Oxo Biodegradable Bag Market Size, Share & Industry Analysis, By Material (Polyethylene (PE), Polypropylene (PP), Polystyrene (PS), Polyethylene Terephthalate (PET), and Others), By Bag Type (Shopping Bags, Tote Bags, Garbage Bags, Produce Bags, and Mailing Bags), By End Use (Food & Beverages, Pharmaceuticals & Healthcare, Electronics & Home Appliances, Personal Care & Cosmetics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

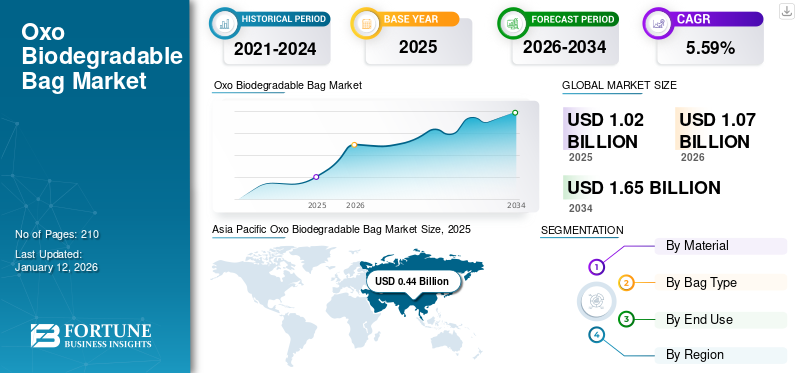

The global oxo biodegradable bag market size was valued at USD 1.02 billion in 2025. It is projected to be worth USD 1.07 billion in 2026 and reach USD 1.65 billion by 2034, exhibiting a CAGR of 5.59% during the forecast period. Asia Pacific dominated the oxo biodegradable bag market with a market share of 43.12% in 2025.

Oxo biodegradable bag is a plastic bag that has been made with a catalyst additive to break down more quickly when exposed to certain conditions. These bags are often used for single-use items such as carrier bags, produce bags, and straws and can be easily recycled like other plastic bags.

Symphony Environmental Ltd. and Natur-Tec are the leading manufacturers, accounting for the largest share in the global oxo biodegradable bag market.

Global Oxo Biodegradable Bag Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 1.02 billion

- 2026 Market Size: USD 1.07 billion

- 2034 Forecast Market Size: USD 1.65 billion

- CAGR: 5.59% from 2026–2034

Market Share:

- Asia Pacific dominated the oxo biodegradable bag market with a 43.12% share in 2025, driven by rapid industrialization, rising e-commerce activity, and increasing government regulations on single-use plastics in countries like China and India.

- By material, polyethylene (PE) is expected to retain the largest market share in 2025, supported by its low cost, durability, and widespread use in carrier and produce bags across retail and logistics sectors.

Key Country Highlights:

- United States: Market growth is driven by increasing environmental regulations, consumer preference for sustainable packaging, and adoption in sectors such as food, retail, and logistics.

- China: Government initiatives promoting biodegradable alternatives to plastic and rapid expansion in retail and e-commerce contribute significantly to regional market growth.

- Germany: Although oxo-biodegradable bags face restrictions, ongoing discussions around sustainability in packaging and innovation in materials maintain steady market presence.

- Brazil: Consumer demand for eco-friendly alternatives and increased use in food and personal care packaging support moderate growth in Latin America.

- Saudi Arabia: Expansion in retail and packaging industries and growing awareness of sustainable solutions contribute to rising adoption of oxo biodegradable bags in the region.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Environmental Concerns Drives the Market Growth

Oxo-biodegradable packaging bags are designed to degrade more quickly than conventional plastic bags owing to the usage of additives, typically metal salts, that promote oxidation. These bags have gained attention as a potential solution to the environmental issues posed by traditional plastics, which can take hundreds of years to break down. However, the use of oxo-biodegradable bags has sparked debate and led to various drivers and trends shaping their development and adoption. Growing awareness of plastic pollution, particularly in oceans, has driven demand for more sustainable alternatives. These bags promise to degrade faster than traditional plastic, potentially reducing plastic and the time it takes to remain in the environment, thus driving the global oxo biodegradable bags market growth.

