Organic Fruits & Vegetables Market Size, Share & Industry Analysis, By Type (Fruits {Apple, Banana, Berries, Orange, and Others} and Vegetables {Carrot, Potato, Leafy Vegetables, Tomato, and Others}), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Retail Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

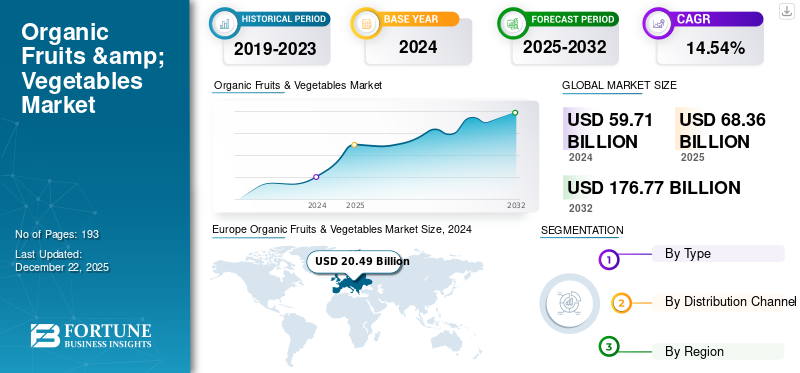

The global organic fruits & vegetables market size was valued at USD 59.71 billion in 2024. The market is projected to grow from USD 68.36 billion in 2025 to USD 176.77 billion by 2032, exhibiting a CAGR of 14.54% during the forecast period. Europe dominated the organic fruits & vegetables market with a market share of 34.32% in 2024.

Organic fruits & vegetables are an emerging global organic foods market segment.

This growth is fueled by rising consumers' health & wellness concerns, supporting government initiatives promoting environmental sustainability, and growing disposable incomes. Emerging trends such as clean-label, natural, and non-GMO food products, especially in fruits and vegetables, will likely fuel market growth globally. Additionally, companies are focusing on achieving certificates such as USDA Organic, which contributes to industry growth. Increasing organic farming areas and growing collaboration with farmers to strengthen vertical integration will create ample growth opportunities in the upcoming years. Nature Fresh Farms, Dole PLC, Driscoll’s Inc., Calavo Growers Inc., and Robinson Fresh Inc. are prominent players in the global market.

Global Organic Fruits & Vegetables Market Overview

Market Size & Forecast:

- 2024 Market Size: USD 59.71 billion

- 2025 Market Size: USD 68.36 billion

- 2032 Forecast Market Size: USD 176.77 billion

- CAGR: 14.54% from 2025–2032

Market Share:

- Europe dominated the organic fruits & vegetables market with a 34.32% share in 2024, supported by growing consumer preference for natural, non-GMO, and clean-label food products across countries like Germany, France, and the U.K.

- By type, the vegetables segment held the largest market share in 2024, driven by rising health consciousness and the perception that organic vegetables contain fewer chemical compounds. The fruits segment is projected to grow the fastest, aided by increased organic farming and consumption of berries and citrus fruits globally.

- By distribution channel, supermarkets/hypermarkets led the market in 2024 due to their wide availability and convenience, while the online retail segment is expected to register the highest CAGR, fueled by shifting shopping behaviors and attractive discounts on organic offerings.

Key Country Highlights:

- Germany: Organic retail sales reached USD 17.46 billion in 2023, driven by a 5% growth and an 11.3% increase in organic farmland between 2022 and 2023.

- United States: Organic fruit & vegetable sales exceeded USD 22 billion in 2022, representing over 36% of organic retail sales, fueled by evolving diets and increased certification.

- India: Under the Paramparagat Krishi Vikas Yojana (PKVY), the government incentivizes organic farming, supporting market expansion across the country.

- China: Expanding organic farming to reduce reliance on chemical inputs is accelerating demand for organic fruits & vegetables.

