Pneumatic Components Market Size, Share & Industry Analysis, By Product Type (Actuators, Valves, Pneumatic Fittings & Tubing, and Others), By Application (Industrial Machinery, Construction, Medical, Automotive, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

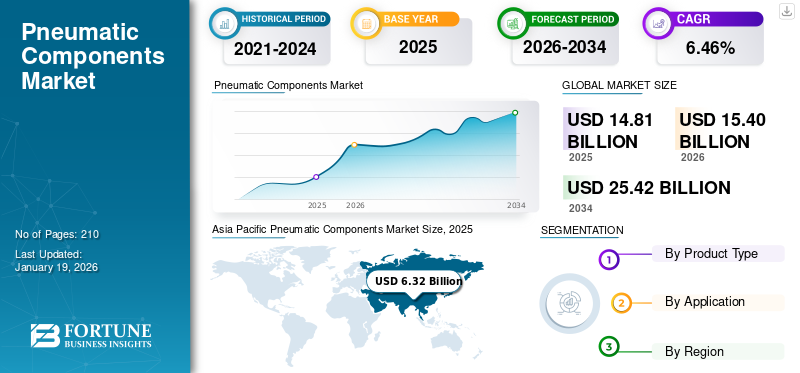

The global pneumatic components market size was valued at USD 14.81 billion in 2025. The global market was projected to grow from USD 15.4 billion in 2026 and expected to reach USD 25.42 billion by 2034, exhibiting a CAGR of 6.46% during the forecast period of 2026-2032. Moreover, Asia Pacific accounts for the largest market revenue share 42.71% in 2025 owing to the presence of large manufacturing activities in the region.

A pneumatic component is a part of a pneumatic system that uses compressed air to perform a specific function, such as generating linear or rotary motion, controlling airflow, or filtering contaminants. These components, including air cylinders, valves, and actuators, convert the pressure energy of air into mechanical work and are characterized by their reliability, ability to operate in harsh conditions, and relative simplicity.

Pneumatic component demand is driven primarily by the growth of industrial automation and Industry 4.0, which require reliable and efficient motion control for manufacturing, packaging, and logistics. Key drivers also include the increasing demand for energy-efficient and sustainable manufacturing practices, stringent safety and environmental regulations, and the rapid industrialization of emerging economies in the Asia Pacific. Advancements in pneumatic technology and the integration of smart, connected systems are further increasing demand for these components, especially in sectors including automotive and healthcare.

- According to the United Nations Industrial Development Organization, in Q1 2025, global manufacturing production increased by 1.3%, and exports rose by 1.4%. Notably, production of higher-technology goods expanded by 1.8% and exports of those advanced products grew by 2.3% over the same period.

SMC Corporation holds a prominent position in the global market, recognized as a market leader alongside companies including Festo and Parker Hannifin. The company's prominence stems from its extensive product portfolios, strong global distribution networks, continuous R&D investments, and a strategic focus on quality and innovation. SMC also actively incorporates smart technologies and IoT capabilities into its offerings to support Industry 4.0, aiming to improve system performance and reduce downtime.

MARKET DYNAMICS

MARKET DRIVERS

Accelerating Adoption of Automation and Smart Manufacturing is Driving Market Growth

The increasing adoption of automation and smart manufacturing directly fuels the pneumatic components market growth by increasing the demand for reliable, efficient, and cost-effective components such as cylinders, valves, and actuators in various industries, including automotive, packaging, and electronics. This growth is further driven by Industry 4.0 initiatives, the need for energy efficiency, and the development of "smart" pneumatic systems integrated with IoT and data analytics for real-time monitoring and predictive maintenance.

- In July 2025, Delta Electronics launched a smart manufacturing innovation center in Taiwan to foster AI-based manufacturing globally. Moreover, Delta Electronics has deepened its strategic collaboration with NVIDIA, resulting in the creation of the Delta & NVIDIA Cyber-Physical Integration Classroom.

The shift toward Industry 4.0 and smart manufacturing involves integrating advanced technologies such as IoT and data analytics. Smart pneumatics incorporate sensors and controllers to provide real-time data, enabling predictive maintenance and optimized process control, which further boosts the demand for sophisticated pneumatic components.

