Plastic Vials Market Size, Share & Industry Analysis, By Material (Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), Polycarbonate (PC), and Others), By Capacity (Up to 10 ml, 11 ml to 20 ml, 21 ml to 30 ml, and 30 ml & Above), By End Use (Healthcare, Personal Care & Cosmetics, Chemicals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

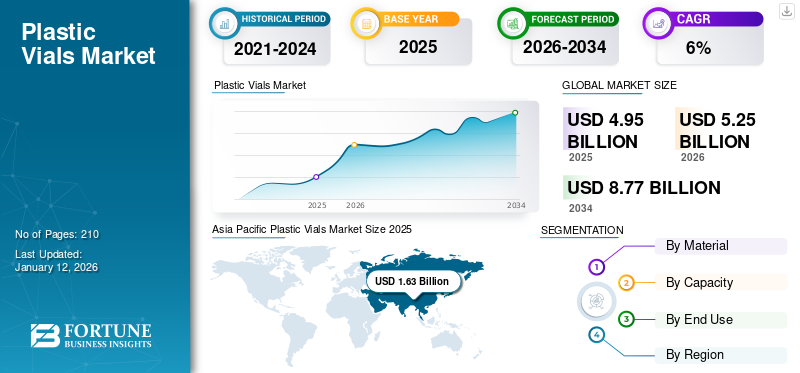

The global plastic vials market size was valued at USD 4.95 billion in 2025. It is projected to be worth USD 5.25 billion in 2026 and reach USD 8.77 billion by 2034, exhibiting a CAGR of 6.62% during the forecast period. Asia Pacific dominated the plastic vials market with a market share of 32.87% in 2025.

A plastic vial is a small, tube- or bottle-shaped container manufactured with plastic and used to store liquids, powders, or capsules. The rising adoption of vials in the healthcare sector augments the market expansion.

Gerresheimer AG and DWK Life Science Inc. are the leading plastic vial manufacturers, accounting for the largest global plastic vials market share.

Global Plastic Vials Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 4.95 billion

- 2026 Market Size: USD 5.25 billion

- 2034 Forecast Market Size: USD 8.77 billion

- CAGR: 6.62% during the forecast period (2026–2034)

Market Share:

- Asia Pacific dominated with a 32.87% market share in 2025.

Regional Insight

- North America: Strong pharma industry drives demand; U.S. accounts for 49.1% of world pharmaceutical sales.

- Europe: Growth driven by established personal care and cosmetics sectors.

- Asia Pacific: Market leader; expanding pharma manufacturing and regulatory support.

- Latin America: Steady growth from rising personal care sector demand.

- Middle East & Africa: Growing chemical sector demand aids market expansion.

MARKET DYNAMICS

Market Drivers

Increasing Utilization of Plastic Vials in Pharmaceutical and Biotechnology Industry Propels Market Growth

Vials are essential in creating a controlled and sterile space for the drug, which eliminates the risk of contamination and safeguards the exact dose delivery. Concerning the issue, manufacturers in the pharmaceutical and biotechnology sectors are increasingly utilizing plastic vials for product safety & user convenience. The constant manufacturing and utilization of drugs and vaccines need additional safety from external factors. Henceforth, the increasing demand and utilization of vials for safe and reliable pharmaceutical packaging drives the global plastic vials market growth.

Significant Benefits Offered by Plastic Vials Enhances Market Growth

Plastic vials are gaining immense popularity in healthcare, personal care, chemicals, cosmetics, and other sectors owing to the significant advantages they offer. The transparent vials manufactured with several plastic polymers allow for easy visibility of contents, assisting in efficient organization. In addition, as the material is resistant to gases & chemicals, it is an ideal solution for medical use. Plastic is strong and does not break easily, further enhancing its usage in the chemical and cosmetic sectors. In addition, as polypropylene has a high melting point compared to other thermoplastics, it is commonly used to manufacture vials. Such potential benefits boost the global plastic vials market growth.

Market Restraints

Lack of Tensile Strength of Vials Hamper Market Growth

Plastic vials can be fragile and may not be able to handle significant amount of drugs. The material can degrade over time and become scratched, dented, or cracked. In addition, the vials may not be suitable for businesses with larger-scale production needs due to their relatively flimsy and easily damaged nature. Moreover, the formation of cracks and fissures, as well as building debris in cracks, causes pathogen growth, further causing health and safety issues and hampering market growth.

