Oyster Sauce Market Size, Share & Industry Analysis, By End-User (Household, Prepared Food, and Processed Food), By Distribution Channel (Convenience Stores, Supermarkets, Hypermarkets, HoReCa, QSR, and Online Sales Channel), and Regional Forecast, 2026-2034

Oyster Sauce Market Size and Future Outlook

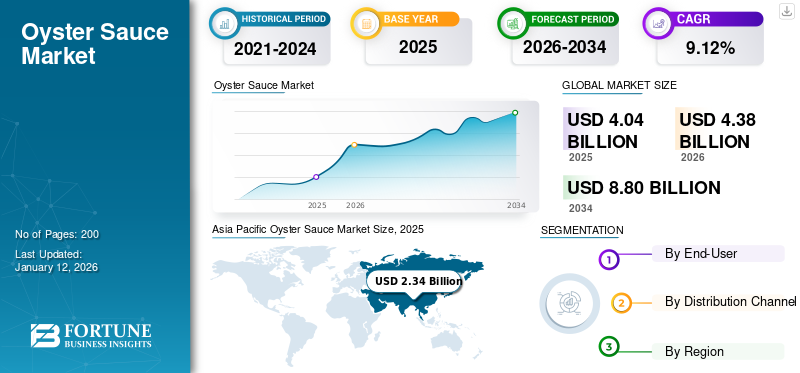

The global oyster sauce market size was valued at USD 4.04 billion in 2025 and is projected to grow from USD 4.38 billion in 2026 to USD 8.8 billion by 2034, exhibiting a CAGR of 9.12% during the forecast period. Asia Pacific dominated the oyster sauce market with a market share of 58.08% in 2025.

Oyster sauce is mainly a salty-flavored seasoning that is usually used in stir-fries and in soups, stews, marinades, and as a drizzle over steamed vegetables. It is usually thick and salty, has a rich taste, umami, and is slightly sweet. This sauce is made from oyster extracts, soy sauce, and various seasonings, providing a rich umami flavor that enhances a wide range of dishes, particularly stir-fries and marinades. The growth of the market is driven by increasing consumer interest in umami-rich flavors and the rising popularity of Asian cuisines worldwide. This trend is complemented by a growing middle class in various regions, particularly in Asia, which has led to higher disposable incomes and an increased willingness to experiment with diverse culinary flavors.

Global Oyster Sauce Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 4.04 billion

- 2026 Market Size: USD 4.38 billion

- 2034 Forecast Market Size: USD 8.8 billion

- CAGR: 9.12% from 2025–2034

Market Share:

- Asia Pacific dominated the oyster sauce market with a 58.08% share in 2025, driven by rich culinary traditions, rising popularity of Asian cuisines, and a growing middle class with higher disposable incomes.

- Prepared foods led the end-user segment due to the growing demand for convenient, ready-to-cook meal solutions that incorporate sauces like oyster sauce for enhanced flavor.

Key Country Highlights:

- United States: Growth fueled by increased restaurant openings and the rising popularity of Asian cuisines in fast food and HoReCa sectors.

- China, Thailand, South Korea, Japan (Asia Pacific): Leading in product consumption due to strong cultural integration and preference for umami-rich flavors in traditional and fusion dishes.

- India: Rising disposable incomes and an expanding middle class are boosting demand for high-quality condiments such as oyster sauce.

- Canada: Market growth driven by strong demand for convenient cooking solutions and increased adoption of Asian sauces.

- Germany, Italy, France (Europe): Growing interest in ethnic cuisines and investments by major sauce manufacturers are enhancing product availability.

- Brazil, Argentina: Growth supported by rising Asian immigrant populations and local demand for fusion cuisine.

- UAE, Saudi Arabia (Middle East & Africa): High expatriate populations and growing preference for Asian flavors are fueling increased oyster sauce consumption.