- Brazil: Rising urbanization, women’s earning capacity, and government support are bolstering organic food consumption.

- UAE: Trade shows like the Organic and Natural Products Expo Dubai are increasing visibility and demand for organic produce across the Middle East.

ORGANIC FRUITS & VEGETABLES MARKET TRENDS

Emerging Clean-Label Food Products to Change Industry Scenario

Over the past decades, consumers have become increasingly concerned about their health and overall well-being. Thus, they are often preferred to purchase natural, organic, and allergen-free food products. Organic fruits & vegetables are believed to contain no/minimal chemicals and be non-GMO, compared to conventional products. Thus, consumers will likely shift toward the organic option over the conventional product. Hence, the consumers’ demand for clean-label products such as natural, non-GMO, and additive-free products is likely to fuel market growth during the forecast period. Europe witnessed a growth from USD 17.86 Billion in 2023 to USD 20.49 Billion in 2024.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Organic Farmland to Drive Market Growth

Over the past decades, organic farming practices have evolved significantly across the globe. Increasing government focus on reducing greenhouse gas emissions and minimizing the utilization of chemicals in agricultural activities is a key driver behind the expansion of organic farmland globally. Rising consumer awareness about the environmental impact of conventional agriculture and the growing preference for healthier and sustainable food options are supporting the growth of organic food cultivation. According to the FiBL & IFOAM – Organics International, the global organic cultivation land increased by 26.6%, reaching nearly 96.4 million hectares by the end of 2022. The area dedicated to organic vegetable production grew by 8.8%, reaching 503,456 hectares. This expansion in organic cultivation will significantly contribute to the global organic fruits & vegetables market growth in the near future.

MARKET RESTRAINTS

High Price of Organic Fruits & Vegetables to Hamper Market Growth

Organic fruits and vegetables are often more expensive than their conventionally produced counterparts. In organic farming practices, farmers rely on bio-friendly fertilizers and pesticides, which are generally less effective in improving yield and controlling pest-related damage. Higher quantities of natural fertilizers are often required to improve product yield, leading to increased operational costs. Additionally, organic-friendly inputs are relatively more costly than their chemical alternatives. Higher labor requirements, high production costs, certification-associated costs, controlled distribution channels, regulatory aspects, low yield, and high exposure to food spoilage make it more expensive in the market. The elevated price may negatively impact consumers' purchasing behavior, especially among price-sensitive buyers, potentially hampering the industry's growth in the coming years.

MARKET OPPORTUNITIES

Vertical Collaboration Activities to Create an Opportunity for Industry Growth

As clean-label, transparency, and authenticity-related concerns increase among users, key players such as Dole Plc and Nature Fresh Farms are reframing strategies. Key companies are collaborating with farmers from production to final distribution. This vertical integration and collaboration with farmers allow companies to educate farmers on best practices for profitable organic farming, ensuring a consistent supply of high-quality organic produce. Such partnerships help streamline the supply chain, minimize disturbance, and enhance traceability, which are critical components in gaining consumer trust. It is one of the key global organic fruits & vegetables market trends that will change the industry landscape during the forecast period. For instance, in December 2022, Amazon Retail India, one of the leading online retail platforms, launched its 11th farmer collection center in Otur, Pune, Maharashtra. The company collects quality organic fruits and vegetables directly from farmers to offer trusted & certified products to its customers.

Segmentation Analysis

By Type

Vegetables Segment Dominated due to Rising Health Consciousness

Based on type, the global market is divided into fruits and vegetables. The fruits segment is further segmented into apple, banana, berries, orange, and others. The vegetables segment held a major organic fruits & vegetables market share in 2024. The segment is further categorized into carrot, potato, leafy vegetables, tomato, and others. Vegetables produced from organic practices contain fewer chemical toxic compounds, making them attractive to health-conscious consumers who are increasingly incorporating them into their daily diets. Furthermore, per capita consumption of green vegetables has risen over the last decades, especially in developing countries such as India and Brazil, further driving the segment’s growth.