Market Opportunities

Utilization of Sustainable Packaging Materials Will Generate Growth Opportunities

Pharmaceutical companies are increasingly utilizing recyclable and biodegradable plastics for vials to reduce their environmental impact. Biodegradable plastics decompose in three to six months faster than traditional plastic, which takes hundreds of years. Several biodegradable plastics such as Polylactic Acid (PLA), recycled plastics such as R-PET recycled HDPE, and various others are used for the manufacturing of vials, thus generating potential growth opportunities in the forthcoming years.

Market Challenges

Presence of Counterfeit Products in Pharmaceutical Sector Challenges Market Growth

Products supplied in the counterfeit market directly and indirectly affect the revenue of the pharmaceutical market, thus impeding the market growth. The supply of counterfeit pharmaceutical products that imitate authentic drugs results in declining growth.

- In 2021, the Pharmaceutical Security Institute (PSI) recorded nearly 6,000 pharmaceutical crime incidents, a 38% increase from the previous year. Moreover, the World Health Organization (WHO) estimates that imitation antibiotics and anti-malarial drugs cause 144,000 additional deaths annually in developing countries.

Download Free sample to learn more about this report.

PLASTIC VIALS MARKET TRENDS

Augmenting Demand for Vials in Cosmetic Sector Emerges as Key Trend

Vials play an essential role in the cosmetics industry owing to the transparency, safety, and lightweight properties offered as per the application. Cosmetic manufacturers utilize vials as promotional sampling solutions to reach out to their consumers and advertise their products, such as creams, gels, serums, perfumes, and moisturizers. The high demand for hair, skin, & personal care, and wellness among the younger population is expanding the usage of vials in the cosmetics sector. The latest trend of vials used in the cosmetics sector due to the prevailing beauty trends bolsters the market growth.

IMPACT OF COVID-19

The sudden advent of the COVID-19 pandemic impacted major industries globally. The pharmaceutical sector witnessed remarkable growth during the pandemic. The rising utilization of vials for the safe and effective protection of vaccines against the COVID-19 variants augmented the market growth.

SEGMENTATION ANALYSIS

By Material

Significant Benefits Offered by Polypropylene Material Boosts Segmental Growth

Based on material, the market is segmented into Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), Polycarbonate (PC), and others.

Polypropylene is the dominating material segment and is expected to experience noteworthy growth. Polypropylene material is a popular choice for manufacturing vials as it is safe, reliable, and cost-effective. The material is resistant to many chemicals, such as acids, bases, and alcohols, boosting its use in a wide range of injectable medications. Moreover, the material is recyclable, making it more environmentally friendly, further driving the segment’s growth. This segment dominated the market in 2026 with a share of 43.61%.

Polyethylene (PE) is the second-dominating material segment. The material is resistant to wear and tear, making it an ideal solution for vial manufacturing. It also offers excellent moisture barrier properties, which are essential for maintaining the stability of drugs and other medicines.

By Capacity

Increasing Usage of Up to 10 ml Vials in Pharmaceutical Sector Contribute to Segment’s Growth

Based on capacity, the market is segmented into up to 10 ml, 11 ml to 20 ml, 21 ml to 30 ml, and 30 ml & above.

Up to 10 ml is the dominating capacity and is expected to witness exponential growth in the projected years. It is used in a vast range of applications, such as medicine and pharmaceuticals. They are mainly designed for diagnostic, injectable, and sample collection applications. The vials are leak resistant as well as validated for container closure integrity, owing to which they are gaining huge traction in the pharmaceutical and personal care sector, thus contributing to the segment’s growth. The segment is expected to capture 38.25% of the market share in 2026.

30 ml and above capacity is the second-dominating segment. The rising utilization of 30 ml and above vials in the cosmetics, chemicals, and especially pharmaceutical sector aids the segment’s expansion. This segment is likely to register a considerable CAGR of 6.64% during the forecast period (2025-2032).

To know how our report can help streamline your business, Speak to Analyst

By End Use

Augmenting Demand for Vials in Healthcare Sector Propels Segmental Growth

Based on end use, the market is segmented into healthcare, personal care & cosmetics, chemicals, and others. Healthcare is the leading end-use segment and is studied to experience remarkable growth in the forecast period. These vials offer potential benefits to the healthcare sectors due to which they are gaining traction. The vials ensure accurate dosage measurements, further decreasing the risk of over or under-medication. They are tamper-evident, which can help in securing the medications. In addition, they are resistant to chemicals such as acids, bases, and alcohols, making them an ideal choice for injectable medications, further thriving the segment’s growth. The segment is estimated to grow with 57.33% of the market share in 2026.

