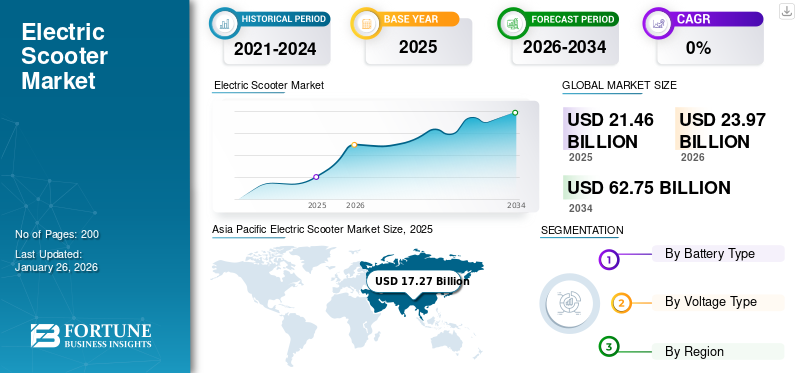

Electric Scooter Market Size, Share & Industry Analysis, By Battery Type (Lead Acid, Li-ion), By Voltage Type (48-59V, 60-72V, 73-96V, Above 96V), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global electric scooter market size stood at USD 21.46 billion in 2025 and is expected to reach USD 23.97 billion in 2025 to USD 62.75 billion by 2034 at a CAGR of 12.80% during the 2026-2034 period. The Asia Pacific dominated the electric scooter market with a share of 80.45% in 2025.

E-scooter is a motorized scooter powered by an electric motor. Conventional scooters require gas or fuel to operate, whereas the EV does not require fuel. The motor and battery are linked in e-scooters, and the battery is charged by plugging into an electric charging station or a power source. The charged battery generates the motion to push the two-wheeler forward. These scooters are environment-friendly, fuel-efficient, battery-powered, and simple to use. The growing need for sustainable urban mobility and modernized transportation infrastructure drives the shift from conventional to an electric mode of transportation. This type of scooter is anticipated to improve energy security and also air quality. The rising demand for fuel-efficient vehicles coupled with increasing concerns over greenhouse gas and carbon emissions is expected to increase the adoption of e-mopeds.

The COVID-19 pandemic had a mixed impact on the global electric scooter market. While initial disruptions in manufacturing and supply chains led to temporary slowdowns, the market gradually rebounded as restrictions eased. Increased demand for personal mobility solutions amid concerns about public transportation safety drove the adoption of electric scooters. However, economic uncertainties and reduced consumer spending posed challenges, affecting market growth to some extent.

Download Free sample to learn more about this report.

Electric Scooter Market Trends

Government Initiatives for Electrification and Increase in Adoption of E-Scooters to Boost the Market Growth

OEMs will be able to expand their revenue stream and geographical presence as governments across the globe increasing their investments in charging infrastructure and offer incentives to consumers. For instance, the Indian government launched the FAME scheme (Faster Adoption and Manufacturing of Hybrid and EV) in 2019 with a budget outlay of USD 100 billion to support 7,000 e-buses, 500,000 e-three wheelers, 55,000 e-passenger vehicles, and a million e-two wheelers. As of now, about 124,415 vehicles have benefited under the scheme.

Additionally, as customers move toward the adoption of EVs, fluctuating fuel prices have decreased sales of gasoline-powered vehicles. Consumers are abandoning the gasoline-powered vehicle segment due to the rising fuel prices, which coincides with significant growth in sales of these scooters, primarily in India, Hong Kong, and the Netherlands. Norway is expected to phase out the sale of all fossil-fuel-powered vehicles over the next few years to meet its 2025 target of 100% renewable energy.

Electric Scooter Market Growth Factors

Increasing Emphasis on Sustainable Urban Mobility Solutions to Boost Market Growth

As cities worldwide face challenges, such as traffic congestion, air pollution, and limited parking spaces, there is a growing recognition of the need for alternative modes of transportation that are environmentally friendly and efficient. Electric scooters offer a compelling solution to these challenges, as clean energy sources power them and produce zero emissions during operation. Electric scooters are well-suited for short-distance travel in urban areas, offering commuters a convenient and cost-effective way to navigate crowded streets and reach their destinations quickly. With the rise of urbanization and the growing population in cities, there is a corresponding increase in demand for compact and agile transportation options that can easily maneuver through congested traffic.

