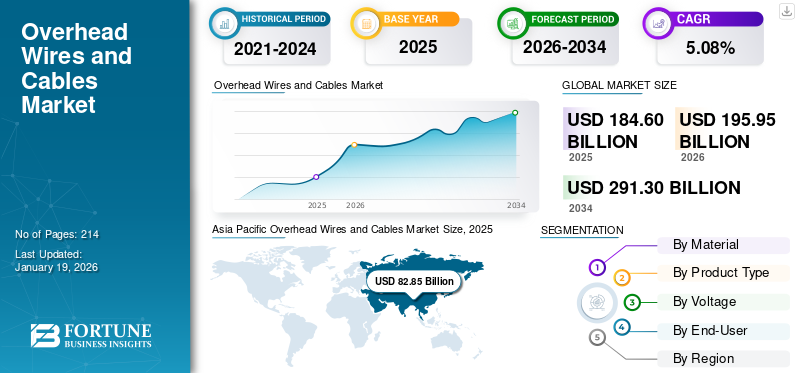

Overhead Wires and Cables Market Size, Share & Industry Analysis, By Material (Metal and Polymer), By Product Type (Power Cables, Hybrid Cables, and Communication Cables), By Voltage (Low Voltage, Medium Voltage, High Voltage, and Extra-High Voltage), By End-User (Aerospace and Defense, Construction (Commercial, Residential), IT and Telecommunication, Power Transmission and Distribution, Oil and Gas, Consumer Electronics, Manufacturing, Automotive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global overhead wires and cables market size was valued at USD 184.6 billion in 2025. It is projected to be worth USD 195.95 billion in 2026 and reach USD 291.3 billion by 2034, exhibiting a CAGR of 5.08% during the forecast period. Asia Pacific dominated the overhead wires and cables market with a share of 44.88% in 2025.

Key factors driving the market growth include the modernization and enhancement of current overhead cable infrastructure, technological innovations resulting in high-performance materials and improved insulation, and the global expansion of smart cities and rural electrification.

The growing implementation of smart grid technologies and expansion of renewable energy projects is driving the demand for overhead cables equipped with sensors and communication features, facilitating real-time grid monitoring, predictive maintenance, and optimized energy distribution. A shift toward renewable energy sources is also a factor to drive the market.

Increased electricity usage, spurred by urbanization, industrial growth, and infrastructure development, particularly in the Asia Pacific region (especially China and India), are the major factors contributing to the market share in recent years.

Nexans is one of the leading players operating in the global market, specializing in designing, manufacturing, and supplying cable systems and services. Under its overhead lines solutions, the company offers HVCRC CABLES (High Voltage Composite Reinforced Conductors), ACSS Round wire, Pure aluminum conductors (AAC), and other products for supporting power infrastructure and utility developers. Nexans has a notable presence across markets and sectors due to its strong manufacturing capabilities and distribution network.

OVERHEAD WIRES AND CABLES MARKET TRENDS

Shift Toward Renewable Energy Sources to Boost Market Growth

Rise in renewable energy integration is driving the overhead wires and cables market growth. As solar and wind power projects are often located in remote or rural areas, overhead transmission lines provide a cost-effective and efficient way to connect these generation sites to the main grid. With increasing investments in renewable energy infrastructure globally, especially in emerging economies and remote regions, the demand for overhead wires and cables is rising to support the transmission of clean power over long distances. Thus, a rise in the demand for overhead wires and cables in renewable energy sources such as wind is the key factor driving the market growth.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Infrastructure Development and Urbanization to Drive Market Growth

Infrastructure development and urbanization are significant contributors to the growth of the overhead wires and cables market. As nations invest substantially in the expansion and modernization of infrastructure, including roads, bridges, airports, and urban utilities, the need for dependable electricity transmission rises considerably. Overhead cables are extensively utilized in these initiatives due to their affordability and straightforward installation, particularly in sparsely populated or developing areas. All these factors are expected to boost the market in the coming years.

