Perfusion Systems Market Size, Share & Industry Analysis, By Product Type (Cardiopulmonary Perfusion Systems {Oxygenation Systems, Heart-Lung Machines, Cooling and Heating Devices, Blood Parameter Monitoring Systems, Centrifugal Blood Pump Systems, and Others}, Extracorporeal Membrane Oxygenation (ECMO), and Isolated Organ Perfusion Systems), By Age Group (Adults and Pediatrics), By End User (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

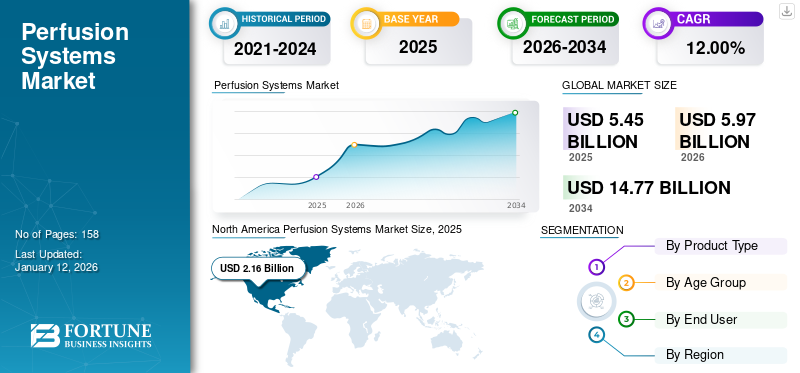

The perfusion systems market size was valued at USD 5.45 billion in 2025. The market is projected to grow from USD 5.97 billion in 2026 to USD 14.77 billion by 2034, exhibiting a CAGR of 12.00% during the forecast period. North America dominated the perfusion systems market with a market share of 39.50% in 2025.

The perfusion systems are devices that mimic the natural process of the organ functioning in a controlled environment. These devices are a vital component used during the process of transplantations among the population. The rising prevalence of chronic cardiac disorders, heart failure, and others, the growing geriatric population in countries including the U.S., China, Japan, and others, along with increasing awareness regarding the treatment options among the population, is resulting in a growing number of cardiopulmonary procedures. The growing geriatric population in the countries is also one of the factors favoring the rising patient population undergoing these procedures.

In addition, the growing efforts of the key players operating in the market to cater to the rising demand leading to technologically advanced product approvals and launches is another factor expected to support the global market growth during the forecast period.

- According to the 2023 statistics published by the Population Pyramid, the population aged 65 years in China was around 203.4 million in 2023, witnessing a growth of 4% from the previous year. The population accounted for 14.3% of the total population.

The overall COVID-19 impact on the global market was negative. The increased focus of healthcare providers on patients suffering from COVID-19 infection, along with the reduced number of organ transplants and donations globally, was another factor that negatively impacted the growth of the market.

Global Perfusion Systems Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 5.45 billion

- 2026 Market Size: USD 5.97 billion

- 2034 Forecast Market Size: USD 14.77 billion

- CAGR: 12.00% from 2026–2034

Market Share:

- North America dominated the perfusion systems market with a 39.50% share in 2025, driven by the rising diagnosis of chronic cardiovascular and respiratory diseases, increasing number of cardiac surgeries, and the presence of key industry players launching novel products.

- By product type, cardiopulmonary perfusion systems are expected to retain their largest market share owing to the growing prevalence of heart and lung diseases and rising adoption in cardiopulmonary procedures and transplantations.

Key Country Highlights:

- United States: Increasing number of cardiac surgeries and transplant procedures, along with a strong focus by market players on product innovation and regulatory approvals.

- Europe: Rising organ transplantation procedures across countries like Germany and France, coupled with improving healthcare infrastructure and awareness regarding organ donations.

- China: Growing geriatric population and rising prevalence of chronic diseases leading to a surge in cardiopulmonary procedures and adoption of advanced perfusion technologies.

- Japan: Efforts by healthcare organizations and government initiatives to promote organ donation and adoption of machine perfusion techniques to improve transplant outcomes.

Perfusion Systems Market Trends

Shifting Preference Toward the Adoption of Machine Perfusion

Government agencies, healthcare organizations, and other institutes in countries such as the U.S., Japan, and China are focusing on raising awareness of the benefits of machine perfusion in the preservation of donated organs to reduce organ rejection, especially in patients with circulatory death (DCD) after transplantation.