Market Dynamics

Market Driver

Rising Demand for Asian Cuisines in the Food Service Industry to Foster Market Growth

The expansion of restaurants is a significant driver of the market growth. According to the National Restaurant Association report, in 2023, 10,608 new restaurants opened in the U.S., which was 5.7% more than in 2022. This substantial growth reflects a broader trend of increasing disposable incomes and changing consumer preferences toward dining out. As dining establishments continue to proliferate and diversify their culinary offerings, the demand for versatile ingredients such as oyster sauce is likely to increase. The growing global interest in Asian cuisines, particularly Chinese and Thai, has further heightened the demand for authentic ingredients such as oyster sauce. Restaurants are incorporating these flavors into their menus to attract customers who seek diverse culinary experiences.

Market Restraint

Increasing Shellfish Allergies Among Consumers to Hamper Product Sales

The global market is facing significant challenges due to increasing shellfish allergies among consumers. This trend is affecting market potential and limiting sales opportunities for manufacturers. According to the Regents of the University of California, Shellfish allergies are among the most common food allergies, affecting approximately 3% of adults and over 1% of children in the U.S. in 2022. These allergies can lead to severe reactions, including symptoms such as itching, swelling, and respiratory difficulties upon exposure to shellfish products, including oyster sauce.

Market Opportunity

Growing Merger & Acquisition Strategies to Pave Growth Opportunities

As the market becomes more competitive, merger and acquisition provide companies with opportunities to consolidate their positions. By acquiring competitors or complementary businesses, firms can increase their global oyster sauce market share and reduce competition. This strategy is crucial in a market where consumers are increasingly seeking unique flavors and health-conscious options. For example, acquiring smaller brands or startups focused on organic products can help established players diversify their portfolios and meet the growing demand for healthier alternatives. For instance, in December 2020, Fraser & Neave Holdings Bhd (F&N), a Thai-Singaporean food and beverage company, acquired three companies for USD 14.79 million. This acquisition includes Sri Nona Food Industries Sdn Bhd, Sri Nona Industries Sdn Bhd, and Lee Shun Hing Sauce Industries Sdn Bhd. The acquisition would enhance F&N's portfolio with established Malaysian brands known for producing rice cakes, condiments (including sauces), beverages, and desserts under the "NONA" and "Lee Shun Hing" brands.

Market Challenge

Regulatory and Maintaining Product Quality to Pose Challenge for Market Growth

Manufacturers face stringent food safety and quality regulations that require rigorous testing and documentation to ensure product safety. This can lead to increased operational costs and complexity, particularly for small and medium-sized enterprises that may lack the resources to meet these requirements effectively. Ensuring consistent product quality, especially concerning the sourcing and processing of oyster extracts, becomes more demanding under strict regulations. This can result in production delays and increased costs, further straining profit margins.

Oyster Sauce Market Trends

Growing Trend of Low Sodium Products to Fuel Market Growth

Consumers today are becoming more conscious about their health and wellness, resulting in a growing preference for products that contain reduced sodium. This trend is especially important as individuals aim to lower their salt consumption due to health issues such as hypertension and heart disease. According to the Food and Drug Administration, elevated blood pressure from high sodium can lead to serious cardiovascular conditions, including heart attacks and strokes. Studies indicate that diets high in sodium are linked to an increased risk of these diseases. Low-sodium products align with this demand, appealing to health-consciouos consumers who value transparency in food labeling and ingredient sourcing. This notable shift toward healthier eating habits prompts manufacturers to develop low-sodium oyster sauces. For instance, in June 2023, Nestlé Thailand launched low-sodium cooking sauces, including Maggi Oyster Sauce, which features a significant sodium reduction of 60%. This initiative is part of a broader trend in the food industry aimed at addressing health concerns related to high sodium intake. Asia Pacific witnessed a growth from USD 1.99 Billion in 2023 to USD 2.16 Billion in 2024.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic led to unprecedented transformations across various sectors of the global economy, with the commercial food service and retail industries being significantly affected. Following the national emergency lockdown declaration, the government imposed stringent regulations to stay-at-home, distancing measures, and closing of high contagious risk industries. This scenario increased the hurdles and led workers to confinement, which hampered the overall production and product sales. Oyster sauce is utilized in the food service sector to prepare an array of cuisines. This sauce is recognized as a staple in Chinese-style cooking and is used to marinate dishes or served as a dip with appetizers in the HoReCa sector. However, due to the pandemic, consumer movement was restricted and visits to fast-food chains/HoReCa establishments dropped significantly, leading to the closure of restaurants. Thus, this scenario led to a drop in the utilization rate of oyster sauces.

