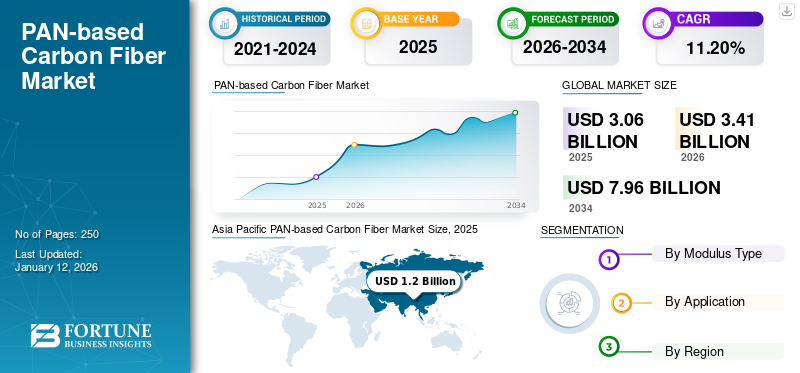

PAN-based Carbon Fiber Market Size, Share & Industry Analysis, By Modulus Type (Standard Modulus Fibers, Intermediate Modulus Fibers, and High Modulus Fibers), By Application (Aerospace & Defense, Automotive, Wind Turbines, Sports & Leisure, Construction, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global PAN-based carbon fiber market size was valued at USD 3.06 billion in 2025. The market is projected to grow from USD 3.41 billion in 2026 to USD 7.96 billion by 2034, exhibiting a CAGR of 11.20% during the forecast period. Asia Pacific dominated the pan-based carbon fiber market with a market share of 39% in 2025.

PAN-based carbon fiber is a type of carbon fiber made from polyacrylonitrile (PAN), a synthetic polymer. These fibers are known for their excellent strength, stiffness, and well-balanced set of properties, making them the dominant material type in the global carbon fiber industry. The ability to offer various exceptional properties and growing utilization from massive industries such as aerospace & defense and the automotive industry will drive the product demand. They are widely used in composites for aerospace, automotive, and sports equipment due to their high strength-to-weight ratio.

The market is expected to grow on the back of growing demand for lightweight materials. One of the key end-use industries contributing to this demand is the wind energy sector. The ability of these materials to offer an exceptional strength-to-weight ratio without compromising performance is a major factor driving market growth.

- According to the U.S. Department of Energy, wind power is the largest source of renewable energy in the U.S., accounting for approximately 10% of the nation’s energy production.

Mitsubishi Chemical Carbon Fiber and Composites, Inc., SGL Carbon, Toray, and Teijin Limited are identified as prominent players in the market. Players in the market are innovating their products through advancements in manufacturing processes, material science, and the integration of technologies such as AI and automation. As a result, the ongoing investments in the pan-based carbon fiber by these market giants are set to shape the market dynamics.

Global PAN-Based Carbon Fiber Market Key Takeaways

Market Size & Forecast

- 2025 Market Size: USD 3.06 billion

- 2026 Market Size: USD 3.41 billion

- 2034 Forecast Market Size: USD 7.96 billion

- CAGR: 11.20% from 2026–2034

Market Share

- Regional Share: Asia Pacific dominated the PAN-based carbon fiber market with a 39% share in 2025, driven by strong manufacturing bases, rapid EV adoption, increasing aerospace investments, and expanding wind energy installations.

- By Modulus Type: Standard Modulus Fibers held the largest share in 2024 due to their balanced performance, versatility, and cost-effectiveness, making them widely used across EVs, aerospace, sports, and industrial applications.

- By Application: Aerospace & Defense dominated the market in 2024 on account of high carbon fiber usage in aircraft structures, UAVs, defense vehicles, and next-generation lightweight composite components.

Key Country Highlights

- China: Leads global demand due to major investments in aerospace & defense, booming EV production, and increasing wind power installations. China also spent USD 471 billion on defense in 2024, supporting continued carbon fiber utilization.