The increased number of DCD donors nationally is a major factor driving this trend toward machine perfusion of donations after cardiac death (DCD).

- According to the 2023 article published by the Journal of Hepatology, the 2023 Scientific Registry of Transplant Recipients (SRTR) database indicates around 1.2% of DCD livers were preserved using hypothermic oxygenated machine perfusion (HOPE) or normothermic machine perfusion (NMP). The proportion increased to around 25% by July 2022 and 60% by July 2023.

Several emerging market players are conducting studies to develop and deploy perfusion devices for lungs, kidneys, heart, and other organs to reduce transplant waiting times for recipients. These factors support the shifting preference toward adopting machine perfusion among researchers, transplant centers, and others.

- North America witnessed a perfusion systems market growth from USD 1.81 Billion in 2023 to USD 1.97 Billion in 2024.

Download Free sample to learn more about this report.

Perfusion Systems Market Growth Factors

Growing Incidence of Non-Communicable Disorders Among the Population to Fuel the Market Growth

The rising incidence of non-communicable disorders (NCD) such as cardiovascular diseases, chronic lung disease, and others among the population due to several factors, including physical inactivity, unhealthy diet, and sedentary lifestyle, among others, is boosting the number of various cardiovascular surgeries among the population in the healthcare settings.

- According to the 2023 article published by the Pan American Health Organization (PAHO), non-communicable diseases (NCD) are responsible for approximately 3.9 million deaths in the Americas. An estimated 200 million people live with some NCD in the region.

- In addition, according to a 2022 study published by the PLOS Journal, the global prevalence of CKD is estimated to be around 13.4% in all five stages and 10.6% in stages 3-5. The average prevalence of CKD stages 3–5 in low-middle-income countries of Asia was nearly 11.2%, as per the same study.

Therefore, the growing patient population is leading to the demand for various procedures and increasing R&D activities among the market players and research institutes to develop and introduce products with novel technology, which is expected to boost the global perfusion systems market growth.

RESTRAINING FACTORS

High Costs Associated with the Devices & Procedures May Restrain the Adoption in the Emerging Countries

The rising technological advancements in cardiopulmonary bypass devices, owing to the robust focus of the market players and research institutes on the development and introduction of products with advanced and novel technology, is one of the major factors leading to the high cost of these devices.

The high costs associated with these systems are expected to hinder their adoption in emerging countries such as India, Brazil, a few African countries, and others. The costs of procurement, maintenance, and other additional costs that the healthcare facility procures on installation of these devices is a major concern among these facilities that can hamper the adoption of these devices.

- According to a 2021 article published by Medical Price Online, the average cost of a heart machine is around USD 8,000 - USD 9,000.

- Similarly, according to a 2021 article published by Ayu Health, the average cost of an ECMO machine in India ranges around USD 42,000 - USD 45,000, depending on the features and parameters of the devices.

The increasing cost of transplantation procedures in emerging countries and the lifetime maintenance therapy post-transplantation is another major factor expected to hinder the number of transplants among the population in developing countries.

- According to a 2022 article published by the Current Medical Science Journal, heart transplantation costs around USD 42,000 - USD 45,000 in China, and long-term use of immunosuppressive agents can incur around USD 700 – USD 750 per month.

All these factors, along with the lack of universally accepted protocols for reporting perfusion parameters and outcomes, are major barriers that are anticipated to restrain the adoption of these devices in the market.

Perfusion Systems Market Segmentation Analysis

By Product Type Analysis

Rising Number of Cardiopulmonary Procedures Led to the Dominance of the Cardiopulmonary Perfusion Systems Segment

Based on product type, the market is segmented into cardiopulmonary perfusion systems, extracorporeal membrane oxygenation (ECMO), and isolated organ perfusion systems. The cardiopulmonary perfusion systems segment is further segmented into oxygenation systems, heart-lung machines, cooling and heating devices, blood parameter monitoring systems, centrifugal blood pump systems, and others.

The cardiopulmonary perfusion systems segment dominated the global market with a share of 76.57% in 2026. The growing prevalence of cardiovascular and respiratory diseases, including stroke, coronary heart diseases, heart failure, pulmonary fibrosis, and others, leading to an increasing patient population requiring various cardiac procedures, are some of the major factors favoring the growth of the segment. Also, the increasing number of heart and lung transplantations among the population owing to heart failures and chronic liver cirrhosis is another major factor supporting the growth of the segment.