Segmentation Analysis

By End-User

Prepared Food Segment Dominated due to Increased Demand for Quick and Easy Meals

On the basis of the end-users segment, the market is divided into household, prepared food, and processed foods.

Among all the categories, prepared foods led the market and held a significant share worldwide. The increasing popularity of convenience foods has significantly impacted the oyster sauce market growth. In recent years, increasingly hectic lifestyles have led consumers to seek quick and easy meal options. As a result, prepared foods that include sauces are gaining popularity. The rising demand for user-friendly cooking products reflects this trend, as consumers seek ways to enhance their home-cooked dishes with minimal preparation. This segment is expected to capture a share of 42.92% in 2026 in the oerall market.

The household sector is projected to experience notable growth with a CAGR of 9.31% during the forecast period (2025-2032). Increased disposable incomes worldwide allow consumers to try out various culinary ingredients, including high-quality products. This financial flexibility also motivates households to buy a broader range of sauces, aiding the segment's expansion. Furthermore, consumers are more frequently looking for ingredients that help them recreate restaurant-quality meals at home, with oyster sauce being a favored option for boosting flavors across different cuisines.

- The household segment is expected to hold a 24.86% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel

HoReCa Segment Lead due to Growing Incorporation of Oyster Sauce in a Variety of Foods

In terms of distribution channels, the market is segmented into convenience stores, supermarkets, hypermarkets, HoReCa, Quick Service Restaurants (QSR), and online sales channels.

Among all sectors, the HoReCa industry is at the forefront of the market and is anticipated to gain significant share of 40.18% in 2026. The global popularity of Asian cuisine has risen sharply, prompting restaurants and catering services to add oyster sauce to their offerings. This trend is especially pronounced in regions such as North America and Europe, where Asian food is becoming increasingly popular. Renowned for its distinct savory-sweet taste, oyster sauce finds its use in a wide range of culinary applications, such as marinades, stir-fries, and dipping sauces. Its adaptability renders it an essential ingredient in professional kitchens. Furthermore, the increasing trend of dining out and exploring various cuisines has further heightened its use in the HoReCa sector.

The supermarket sector is projected to experience substantial growth during the forecast period. Supermarkets provide a wide variety of product brands and varieties, making them convenient locations for shoppers. This broad product assortment improves visibility and accessibility, positively impacting consumers' purchasing choices. Supermarkets employ eye-catching displays and promotions to attract consumer interest in oyster sauces, thereby enhancing sales within this sector.

The online sales segment is estimated to grow with a CAGR of 10.33% during the forecast period (2025-2032).

Oyster Sauce Market Regional Outlook

The market is studied across Asia Pacific, Europe, North America, South America, and Middle East & Africa

Asia Pacific

Asia Pacific Oyster Sauce Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.55 billion in 2026 and USD 2.34 billion in 2025 . The region accounted for a major share of 57.62% in the overall market. The region dominates product consumption, with several countries such as China, Thailand, South Korea, Japan, and others leading the way due to their rich culinary traditions and increasing demand for Asian cuisine. China is leading the market and is expected to capture a share of USD 1.19 billion in 2025. Oyster sauce is famous for its unique umami flavor, which comes from its main ingredient, oysters. This savory flavor attracts consumers who are more frequently looking for rich and intricate taste experiences in their meals. As food preferences move toward umami-rich options, oyster sauce has emerged as a popular condiment that elevates the overall flavor of a variety of dishes, making it essential in both Asian and fusion cooking. Additionally, economic growth in key Asia Pacific nations, especially India and China, has led to higher disposable incomes, enabling consumers to invest in premium products. The growing middle class is increasingly inclined to invest in high-quality ingredients, such as oyster sauce, which is further driving market expansion. India is expected to be worth USD 0.02 billion in 2026, while Japan is set to be valued at USD 0.2 billion in the same year.