The proliferation of ride-sharing and rental services has contributed to the popularity of electric scooters, making them accessible to a wider range of users. These services provide a convenient and flexible transportation solution for users who may not want to own a scooter outright or prefer to use it for occasional trips. Technological advancements in battery technology and electric motor efficiency have significantly improved the performance and range of electric scooters, making them more attractive to consumers. With longer battery life and faster charging times, electric scooters offer a viable alternative to traditional gasoline-powered vehicles, further driving market growth.

RESTRAINING FACTORS

Lack of Charging Infrastructure May Hamper Market Growth

Lack of charging infrastructure will be the largest obstacle to the expansion of the e-scooter sector. The most important consideration for any user before purchasing an electric two-wheeler is the ease with which that vehicle can be charged anywhere and at any time. Most emerging countries, unlike developed countries, lack the required charge stations. As a preliminary solution, the manufacturers are developing their charging infrastructure network, especially in the developing countries; however, participation of government as well as private investors is also equally necessary to boost the adoption of such vehicles across the world. To expand the e-two-wheeler industry, users will need an extensive charging infrastructure network that allows them to travel long distances without worrying about finding a charging station.

Electric Scooter Market Segmentation Analysis

By Battery Type Analysis

Lead-Acid Battery Type Dominates Market

Based on Battery type, the market is bifurcated into Lead Acid batteries, Li-ion batteries.

The Lead-Acid battery segment dominated the market in 2025 with 51.31% share, due to the benefits of the Lead-Acid battery, such as durability, damage tolerance, and low cost. However, the adoption of SLA batteries is expected to decline in the coming years as they are large and drain quickly, even not carrying significant loads.

The lithium-ion battery segment witnessed low demand in 2023; however, it is expected to gain momentum and grow at the fastest CAGR over the forecast period. In 2023, the Lithium-ion Battery segment accounted considerable market share. Due to better performance, high charging-discharging efficiency, high charge density, and lightweight performance.

By Voltage Type Analysis

To know how our report can help streamline your business, Speak to Analyst

48-59 V Segment Dominates the Market

Based on voltage type, the market is divided into 48-59 V, 60-72 V, 73-96V, and above 96V.

The 48-59 V segment holds the largest share, 38.09% globally in 2026. It is expected to dominate the forecast period because these batteries have a high level of connectivity with e-scooters and have higher power output, which is expected to drive market expansion. These scooters are generally preferred for short-distance commutes.

The 60-72 V segment will have high growth and penetration in 2023. The 60-72 V segment accounted for second largest market share in 2023. The segment will grow during the forecast period to avoid the hassle of regular battery charging; consumers prefer scooters with a long battery range.

The 73-96 V segment is also predicted to show positive growth in the market. The segment will grow at a significant rate during the forecast period. Consumer preference for high-voltage e-scooters for long-range distance and to avoid frequent battery charging will boost the growth of this segment.

The above 96 V segment had low penetration in 2020; however, it is anticipated to gain momentum and lowest CAGR of during the forecast period owing to high demand in developed countries.

REGIONAL INSIGHTS

Asia Pacific Electric Scooter Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market dominated the market with a valuation of USD 17.27 billion in 2025 and USD 18.97 billion in 2026. The region is expected to dominate the global electric scooter market share as an automotive hub, with large sales and production in China. This growth is accountable because the increasing preference for personal mobility in the post-COVID period will boost automobiles. The increasing demands for economical e-scooters for short-distance transportation and governments initiatives to promote this type of scooter adoption are expected to drive the APAC market during the forecast period. The country’s rapidly growing economy drives the expansion of advanced technologies to improve electrification in China. The Indian government has promoted electric two-wheelers through schemes, such as FAME-II, which provide customers with incentives and tax benefits. The Japan market is projected to reach USD 2.48 billion by 2026, the China market is projected to reach USD 11.41 billion by 2026, and the India market is projected to reach USD 1.47 billion by 2026.

North America is expected to have significant growth during the projected period. Increasing government and private market players' initiatives to expand regional electric two-wheeler charging station network. Furthermore, promoting research & development activities directed towards the development of high-density batteries is expected to boost the regional market growth in the upcoming few years. The U.S. market is projected to reach USD 1.26 billion by 2026.

