Optical Coherence Tomography Market Size, Share & Industry Analysis, By Device Type (Tabletop and Portable and Handheld), By Technology (Time Domain OCT (TD-OCT), Spectral Domain OCT (SD-OCT), and Swept Source OCT (SS-OCT)), By Application (Ophthalmology, Cardiology, Oncology, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

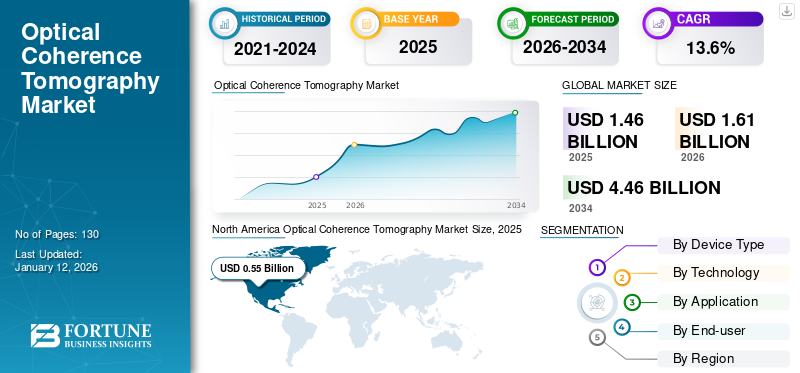

The global optical coherence tomography market size was valued at USD 1.46 billion in 2025. The market is projected to grow from USD 1.61 billion in 2026 to USD 4.46 billion by 2034, exhibiting a CAGR of 13.6% during the forecast period. North America dominated the optical coherence tomography market with a market share of 37.8% in 2025.

Optical coherence tomography (OCT) is an invasive technique that utilizes light to create cross-sectional images of tissue. This imaging technology is used in the diagnosis of various applications, including cardiology, ophthalmology, and oncology. The increasing prevalence of diseases such as cardiovascular disorders, glaucoma, diabetic retinopathy, age-related macular degeneration, and cancer, has been fueling the demand for these devices for effective and early diagnosis of the disease.

- For instance, as per the study published by JAMA Ophthalmology on the 'Prevalence of Glaucoma among U.S. Adults in 2022', around 4.22 million were living with glaucoma and around 1.49 million people had vison-affecting glaucoma.

The market consists of small and mid-sized players. Market players such as ZEISS Group, Heidelberg Engineering Inc., and Abbott are among the key players focusing on new product launches to increase their revenue generation from the OCT products.

Global Optical Coherence Tomography Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.46 billion

- 2026 Market Size: USD 1.61billion

- 2034 Forecast Market Size: USD 4.46 billion

- CAGR: 13.6% from 2026–2034

Market Share:

- Region: North America dominated the market with a 37.8% share in 2025. The region's growth is driven by the increasing focus of market players on adopting advanced technologies in their product offerings and a high prevalence of chronic and ophthalmic disorders.

- By Application: The Ophthalmology segment held the largest market share in 2024. This dominance is attributed to the strong presence of branded OCTs for ophthalmic indications and the high demand for effective and early diagnosis of various eye conditions.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, the market is driven by an increasing focus from major players on launching new and technologically advanced products to cater to the rising prevalence of ophthalmic diseases.

- United States: The market is fueled by a high prevalence of ophthalmic conditions, with approximately 4.22 million people living with glaucoma. Growth is also supported by consistent U.S. FDA approvals for new technologies, such as Heidelberg Engineering's OCT angiography module, and the launch of AI-powered platforms.

- China: Growth is supported by the introduction of new, locally available systems. For example, MicroPort Scientific Corporation's launch of its MicroPort Argus OCT system at a major cardiology congress in China is expanding access to advanced diagnostic tools.

- Europe: The market is advanced by a high prevalence of diseases such as diabetes, which affects one in eleven people in the region and is a leading cause of retinopathy. The market also benefits from a strong presence of key manufacturers like ZEISS Group and Heidelberg Engineering Inc.

Market Dynamics

Market Drivers

Increasing Prevalence of Chronic Disorders to Fuel Market Growth

The burden of chronic conditions such as cardiovascular diseases, cancer, and ophthalmic diseases has been growing significantly, fueling the demand for efficient diagnosis options.