MARKET RESTRAINTS

Constant Fluctuations in Raw Material Prices to Hinder Market Growth

Fluctuations in the prices of raw materials, especially copper, aluminum, zinc, and steel, represent a major constraint on the development of the overhead wires and cables market. These materials are vital for producing wires and cables due to their electrical conductivity and mechanical characteristics. Price fluctuations impact profit margins, elevate manufacturing expenses, and generate pricing uncertainties for industry participants, potentially resulting in postponed investments and expansion strategies in the sector.

MARKET OPPORTUNITIES

Growing Technological Advancements to Boost Market Growth

Contemporary conductors such as ACSS/TW (trapezoidal wire) and high-temperature low-sag (HTLS) varieties provide increased power capacity, reduced sag, and enhanced tensile strength in comparison to conventional ACSR conductors. These enhancements potentially more than double the capacity of current lines without altering tower frameworks, facilitating quicker and more economical grid expansion.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Material

Lightweight and High Strength Properties Propel Polymer Segment Growth

Based on material, the market is bifurcated into metal and polymer.

Polymer is the dominating segment in the market. Utilities are replacing traditional bare aluminum conductors with covered or insulated polymer conductors to improve grid reliability and reduce outages. Composite core polymer cables are lighter yet stronger than steel-reinforced ones, allowing for longer spans and higher current capacity without sag.

By Product Type

Grid Expansion and Electrification Drive Power Cables Segment Growth

By product type, the market is categorized into power cables, hybrid cables, and communication cables.

Power cables dominate the overhead wires and cables market share. Developing economies (India, Africa, and Southeast Asia) are rapidly expanding their transmission and distribution networks to increase electricity access. Overhead lines are significantly cheaper to install and maintain in an electric grid compared to underground systems.

By Voltage

Cost-Effective Expansion Process Bolsters Low Voltage Segment Growth

By voltage, the market is categorized into low voltage, medium voltage, high voltage, and extra-high voltage.

The low voltage segment is the dominating segment as overhead low voltage wires & cables are cheaper and easier to deploy and maintain than underground systems, especially valuable in developing countries.

By End-User

Expansion of Renewable Energy Sector Fosters Power Transmission and Distribution Segment Growth

By end-user, the market is categorized into aerospace and defense, construction (commercial and residential), IT and telecommunication, power transmission and distribution, oil and gas, consumer electronics, manufacturing, automotive, and others.

The power transmission and distribution segment holds the major share in the market, owing to the expansion of the renewable energy sector and the replacement of aged grids by smart grids and renewable power-sourced grids.

OVERHEAD WIRES AND CABLES MARKET REGIONAL OUTLOOK

The market has been analyzed regionally over five primary regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Asia Pacific

Asia Pacific Overhead Wires and Cables Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the dominating region in the market due to the significant government funding, extensive infrastructure projects such as intelligent cities, transport systems (highways, overpasses, railways), and utility infrastructure that encompasses power production and distribution systems. Programs such as China’s Belt and Road, India’s Smart Cities Mission, and Bharatmala Pariyojana are primary catalysts. The rapid speed of urban development and industrial growth in nations such as China and India is raising the need for power and communication cables to assist residential, commercial, and industrial sectors.

North America

In North America, overhead electrical wires are widely utilized for the transmission and distribution of power. Organizations such as Prysmian Group offer a diverse selection of overhead conductor cables tailored for different transmission and distribution requirements, including medium-voltage and low-voltage cable systems for substantial projects and building wiring.

In the U.S., overhead lines (catenary systems) are employed to provide electricity to electric trains and light rail systems. For instance, the Northeast Corridor utilizes overhead catenary wires for Amtrak trains, and cities such as Cleveland and Boston utilize overhead wires for commuter and rapid transit rail services.

Europe

Europe is experiencing significant upgrades of outdated electrical infrastructure and the development of new commercial and residential properties, which is boosting the demand for overhead wires and cables. The growing implementation of renewable energy initiatives such as offshore wind farms and solar energy necessitates large overhead cable networks for power transmission, fueling market expansion.

Latin America

Privatization in telecommunications and utilities has resulted in several providers setting up parallel infrastructure contributing to the Latin America’s market growth. When customers change providers, additional cables are installed without taking out the existing ones, leading to thick overhead clusters.

