Ovulation Testing Kits Market Size, Share & Industry Analysis, By Device Type (Line Indicator Devices, Digital Devices, and Microscopic Devices), By Sample Type (Urine, Blood, and Saliva), By End-user (Hospitals & Clinics, Fertility Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

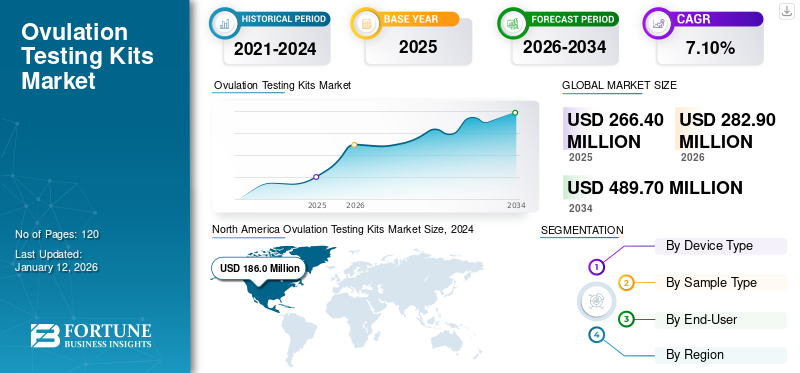

The global ovulation testing kits market size was valued at USD 266.4 million in 2025. The market is projected to grow from USD 282.9 million in 2026 to USD 489.7 million by 2034, exhibiting a CAGR of 7.10% during the forecast period. North america dominated the ovulation testing kits market with a market share of 74.20% in 2025.

Ovulation testing kits are used to understand the menstrual cycle and ovulation period of women who are trying to conceive. These tests help in analyzing their fertility window and the best time for planning their pregnancy. They are majorly used by women suffering from Polycystic Ovary Syndrome (PCOS) as they experience symptoms, such as delayed ovulation and infertility. Therefore, the increasing prevalence of PCOS is fueling the demand for these tests.

- For instance, as per the data published by the National Center for Biotechnology Information (NCBI) in 2022, in India, the prevalence of polycystic ovary syndrome (PCOS) as per the Androgen Excess Society (AES) was around 10% among women aged 15-45 years. This proportion was 5.8% as per the National Institutes of Health (NIH).

Moreover, the increasing adoption of home-based sample collection kits for ovulation testing is also fueling the ovulation testing kits market growth.

During the COVID-19 outbreak in 2020, the market experienced slow growth. This was due to the supply chain disruptions, limited availability of resources, and decrease in the number of people visiting their gynecologists. However, during the second half of 2020, the demand for home-based ovulation testing kits increased.

Ovulation Testing Kits Market Overview & Key Metrics

Market Size & Forecast

- 2025 Market Size: USD 266.4 million

- 2026 Market Size: USD 282.9 million

- 2034 Forecast Market Size: USD 489.7 million

- CAGR: 7.10% from 2026–2034

Market Share

- North America dominated the global ovulation testing kits market with a 74.20% share in 2025, primarily due to the high prevalence of Polycystic Ovary Syndrome (PCOS) and growing awareness regarding fertility health and at-home testing. The presence of key players such as Proov, Ro, and Everly Health, Inc. further supports market dominance.

- By device type, digital devices held the leading market share in 2024, driven by their higher efficiency, faster and more accurate results, and easy-to-use interface. These features have increased their adoption among women seeking convenient and reliable ovulation tracking.

Key Country Highlights

- Japan: Market growth is driven by increased awareness of fertility tracking, aging demographics, and the demand for advanced, user-friendly digital ovulation testing solutions that meet high quality and safety standards.

- United States: The country leads regional market share due to the high rate of PCOS, strong consumer preference for home-based fertility kits, and active involvement of digital health startups. Supportive healthcare coverage and regulatory approvals for at-home testing have further expanded access.

- China: Demand is driven by increased cases of infertility and rising awareness about reproductive health. Government health initiatives focused on family planning and maternal care have helped promote usage of ovulation testing products.

- Europe: Growth is supported by the strong presence of leading manufacturers, such as SPD Swiss Precision Diagnostics GmbH and Geratherm Medical AG. The region’s high fertility treatment adoption rate and focus on digital healthcare innovations contribute to market expansion.

Ovulation Testing Kits Market Trends

Increasing Focus of Market Players on New Product Launch

Rising awareness about Polycystic Ovary Syndrome (PCOS) and ovulation testing devices is fueling the product demand among women who are planning their pregnancy. To fulfill this increasing demand, market players have increased their focus on new product launches.

- For instance, in May 2023, Fridababy, LLC, a consumer goods company, announced the launch of a new line of fertility products, which includes an ovulation prediction test, at-home insemination set, and ovulation & pregnancy test + track set. The ovulation prediction test offered by the company is affordable and easy to understand.