- For instance, as per the research study published by the National Center for Biotechnology Information (NCBI) in 2023, 71.52% the U.S. population aged 50 and above were suffering from at least one chronic disease in 2020. This number is expected to grow by 99.5% and is estimated to reach 142.66% by 2050.

Optical coherence tomography can help in the diagnosis and treatment of diabetic retinopathy, central serous retinopathy, and papilledema. Moreover, it also useful imaging in conditions such as optic neuritis, papilledema, and neuroretinitis. OCTs are a non-invasive or minimally invasive procedures that provides early, safe, fast, and precise diagnosis. As awareness of these procedures fuels, the adoption of OCT is fueling globally.

Therefore, the growing burden of chronic disorders has been fueling the demand for effective diagnosis and treatment options, thereby fueling the optical coherence tomography market growth.

Market Restraints

High Cost of Optical Coherence Tomography Along With the Alternative Diagnostics to Limit Market Growth

The increasing awareness of the efficiency of OCT has been fueling its adoption. However, the high cost of products limits its adoption in developing countries.

- For instance, few OCT instruments can be cost around USD 8,000.0, while new high-tier systems can be priced at around USD 70,000.0.

Furthermore, there are many alternative diagnostics methods available, such as ultrasound biomicroscopy, intravascular ultrasound (IVUS), and intravital microscopy.

Market Opportunities

Integration of Telemedicine with Optical Coherence Tomography to Expand Product Usage

Telemedicine allows patients to consult with doctors remotely, eliminating the need to visit clinics or diagnosis centers for treatment or diagnosis. Many studies have been conducted to evaluate the effectiveness of integrating OCT with telemedicine.

- For instance, a research study, 'Evaluation of an OCT-AI–Based Telemedicine Platform for Retinal Disease Screening and Referral in a Primary Care Setting' was published by the Association for Research in Vision and Ophthalmology in March 2022. This study aimed to analyze the performance of OCT integrated with AI over a telemedicine platform. As per this study, the OCT-AI integration with telemedicine showed high practical value for effective screening and referral of retinal diseases.

Therefore, the adoption of OCT integrated with telemedicine is expected to fuel the increased use of OCT in diagnosing cardiovascular, retinal, and cancer diseases, thereby fueling market growth.

Market Challenges

Lack of Skilled Professionals Acts as a Major Challenge in Market Growth

Skilled professionals are required to operate OCT systems in order to get accurate, efficient, and timely outcomes. Therefore, lack of a skilled workforce can limit the adoption of these devices, thereby restricting market growth.

Regulatory Hurdles

Strict regulatory approvals in many countries and variations in regulations from region to region limit the expansion of product commercialization globally.

Download Free sample to learn more about this report.

OPTICAL COHERENCE TOMOGRAPHY MARKET TRENDS

Increasing Focus of the Market Players on New Product Launches to Expand their Offerings Globally

The growing awareness of advanced products, along with the increasing prevalence of eye diseases and other chronic diseases, has fueled the demand for efficient diagnostic tools. In order to fulfill this demand, market players have increased their focus on new advanced product launches.

- For instance, in July 2024, Heidelberg Engineering Inc. announced the Food and Drug Administration (FDA) approval of its Spectralis OCT angiography (OCTA) module, including SHIFT technology.

Other Trends

Increasing Adoption of Advanced Technologies to Amplify Product Demand

Market players have been focusing on the adoption of advanced technologies in their products to enhance efficiency.

- For instance, in April 2021, Abbott announced the launch of its first coronary imaging platform, Ultreon, merging optical coherence tomography. The software is powered by artificial intelligence (AI) for enhanced visualization. Ultreon automatically detects calcium-based blockages and measure vessel diameter, thereby enhancing physicians' decision-making in coronary stenting.

Focus on the Expansion of the OCT's Application for Various Diseases

Market players have increased their focus on the development and launch of OCT products for other applications such as cardiology, dermatology, and neurology.

- For instance, in July 2024, Spryte Medical announced that it had received Breakthrough Device Designation from the U.S. Food and Drug Administration (FDA) for its neuro Optical Coherence Tomography (nOCT) technology.

