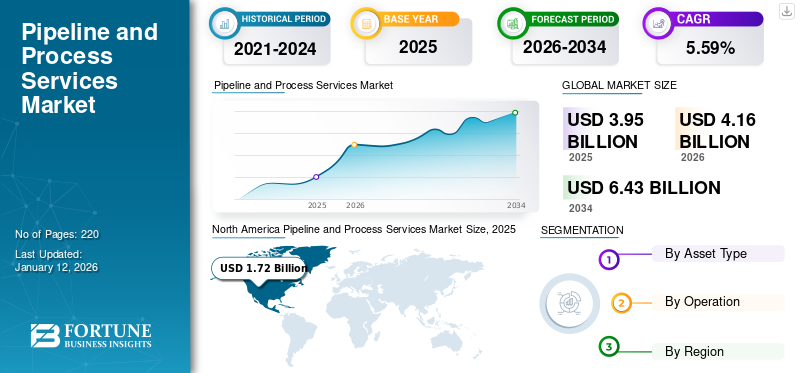

Pipeline and Process Services Market Size, Share & COVID-19 Impact Analysis, By Asset Type (Pipeline and Process), By Operation (Pre-Commissioning, Maintenance, and Decommissioning), and Regional Forecasts, 2026-2034

Pipeline and Process Services Market Size

The global pipeline and process services market size was valued at USD 3.95 billion in 2025. The market is projected to grow from USD 4.16 billion in 2026 to USD 6.43 billion by 2034, exhibiting a CAGR of 5.59% during the forecast period. North America dominated the global market with a share of 43.46% in 2025. The Pipeline and Process Services Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 2.16 billion by 2032.

Several activities are included in pipeline and process services throughout an oil and gas pipeline's life cycle. Pre-commissioning is one of these activities, where the laid pipeline goes through several steps to see if it can do everything. Additionally, several safety checks are carried out to guarantee that the pipelines will not cause any harm to living things or the surrounding environment. During its 20- to 25-year lifespan, pipeline service providers keep the channel in the top condition.

Global Pipeline & Process Services Market Overview

Market Size:

- 2025 Value: USD 3.95 billion

- 2026 Value: USD 4.16 billion

- 2034 Forecast Value: USD 6.43 billion

- CAGR (2026–2034): 5.59%

Market Share:

- Regional Leader: North America held 43.46% market share in 2025, driven by aging infrastructure and strict regulatory frameworks.

- Fastest‑Growing Region: Asia Pacific is projected to be the fastest-growing region, supported by large-scale pipeline projects in China, India, and Southeast Asia.

- End‑User Leader: Maintenance operations led the market, owing to high demand for inspection, cleaning, and regulatory compliance services.

Industry Trends:

- Pre‑commissioning Leads: Pre‑commissioning services dominate the market due to a surge in new pipeline installations requiring safety and integrity testing.

- Maintenance Services Strengthen: Continuous demand for maintenance operations ensures safety and operational efficiency in aging pipelines.

- Process Services Segment Growth: Increasing services demand in refineries, FPS units, and storage facilities.

- Digitalization & Automation: Advanced technologies like AI, IoT, and predictive analytics are optimizing service efficiency, reducing downtime, and ensuring safety compliance.

Driving Factors:

- Aging Pipeline Infrastructure: Requires ongoing inspection, cleaning, and integrity management.

- Stringent Regulatory Standards: National and international safety mandates drive continuous service demand.

- Rising Oil & Gas Transmission Needs: Expansion of natural gas and oil infrastructure globally boosts service requirements.

- Technology-driven Efficiency Gains: Adoption of digital solutions for real-time monitoring and predictive maintenance.

Post-COVID-19 Project Resumptions: Resumed pipeline projects delayed by the pandemic spur service demand.