Moreover, market players have also been emphasizing on collaborating with other players to enhance the distribution of their products globally.

- For instance, in July 2023, Proov and Quest Diagnostics Incorporated collaborated to enhance the accessibility of Confirm PdG, an ovulation testing device manufactured by Proov, among women who are planning their pregnancy. It is an at-home sample collection kit for fertility testing.

Download Free sample to learn more about this report.

Ovulation Testing Kits Market Growth Factors

Increasing Prevalence of Polycystic Ovary Syndrome (PCOS) to Fuel Demand for Ovulation Testing

Polycystic Ovary Syndrome (PCOS) is a hormonal disorder that causes enlarged ovaries and cysts on the outer side of the ovaries. PCOS symptoms include irregular menstrual cycle, unpredictable ovulation, and infertility among women. Moreover, women suffering from PCOS face issues while conceiving.

The increased prevalence of PCOS has resulted in a rising need for ovulation testing kits as they help women with PCOS determine their fertility window and ovulation dates, which is helpful in pregnancy planning.

- For instance, according to the data published by the World Health Organization (WHO) in June 2023, Polycystic Ovary Syndrome (PCOS) affects 8–13% of reproductive-aged women globally. Moreover, as per the same source, PCOS is the leading cause of infertility among women.

Moreover, the high accuracy rate of these kits has also been fueling its adoption among the female population suffering from PCOS. For instance, as per the data published by Cloudnine Fertility in November 2022, the prediction offered by ovulation testing kits can be around 97% accurate.

RESTRAINING FACTORS

Limitations Associated with Use of Ovulation Testing Kits to Hinder Market Growth

The increasing prevalence of female fertility disorders is fueling the demand for ovulation kits. At-home ovulation testing kits are quite helpful for women who are planning their pregnancy as they can increase their chances of conceiving by tracking their ovulation period. However, there are certain clinical limitations that can be responsible for negative or false results.

- For instance, in June 2023, according to an article published by Dotdash Meredith, a digital media company, ovulation tests lack accuracy if used in coordination with medications, such as hormonal birth control, fertility drugs, and antibiotics with tetracycline.

- Similarly, according to an article by Zeeva Clinic in August 2023, ovulation prediction kits are 99% effective in detecting a surge in LH plasma. However, they are not able to detect ovulation or fertility with 100% accuracy.

Such limitations associated with the use of at-home ovulation testing kits can hinder their adoption globally.

Moreover, these kits do not assure 100% pregnancy as they only help track the ovulation and do not track the viability of eggs. These factors can hinder their adoption among women.

Ovulation Testing Kits Market Segmentation Analysis

By Device Type Analysis

Various Advantages Associated with Digital Devices Boosted Their Market Dominance

Based on device type, the market is segmented into line indicator devices, digital devices, and microscopic devices.

The digital devices segment will account for 89.57% market share in 2026. The various advantages associated with these devices, such as higher efficiency, faster & more accurate results, reliability, and easy readability are responsible for the segment’s robust growth. Moreover, these devices are increasingly becoming popular as they are easy to use. They are also much easier to read, and the results can be interpreted quickly.

The line indicator devices segment is expected to record the fastest CAGR during the forecast period. The high growth of the segment is attributed to the comparatively cheaper cost of these devices and their easy usability as these kits can be used conveniently at home.

Furthermore, the microscopic devices segment is projected to witness substantial growth during the forecast period. The growth of this segment is attributed to the devices’ easy-to-read results, reusability, and long-lasting factors.

To know how our report can help streamline your business, Speak to Analyst

By Sample Type Analysis

Increasing Penetration of Blood-based Ovulation Testing Kits Owing to its Higher Accuracy is Responsible for the Segment’s Dominance

Based on sample type, the market is segmented into urine, blood, and saliva.

The blood segment is anticipated to hold a dominant market share of 89.15% in 2026. The segment’s dominance is attributed to the increasing use of blood-based ovulation tests as these tests are more accurate and sample collection can be done at home. Also, the results are available at home with the help of mobile applications, which makes the testing process easy and hassle-free.

The urine segment is expected to record a significant CAGR during the forecast period owing to the market players’ increasing focus on new product launches to fulfill the increasing demand for these devices.

- For instance, in June 2020, Ro, through its subsidiary Modern Fertility, announced the launch of a urine ovulation test that detects the Luteinizing Hormone (LH) level in the urine to predict the ovulation period.

By End-User Analysis

Increasing Number of Fertility Centers Globally Fueled Product Adoption

Based on end-user, the market is segmented into hospitals & clinics, fertility centers, and others.

In 2026, the fertility centers segment is projected to lead the market with a 57.72% share. The growth of the segment is attributed to the increasing establishment of fertility clinics globally.