Europe is expected to witness the highest CAGR during the forecast period due to consumer adoption of EVs and autonomous vehicles; shared mobility is likely to fuel market expansion. The rest of the world due to fewer automotive OEMs, low adoption of technology, and less presence of all typed vehicles. However, it is expected to grow at considerable growth rate. The UK market is projected to reach USD 0.28 billion by 2026, while the Germany market is projected to reach USD 1.45 billion by 2026.

List of Key Companies in Electric Scooter Market

Strong Portfolio and Advanced Features Have Propelled Yadea Technology Group Co. Ltd, Niu Technologies to Lead Market

The market is consolidated because of its strong product portfolio and noteworthy distribution network of major companies in developed and developing countries.

The key market players are concentrating on R&D efforts and product-level strategies. For instance, Gogoro’s swappable battery e-scooter bike has revolutionized the market in Taiwan. Many Asian vendors are collaborating with the company to integrate the swappable battery technology into their models. This type of scooters from major Japanese companies, such as Honda, Yamaha, Suzuki, and Kawasaki, have been launched, increasing the competition in the Asian market.

LIST OF KEY COMPANIES PROFILED:

- Yadea Technology Group Co. Ltd (China)

- Zhejiang Luyuan Electric Vehicle Co Ltd (China)

- Niu Technologies (China)

- Mahendra GenZe (U.S.)

- Hero Electric (India)

- Vmoto Limited (Australia)

- Amper Vehicles (India)

- Govecs Group (Germany)

- BMW Motorrad International (Germany)

- Gogoro Inc. (Taiwan)

KEY INDUSTRY DEVELOPMENTS

- January 2024: Hero MotoCorp announced stepping up its electric vehicle (EV) play by launching three new electric scooters in 2024. This new launch will be in mid, affordable, and business-to-business (B2B) segments, considering all types of usage requirements.

- December 2023: Gogoro launched battery swapping in Delhi, Goa, along with CrossOver GX250 Made-in-India e-scooter, Taiwan's largest battery-swapping and e-scooter maker Gogoro partnered with Hero MotoCorp in India to co-develop vehicles and swapping infrastructure.

- December 2023: Kinetic Green, the Pune-based electric vehicle (EV) player, launched its high-speed e-scooter, Zulu. This Kinetic's high-speed e-scooter, Zulu, also comes with a battery subscription plan. The battery subscription model is claimed to have reduced the acquisition cost by over 35 percent and offers significant savings on running costs.

- October 2023: Automaker LML acquired land in Haryana for its upcoming EV industrial park focused on e-scooters. The park aims to transform the EV manufacturing landscape by combining technology, innovation, and sustainability. LML's strategic partnership with Saera Electric Auto enables the production of its electric two-wheelers.

- August 2023: Vijayawada, India-based electric scooter manufacturer Avera AI Mobility Pvt. Ltd. (AAMPL) announced its expansion plan with an investment of USD 1 Billion to increase production from 25,000 units per annum to 1,00,000 per annum and cater to the emerging markets in Australia, Vietnam, and Sri Lanka in the immediate future and to some other countries in due course.

REPORT COVERAGE

The global electric scooter market research report provides a detailed analysis and focuses on crucial aspects such as leading companies, product types, and leading product applications. Besides this, the report offers insights into the market trends and highlights vital industry developments. In addition to the factors above, the report encompasses several factors contributing to the market’s growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.80% from 2026 to 2034 |

|

Unit |

Value ( USD Billion) & Volume (Thousand Units) |

|

Segmentation |

By Battery Type

|

|

By Voltage Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was at USD 21.46 billion in 2025, and it is expected to reach USD 62.75 billion by 2034.

In 2023, the Asia Pacific stood at USD 17.27 billion.

The market is projected to grow at a CAGR of 12.80% and exhibit steady growth during the forecast period (2025-2034).

The lead-acid battery segment is the leading segment in this electric scooter market.

Increased vehicle production, focus on advanced technologies, low maintenance and operating cost, and increased adoption.

NIU Technologies and Yadea Technology Group are the major players in the market.

The Asia Pacific dominated the market share in 2025.

The increasing adoption of electric mobility coupled with favorable government initiatives will drive market growth. Increased consumer preference for EV expected to boost the electric scooter market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us