Personal care and cosmetics are the second-leading end-use segments. Vials are majorly used for products such as moisturizers, oils, perfumes, and other skin care items due to their compact and lightweight nature, thus boosting the segment’s development. This segment is estimated to exhibit a significant CAGR of 6.27% during the forecast period.

PLASTIC VIALS MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Well-established Pharmaceutical Industry Drive North America’s Market Growth

North America is the second largest market expected to hit USD 1.45 billion in 2026, exhibiting a CAGR of 6.53% during the forecast period (2025-2032). The pharmaceutical sector in the U.S. is growing rapidly. The augmenting demand for vials from the pharmaceutical industry due to their non-reactivity, eco-friendliness, durability, transparency, and versatility drives market growth in the region.

- According to the European Federation of Pharmaceutical Industries and Association, in 2021, North America accounted for 49.1% of world pharmaceutical sales. 64.4% of sales of new medicines were also launched during the period 2016-2021 in the U.S. market.

The U.S. market is estimated to be worth USD 1.2 billion in 2026.

Europe

Growing Demand from Personal Care and Cosmetic Sector Enhance Europe’s Market Growth

Europe is the third largest market, anticipated to acquire USD 0.95 billion in 2026. Europe’s market is studied to grow remarkably in the forecast period. The U.K. market is likely to gain USD 0.18 billion in 2026. The well-established personal care and cosmetics sector in the region, especially in Germany, France, and other countries, is driving the demand for vials, further boosting the market growth.

- According to Cosmetics Europe, the personal care association, Europe is a global flagship market for cosmetics as well as personal care products, which is valued at USD 103 billion at retail sales price in 2023. The massive majority of Europe’s 500 million consumers use personal care and cosmetics products every day to protect their health, improve their well-being as well as boost their self-esteem.

Germany is set to be valued at USD 0.21 billion in 2026, while France is projected to reach USD 0.11 billion in the same year.

Asia Pacific

Rising Pharmaceutical Initiatives Cushions Market Growth in Asia Pacific

Asia Pacific Plastic Vials Market Size 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the dominating plastic vials market share with a valuation of USD 1.75 billion in 2026 and USD 1.63 billion in 2025. The region's burgeoning pharmaceutical manufacturing, coupled with regulatory shifts, is boosting the demand for plastic vials. China is estimated to reach a market value of USD 0.55 billion in 2025.The rising initiatives by the pharmaceutical companies to manufacture new pharmaceutical drugs and vaccines are also thriving the market growth.

- According to the Department of Pharmaceuticals, the Indian pharmaceutical industry ranks third globally in pharmaceutical production by volume. From FY18 to FY23, the Indian pharmaceutical industry recorded a growth rate of 6-8%, which was majorly driven by an 8% increase in exports.

India is anticipated to hold USD 0.48 billion in 2026, while Japan is set to reach USD 0.32 billion in the same year.

Latin America

Surge in Demand from Personal Care Sector Will Encourage Steady Growth in Projected Years

Latin America is set to reach a market value of USD 0.66 billion in 2025. The region is anticipated to experience steady growth in the projected period. The region’s growth is due to the rising demand for vials from the personal care and cosmetic sector.

- Mexico is one of the world's top 10 markets for personal care and cosmetic products and ranks second for beauty products in Latin America, behind only Brazil. According to the U.S. Department of Commerce’s International Trade Administration (ITA), Mexico imported USD 1.4 billion worth of cosmetics and personal care products in 2022.

Middle East & Africa

Increasing Demand for Vials in Chemical Industries Aids Market Growth

The Middle East is expected to experience significant growth in the projected period. The rising utilization of vials in the region's chemical sector is aiding the market’s growth. Polypropylene and polyethylene vials can be frequently cleaned and sterilized for clinical environments, thus boosting their usage in the chemical sectors.

- According to the Gulf Petrochemicals and Chemicals Association, the chemical industry in the GCC (Gulf Cooperation Council) generated USD 107.8 billion in revenue in 2022, further contributing 5% to the region's GDP and 39% to the manufacturing GDP.

