gamers, social gamers, single-player enthusiasts, and multiplayer enthusiasts.

Casual gamers accounted for the highest market share in 2024. Unlike hardcore or professional gamers, casual gamers engage in gaming as relaxation or entertainment rather than competition or skill mastery. This group includes many players, from working adults to students and even older generations, who prefer short, engaging sessions that fit their busy schedules. The segment is anticipated to capture 28% of the market share in 2025. Additionally, gaming companies' recent investments in casual games have fueled segment growth. For instance,

- In December 2024, Krafton announced the launch of CookieRun, a casual game that features India-themed characters. They intend to launch 3-4 new games in 2025 and allocate USD 140 million to Indian gaming and entertainment startups in the coming 12-18 months via their Krafton India Gaming Incubator program.

Hardcore gamers are projected to grow with the highest CAGR of 12.49% during the studied period as they are knowledgeable, active, and committed individuals committed to playing video games. Their dedication to mastering complex gameplay mechanics, staying updated with industry trends, and participating in competitive gaming events further fuels this growth.

By Demographic Insights

Adults (25-34) Led the Market Due to Their Increased Purchasing Power

By demographic, the market is divided into kids (under 12), teens (13-17), young adults (18-24), adults (25-34), middle-aged (35-54), and seniors (55+).

The adult demographic (25-34 years old) accounted for the highest market share in 2024. As a result of higher disposable income and enhanced purchasing power, adults can invest independently in high-end gaming equipment, in-game purchases, and subscriptions. Additionally, this age demographic was raised during the emergence of modern gaming, which resulted in a strong engagement and nostalgia for gaming culture. Their ability to balance work and leisure also contributes to their sustained participation, especially in competitive and strategy-driven games, such as battle royales, MMOs, and eSports titles. The segment is expected to attain 26.51% of the market share in 2026.

Middle-aged (35-54) people are projected to grow with the highest CAGR of 12.44% during the studied period as they play games as a relaxation or hobby in addition to other stuff. Balancing work and personal responsibilities, they prefer accessible and engaging gaming experiences that fit their schedules.

ONLINE GAMING MARKET REGIONAL OUTLOOK

In terms of geography, the market is categorized into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Online Gaming Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the highest market share with a valuation of USD 115.25 billion in 2025 and USD 124.85 billion in 2026. The extensive use of smartphones and inexpensive data packages has made mobile gaming accessible to a wider audience in the region. China is expanding and is expected to reach USD 48.92 billion in 2026. Furthermore, hardcore gamers devote a lot of time and money to gaming and live-streaming their gameplay for millions of online followers. This is directly translating into an increasing number of in-app purchases. For instance,

- According to the Redseer Survey, in 2022, 60% of hardcore gamers in India spent on in-app purchases; that’s 3X more than casual gamers. The survey highlights that 77% of casual gamers spend only on gaming subscriptions. On the other hand, 58% of hardcore gamers in India are most likely to make in-app purchases to have a complete gaming experience.

According to Reuters, the growth rate of China's market is especially noteworthy when considering the country's unprecedented number of gamers, which reached 668 million in 2023. The extensive appeal and prevalence of gaming culture in China support the size and possibilities of the market. India is set to reach a market value of USD 11.44 billion in 2026, while Japan is projected to be valued at USD 17.10 billion in the same year.

North America

North America is projected to grow with a stable CAGR during the forecast period, primarily led by the U.S. North America is supported by its advanced digital infrastructure, high internet penetration, and a strong culture of gaming.

The U.S. holds the majority of the online gaming market share, playing a major role in revenue production and technological progress. Due to its extensive gaming audience, the U.S. is at the forefront of online gaming adoption, especially in mobile, cloud, and esports areas. The U.S. market is estimated to stand at USD 43.52 billion in 2026.

For instance,

- A survey conducted by the Consumer Technology Association revealed that 61% of gamers in the U.S. use multiple devices to play. The survey consisted of 2,703 U.S. adults and teens to identify consumer preferences regarding video games.

South America

The market share is projected to grow with a considerable CAGR across South American countries. The countries of South America are investing significantly in the sports and entertainment industry through digitalization to expand their revenue generation.

Europe

Europe is the third largest market anticipated to grow with a valuation of USD 35.00 billion in 2026. European countries are improving their regulatory systems to encourage responsible gambling, protect consumers, and prevent fraud. The U.K. market is expanding, estimated to hit USD 6.57 billion in 2026. Moreover, there is a tendency among consumers to shift toward mobile betting, indicating an increasing inclination for mobile betting apps and websites tailored for mobile use. The European Parliament called on the Commission and the Council to acknowledge the significance of the EU's video game and e-sports sector by developing an extensive long-term strategy for video games. These initiatives are projected to enhance the European gaming market throughout the forecast period. Germany is likely to stand atUSD 7.42 billion in 2026, while France is set to be valued at USD 4.69 billion in the 2025.