- The Cardiopulmonary Perfusion Systems segment is expected to hold a 76.57% share in 2026.

- According to 2023 database published by the International Registry in Organ Donation and Transplantation, the number of heart transplantation in the U.S. was around 4,596 witnessing a growth of around 10.4% as compared to the previous year.

The extracorporeal membrane oxygenation (ECMO) segment is expected to grow steadily during the forecast period. The growing number of ECMO centers globally leading to increasing adoption of these devices among these centers is one of the prominent factors contributing to the segment's growth.

The isolated organ perfusion systems segment is projected to witness the highest growth rate during the forecast period. The increasing R&D activities among companies, institutes, and others to develop and introduce perfusion machines with novel technological advancements is a major factor contributing to the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By Age Group Analysis

Increasing Number of Adult Patients Undergoing Various Cardiac Surgeries Contributed to the Dominance of the Segment

The market is bifurcated into adults and pediatrics based on age group.

The adults segment accounted for the largest market with a share of 58.42% in 2026 and is expected to grow considerably during the forecast period. The dominance of the segment can be attributable to factors such as the rising prevalence of cardiovascular disorders, vital organ failures among the adult population, the growing number of cardiac procedures and transplantation procedures among the population, and others.

- According to 2021 data published by the Scientific Registry of Transplant Recipients, around 9,234 liver transplants were performed in the U.S. in 2021. Among these, around 94.6% were adult transplant recipients.

On the other hand, the pediatrics segment is projected to grow at a significant CAGR during the forecast period. The increasing number of newborns with congenital heart disorders and other chronic conditions resulting in a rising number of various procedures among the pediatric population is one of the crucial factors augmenting the growth of the segment.

- According to 2023 statistics published by Donate Life America, a non-profit organization, there were more than 1,900 pediatric transplants in 2023, and more than 1,200 children are on the national transplant waiting list.

By End user Analysis

Hospitals & ASCs Segment Dominated Fueled by Increasing Number of Procedures in Hospitals

On the basis of end user, the market is segmented into hospitals & ASCs, specialty clinics, and others.

The hospitals & ASCs segment dominated the market with a share of 45.60% in 2026. The growing number of hospitals in the countries and the increasing number of patient admissions in these settings are due to the rising adoption of technologically advanced devices in hospitals.

- According to the 2019 French National Report, kidney transplantation in France is currently performed by around 47 centers, most of which are conducted in public university hospitals.

The specialty clinics segment is projected to witness growth during the forecast period. The increasing preference shift among patients toward specialty clinics owing to increased quality of care and other benefits is one of the important factors supporting the segment's growth.

The others segment, including research institutes, academic institutes, and others, is projected to witness a lucrative growth during the forecast period. The segment's growth can be attributed to factors such as growing R&D focus and clinical studies by the major players and institutes to develop and introduce ex vivo organ perfusion systems with novel technology.

- In June 2024, OrganOx Limited, one of the leading medical technology companies specializing in organ preservation before transplantation and treating acute organ failure, opened its new state-of-the-art research facility in the U.K.

REGIONAL INSIGHTS

Based on geography, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Perfusion Systems Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America, valued at USD 2.16 billion, dominated the perfusion systems market share in 2025. The region's dominance is attributable to several factors, including the rising diagnosis of various chronic cardiovascular and respiratory diseases and the increasing number of cardiac surgeries and other procedures in the U.S. and Canada. In addition, the rising focus of the key players on launching novel products in these countries to cater to the increasing demand is another crucial factor favoring the region's growth. The U.S. market is projected to reach USD 2.2 billion by 2026.

Europe

Europe is expected to grow during the forecast period. The growing number of transplant procedures in countries including Germany, France, and others owing to a rising number of vital organ failures among the population are some of the major reasons contributing to the region's growth. The UK market is projected to reach USD 0.37 billion by 2026, while the Germany market is projected to reach USD 0.31 billion by 2026.

- According to 2022 statistics published by the International Registry in Organ Donation and Transplantation, the total number of organ transplantations in France in 2022 was around 5,502, witnessing a growth of around 5.6% as compared to 2021, wherein the total number of transplantations performed was 5,208.

Asia Pacific

Asia Pacific is projected to witness the highest growth rate in the market during the forecast period. The increasing geriatric population and rising prevalence of chronic cardiovascular and respiratory conditions among the population in countries such as China, India, Japan, and others are among the major factors expected to spur the demand for perfusion machines and systems in these countries. The Japan market is projected to reach USD 0.18 billion by 2026, the China market is projected to reach USD 0.2 billion by 2026, and the India market is projected to reach USD 0.16 billion by 2026.