- United States: Strong demand from aerospace (commercial + defense), rising wind energy capacity (153.15 GW), and expanding EV manufacturing contribute to robust market growth.

- Japan: Major producer of high-quality carbon fibers with companies like Toray and Teijin; continuous innovation and global supply leadership fuel market momentum.

- Germany & France: Growth supported by advanced aerospace manufacturing, rising EV transition, and industrial applications.

- Brazil: EVP growth and increasing wind energy deployment fuel expanding demand for carbon fiber composites in Latin America.

MARKET DYNAMICS

MARKET DRIVERS

Surging Product Demand from Aerospace & Defense to Fuel Market Growth

The global market is experiencing significant growth, driven by its unique set of properties required in aerospace & defense. Carbon fiber is widely used in these industries due to its high strength-to-weight ratio, excellent durability, and resistance to fatigue and corrosion. These properties make it ideal for applications where weight reduction and structural integrity are crucial, such as aircraft structures, defense vehicles, and advanced weapon systems. In aircraft, it is used in the fuselage, wings, and tails to improve fuel efficiency and reduce emissions. In addition, it plays a crucial role in improving the performance and durability of drones and other UAVs. As a result, the huge demand from aerospace and defense will fuel the global PAN-based carbon fiber market growth during the forecast period.

- According to the Civil Aviation Ministry, the global drone industry is expected to reach USD 1.9 billion by 2026, reflecting the expanding scope of UAV applications.

MARKET RESTRAINTS

High Product Costs to Hamper Market Growth

Carbon fibers have gained significant interest from end-use customers due to their exceptional properties. However, their high price remains a major constraint, hindering the extensive adoption of carbon composites across different sectors. The price of carbon fibers is largely influenced by the yield and cost of the precursor material, primarily PAN. At present, the average price for PAN-based fibers, specifically those not qualified for aerospace applications, stands at approximately USD 21.5 per kg, with a conversion efficiency of just 50%. These elevated production costs pose a challenge for local and smaller manufacturers, thereby restricting market expansion.

MARKET OPPORTUNITIES

Surge in Electric Vehicle Adoption to Create Lucrative Opportunities in Market

The surge in EV adoption globally has heightened the demand for carbon fibers. Carbon fiber is increasingly integrated into electric vehicles to reduce overall vehicle weight, improve energy efficiency, and improve structural integrity. Its high strength-to-weight ratio makes it ideal for critical components such as body panels, chassis components, and even battery packs. Carbon fiber composites are significantly lighter than traditional materials such as steel or aluminum, making them ideal for reducing the overall weight of an EV. This weight reduction translates to increased efficiency, as the vehicle requires less energy to move and accelerate. Therefore, the surge in EV adoption is set to create lucrative opportunities in the market.

- According to the International Energy Agency, in 2023, around 14 million new electric vehicles were registered globally.

PAN-based CARBON FIBER MARKET TRENDS

Growing Transition to Renewable Energy Propels Market Growth

The global transition to renewable energy, particularly wind power, is significantly driving the growth of the carbon fiber market. Carbon fiber's lightweight and high-strength properties make it ideal for manufacturing wind turbine blades, allowing the production of larger, more efficient blades that capture greater amounts of energy, ultimately driving the demand for carbon fiber composites. Therefore, the growing adoption of wind energy boosts the demand for carbon fiber composites due to their suitability in manufacturing wind turbine blades. The global transition to renewable energy sources, particularly wind, is driving the deployment of wind turbines, which will further propel market growth in the foreseen period.

