Pharmaceutical Inspection Machines Market Size, Share & Industry Analysis, By Component (Hardware {AVI Systems, X-Ray Inspection Systems, Leak Detection Systems, Metal Detectors, Checkweighers, Combination Systems, and Others}, and Software), By Packaging Type (Injectables, Bottles, Blisters and Others), By Formulation (Oral, Parenteral, Biologics/Vaccines, and Others), By Type (Fully Automated, Semi Automated, and Manual), By End User (Pharmaceutical Companies, Biotechnology Companies, CMOs & CDMOs, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

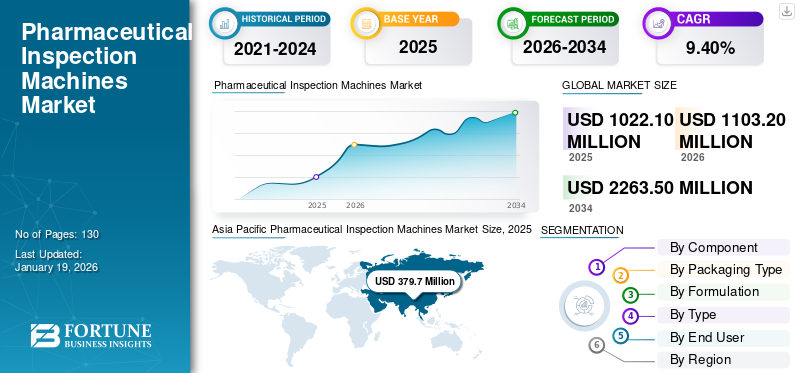

The global pharmaceutical inspection machines market size was valued at USD 1,022.10 million in 2025 and is projected to grow from USD 1,103.20 million in 2026 to USD 2,263.50 billion by 2034, exhibiting a CAGR of 9.40% during the forecast period. The Asia Pacific dominated global market with a share of 37.20% in 2025.

Pharmaceutical Inspection Machines are automated and semi-automated systems. They are used across pharmaceutical manufacturing and packaging integrity. These medical devices enable detection of visual defects, packaging defects, dimensional defects, label/code verification and non-visible faults. These devices enable regulatory compliance, increase throughput, reduce recall risk, and are utilized for a broader range of dosage forms.

The market is growing steadily driven by the growing demand for high-precision machinery for quality assurance, safety, and efficient pharmaceutical products. Furthermore, rising requirement for serialization and anti-counterfeit measures and escalating focus on patient safety and product qualities are impelling market growth.

Few prominent players operating in the market are ACG Group, Cognex Corporation, Antares Vision Group, Minebea Intec, Stevanato Group, Loma Systems, and others.

MARKET DYNAMICS

Market Drivers

Rising Regulatory & Quality Compliance Requirements Drives the Market Development

Growing requirements for imposition of favorable regulators and quality policies are fostering pharmaceutical inspection machines market growth. These stricter regulations and guidelines for sterile manufacturing, serialization, and traceability are pushing manufacturers to invest in validated inspection systems and upgrades. The FDA and Good Manufacturing Practices (GMP) are two regulations compiled by manufacturers to guarantee that inspection devices are being developed which lowers the possibility of product recalls and guarantees patient safety.

For instance, according to the FAD, the number of drug recalls due to quality assurance issues has reduced by 20% with the adoption of advanced inspection technologies.

Furthermore, the growing pharmaceutical outsourcing especially in emerging regions is fostering market growth. They are leading to requirements of standardized inspection processes to ensure product quality across different manufacturing sites.

Market Challenges

High Capital Cost and Long Validation Cycles Hampers the Market Growth

One of the main challenges the market is facing is the requirement of significant CAPEX for equipment acquisition. Also, the procurement process involves lengthy IQ/OQ/PQ and regulatory approval timelines. These barriers are causing delay in purchasing and consequently slow refresh cycles is hindering market growth.

Market Opportunities

Adoption of AI-driven Inspection and Software-as-a-Service Offers Lucrative Growth Opportunities

Rising adoption and implementation of AI-driven inspection machines along with software-as-a-services systems are offering great opportunities for market growth. These generative and deep-learning models facilitate fast model deployment, decrease false rejects, and recurring revenue from subscription software and model-monitoring services.

For instance in February 2021, Syntegon Technology installed the first fully validated AI-driven visual inspection systems, marking a significant advancement in automated inspection.

Additionally, emphasizing the improvement of industry 4.0 and smart manufacturing concepts is bolstering market growth. Sensor and communication interfaces are being added to mode machines more often, enabling easy connection with production line management systems.

PHARMACEUTICAL INSPECTION MACHINES MARKET TRENDS

Integration of Sensor Fusion and Integrated Combination Systems Has Emerged as a Prominent Market Trend

With the incorporation of sensor fusion and implementation of combination systems are current trends in the market. They are combining vision, X-ray, weight and metal detection into unified systems to reduce line footprints. They facilitate to improve defect detection accuracy, and simplifies data-driven quality control are propelling market expansion.