The fruit segment is anticipated to exhibit the highest growth during the forecast period, supported by the increasing area dedicated to organic fruit cultivation across the globe. According to FiBL’s survey report published in 2024, Berries and Citrus fruit production areas reached 87,517 hectares and 115,346 hectares, respectively, in 2022. Furthermore, increasing disposable income, awareness about health benefits, and changing consumer lifestyles contribute to increase per capita consumption of organic fruits globally.

By Distribution Channel

Convenient Shopping Experience Encouraged Supermarket/Hypermarket Segment Growth

Based on distribution channel, the global market is divided into supermarket/hypermarket, specialty stores, convenience stores, online retail stores, and others. The supermarket/hypermarket segment held the dominant share in 2024, mainly due to its wide geographical presence, convenience shopping experience, availability of various products, competitive pricing, and attractive promotional offers. As supermarkets and hypermarkets offer a more convenient shopping experience and accept a wide range of payment modes, it is one of the popular shopping formats for consumers. Increasing supermarkets’ popularity will drive product sales in this segment.

The online retail stores segment is anticipated to expand with the highest CAGR during the forecast period. Many consumers prefer online platforms as they offer a hassle-free shopping experience. Additionally, organic fruit & vegetable brands offer their products at attractive and discounted prices, which helps to boost consumers’ interest. The increasing penetration of electronic gadgets, expansion strategies by e-commerce companies, and changing shopping preferences among millennials and Gen Z consumers further support the segment growth.

Organic Fruits & Vegetables Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Europe

Europe Organic Fruits & Vegetables Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the global market and held the largest market share of 44.30% in 2024. Increasing consumer concern for natural, organic, and non-GMO food products primarily drives industry growth across European countries such as Germany, Italy, France, Spain, and the U.K. Increasing sales of organic foods on retail shelves across the region further boost industry growth. According to IFOAM Organics Europe, sales of organic products, including fruits & vegetables, reached USD 50.48 billion in 2023, representing a 3% increase over 2022.

Germany is a key market that contributes significantly to the regional market. IFOAM said organic retail sales increased 5%, reaching USD 17.46 billion in 2023. Expanding organic farming land will further contribute to the country’s organic fruits & vegetables industry growth. According to IFOAM, organic farming land in Germany increased by 11.3% from 2022 to 2023.

North America

North America is the second-largest market. The fruits & vegetables category is one of the top categories within the organic foods industry. According to the U.S. Department of Agriculture, the organic category of fruit & vegetable sales surpassed USD 22 billion in 2022, holding more than 36% of all organic retail sales. Increasing organic certification, key players penetrating activities, evolving consumer diet practices, and new product developments are likely to drive product demand across the U.S., Canada, and Mexico.

Asia Pacific

Asia Pacific is one of the fastest-growing markets globally. The market’s expansion is driven by shifting consumer preferences, rising health consciousness, and supportive government initiatives. China, India, Australia, and Indonesia focus on expanding organic farming activities to achieve long-term environmental benefits and reduce access to chemical inputs such as fertilizers and pesticides. According to the India Ministry of Agriculture & Farmers Welfare, the country has promoted organic farming under the Paramparagat Krishi Vikas Yojana (PKVY) and Mission Organic Value Chain Development for the North Eastern Region (MOVCDNER). Under the PKVY policy, the government offers up to USD 376.45 per hectare over three years to facilitate the conversion to and practice of organic farming. Such initiatives will improve the production of organic fruits & vegetables across the country, thereby supporting market growth in the upcoming years.

South America

South American organic agriculture has steadily grown over the last decade. The sector is important in promoting sustainable agriculture practices and meeting the consumer demand for organically produced foods. This growth is important in supporting economic recovery across South America and Caribbean countries, especially after the COVID-19 pandemic. The production of organic fruit & vegetables is gradually gaining popularity, supported by multiple factors including increasing individuals' earning capacity, awareness of a healthy lifestyle, growing urbanization, women's earning capacity, and government support to promote organic food consumption.