COVID-19 IMPACT

COVID-19 has Moderately Impacted Global Pipeline and Process Services Market Growth

COVID-19 has affected the entire industry negatively. According to the International Energy Association (IEA) COVID-19 crisis has significantly impacted the oil & gas industry. The levels of exploration and development in the offshore oil and gas industry have fluctuated significantly over time, making it a historically cyclical sector. Oil & gas prices and market expectations of possible price changes significantly impact the pipeline and process services. Due to the influence of COVID-19, which included the resulting significant reduction in global demand for oil and natural gas and the sharp decline in oil prices following the announcement of price reductions and production increases in March 2020 by associates of the Organization of Petroleum Exporting Countries (OPEC) and other foreign, oil-exporting countries, many oil and gas companies made significant reductions in their capital and operating expenditures.

Pipeline and Process Services Market Trends

Exceptional Growth of the Renewable Energy Sector to Create Lucrative Opportunities

Over the forecast period, the U.S. pipeline market is projected to grow at a significant CAGR. The pipeline repair and maintenance sector is expected to hold a substantial market share. The root cause of pipeline damage worldwide is corrosion. The U.S. has considerable growth opportunities for exploring conventional and unconventional hydrocarbon reserves and drilling new mining projects to boost the deployment of Pipeline transmission. Additionally, increasing oil and shale gas production and introducing new contracts to boost the output will likely propel the national outlook. The growing energy demand due to increased industrialization has increased oil and gas imports to the country. For instance, in February 2021, EIA estimated that net imports of crude oil would rise from its average in 2020 of 2.7 million barrels per day (b/d) to 3.7 million b/d by the end of 2021 and 4.4 million b/d in 2022.

Download Free sample to learn more about this report.

Pipeline and Process Services Market Growth Factors

Increasing Worldwide Demand for Oil & Natural Gas Contributes to the Market Growth

The pipeline industry is a dynamic part of the oil and gas industry as it facilitates the transfer of these products from production areas to facilities for refining and marketing. Pipeline transportation is the most resourceful way to move large volumes of oil and gas over long distances, and it is also a secure method of transportation. New oil discoveries have significantly increased oil and gas reserves in important energy markets, such as the U.S. and Asia Pacific, over the past few years. The discovery of millions of tons of oil reserves has increased the demand for various pipeline and process services. Since these energy markets require commissioning maintenance and decommissioning projects to be completed quickly, this market is witnessing significantly lucrative opportunities for providers. Advanced and developing nations are looking forward to increasing the use of natural gas across various end-use industries by replacing coal and oil with natural gas in all possible scenarios. This has led to the construction of new natural gas pipelines across countries and opened opportunities for market players. As a result, pipelines for oil and gas transmission and production have increased due to rising energy demand in recent years.

Strict Regulations over the Operation of Pipelines to Aid Market Growth

Gas and oil, two combustible fuels, are transported through pipelines, and any leak would significantly harm life and the environment. Additionally, these pipelines traverse seas that are home to numerous aquatic animals. Although technological advancements in pipeline material and monitoring systems have enhanced pipeline safety and efficiency, offshore pipelines pose a greater environmental impact and leakage risk than onshore pipelines. These pipelines must adhere to stringent regulations to ensure safe transmission and distribution and safeguard the regions they pass through. Developments in technology assessment maintenance practices, methodology, and processes over the past few years have considerably condensed the risk of pipeline failure and necessitated updating the standards. Regulations foster a safe and competitive market, improving the oil and gas source chain and driving global demand for cutting-edge pipeline and process services. Onshore Pipeline Regulations (OPR) and the National Energy Board Act (NEB Act), for instance, stipulate that all pipelines in the U.S. must adhere to timely supervision and pressure testing.

RESTRAINING FACTORS

Shift to Renewables in the Overall Energy Mix Poses Threat to Market Growth

The widespread acceptance of renewable energy sources for power generation is one of the main threats to the market. As their use has grown at an exponential rate over the past 10 years, solar and wind power pose the greatest threat. The growth rate of oil production is hampered by this shift toward renewable energy, causing well-drilling to proceed slower than anticipated. This swelling adoption of renewables to curb carbon emissions directly omits the necessity for oil and gas exploration happenings and obstructs the global pipeline and process services industry.