Furthermore, rising development of personalized medicine and biopharmaceuticals is supporting market growth. This is encouraging the making of innovative inspection tools, which are appropriate for particular industrial requirements.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Component

Rising Demand for Machine-based Inspection Solutions Boost Hardware Segment Growth

Based on the component, the market is segmented into hardware and software. Hardware is further sub-segmented into AVI systems, X-ray inspection systems, leak detection systems, metal detectors, checkweighers, combination systems, and others.

In 2026, the hardware segment held the highest pharmaceutical inspection machines market share of 82.19% in 2026 and with revenue share of USD 784.1 million. This segment is dominating in the market, driven by rising strong demand from manufacturers. As they prioritize proven machine-based inspection solutions including AVI, X-ray, and CCIT for compliance and larger-scale production.

The software segment is expected to grow with a highest CAGR of 9.6% over the forecast period. The attribute for this segment’s expansion is the rapid adoption of sterilization and track-and-trace systems by the end-users. As firms are seeking smarter and more flexible inspection capabilities, the implementation of AI-driven analytics is supporting high growth in software.

By Packaging Type

Growing Demand for Biologics and Vaccine Pipelines Support Injectables Segment Growth

The market is divided into injectables, bottles, blisters, and others based on packaging type.

The injectables segment is the dominating segment among the packaging types with a highest market share of 43.25% in 2026. It is also the fastest growing segment with the highest CAGR of 9.6% attributed to rising demand for biologics and vaccine pipelines. The requirements of stringent container closure and particle inspection are encouraging utilization of the tool. In addition, the extensive utilization of vials, syringes, and ampoules in sterile and biologics manufacturing are sustaining wide-ranging reliance on advanced inspection systems.

By Formulation

Constant Adoption of Tablets and Capsules Augments the Oral Segment Growth

Based on the formulation, the market is divided into oral, parenteral, biologics/vaccines, and others.

Oral segment held the highest market share in 2024 with a revenue share of USD 396.9 million. This dominance is due to consistent utilization of tablets and capsules by consumers are heightening demand for inspection. They are increasingly using blisters and bottle lines that promote equipment usage across high-volume facilities. The Parenteral segment is projected to dominate the market with a share of 41.52% in 2026.

On the other hand, the biologics/vaccines segment is anticipated to grow significantly with the highest CAGR of 10.6% in the market. This is caused by rising investment in biologics and vaccine production that fuels strong uptake of advanced AVI and CCIT systems to fulfill stricter quality standards.

By Type

Rising Adoption of Digitalization of Systems Fosters the Fully Automated Segment Growth

Based on the formulation, the market is divided into fully automated, semi automated, and manual.

In 2024, fully automated segment is dominating the market and holds the highest market share revenue of USD 664.9 million, driven by escalating adoption of this system to cater the requirements of efficiency by end-users and supporting decrease in manual error. In addition, this segment is expanding due to focusing on modern production facilities by manufactures.

On the other hand, the fully automated is the fastest growing segment with a CAGR of 9.2% in the market. This is due to the rising inclination towards digitalization of the systems. Growing requirements for high-throughput lines and integration of robotics and AI into inspection workflows are boosting segment growth.

To know how our report can help streamline your business, Speak to Analyst

By End User

Intensifying Installation of the Systems to Upgrade Machines Impel the Pharmaceutical Companies Segment Growth

Based on the end user, the market is divided into pharmaceutical companies, biotechnology companies, CMOs & CDMOs, and others.

In 2024, pharmaceutical companies segment was dominating the market and held highest market share of USD 529.0 million. This is owing to the established pharma firms' rising demand for most installations of the systems to upgrade legacy lines as well as ensure compliance with standards across the world.

Biotechnology companies segment is anticipated to grow significantly in the market with highest CAGR of 10.0% among others. This expansion is attributed to the increasing expansion in biotech capacity and growing focus on sterile injectables. These demands are pushing rapid adoption of advanced inspection solutions in this group.

PHARMACEUTICAL INSPECTION MACHINES MARKETREGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

Asia Pacific Pharmaceutical Inspection Machines Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

The North America pharmaceutical inspection machines market is growing substantially with a market share of USD 276.6 million in 2025 and USD 298 million in 2026 due to higher investment in research and development. Growing implementation of sophisticated technologies and existence of several pharmaceutical and biotechnology firms are impelling market growth. The U.S. leads the North American market with an expected revenue share of USD 256.9 million in 2026. This is attributed to imposition of high regulatory standards and rising emphasis on providing drug safety in the U.S. market.

Europe

The European market is substantially growing and likely to contribute to a revenue share of USD 225 million in 2025. The growth is driven by rising emphasis on high-quality and safe pharmaceuticals and growing innovation in inspection technology. Rising imposition of the regulatory environment is promoting acceptance of advanced inspection systems. U.K., Germany, and Italy are some of the major contributors to the market growth with an expected revenue share of USD 42.5 million, USD 56 million in 2026 and USD 20.4 million respectively by 2025.