IMPACT OF COVID-19

Limited Patients Visits for Regular Checkups During Pandemic Negatively Impacted Market Growth

The company experienced a decline in its value in 2020 due to the outbreak of the COVID-19 virus. This decline in market value was due to the lower demand for OCT products in hospitals and clinics, as patient visits for non-emergency diagnosis and treatment were limited.

However, the market witnessed significant growth post-COVID-19 in 2021 and 2022 due to the increased number of patient visits for diagnosis and treatment of chronic diseases.

SEGMENTATION ANALYSIS

By Device Type

Tabletop Segment Led due to their Strong Sales

By device type, the optical coherence tomography market is segmented into tabletop, and portable and handheld.

The tabletop segment dominated the market with a share of 50.93% in 2026. The segment's growth is attributed to strong global sales of tabletop devices such as SPECTRALIS and VivoSight Dx. Moreover, the increasing focus of the market players on new advanced product launches has also been fueling the segment’s growth.

The portable and handheld segment is expected to grow at the fastest CAGR during the forecast period. The segment's growth is attributed to the major advantage of these devices, which is their convenient handling and transport. These devices are lightweight and can be easily carried and placed in any location without requiring much manpower.

To know how our report can help streamline your business, Speak to Analyst

By Technology

Spectral Domain OCT (SD-OCT) Segment Led the Market owing to its Advantages Over Conventional Time-Domain OCT

Based on technology, the market is segmented into time domain OCT (TD-OCT), spectral domain OCT (SD-OCT), and swept source OCT (SS-OCT).

The spectral domain OCT (SD-OCT) dominated the market contributing 47.83% globally in 2026, attributed to the various advanced features of these devices, such as high axial resolution, faster image capturing, and improved analytic capabilities. Moreover, due to its advantages over conventional time-domain OCT, these devices replace conventional devices, fueling the segment growth.

Furthermore, swept source OCT (SS-OCT) is expected to grow at a significant CAGR during the forecast period. The segment's dominance is attributed to the growing prevalence of chronic disorders and the increasing demand for technologically advanced products.

By Application

Ophthalmology Segment Dominated due to Strong Availability of Brands for Ophthalmic OCT

Based on application, the market is segmented into ophthalmology, cardiology, oncology, and others.

The ophthalmology segment dominated the market with a share of 59.01% in 2026, due to the strong presence of branded OCTs for ophthalmic indication, such as CIRRUS 6000 by ZEISS Group and KUOS-O100 by PHILOPHOS.

The cardiology segment is expected to grow at a significant CAGR during the forecast period attributed to the growing burden of cardiovascular disorders.

- For instance, as per the data published by the Centers for Disease Control and Prevention (CDC) in 2024, around 795,000 people suffered from stroke each year in the U.S.

By End-user

Hospital & ASCs Segment Dominated due to Rise in Chronic Conditions

On the basis of end-user, the market is segmented into hospitals & ASCs, specialty clinics, and others.

The hospitals & ASCs segment dominated the market with a share of 44.1% in 2026 which is attributed to the rising population suffering from chronic diseases and secondary microvascular complications such as diabetic retinopathy. This increase in chronic conditions is leading to more hospital visits, thus driving the demand for OCT devices in the hospitals.

- For instance, according to IDF (International Diabetes Federation) Diabetes Atlas 2021, one in eleven people has diabetes in the European region, and another study reveals that 77.3% of type 1 diabetes patients have diabetic retinopathy. This high proportion of retinopathy and hospital visits increases demand for these devices in hospital settings.

The specialty clinics segment is expected to grow at the fastest CAGR during the forecast period. The segment's dominance is attributed to the increasing focus of market players on enhancing the efficiency of their products for ophthalmologists.

Optical Coherence Tomography Market Regional Outlook

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Optical Coherence Tomography Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2025, accounting for USD 0.55 billion of the global market. The strong market growth in North America is attributed to the increasing focus of market players on adopting advanced technologies in their product offerings.

- For instance, in May 2024, ZEISS Group announced technological advancements in its OCT product, CIRRUS 6000. With the adoption of advanced technology, CIRRUS 6000 enables efficient and data-driven workflow for ophthalmologist. The product also included enhanced cybersecurity features.

Furthermore, in North America, the U.S. dominated the market in 2024. The market growth in the region is attributed to the increasing focus of market players on new product launches and the growing burden of chronic disorders. The U.S. market is projected to reach USD 0.56 billion by 2026.