Underground cabling continues to be restricted due to elevated installation expenses (in certain instances, up to 10 times costlier than overhead lines) and maintenance difficulties. Many nations focus on broadening access instead of aesthetics, particularly in swiftly developing urban regions.

Middle East & Africa

Rapid urbanization and industrial expansion in the region are increasing the need for overhead wires and cables to support new residential, commercial, and industrial structures. Smart city projects, particularly in Gulf nations such as Saudi Arabia, UAE, and Qatar, necessitate sophisticated cable solutions for energy management, communication, and intelligent lighting systems.

Increasing electricity usage resulting from population increase and urban development requires the expansion of power plants, transmission lines, and substations. The rise of renewable energy initiatives such as solar and offshore wind farms also stimulates the need for specialized power and submarine cables.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Rising Investments to Make More Effective Overhead Wires and Cables Drive Market Growth

Prysmian is making significant investments to aid the modernization and growth of power distribution and transmission networks, especially in North America, where outdated infrastructure and increasing energy demand necessitate enhancements. For instance, Prysmian revealed plans to invest USD 100 million and USD 245 million to enhance production capacity for medium and high voltage cables to address these requirements.

In March 2025, Ravin Group, engaged in cable manufacturing, declared plans to invest USD 5.86 billion over the next five years to expand capacity. This investment is expected to boost production capacity by 300-400% to meet the rising demands from metros, airports, renewable energy projects, and industrial applications.

List of Key Overhead Wires and Cables Companies Profiled

- Prysmian (Italy)

- Ravin Group (India)

- Ducab HV (UAE)

- Nexans (France)

- KEC International (India)

- Southwire Company, LLC (U.S.)

- Shandong Dingcheng Liye Materials Co., Ltd. (China)

- NKT Cables (Denmark)

- Gulf Cables and Electrical Industries Group Co (Kuwait)

- Atlas Wire, Corp (U.S.)

- Sumitomo Electric Industries, Ltd. (Japan)

- HellermannTyton (U.K.)

- Allied Cables Ltd. (U.K.)

- Anixter (U.S.)

- Falcon Cables (New Delhi)

- alfanar Group (Saudi Arabia)

KEY INDUSTRY DEVELOPMENTS

- In April 2025, Ducab Group introduced its newest innovation, the High Voltage (HV) Fiber Optic cable, at the Middle East Energy 2025 exhibition in Dubai. Being the first of its type in the GCC, this groundbreaking product will provide smarter, greener, and more robust power solutions to address the increasing global energy demand and diversification.

- In March 2025, Sumitomo Electric Industries, Ltd. received a framework contract for HVDC cables from National Grid to supply upcoming HVDC subsea power cable projects in the U.K. The cables will be manufactured at Sumitomo’s facility in the U.K., thereby enhancing the U.K. economy, its employment initiatives, and Energy Transition objectives.

- In October 2024, Denmark-based power cable producer and installation firm NKT is increasing its footprint in India and has opened a new office in Chennai. Worldwide, NKT has elevated its order backlog of high-voltage projects to USD 12.89 billion by the conclusion of the second quarter of 2024.

- In August 2023, Southwire received the contract for supplying a segment of the underground power cables for Champlain Hudson Power Express (CHPE) from NKT, the turnkey cable supplier for the project, and the owner of the cable system technology, as the organization maintains its emphasis on strategic development and sustainability.

- In June 2020, WESCO International, Inc., a top provider of business-to-business (B2B) distribution, logistics services, and supply chain solutions, declared that it had finalized its merger with Anixter International Inc., resulting in a leading, industry-preeminent global B2B distribution and supply chain solutions organization.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service process, competitive landscape, and the leading source of the overhead wires and cables. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.08% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Product Type

|

|

|

By Voltage

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 184.6 billion in 2025.

In 2025, the Asia Pacific market value stood at USD 82.85 billion.

The market is expected to exhibit a CAGR of 5.08% during the forecast period of 2026-2034.

The power transmission & distribution segment leads the market by end user.

Infrastructure development and urbanization to drive market growth

Some of the top major players in the market are Prysmian Group, Nexans, and Southwire Corporation.

Asia Pacific holds the largest share of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us