Middle East & Africa

Middle East & Africa is the fourth largest market, projected to reacha valuation of USD 15.85 billion in 2026. This growth is driven as Saudi Arabia is set to host the first Olympic Esports Games in 2025. As per ITP.NET, it is estimated that over 377 million gamers reside in the region, with Egypt, the UAE, and Saudi Arabia leading the industry's advancement. A youthful demographic and increasing investments in digital technologies fuel the rise in popularity of both single-player and multiplayer games such as Fortnite and Player Unknown’s Battlegrounds (PUBG). For instance,

- Based on the UAE Consumer Market Snapshot, 77% of the UAE population engages in online gaming, primarily within the 25-44 age range. In Saudi Arabia, more than half of the population participates in this type of gaming, with a notable portion being female gamers.

The GCC market is anticipated to reach a valuation of USD 4.59 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players are Constantly Engaging in Strategic Alliances, Mergers, and Acquisitions to Keep Up with Changing Technology

The market players are increasing their product portfolio due to the increasing demand for more automated technology-driven trade management solutions. Market players are implementing various business strategies, such as partnerships, mergers, and acquisitions, to expand their businesses across the globe.

Major Players in the Online Gaming Market

To know how our report can help streamline your business, Speak to Analyst

The market is consolidated, with top market players accounting for 36% of the market share. The key players focus on new product innovations, upgrades, portfolio expansion into new geographical areas, and collaborations with other players to expand their business presence across different regions.

List of Key Online Gaming Companies Profiled:

- Activision Blizzard Entertainment, Inc. (U.S.)

- SEGA SAMMY HOLDINGS Inc. (Japan)

- Bandai Namco Holdings Inc. (Japan)

- Sony Corporation (Japan)

- Tencent Holdings Ltd (China)

- Electronic Arts Inc. (U.S.)

- Ubisoft Entertainment (France)

- NEXON Co., Ltd (Japan)

- NCSOFT Corporation (South Korea)

- Amazon.com, Inc. (U.S.)

- Square Enix Holdings Co. Ltd (Japan)

- Apple Inc. (U.S.)

- Rovio Entertainment Ltd (Finland)

- Capcom Co., Ltd (Japan)

- GungHo Online Entertainment Inc (Japan)

- PopReach Corporation (Canada)

- Take Two Interactive Software Inc. (U.S.)

- NetEase, Inc (China)

- Valve Corporation (U.S.)

- Epic Games, Inc (U.S.)

- Supercell Oy (Finland)

KEY INDUSTRY DEVELOPMENTS:

November 2024: In collaboration with Square Enix, Tencent's Lightspeed Studios announced "Final Fantasy XIV Mobile," a reimagined version of the original MMORPG tailored for mobile devices. The game aims to faithfully recreate the story and battle content of the original, featuring simplified controls and chibi-style character art.

October 2024: Ubisoft announced the cloud streaming right transaction for Call of Duty with Activision Blizzard for the next 15 years. It will help to expand access to more players all around the world.

May 2024: Amazon Games opened a new game development studio in Bucharest, Romania. Bucharest is known as the merging European cities for game development. The new studio aims to support Amazon Games' portfolio of games in the future.

September 2023: Criterion Games joined EA Entertainment. Criterion Games was added to the Battlefield studios. EA Entertainment aimed to collaborate on the ongoing Battlefield 2042 Game. Criterion is well known for Battlefield, Battlefront, and Burnout.

March 2023: Bandai Namco Entertainment announced two investments in gaming technology startups. Bandai has invested in Deepmotion, which is based in the U.S., and SuperGaming, which is based in India. The investment aims to connect with all the partners to build the future of entertainment.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Strategic investments in online gaming provide significant business opportunities to market players. It helps them to expand their business presence, capitalize on the global economy, and diversify their operations. Investment also helps key players in enhancing their capabilities and develop new intellectual properties (IPs).

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.4% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Gaming Type

By Platform

By Gamer Type

By Demographic

By Region

|

|

Companies Profiled in the Report |

Activision Blizzard Entertainment, Inc. (U.S.), SEGA SAMMY HOLDINGS Inc. (Japan), Bandai Namco Holdings Inc. (Japan), Sony Corporation (Japan), Electronics Arts Inc. (U.S.), Tencent Holdings Limited (China), and Ubisoft Entertainment (France). |

Frequently Asked Questions

The market is projected to reach USD 501.91 billion by 2034.

In 2025, the market was valued at USD 225.28 billion.

The market is projected to grow at a CAGR of 9.4% during the forecast period.

Massively multiplayer online role-playing games (MMORPGs) held the highest market share in 2024

The rising adoption of smartphones propels market growth.

Activision Blizzard Entertainment, Inc., SEGA SAMMY HOLDINGS Inc., Tencent Holdings Limited, Sony Corporation, and Electronics Arts Inc. are the top players in the market.

Asia Pacific dominated the global market with a share of 51.2% in 2025.

By gamer type, hardcore gamers are expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us