Every nation has set goals for renewable energy that must be encountered in the coming years. By 2025, the government of the U.K. intends to generate fifty percent of its electricity from renewable sources. By 2030, Germany intends to generate at least 65% of its energy from environment-friendly sources. By 2030, China intends to meet 16% of its energy needs with renewable sources. By 2023, Brazil intends to use renewable energy sources to generate 42.5% of its energy needs. Thus, the growth of pipeline and process services is likely to be impacted. The market will suffer as a result of the adoption of renewable energy by Europe, which has always been a major buyer. This will have a contrary impact on the market.

Pipeline and Process Services Market Segmentation Analysis

By Asset Type Analysis

Pipeline Segment is Overriding the Market due to its Varied Usage in Oil & Gas Sector

Based on asset type, the market is segmented into pipeline and process, where the pipeline segment is dominating the market share of 69.59% in 2026, as it is applicable in the transmission and distribution of many substances, they consume less energy, have low cost & a smaller footprint, and are reliable. Natural gas and refined petroleum products are transported through transmission pipelines to customers for use or further distribution. Transmission pipelines are primarily used to transport advanced petroleum products, crude oil, and natural gas, with very few exceptions. Transmission pipeline systems contain all the facilities and equipment required for product transportation.

By Operation Analysis

Maintenance Segment is Dominating as it is an Unavoidable & Essential Need of Companies

On the basis of operation, the market is divided into pre-commissioning, maintenance, and decommissioning, where maintenance is dominating the market share of 60.97% in 2026, due to the fact that no matter which pipeline construction has been done, its maintenance is of critical importance. If not maintained, all sorts of disastrous consequences, including service disruptions, environmental damage, and even explosions can happen. Pipeline commissioning and pre-commissioning procedures are crucial to their future operation. During construction, grease, oil, grit, and other contaminants are bound to contaminate the materials used in a new piping system. This contamination is removed during commissioning, and a pipeline system that is primed and ready for use is created. Expert inspection, checking, cleaning, flushing, verification, leak tests, performance evaluation, and the functional tests required to operate a new facility are all part of the commissioning process. It is carried out jointly by a facility's operator and contractor. Pipeline maintenance ensures all its components remain functional and intact. It is not a once-in-a-lifetime activity as regular and thorough maintenance will prolong the lifespan of the pipes.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

North America

North America dominated the market with a valuation of USD 1.72 billion in 2025 and USD 1.8 billion in 2026. North America comprises developed nations, such as the U.S. and Canada, which hold a probable huge market for oil transportation, backing up the rising energy demand, which fuels the demand for pipeline and process services. The U.S. market is projected to reach USD 1.71 billion by 2026.

North America Pipeline and Process Services Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The market was affected in 2020 due to the COVID-19 outbreak. Pipeline construction and maintenance in North America have been delayed due to lockdown restrictions imposed by various regional governments. Additionally, the COVID-19 pandemic has caused pipeline operators in the United States, such as Harvest Midstream and Pembina Pipeline Corp., to either postpone or postpone their projects.

Europe

Europe is the second largest region in the market, owing to the region's huge oil and gas market potential. While the market for oil transmission administrations has mostly been viewed as open, endeavors have been expected by the lawmaker to direct free admittance to the market of gas transmission administrations. The UK market is projected to reach USD 0.08 billion by 2026, and the Germany market is projected to reach USD 0.04 billion by 2026.

Asia Pacific

The pipeline segment is anticipated to grasp a significant market share during the forecast period. Numerous pipeline projects have been postponed recently due to the fall in oil prices. However, delayed projects are now being commissioned in the future due to the price increase that began at the beginning of 2021. Asia Pacific will probably witness the most pipeline kilometers added over the next five years. Oil and gas pipelines, stations, tank farms, underground storage caverns, oil-gas field gathering and transportation, and central processing plants are just a few examples of the facilities that CPPCOC is capable of commissioning and operating. The China market is projected to reach USD 0.22 billion by 2026, and the India market is projected to reach USD 0.09 billion by 2026.