Download Free sample to learn more about this report.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Trade Protectionism Limits Supply, Causing Negative Impact on Market

Trade protectionism, including tariffs and other trade barriers, poses a significant challenge to the PAN-based carbon fiber market by increasing costs, limiting access to global markets, and potentially hindering innovation. Trade protectionism in key regions such as the U.S., China, and the European Union has influenced PAN-based carbon fiber supply and pricing. Tariffs on raw materials and intermediate products (such as PAN precursors) have caused volatility. While trade protectionism might protect domestic manufacturers, it can also lead to higher prices for consumers and reduced competitiveness for industries relying on imported carbon fibers. These factors can negatively impact both producers and consumers, affecting demand, pricing, and overall market growth.

Segmentation Analysis

By Modulus Type

Standard Modulus Fibers Segment Held Dominant Market Share Due to Its Balanced Properties and Cost-Effectiveness

Based on modulus type, the market is segmented into standard modulus fibers, intermediate modulus fibers, and high modulus fibers.

The standard modulus fibers segment held the largest global PAN-based carbon fiber market share in 2024. Standard modulus carbon fiber is a type of carbon fiber characterized by a tensile modulus of 33-36 million pounds per square inch (MSI). It's known for being a cost-effective option with a balanced set of properties, making it a widely used grade across various industries.

Growing demand for electric vehicles will drive the demand for standard modulus fibers, supporting the segment’s continued market dominance.

Intermediate modulus fibers offer a balance of stiffness and strength, finding applications in various industries. They typically exhibit a tensile modulus of around 42 million pounds per square inch (Msi). These fibers are often used in aerospace, industrial, and recreational sectors, providing a good combination of performance and cost. As a result, the demand for intermediate modulus fibers is anticipated to experience significant growth in the forthcoming years.

By Application

Aerospace & Defense Segment Dominated Market Due to High Product Utilization

Based on application, the market is segmented into aerospace & defense, automotive, wind turbines, sports & leisure, construction, and others.

The aerospace & defense segment held the largest global market share in 2024. PAN-based carbon fiber is used in aerospace & defense primarily due to its exceptional strength-to-weight ratio, high stiffness, and resistance to corrosion and fatigue. These properties allow the production of lightweight yet highly durable components, improving aircraft performance, fuel efficiency, and operational reliability. Therefore, the aerospace & defense segment is poised to remain a major application segment for the product in the foreseen period.

The automotive segment is expected to grow at a significant rate during the forecast period. The growth is mainly due to the carbon fiber's strength, which helps to improve structural integrity, providing better protection for occupants in a crash. Additionally, it is a poor conductor of heat, making it suitable for components that experience high temperatures, such as brake rotors. In addition, increasing sales of electric vehicles is anticipated to bolster the product demand further.

PAN-based Carbon Fiber Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific PAN-based Carbon Fiber Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest global PAN-based carbon fiber market share in 2025, generating revenue of USD 1.2 billion. The region’s dominance stems from its robust manufacturing hubs and growing demand across key sectors such as aerospace, automotive, and wind energy. Within the region, China plays a leading role due to the country’s massive investment in the aerospace & defense sector and continuously expanding EV sector, which is driving the product demand.

- According to the Texas National Security Review, China spent around USD 471 billion on defense in 2024.

North America

North America is the second-largest market. Demand in the region is projected to grow considerably, driven by the growing electric vehicle (EV) sector and increased investments in renewable wind energy projects. As PAN-based carbon fiber becomes a dominant material in these applications, there will be significant regional market growth during the forecast period. The U.S. is identified as the largest market in the region, which is anticipated on the back of robust growth, particularly in the aerospace, automotive, and energy sectors. The aerospace sector heavily relies on PAN-based carbon fiber for manufacturing lightweight, high-strength components in aircraft and defense equipment.

- According to the American Clean Power Association, the U.S. has a total wind energy capacity of approximately 153.15 gigawatts (GW), making it the country’s fourth-largest electricity source and the largest contributor to renewable energy

Europe

The European region presents a mixed outlook for the market over the long-term forecast, as the European Union is planning to phase out the usage of carbon fiber in automotive. In July 2023, the European Commission proposed a new regulation on end-of-life vehicles under which carbon fiber could soon be classified as a hazardous material, potentially leading to a phased ban by 2029.