Saudi Arabia is likely to reach USD 0.16 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global plastic vial market is highly fragmented and competitive. A few significant players are dominating the market by offering innovative packaging solutions in the packaging industry. These major market players constantly focus on expanding their customer base across regions by innovating their existing wide range of products. The market report also highlights the key developments by the manufacturers.

Major players in the industry include Amcor Plc, Gerresheimer AG, DWK Life Science Inc., Sigma-Aldrich Co. LLC, AptarGroup, Inc., Berry Global Inc., and others. Numerous other companies operating in the market are focused on market scenarios and delivering advanced packaging solutions.

List of Key Plastic Vials Companies Profiled in the Report:

- Amcor Plc (Switzerland)

- Gerresheimer AG (Germany)

- DWK Life Science Inc. (Germany)

- Sigma-Aldrich Co. LLC (U.S.)

- AptarGroup, Inc. (U.S.)

- Berry Global Inc. (U.S.)

- Origin Pharma Packaging (U.K.)

- West Pharmaceutical Services (U.S.)

- Jarsking Group (U.S.)

- Quadpack Group (Spain)

- MedicoPack (Denmark)

- Ningbo Suncity Package Co., Ltd. (China)

- Thornton Plastics (U.S.)

- Tekniplex (U.S.)

- Althor Products, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2024: Eli Lilly and Company launched Zepbound (tirzepatide) 2.5 mg and 5 mg single-dose vials. These vials are available for self-pay for patients with an on-label prescription, considerably expanding the supply of Zepbound in response to the growing demand.

- May 2023: DWK Life Sciences, a leading global manufacturer and supplier of plastic ware, laboratory glassware, and primary packaging solutions, declared the acquisition of Assem-Pak. The acquisition allows DWK to widen its range of customizable packaging solutions for the Life Science industry segment, allowing it to support customers at every critical step of its development process.

- November 2022: Gerresheimer AG, a leading global provider of healthcare & beauty and drug delivery systems for pharma, biotech, and cosmetics, and Stevanato Group S.p.A. introduced a new and innovative Ready-To-Use (RTU) vial platform, EZ-fill Smart. It is an effective solution designed to enhance drug packaging quality, decrease Total Cost of Ownership (TCO), and shorten lead times for customers.

- July 2022: Airnov declared the launch of a sustainable HAT-B vial at the AACC event in Chicago. HAT-B is the latest addition to the company’s HAT range of products, and it carries numerous sustainable characteristics. The vial, suitable for the diagnostics & nutraceutical markets, is available in two sizes to fit all the growing customer needs

- January 2022: MicroSolv Technology Corporation declared the launch of a 2ml plastic autosampler vial. It is designed to minimize ionic interactions with vial walls. These plastic vials enable the removal of samples easily and have a slightly concave inner base, which decreases dead volume.

- INVESTMENT ANALYSIS AND OPPORTUNITIES

- In December 2022, Granules India forayed into pharmaceutical packaging operations in the U.S. and will invest USD 12.5 million in the new facility at Prince William County, Virginia. The investment will make the company among the limited pharmaceutical companies to be vertically integrated from API to packaging.

REPORT COVERAGE

The market research report provides a detailed market analysis. The plastic vials market overview also focuses on key aspects, such as top key players, competitive landscape, product types, market segments, Porter’s five forces analysis, and leading segments of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, it encompasses several factors that have contributed to the market intelligence & growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.62% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Billion Units) |

|

Segmentation |

By Material, Capacity, End Use, and Region |

|

Segmentation |

By Material · Polypropylene (PP) · Polyethylene (PE) · Polystyrene (PS) · Polycarbonate (PC) · Others |

|

By Capacity · Up to 10 ml · 11 ml to 20 ml · 21 ml to 30 ml · 30 ml & Above |

|

|

By End Use · Healthcare · Personal Care & Cosmetics · Chemicals · Others |

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 4.95 billion in 2025.

The market is likely to grow at a CAGR of 6.62% during the forecast period of 2026-2034.

Up to 10 ml segment is expected to lead the market during the forecast period.

Asia Pacific’s market size stood at USD 1.75 billion in 2026.

The key market drivers are the increasing utilization of plastic vials in the pharmaceutical and biotechnology industries and the significant benefits offered by plastic vials.

Some of the top players in the market are Amcor Plc, Gerresheimer AG, DWK Life Science Inc., Sigma-Aldrich Co. LLC, AptarGroup, Inc., Berry Global Inc., and others.

The global market size is expected to record a valuation of USD 8.77 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us