Growing Environmental Regulations Enhances the Market Growth

Governments around the world are tightening regulations on plastic waste to encourage the use of biodegradable alternatives. Countries and regions (e.g., the European Union,U.S., and parts of Asia) are implementing bans or taxes on single-use plastics, creating a significant opportunity for OXO-biodegradable bags as an eco-friendly solution. There is increasing pressure on manufacturers to produce eco-friendly packaging solutions and reduce plastic usage, which has given rise to new technologies, including oxo-biodegradable additives.

Many companies, particularly in retail and consumer goods, are setting ambitious sustainability targets. Switching to oxo-biodegradable bags can help these companies reduce their carbon footprint and demonstrate a commitment to environmental stewardship, boosting market growth.

MARKET RESTRAINTS

Incomplete & Slow Degradation Limits Market Development

Oxo-biodegradable bags break down into smaller pieces of plastic rather than completely degrading into non-toxic materials. These fragments can contribute to the formation of microplastics in the environment, which persist for years and pose a threat to marine life and ecosystems. Moreover, in ideal conditions (high heat and direct sunlight), these bags may degrade faster. However, in many real-world environments, such as landfills or the ocean, they may not degrade at all or do so very slowly as the degradation process often requires specific conditions that are not present in all environments. The slow degradation in real-world conditions and the microplastic formulation are factors that could hamper the global oxo-biodegradable bags market growth.

MARKET OPPORTUNITIES

Rising Collaborations and Technological Advancements to Present Growth Opportunities

Companies involved in the production of biodegradable bags are increasingly seeking partnerships with packaging manufacturers, retailers, and distributors to scale production and reach new markets. Collaborations between governments, businesses, and environmental organizations can further increase market penetration. Ongoing research is focused on improving the formulation of oxo-biodegradable bags to reduce costs while enhancing their biodegradability. Technological advancements that improve the durability, strength, and cost-effectiveness of these bags offer opportunities for manufacturers, further driving oxo biodegradable bag market growth.

MARKET CHALLENGES

High Upfront Costs & Potential for Misuse Challenges the Market Growth

Oxo-biodegradable bags are generally more expensive than regular plastic bags due to the additives used in their production. This price difference can be a barrier to their widespread adoption, especially in countries where cheap plastic bags are prevalent. Moreover, the availability of oxo-biodegradable bags may lead to a false sense of security, encouraging people to use them as an alternative to more sustainable options. Oxo-biodegradable bags are often witnessed as a less ideal alternative compared to other biodegradable options, such as compostable bags made from plant-based materials (e.g., PLA or PHA). As more sustainable solutions gain traction, oxo-biodegradable bags may face challenges in terms of market demand. Asia Pacific witnessed a growth from USD 396.84 million in 2023 to USD 417.26 million in 2024.

Download Free sample to learn more about this report.

OXO BIODEGRADABLE BAG MARKET TRENDS

Growing Consumer Awareness and Alternatives Emerges as a Key Trend

As consumers become more eco-conscious, demand for sustainable packaging options is rising. However, many consumers are skeptical about claims made by manufacturers of oxo-biodegradable bags, which could influence purchasing decisions. There is a growing preference for biodegradable, compostable, or recyclable materials that can be more easily integrated into waste management systems, such as plant-based plastics. Oxo-biodegradable bags are often witnessed as a cost-effective alternative to other biodegradable or compostable options, which can be more expensive to produce. The technology is relatively simple to implement into existing plastic production processes, making it attractive to manufacturers who want to meet sustainability goals without significant investment, thus emerging as a key market trend.

IMPACT OF COVID-19 ON THE MARKET

The COVID-19 pandmeic affected every sector, both positively and negatively, and altered individuals' lifestyles and dietary choices. Major companies have contributed to the circular economy by reducing their impact on landfills and marine environments during the pandemic. However, the use of plastic during COVID-19 significantly increased during the outbreak, which influenced market growth.

SEGMENTATION ANALYSIS

By Material

Polyethylene (PE) Segment Leads due to its Ability to Protect Products During Shipping and Production

Based on material, the market is segmented into polyethylene (PE), polypropylene (PP), polystyrene (PS), polyethylene terephthalate (PET), and others.

Polyethylene (PE) is the dominating material segment and will experience significant growth. Polyethylene bags are strong and resistant to rips and tears, making them ideal for protecting products during shipping and production. Moreover, the bags produced with polyethylene material are cheaper to produce than other materials, thus enhancing the segment's growth. The segment held 36.45% of the market share in 2026.