Latin America and the Middle East & Africa

Similarly, Latin America and the Middle East & Africa are expected to expand at a steady growth rate during the forecast period. The increasing number of transplantation procedures in Brazil, Mexico, UAE, and others, coupled with improving healthcare infrastructure and increasing healthcare expenditure per capita in these countries, are expected to fuel the market growth in the regions. In addition, the rising awareness initiatives by government bodies, healthcare organizations, and market players are anticipated to drive the adoption of these systems.

- In January 2024, The Ministry of Health and Prevention (MoHAP) hosted the 2024 Annual UAE Organ Donation and Transplantation Congress to promote organ donation's significance and improve the procedures' regulatory framework.

KEY INDUSTRY PLAYERS

Robust Efforts of the Key Players to Develop and Introduce Systems with Novel Technology to Support their Growth

The global market is semi-consolidated, with a few prominent players operating in the market and a wide product portfolio. LivaNova PLC, Getinge, and Medtronic are some of the key players holding a major share of the global market.

The increasing efforts of these companies to receive approvals and launch new products to strengthen their product portfolio, along with expanding their presence and distribution network, are some of the major reasons for the growing market shares of these companies in the global market.

- In August 2023, LivaNova PLC received CE Mark and U.S. Food and Drug Administration (FDA) 510(k) clearance for Essenz In-Line Blood Monitor (ILBM).

Similarly, XVIVO and TransMedics are some of the other major players operating in the market, and they have a wide product portfolio in isolated organ perfusion systems. The rising initiatives by companies to create awareness regarding their perfusion machines and the benefits of these devices to increase the viability of the organs is one of the crucial factors boosting the market positions of these companies.

- In October 2023, Duke University Hospital performed the first heart transplant in the U.S. using XVIVO’s Non-Ischemic Heart Preservation (NIHP) device.

Therefore, the growing R&D focus of these companies and many emerging players in the market to develop novel products with advanced technology are expected to boost these companies' global perfusion systems market shares.

List of Top Perfusion Systems Companies:

- LivaNova PLC (U.K.)

- XVIVO (Sweden)

- TransMedics (U.S.)

- Getinge (Sweden)

- Medtronic (Ireland)

- Terumo Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- May 2024 - Terumo Corporation received clearance for its CDI OneView Monitoring System from the U.S. Food and Drugs Administration. This advanced platform offers crucial information on key patient parameters during cardiopulmonary bypass surgery, enhancing perfusion safety and improving patient outcomes.

- May 2023 - Cardinal Health announced opening a new distribution center in the Greater Toronto Area to meet the Canadian healthcare system's medical and surgical product demand.

- March 2023 - LivaNova PLC received the U.S. FDA 510(k) clearance for the Essenz Heart-Lung Machine (HLM) and initiated its commercial launch in the U.S. market.

- August 2021 - NIPRO announced the launch of Vascular Division in the U.S. The division comprises cutting-edge technologies and innovative vascular and cardiovascular products to provide clinicians with procedural and imaging solutions that enhance patient care.

- April 2021 - Getinge announced the commercial availability of HL 40 heart-lung machines in Germany, Netherlands, Italy, France, and Spain, followed by Sweden, Australia, the U.K., and Ireland.

REPORT COVERAGE

The global perfusion systems market report provides a detailed market analysis. It focuses on key aspects, such as market size & market forecast, market segmentation based on product type, age group, and end user, and competitive landscape. It also gives an overview of the regulatory scenario, insights on insurance penetration, and analysis for significant companies.

Besides, the report offers insights into the latest perfusion system market trends, market statistics, and key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.00% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Age Group

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 5.45 billion in 2025.

The market is slated to exhibit a steady 12.00% CAGR during the forecast period.

By product type, the cardiopulmonary perfusion systems segment led in 2026.

The key driving factors of the market include the rising prevalence of chronic conditions, the increasing geriatric population, the growing number of transplantation procedures among the population, and the increasing R&D focus of the companies.

LivaNova PLC, Getinge, Medtronic, and XVIVO are some of the major players operating in the market.

North America dominated the perfusion systems market with a market share of 39.50% in 2025.

North America was valued at USD 2.16 billion in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us