Middle East & Africa

The demand for sustainable and high-quality food products is a key factor fueling the growth of the organic fruits & vegetables market in the Middle East & Africa region. In particular, Middle Eastern countries are witnessing a rise in organic food consumption, supported by increased visibility through trade shows and expos. Prominent exhibitions such as the Organic and Natural Products Expo Dubai and the Middle East Organic & Natural Products Expo open an opportunity for international players to enter and expand their regional supplier network.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Expanding Supplier Network to Maintain Competitiveness

The global fruits & vegetables market share is highly fragmented and competitive, with large and small organic vegetables and fruit manufacturing companies vying for market share. Some major players in the organic foods industry, such as Nature Fresh Farms, Dole PLC, Driscoll’s Inc., Calavo Growers Inc., and Robinson Fresh Inc., are reframing their strategies to increase their footprint in the market and achieve competitive advantages. Key strategic initiatives include strengthening e-commerce channel presence, new product launches, and expanding supplier networks. These activities are crucial for maintaining competitiveness in a rapidly evolving market landscape.

Dole PLC is one of the leading manufacturers and distributors of fresh fruits and vegetables across the Americas, Europe, the Middle East & Africa, and Asia. The company has a strong history and an experienced workforce, which helps it execute effective strategies in the competitive landscape. The company operates in more than 30 countries globally and manages a vertically integrated supply chain that extends over 250 facilities worldwide.

LIST OF KEY ORGANIC FRUIT & VEGETABLE COMPANIES PROFILED

- Calavo Growers, Inc. (U.S.)

- Robinson Fresh (U.S.)

- Driscoll's Inc. (U.S.)

- Blife Srl (Italy)

- Dole Plc (Ireland)

- Nature Fresh Farms (U.S.)

- Earthbound Farm Inc. (U.S.)

- Mazzoni S.p.A. (Italy)

- Biosic Srl. (Italy)

- Almaverde Bio Italia (Italy)

KEY INDUSTRY DEVELOPMENTS

- May 2025 – Nature Fresh Farm, an American organic vegetable manufacturing company, received a minority investment from Manulife Investment Management (“Manulife IM”). This strategic funding allows the company to enhance its operational capacities.

- May 2025 – Big Basket, an Indian emerging quick grocery delivery application, signed a strategic MoU with the Andhra Pradesh (AP) government to strengthen its organic vegetables sourcing and supplying activity. As a part of the collaboration, Bigbasket will establish four new vegetable collection centers in AP to ensure a daily supply of fresh, high-quality organic produce.

- March 2025 – RIJK ZWAAN, an organic vegetable growing company, collaborated with Austrian retailers to supply Tatayoyo, a premium pepper, year-round across the country.

- September 2024 - The Agricultural and Processed Food Export Development Authority, the Indian government's agricultural export facilitation arm, signed a Memorandum of Understanding (MoU) with Lulu Group International, the leading retail channel in the Middle East & Asia. According to the agreement, Lulu Group would promote Indian-origin organic vegetables, fruits & processed foods across the Middle East.

- October 2023 – Farmizen, one of the emerging organic vegetable supplying companies, collaborated with LiteFarm, an organic farming organization, to reshape and revitalize organic farming in India.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Estimated Year |

2025 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 14.54% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 59.71 billion in 2024 and is projected to reach USD 176.77 billion by 2032.

The market is expected to exhibit a CAGR of 14.54% during the forecast period (2025-2032).

By type, the vegetables segment led the market.

Increasing organic farming area is a key factor driving market growth.

Nature Fresh Farms, Dole PLC, Driscoll’s Inc., Calavo Growers Inc., and Robinson Fresh Inc. are prominent players in the global market.

Europe dominated the market in 2024.

Vertical collaboration activities are key opportunities for industry growth.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us