Polypropylene (PP) is the second-dominating segment and will experience steady growth in the coming years. Polypropylene material is strong, can withstand heavy loads, and is ideal for packaging heavy or fragile items.

By Bag Type

Rising Demand in the Food Sector Propels Shopping Bags Segment Growth

Based on bag type, the market is categorized into shopping bags, tote bags, garbage bags, produce bags, and mailing bags.

The shopping bags segment is the dominant bag type segment. Shopping bags and they are used in the food industry have different uses, including carrying groceries, packaging fresh food, and transporting other goods. Moreover, these bags are eco-friendly, durable, and cost-effective, which has led to increasing demand in the food sector, thus driving the segment's growth. The segment is expected to capture 42.18% of the market share in 2026.

Garbage bags are the second-leading bag type segment and are estimated to witness significant growth with a CAGR of 3.11% during the forecast period (2025-2032). Garbage bags are a cost-effective way to dispose of waste and maintain cleaniness. They are used in homes and businesses to store, remove, and handle waste, thus boosting the growth of the segment.

By End Use

To know how our report can help streamline your business, Speak to Analyst

Potential Benefits Offered by Oxo-Biodegradable Bags Thrives Food and Beverages Segment Growth

Based on end use, the market is classified into food & beverages, pharmaceuticals & healthcare, electronics & home appliances, personal care & cosmetics, and others.

Food and beverages segment held the largest market share in the end use segment. Oxo-biodegradable plastics are safe for long-term contact with food at temperatures up to 40°C. They are also compliant with FDA requirements in the U.S. Some oxo-biodegradable bags contain an active agent that slows down the rotting process and keeps fruits and vegetables fresh for longer.

- The segment is anticipated to hold 42.84% of the market share in 2026.

Personal care & cosmetics segment is a rapidly growing. Oxo-biodegradable bags can be used to dispose of hygiene products in an eco-friendly and discreet way. They are tear and tamper-proof and have an adhesive seal to lock in odors and prevent spills, thus enhancing the segment's growth. This segment is poised to grow with a CAGR of 3.43% during the forecast period (2025-2032).

OXO BIODEGRADABLE BAG MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Oxo Biodegradable Bag Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Growing Sustainability Concerns Boosts Oxo Biodegradable Bag Market Growth

Asia Pacific dominated the market with a valuation of USD 0.44 billion in 2025 and USD 0.46 billion in 2026. Rapid industrialization and urban development have caused significant environmental issues, especially regarding plastic waste disposal. As the e-commerce sector expands quickly, there is an increasing demand for sustainable packaging, thus boosting its usage in logistics and retail. China is expected to hold USD 0.17 billion in 2026.

- In September 2021, The Chinese government has enforced strict measures to decrease plastic consumption, including promoting the use of biodegradable alternatives.

India is poised to be valued at USD 0.13 billion in 2026, while Japan is set to reach USD 0.06 billion in the same year.

North America

Government Initiatives and Growing Awareness Among Consumers Drive the Regional Market Growth

North America is the second-dominating region and is expected to hold USD 0.29 billion in 2026, exhibiting a CAGR of 5.12% during theGovernment programs aimed at minimizing plastic waste and raising consumer awareness regarding sustainable packaging and products are fueling the expansion of the oxo biodegradable bag market. These trends in oxo-biodegradable plastic packaging are advantageous for manufacturers. Conventional plastics, often referred to as standard plastics, exert a significant effect on the environment due to their extended lifespans, thus boosting the demand for oxo-biodegradable bags in the region.

In U.S. the market is expanding consistently, propelled by heightened environmental consciousness and the need for sustainable packaging options. This growth is supported by tighter regulations regarding plastic usage, an increasing consumer inclination towards eco-friendly options, and improvements in bag durability and print quality. Major sectors boosting demand consist of food and beverage, retail, and logistics. The U.S. market is estimated to grow with a valuation of USD 0.22 billion in 2026.

Europe

Ban on Plastic Usage Influences Europe Market Growth

Europe is the third-largest contributor to the market anticipated to gain USD 0.21 billion in 2026. In Europe, oxo-biodegradable bags are largely prohibited due to worries regarding their environmental effects. The EU views them as not genuinely biodegradable but rather decomposing into harmful microplastic. The U.K. market is poised to expand with a value of USD 0.05 billion in 2026.