- For instance, in March 2022, CK Birla Healthcare Pvt. Ltd. launched its fertility clinic, Birla Fertility and IVF in Delhi, India. The center was developed with the aim of fulfilling the unmet demand for fertility treatments.

The hospitals & clinics segment is anticipated to record a significant CAGR during the forecast period. Rising awareness regarding ovulation testing and the increasing preference of patients for undergoing ovulation tests and treatments at the same place are responsible for the segment’s growth in the market.

REGIONAL INSIGHTS

North America Ovulation Testing Kits Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Increasing Prevalence of PCOS is Responsible for Market’s Strong Growth in North America

In terms of geography, the global market is studied across North America, Europe, Asia Pacific, and the rest of the world.

North America dominated the global market in 2026 by accounting for a significant share worth USD 210.4 million. The market’s growth in North America is attributed to the increasing prevalence of PCOS in the region and rising awareness regarding fertility testing and treatment. The U.S. market is estimated to reach USD 204.5 million by 2026.

- For instance, as per the data published by the Office on Women's Health, around 10% of women aged between 15-44 years face difficulty in getting pregnant.

Europe accounted for a substantial market share in 2023. The market’s growth in the region is attributed to the strong presence of reputed companies, such as Geratherm Medical AG, SPD Swiss Precision Diagnostics GmbH, and The Boots Company PLC among others. The UK market is estimated to reach USD 5.5 million by 2026, while the Germany market is estimated to reach USD 15 million by 2026.

Asia Pacific is anticipated to record a significant CAGR during the forecast period. The growth of the market in the region is attributed to the increasing prevalence of infertility in China and India. Moreover, rising awareness regarding ovulation testing is also responsible for the market’s growth in the region. The Japan market is estimated to reach USD 5.2 million by 2026, the China market is estimated to reach USD 3.5 million by 2026, and the India market is estimated to reach USD 2.7 million by 2026.

The market in the rest of the world is expected to register a substantial CAGR during the forecast period. The market’s growth is attributed to the increasing penetration of key players in the untapped regions.

List of Key Companies in Ovulation Testing Kits Market

Market Players to Focus on Mergers and Acquisitions to Enhance their Product Portfolio

Market players, such as Piramal Pharma Ltd., SPD Swiss Precision Diagnostics GmbH, Proov, and Everlywell, Inc. accounted for a significant global ovulation testing kits market share in 2023. The strong presence of these players in the market is attributed to their increasing focus on new product launches.

- For instance, in March 2020, Proov, a developer of at-home fertility and hormone tests, announced that the U.S. Food and Drugs Administration (FDA) had approved its at-home ovulation testing kit, PdG. The test detects the progesterone metabolite in urine, which helps interpret the ovulation period.

Moreover, other players, such as Alfa Scientific Designs, Inc. and Wondfo, among others, have been focusing on enhancing their product portfolio to strengthen their presence in the market.

LIST OF KEY COMPANIES PROFILED:

- Piramal Pharma Ltd. (India)

- Geratherm Medical AG (Germany)

- SPD Swiss Precision Diagnostics GmbH (Switzerland)

- The Boots Company PLC (U.K.)

- Alfa Scientific Designs, Inc. (U.S.)

- Proov (U.S.)

- Ro (U.S.)

- Wondfo (China)

- AdvaCare Pharma (U.S.)

- Everly Health, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023 – Proov signed a distribution agreement with 2SAN GLOBAL LIMITED for the distribution of the latter’s at-home fertility tests. With this agreement, 2SAN GLOBAL LIMITED strengthened its product distribution in the U.S.

- May 2023 – Fridababy, LLC, a consumer goods company, announced the launch of a new line of fertility products, which includes an ovulation prediction test, at-home insemination set, and ovulation & pregnancy test + track set.

- January 2022 – Kindbody announced the launch of its at-home fertility test kits, Kind at Home, for both men and women.

- December 2021 – Proov announced that it had raised funds worth USD 9.7 million for an at-home ovulation testing platform.

- May 2021 – Ro, a digital elective care and telemedicine provider, announced the acquisition of Modern Fertility, a reproductive healthcare company, to enhance its product offerings in female fertility.

REPORT COVERAGE

The report provides a detailed competitive landscape. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on key points, such as new product launches in the market. Furthermore, the report covers regional analysis of different segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.10% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Device Type

|

|

By Sample Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 282.9 million in 2026 and is projected to reach USD 421.5 million by 2034.

In 2025, the market value in North America stood at USD 186.0 million.

The market is predicted to exhibit a CAGR of 7.10% during the forecast period of 2026-2034.

The digital devices segment is leading the market by device type.

The increasing prevalence of Polycystic Ovary Syndrome (PCOS) and rising awareness regarding ovulation testing kits are fueling the market’s growth.

Piramal Pharma Ltd, SPD Swiss Precision Diagnostics GmbH, Proov, and Everlywell, Inc. are the top players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us