- According to the European Automotive Manufacturers Association, the region produced 12.2 million units of cars in 2023.

Latin America

The market in Latin America is expected to grow moderately, driven by the rising demand for electric vehicles (EVs) and energy storage systems. Brazil and Mexico are anticipated to play key roles in the region's market growth. Brazil's commitment to renewable energy is boosting the use of carbon fiber in wind turbine blades and other clean energy components.

Middle East & Africa

The product demand in the Middle East & Africa is expected to grow steadily due to growth factors such as rising demand for electric vehicles. As PAN-based carbon fiber is a key component to reduce the weight of vehicles without compromising their strength, the rising demand for fuel-efficient vehicles will drive the use of products in lightweight automotive production. Countries, including Saudi Arabia, UAE, and South Africa, are investing in wind energy and electric vehicle production plants, fostering a progressive environment for market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Capacity Expansion and Product Innovation to Meet Product Demand

The global market is partially concentrated, with companies such as Mitsubishi Chemical Carbon Fiber and Composites, Inc., SGL Carbon, Toray, and Teijin Limited accounting for a significant market share. These companies are well-positioned to capitalize on the surging demand for lightweight materials across industries such as aerospace & defense, automotive, and energy sectors, particularly in wind turbine manufacturing. These major players are investing in expanding their manufacturing facilities and advancing research and development efforts to meet the growing demand for the product. Major companies such as Hyosung Advanced Materials, Syensqo, and Toray Industries are heavily investing in capacity expansion and R&D in response to the increasing product demand.

LIST OF KEY PAN-BASED CARBON FIBER COMPANIES PROFILED

- Advanced Composites Inc. (U.S.)

- Formosa M Co., Ltd. (Taiwan)

- Hexcel Corporation (U.S.)

- HS Hyosung Advanced Materials (South Korea)

- Mitsubishi Chemical Carbon Fiber and Composites, Inc. (Japan)

- SGL Carbon (Germany)

- Syensqo (Belgium)

- TEIJIN LIMITED (Japan)

- Toray Industries, Inc. (Japan)

- ZOLTEK Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2023: Teijin Limited introduced the Tenax Carbon Fiber, produced from sustainable acrylonitrile (AN) by utilizing residue and waste from recycled raw materials or biomass-derived products.

- October 2023: Toray Industries Inc. expanded its high modulus and regular tow medium carbon fibers production facilities at its French subsidiary Toray Carbon Fibers Europe S.A. This move aims to meet the increasing demand for carbon fiber in Europe, driven by the transition to a net-zero economy.

- December 2022: Hyosung Advanced Materials revealed that it had achieved the successful development of ultra-high-tensile carbon fiber, marking a significant step toward independent production of aeronautic-grade materials.

- March 2022: Hyosung Advanced Materials announced that it would invest USD 38.5 million to expand carbon fiber production at the company’s JeonJu, South Korea, plant facility. The expansion would allow the company to serve its customers in South Korea.

- July 2021: Hexcel Corporation entered into an agreement with Dassault to supply carbon fiber prepreg for the Falcon 10X program. The partnership strengthened the company’s position in the aerospace sector and reinforced its long-standing collaboration with Dassault.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Unit |

Value (USD Billion) & Volume (Kilotons) |

|

Growth Rate |

CAGR of 11.20% during 2026-2034 |

|

Segmentation |

By Modulus Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.41 billion in 2026 and is projected to reach USD 7.96 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 1.2 billion.

The market is expected to exhibit a CAGR of 11.20% during the forecast period from (2026-2034)

The aerospace & defense segment led the market by application.

Surging product demand from aerospace & defense is a key factor driving market growth.

Mitsubishi Chemical Carbon Fiber and Composites, Inc., SGL Carbon, Toray, and Teijin Limited are the top players in the market.

Asia Pacific dominated the pan-based carbon fiber market with a market share of 39% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us