KEY INDUSTRY PLAYERS

Key Participants Are Intent on Expanding their Product Capabilities and New Product Development

The global market comprises a few global and numerous small & medium-scale pipeline and process services players. New product development has been the major strategy adopted by major players. For instance, in November 2022, Halliburton launched NeoCem E Plus and EnviraCem to extend their portfolio of reduced high-performance Portland cement, which comprises 50% or better reduction of mass cement. Halliburton established a new compact cement system to leverage the synergies among the chemical and physical possessions of specialized materials combined with cement used in zonal isolation.

Major players include Halliburton, BlueFin Services (Gate Energy), Altus Intervention, Techfem and Eunisell Limited, EnerMech, Chenergy Services Limited, Baker Hughes, and others. The major companies have more than half of the market share, and many regional and local players for various applications dominate the remaining market.

List of Top Pipeline and Process Services Companies:

- Halliburton (U.S.)

- BlueFin Services (Gate Energy) (U.S.)

- Altus Intervention (Norway)

- Techfem (Italy)

- Eunisell Limited (Nigeria)

- EnerMech (U.S.)

- Chenergy Services Limited (Nigeria)

- CR3 (Thailand)

- Alphaden Energy & Oilfield Limited (U.S.)

- Trans Asia Group (UAE)

- T.D. Williamson, Inc (U.S.)

- STATS Group (United Kingdom)

- Oceaneering International, Inc (U.S.)

- TEAM, Inc. (U.S.)

- Baker Hughes (U.S.)

- BGS ES (U.S.)

- Hydratight Limited (U.K.)

- Ideh Pouyan Energy Co (Iran)

- IKM Group (Norway)

- Dexon Technology PLC (Thailand)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 - Halliburton launched NeoCem E+ and EnviraCem cement barrier systems to extend their portfolio of high-performance reduced Portland cement systems, which comprises 50% or better reduction of mass cement. Halliburton established a new compact cement system to leverage the synergies among the chemical and physical possessions of specialized materials combined with cement used in zonal isolation.

- November 2022 - Halliburton unveiled the BrightStar resistivity service, a novel resolution that discloses the trail ahead of the drill bit to empower upbeat drilling decisions. The BrightStar service includes visualization technology, data, and calculations to diminish operational risks in unidentified environments and deliver higher confidence to evade unwanted formation exits.

- November 2022 - Techfem announced that it has been working on developing cross-border hydrogen pipelines. It delivered several design packages and pre-project consultancy services related to long-distance high-pressure pure hydrogen transmission systems.

- June 2022- Techfem proclaimed to contribute its expertise in the Baltic Pipe Project developed by Energinet and GAZ-SYSTEM S.A. as co-investors. A new bi-directional pipeline system will be built as part of the project, allowing shippers to transport gas from Norway to other markets across Poland and Denmark.

- March 2022 - Altus Intervention, a prominent international supplier of well intervention services & down-hole oil & gas expertise with 40 years of industry experience, has announced that Baker Hughes will acquire it. The acquisition will enhance the company's life-of-well capabilities, which adds to Baker Hughes' existing portfolio of integrated solutions and technologies for oilfields as operators seek to increase efficiency from mature fields.

REPORT COVERAGE

The research report offers a complete industry assessment by proposing valuable insights, facts, industry-related information, competitive landscape, and past data. Various methodologies and approaches are accepted to make expressive assumptions and views to formulate the global pipeline and process services market growth analysis.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.59% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Asset Type, Operation, and Region |

|

Segmentation |

By Asset Type

|

|

By Operation

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 3.95 billion in 2025.

The global market is projected to grow at a CAGR of 5.59% in the forecast period.

The market size of North America stood at USD 1.72 billion in 2025.

Based on operation, maintenance holds the dominating share in the global market.

The global market size is expected to reach USD 6.43 billion by 2034.

The key market driver is strict regulations over the operation of pipelines to increase market growth.

The top players in the market are Halliburton, Baker Hughes, BGS Energy Services, and CG Hydratight.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us