- The European Union has implemented a directive that specifically prohibits oxo-degradable plastics, such as bags, based on evidence showing that they break down into microplastic instead of completely biodegrading.

Germany is expected to attain USD 0.07 billion in 2026, while France is projected to be valued at USD 29.41 million in 2025.

Latin America

Growing Consumer Demand for Sustainable Products Drives the Market Growth

Latin America is the fourth largest market set to reach USD 0.06 billion in 2026. The region will experience steady growth in the projected period. Consumers are becoming more environmentally conscious and are opting for products that reduce environmental impact. As sustainability becomes a key purchasing criterion, businesses and individuals are turning to OXO-biodegradable bags as a more sustainable option compared to traditional plastic bags.

Middle East & Africa

Adoption in Retail and Packaging Sectors Propels Market Growth

The Middle East region will foresee significant growth in the projected period. The retail and packaging sectors are major consumers of plastic bags. The transition to oxo-biodegradable bags offers a chance for companies to differentiate themselves by adopting more sustainable packaging solutions. It is particularly relevant for supermarkets, food packaging, and e-commerce companies looking to meet sustainability goals. Saudi Arabia is foreseen to stand at the valuation of USD 1.42 million in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global oxo biodegradable bag market is highly fragmented and competitive, with significant players are dominating the market by offering innovative packaging solutions in the packaging industry. These major market players constantly focus on expanding their customer base across regions by innovating their existing wide range of products.

Major players in the industry include Symphony Environmental Ltd., Natur-Tec, Airpack Systems, Neoteric Packaging, Welpack Industries Private Limited, and Green Tech Packs. Other companies operating in the market are focused on analyzing market trends and delivering advanced packaging solutions.

List of the Key Companies Profiled in the Report

- Symphony Environmental Ltd. (U.K.)

- Natur-Tec (U.S.)

- Airpack Systems (U.K.)

- Neoteric Packaging (India)

- Welpack Industries Private Limited (India)

- Green Tech Packs (India)

- ECOPRO (China)

- Biopacktech Co., Ltd. (China)

- Proton Polymer (India)

- Global Polybags Industries Pvt. Ltd (India)

- Balson Industries (India)

- Stars Packaging (China)

- Leadpacks (Xiamen) Environmental Protection Packing Co., Ltd. (China)

- Euphoria Packaging Private Limited (India)

- Shree Laxmi Plastics (India)

KEY INDUSTRY DEVELOPMENTS

- October 2024- Stora Enso Oyj launched Beyond Board Packaging Services, offering sustainability training and circularity assessments to clients.

- October 2024- ProAmpac committed to the Science-Based Targets initiative, aiming for net-zero emissions by 2050, reflecting its dedication to environmental sustainability.

- November 2023- Reynolds Consumer Products, known for Hefty Ultra Strong trash bags, revealed that the Hefty Ultra Strong Fabuloso Scented tall kitchen trash bags have been acknowledged as one of the 2022 New Product Pacesetters. The 28th annual report from Circana highlights the leading new product introductions in the food, beverage, and non-food sectors.

- October 2023- Stripform Packaging introduced their newly designed oxo-biodegradable bags, suitable for use as ziplock bags, courier bags, boutique bags, and pharmaceutical bags. The newly developed oxo-biodegradable bags break down naturally within two years without leaving any toxic residue.

- September 2023- Symphony Environmental Technologies Plc, the worldwide experts in innovations that enhance the intelligence, safety, and sustainability of plastic and rubber products, reported that the Republic of Yemen has begun implementing laws enacted in 2010, which were postponed because of the civil war.

REPORT COVERAGE

The market research report provides a detailed market analysis, focuses on key aspects, such as top key players, competitive landscape, product/service types, market segments, Porter's five forces analysis, and leading segments of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.59% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Bag Type

|

|

|

By End Use

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 1.02 billion in 2025.

The market is likely to grow at a CAGR of 5.59% over the forecast period.

By end use, the food and beverages segment led the market.

The Asia Pacific market size stood at USD 0.44 billion in 2025.

Increasing environmental concerns and growing environmental regulations are key factors driving market growth.

Some of the top players in the market are Symphony Environmental Ltd., Natur-Tec, Airpack Systems, Neoteric Packaging, Welpack Industries Private Limited, Green Tech Packs, and others.

The global market size is expected to reach USD 1.65 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us