North America

North America is the second largest market and is expected to lead with a valuation of USD 0.91 billion in 2026, exhibiting a CAGR of 8.43% during the forecast period (2025-2032). The increasing popularity of sauces in countries such as the U.S. and Canada has been positively impacting the market's growth. In addition, the consumption of fast foods and snacks is on the rise in the U.S., especially among millennials. Oriental sauces such as soy sauce and oyster sauce are often used in culinary preparations and for complimenting snacks or fast foods as they help enhance the flavor profile of the food products. The fast- paced modern lifestyle in the region is increasing the demand for convenient food options, including processed items. Ready-to-cook and ready-to-eat meals are becoming essential in numerous households, which corresponds with the use of oyster sauce as a rapid flavor enhancer in a variety of dishes. Processed foods such as frozen meals and chilled items provide ease of preparation, appealing to consumers who wish to cut down on cooking time. This aspect of convenience plays a crucial role in boosting the popularity of product, as it enhances the flavors of quick and easy meal meal options. The U.S. market is set to be worth USD 0.54 billion in 2026.

Europe

Europe is the third leading region, projected to be valued at USD 0.59 billion in 2026. The strong expansion of the sauces and condiments sector in the region significantly boosts the market share of oyster sauce in Europe. The U.K. market is expanding and is expected to capture the market share of USD 0.10 billion in 2025. The growing interest in ethnic cuisines and their rising popularity in European nations such as Germany, Italy, and France are prompting major international companies such as Foshan Haitian Flavouring & Food Co. Ltd, Ajinomoto Co., Inc., and Lee Kum Kee to invest in the European market. Additionally, the presence of Asian immigrants has led to greater availability and acceptance of traditional Asian ingredients in local markets. Items such as soy sauce, rice noodles, and various spices are increasingly accepted in European kitchens, reflecting a blend of culinary traditions. Germany is estimated to be valued at USD 0.08 billion in 2025, while France is projected to reach a market value of USD 0.04 billion in the same year.

South America

South America is the fourth leading region, expected to capture a share of USD 0.16 billion in 2025. In this region, Brazil dominates the market. The country holds particular importance due to its sizable population and increasing interest in Asian cuisine, leading to a heightened demand for oyster products as a multifunctional condiment. Argentina also exhibits promise with its developing food service industry and growing consumer inclination for varied flavors. The presence of Asian communities in South America has significantly contributed to cultural exchange, enhancing the awareness and acceptance of Asian cuisines across the region. According to the Brazilian Institute of Geography and Statistics Government agency census 2022, 850,132 Asian people resided in Brazil. These communities have introduced their culinary traditions, leading to a fusion of flavors that enrich local cuisines.

Middle East & Africa

The growing interest in Asian cuisines, especially Chinese and Thai, has resulted in a higher acceptance and incorporation of oyster sauce within Middle Eastern cooking. As diners explore bolder flavor profiles, they are utilizing oyster sauce in both classic and modern dishes, enriching flavors and broadening their culinary experiences. Countries with significant expatriate populations, such as the UAE and Saudi Arabia, see a higher demand for authentic Asian ingredients, including oyster sauce. Many expatriates seek to recreate familiar dishes from their home countries, further driving the consumption of products such as oyster sauce. The UAE market is anticipated to reach USD 0.05 billion in 2025.

Competitive Landscape

Key Market Players

Product Innovation has Emerged as Major Trend Adopted by Market Players

The competitive landscape of the oyster sauce market is dynamic, with established brands continuously innovating to meet evolving consumer demands. At the same time, new entrants are capitalizing on emerging trends such as the growing preference for plant-based diets.