Rising Demand for Compact and Modular Pneumatic Actuators and Components to Boost Market Growth

The demand for compact and modular pneumatic components is a key driver for market growth due to their increased flexibility, adaptability, and suitability for modern manufacturing processes, especially in the growing areas of automation and Industry 4.0 integration. These characteristics allow for more efficient use of space and quicker system adjustments, aligning with the needs of diverse sectors such as automotive, electronics, and manufacturing that are increasingly adopting automation to boost operational efficiency and machine safety.

- In November 2025, Festo introduced the VTUX modular valve terminal, a compact and rugged platform for industrial automation, functioning as I/O, remote I/O, or decentralized I/O for greater operational performance and OEM productivity.

Modular systems offer greater flexibility, allowing for quick changes and customization to meet specific production requirements, which is crucial for lean production systems. They are widely used in robotics, material handling, and production line automation, creating a consistent demand for these solutions.

MARKET RESTRAINTS

Technological Limitations of Pneumatic Components to Restrain Market Demand & Growth

Technological limitations in precision and control within the market stem from factors including the inherent compressibility of air, which can lead to sluggish response times and reduced accuracy compared to other fluid power systems. These systems are also susceptible to issues such as air leaks, pressure drops, and air contamination, all of which negatively impact precision and control. Additionally, achieving fine-grained control and high precision with compressed air can require complex and expensive components and systems, limiting their widespread adoption in applications demanding extreme accuracy.

MARKET OPPORTUNITIES

Emergence of Battery-Powered & Hybrid Solutions to Create Lucrative Market Opportunities

The rise of battery-powered and hybrid solutions creates lucrative market opportunities for pneumatic components by driving demand for specialized, robust, and energy-efficient pneumatic systems in applications including battery manufacturing, electric vehicle (EV) actuation, and renewable energy storage. These new technologies create a need for pneumatic actuators in areas such as battery venting, EV assembly, and energy management, fostering growth in the pneumatic market.

- In December 2023, Atlas Copco launched the B-Air battery-powered portable screw compressor. Such a product launch is expected to create lucrative opportunities for pneumatic components market players.

MARKET CHALLENGES

Complex Renewable Integration to Create Challenges for Market Players

The pneumatic components market faces significant challenges from the rise of electric and hydraulic alternatives, which offer advantages in precision, energy efficiency, and controllability, particularly in high-power or complex applications where pneumatics traditionally struggled. Electric systems excel in accurate positioning and low energy consumption, while hydraulics provide superior force for heavy-duty tasks. These competing technologies limit the growth of the pneumatic market by providing superior performance in specific use cases, forcing pneumatics to emphasize its own strengths in simplicity, cost effectiveness, and cleanliness for appropriate applications.

GLOBAL PNEUMATIC COMPONENTS MARKET TRENDS

Automation & Retrofitting Older Systems is Expected to Shape Future Market Scenario

Automation and retrofitting legacy systems are significant drivers shaping the future of the pneumatic components market. As industries adopt Industry 4.0 and seek to enhance productivity, efficiency, and sustainability, they are upgrading existing machinery and implementing new pneumatic components for automated processes, robotics, and digital integration. This trend leads to increased demand for smart, energy-efficient pneumatic solutions, creating new opportunities and growth for manufacturers.

- In July 2025, Bürkert launched the SideCONTROL series, which offers features such as enhanced precision, predictive maintenance via integrated diagnostics, and simplified setup with the X.TUNE function. SideCONTROL is designed for seamless integration with various actuators and supports standard communication protocols such as IO-Link for modern automation systems.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

Tariffs impact the global pneumatic components market by increasing component costs (especially steel, bearings, and aluminum), disrupting supply chains, and slowing demand due to higher machinery prices, leading to supply chain shifts, increased domestic manufacturing efforts, and a focus on modular designs and R&D efficiency to mitigate costs and uncertainties. While challenging, these pressures also create opportunities for innovation, regionalization, and strategic partnerships as the market adapts to evolving trade dynamics.

SEGMENTATION ANALYSIS

By Product Type

Actuators Dominated Market Due to Rising Demand for High-Performance Motion Control Applications

Based on the product type, the market is segmented into actuators, valves, pneumatic fittings & tubing, and others.