Asia Pacific

The Asia Pacific market is expected to grow at the fastest CAGR during the forecast period. The growth of the market in the region is attributed to the increasing focus of market players on new product launches in the region.The Japan market is projected to reach USD 0.1 billion by 2026, the China market is projected to reach USD 0.1 billion by 2026, and the India market is projected to reach USD 0.07 billion by 2026.

- For instance, in October 2023, Abbott launched Ultreon 1.0 in India. Ultreon is a coronary imaging software that merges optical coherence tomography with artificial intelligence.

Europe

The market in Europe accounted for a significant portion of the market share in 2024. The strong market growth in North America is attributed to the strong presence of market players such as ZEISS Group, Heidelberg Engineering Inc., and VivoSight. The UK market is projected to reach USD 0.07 billion by 2026, while the Germany market is projected to reach USD 0.13 billion by 2026.

Middle East & Africa and Latin America

Latin America and the Middle East & Africa are expected to grow at a substantial rate during the forecast period attributed to the growing burden of chronic conditions and increasing awareness regarding OCT devices.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Focus on Raising Awareness to Boost Their Product Portfolio

Market players such as ZEISS Group, Heidelberg Engineering Inc., and Abbott are among the major players in the market, accounting for a significant portion of the optical coherence tomography market share in 2024. The strong presence of these market players in the region is attributed to their focus on raising awareness of their product offerings.

- For instance, in October 2024, ZEISS Group showcased its digital and surgical offerings at the American Academy of Ophthalmology (AAO) annual meeting. The showcased products also included the company's OCT system, ARTEVO 850.

Other players, such as VivoSight, Novacam Technologies, Inc., and NIDEK CO., LTD., have been focusing on launching new offerings with the aim of enhancing their revenue generation.

- For instance, in June 2024, NIDEK CO., LTD. launched RS-1 Glaucoma optical coherence tomography system. The product incorporates analytics functions for retinal and glaucoma diseases.

LIST OF KEY OPTICAL COHERENCE TOMOGRAPHY COMPANIES PROFILED

- ZEISS Group (Germany)

- Heidelberg Engineering Inc. (Germany)

- VivoSight (U.K.)

- Novacam Technologies, Inc. (Canada)

- Leica Microsystems (Germany)

- Abbott (U.S.)

- Topcon Corporation (Japan)

- Terumo Corporation (Japan)

- Thorlabs, Inc. (U.S.)

- PHILOPHOS (South Korea)

- NIDEK CO., LTD. (Japan)

KEY INDUSTRY DEVELOPMENTS

- October 2024 – Siloton, a U.K.-based start-up medical technology company, secured USD 1.1 million for the commercial roll-out of its eye imaging chip technology. This funding would further help the company develop Akepa optical coherence tomography (OCT) chip technology.

- June 2024 – ZEISS Group announced the inclusion of data-driven workflow for ophthalmologists and improved cybersecurity features in its optical coherence tomography (OCT) reference database (Cirrus 6000).

- September 2023 – Orbis, a global charity, partnered with Heidelberg Engineering Inc. with the aim of improving vision services by funding crucial teaching opportunities and research. The teaching webinars would also include optical coherence tomography (OCT).

- June 2022 – MicroPort Scientific Corporation announced the launch of its OCT system MicroPort Argus at the 16th Oriental Congress of Cardiology in China.

- August 2021 – Topcon Healthcare partnered with RetInSight GmbH with the aim of developing an interface between RetInSight's AI-assisted retinal biomarker applications and Topcon's OCT device.

REPORT COVERAGE

The global optical coherence tomography market report provides a detailed competitive landscape and market insights. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on key points, such as new solution launches in the market. Furthermore, the report covers regional analysis of different market segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.6% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Device Type

|

|

By Technology

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1.46 billion in 2025 and is projected to reach USD 4.46 billion by 2034.

In 2025, the market value stood at USD 1.46 billion.

The market is predicted to exhibit a CAGR of 13.6% during the forecast period.

By device type, the tabletop segment led the market.

The growing burden of chronic disorders and the increasing focus of market players on new product launches are key factors fueling market growth.

ZEISS Group, Heidelberg Engineering Inc., and Abbott are the top players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us