To know how our report can help streamline your business, Speak to Analyst

Major players in the oyster sauce market include Foshan Haitian Flavouring & Food Co. Ltd., Kikkoman Corporation, Lee Kum Kee, and Ajinomoto Co., Inc. Haday Oyster Sauce (Foshan Haitian Flavouring & Food Co. Ltd.) stands out in the highly competitive market due to its exceptional quality, distinct flavor, and versatility in culinary applications.

Lee Kum Kee, a Hong Kong-based brand that has become synonymous with oyster sauce in China and globally. Kikkoman is another Japanese brand that has successfully expanded its presence beyond soy sauce into other Asian condiments, including.

List of Key Companies Profiled

- Foshan Haitian Flavouring & Food Co. Ltd. (China)

- Lee Kum Kee (China)

- Nestle S.A.(Switzerland)

- Ajinomoto Co., Inc. (Japan)

- Zhongshan Jolion Foodstuffs Co., Ltd. (China)

- Yantai Shinho Weidamei Food Co. (China)

- Cholimex Food JSC (Vietnam)

- Kikkoman Corporation (Japan)

- Jiajia Food Group Co., Ltd. (China)

- QIANHE Condiment and Food CO., LTD. (China)

Key Industry Developments

- June 2024 – Lee Kum Kee, a Hong Kong-based food enterprise, announced the investment of USD 288 million to construct a new production facility across Georgia, U.S. This plant would focus on innovation of products, including the development of oyster sauces.

- April 2024 – Kikkoman Corporation, a Japanese food manufacturer, introduced its first-ever 100% Vegetarian oyster-flavored sauce for both non-vegetarians and vegetarian individuals across the Indian market.

- June 2023 – Nestle Thailand, a food processing & beverage conglomerate, announced the launch of its new low-sodium oyster sauce and cooking sauce. These products were launched to help Thai consumers minimize their salt intake.

- May 2022 – Lee Kum Kee, a food processing firm, announced a USD 5.86 million investment in building a new oyster sauce smart production line with government support. This new plant is constructed at its headquarters and commenced operations in 2024.

- February 2023 – Lucky Foods, a family-owned Asian food firm, expanded its product offerings with the launch of its latest Vegan Hoisin Sauces and Vegan Oyster Sauces. Both sauces are made up of clean ingredients and are sold across the Asian market.

Report Coverage

The global oyster sauce market report analyzes the market in-depth. It highlights crucial aspects such as prominent companies, the oyster sauce market, the oyster sauce market segmentation, competitive landscape, product types, distribution channels, and application usage areas. Besides this, it provides insights into the global oyster sauce market demand and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.12% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By End-User

By Distribution Channel

|

|

By Region North America (By End-User, Distribution Channel, and Country) · U.S. · Canada · Mexico Europe (By End-User, Distribution Channel, and Country) · France · Spain · U.K. · Italy · Germany · Russia

Asia Pacific (By End-User, Distribution Channel, and Country) · China · India · Japan · South Korea · Indonesia · Singapore · Malaysia · Philippines · Vietnam

South America (By End-User, Distribution Channel, and Country) · Argentina · Brazil · Colombia

Middle East & Africa (By End-User, Distribution Channel, and Country) · Egypt · Saudi Arabia · Nigeria · UAE · Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 4.04 billion in 2025 and is anticipated to record a valuation of USD 8.8 billion by 2034.

The global market is projected to grow at a significant CAGR of 9.12% during the forecast period.

By end-user, the prepared food segment dominated the market during the forecast period.

Rising demand for Asian cuisines in the food service industry is a key factor driving the market.

Foshan Haitian Flavouring & Food Co. Ltd., Kikkoman Corporation, Lee Kum Kee, Ajinomoto Co., Inc., and others are some of the leading players globally.

Asia Pacific dominated the oyster sauce market with a market share of 58.08% in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us