Asia Pacific

Asia Pacific dominates the market with a revenue share of USD 379.7 million in 2025 and expected to reach USD 416.6 million in 2026 along with the largest CAGR of 10.6% over the forecast period. This regional growth is due to growing domestic consumption and expansion of CMOs. Presence of supportive regulatory policies is reinforcing strong deployment of equipment. The major countries including China, India, and Japan maintain large pharmaceutical manufacturing bases as they are widely adopting inspection systems across oral dosage and injectable lines. India and China are expected to contribute to a revenue share of USD 61.9 million and USD 204.5 million respectively in 2026.

Additionally, rising investment by multinational pharmacy firms and local players adopting automated facilities are creating momentum for advanced inspection technologies. Rapid expansion of capacity of biologics, vaccines, and sterile injectables are amplifying market growth. Furthermore, escalating implementation of AI-enabled visual inspection and serialization systems is impelling faster market growth in this region.

South America and Middle East & Africa

The markets of South America and Middle East & Africa are growing with an expected market valuation of USD 80.7 million and USD 60.1 million respectively in 2025 owing to expansion of pharmaceutical production and rising imposition of regulator standards along with adoption of technological advancements in inspection systems. GCC countries are predicted to have a market share of USD 27.8 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Key Players on Extensive Research and Development Efforts Lead to their Dominating Market Positions

The global pharmaceutical inspection machines industry is highly fragmented with different market players operating in the market. These include OPTEL Group, Stevanato Group, Syntegon Technology, Uhlmann Pac-Systeme, Loma Systems, CEIA, sesotec, and others. These companies applying several strategic initiatives including collaboration, mergers, acquisitions, and invest in research and development activities to persist the market competition.

LIST OF KEY PHARMACEUTICAL INSPECTION MACHINES COMPANIES PROFILED

- ACG Group (India)

- Antares Vision Group (Italy)

- Cognex Corporation (U.S.)

- Keyence Corporation (Japan)

- Mettler-Toledo (U.S.)

- Minebea Intec (Germany)

- OPTEL Group (Canada)

- Stevanato Group (Italy)

- Syntegon Technology (Germany)

- Uhlmann Pac-Systeme (Germany)

- Loma Systems (U.K.)

- CEIA (Italy)

- Sesotec (Germany)

KEY INDUSTRY DEVELOPMENTS

- June 2025- Antares Vision Group in partnership with Orobix introduced AI GI, an advanced artificial intelligence-driven visual inspection platform with an aim to promote inspection standards by allowing systems capable of self-adapting, understanding, and constantly improving.

- September 2024- Antares Vision S.p.A., a well-known provider of Track & Trace and quality control systems confirmed the extension of its collaboration with Renata Limited in Bangladesh to augment pharmaceutical traceability and combat counterfeit drugs.

- May 2024- Eschbach introduce the Shiftconnector Equipment Hub, designed to streamline regulatory fulfillment in the pharmaceutical sector by ensuring data integrity and abridge audit processes.

- April 2024-Cognex Corporation unveiled its first AIN powered 3D vision system in order to solve a range of inspection and measurement applications.

- December 2023- Korber AG announced its partnership with Franz Ziel GmbH to enhance its expertise in cleanroom technology for the pharmaceutical and biotech solutions. This partnership facilitated Korber’s existing inspection and packaging solutions.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, component, packaging type, formulation, type, end user of the product. Besides this, it offers insights into the pharmaceutical inspection machines market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 9.40% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Component · Hardware o AVI Systems o X-Ray Inspection Systems o Leak Detection Systems o Metal Detectors o Checkweighers o Combination Systems o Others · Software |

|

By Packaging Type · Injectables · Bottles · Blisters · Others |

|

|

By Formulation · Oral · Parenteral · Biologics/Vaccines · Others |

|

|

By Type · Fully Automated · Semi Automated · Manual |

|

|

By End User · Pharmaceutical Companies · Biotechnology Companies · CMOs & CDMOs · Others |

|

|

By Region · North America (By Component, Packaging Type, Formulation, Type, End User, and Country/Sub-region) o U.S. (By Type) o Canada (By Type) o Mexico (By Type · Europe ( Component, Packaging Type, Formulation, Type, End User, and Country/Sub-region) o U.K. (By Type) o Germany (By Type ) o France (By Type ) o Italy (By Type) o Rest of Europe (By Type) · Asia Pacific (By By Component, Packaging Type, Formulation, Type, End User, and Country/Sub-region) o China (By Type) o Japan (By Type) o India (By Type) o Rest of Asia Pacific (By Type) · South America (By Component, Packaging Type, Formulation, Type, End User, and Country/Sub-region) o Argentina (By Type) o Brazil (By Type) o Rest of South America (By Type) · Middle East & Africa (By Component, Packaging Type, Formulation, Type, End User, and Country/Sub-region) o GCC (By Type ) o South Africa (By Type ) · Rest of the Middle East & Africa (By Type ) |

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1,103.20 million in 2026 and is projected to reach USD 2,263.50 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 9.40% during the forecast period.

Rising regulatory & quality compliance requirements drives the market growth.

ACG Group, Cognex Corporation, Minebea Intec, and Stevanato Group are some of the top players in the market.

The Asia Pacific dominated global market with a share of 37.20% in 2025.

North America was valued at USD 276.6 million in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us