In 2024, the actuators dominated the market with a market share of 42.39% in 2026. Demand for pneumatic actuators is driven by industrial automation, energy, and automotive sectors, fueled by the need for efficient, reliable, and high-performance motion control in applications such as robotics, process control, and vehicle systems.

Moreover, the valves emerged as the fastest-growing technology with a CAGR of 6.4%. Demand for pneumatic valves is strong and expected to continue growing, driven by automation, Industry 4.0 adoption, and the increasing need for precise flow control systems in manufacturing, oil & gas, and packaging. Key factors include their versatility, essential role in directing compressed air for actuators, and the integration of smart technologies such as IoT, which enhances energy efficiency and monitoring capabilities.

By Application

To know how our report can help streamline your business, Speak to Analyst

Industrial Machinery Segment Dominated Market Owing to High Adoption of Manufacturing Processes

Based on the application, the market is broadly categorized into industrial machinery, construction, medical, automotive, and others.

Industrial Machinery accounted for the largest pneumatic components market share of 49.80% in 2026, owing to the major application of pneumatic components in various large-scale manufacturing machinery.

- In February 2023, MB Pneumatics entered the Indian market through MB Pneumatics India, the company is offering specialized fittings for braking and air suspension systems for commercial vehicles.

Moreover, automotive emerged as the fastest-growing segment with a CAGR of 6.8% as pneumatic components are crucial for high-speed assembly line tasks such as lifting, positioning, and painting, as well as powering air brakes on commercial vehicles.

GLOBAL PNEUMATIC COMPONENTS MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

ASIA PACIFIC

Asia Pacific Pneumatic Components Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific emerged as the largest market with a valuation of USD 6.6 billion in 2026, driven by significant government initiatives, a strong manufacturing base in key economies including China and India, and growing investment in sectors such as automotive, electronics, and food processing. The region also benefits from a large pool of skilled labor, competitive labor costs that drive the need for automation, and government policies promoting local manufacturing and technological advancement. The China market is estimated to reach around USD 3.11 billion in 2026.

- In January 2025, Atlas Copco announced the acquisition of Trident Pneumatics to expand its presence in the Indian compressed air treatment components, pneumatic valves, and on-site gas generation market. Market players in the region are focused on the expansion of their product portfolio and regional presence.

NORTH AMERICA

In 2026, the North America market is valued at around USD 4.81 billion and is driven by growing adoption of industrial automation and Industry 4.0, requiring components for assembly, packaging, and robotic application, increased demand in key sectors including food and beverage and healthcare, which need high-quality and hygienic solutions, and a focus on energy efficiency, as manufacturers seek to reduce operational costs. Furthermore, the U.S. pneumatic components market was valued at USD 4.26 billion in 2026. The market growth in the country is driven by the increasing need for efficiency and precision in sectors such as manufacturing, automotive and the growth of other end-user industries, particularly food & beverage, healthcare, and electronics over the forecast period.

EUROPE

The European Industry was valued at around USD 2.33 billion in 2025 and is estimated to reach USD 2.41 billion in 2026. The market growth in the region is driven by stringent regulations across Europe, which compel industries to improve their efficiency and environmental compliance, often through the adoption of advanced and sustainable pneumatic technologies.

LATIN AMERICA & MIDDLE EAST & AFRICA

The market growth in Latin America and the Middle East & Africa is driven by industrial expansion, increased automation adoption. Specifically in Latin America, factors such as foreign direct investment and government-backed technology plans are creating significant growth opportunities, while in the Middle East & Africa, growth is supported by the development of the oil and gas, construction, and manufacturing sectors. Furthermore, the Middle East & Africa market is experiencing a significant CAGR of 3.5%, driven by the expansion of manufacturing industries across countries such as Saudi Arabia, South Africa, and Nigeria, positively impacting the demand for pneumatic components. Moreover, the Latin American market was valued at ~USD 0.9 billion and is expected to reach USD 1.1 billion by 2032. Increased FDI into the region's manufacturing sector is creating more demand for pneumatic solutions. Programs including Brazil's "Industry 4.0 National Plan" encourage the adoption of advanced technologies, stimulating the market.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players to Increase Product Offerings through Strategic Collaboration, and Acquisitions to Increase Market Share in Future

The competitive landscape of the pneumatic components market is moderately concentrated, led by SMC Corporation, Festo SE & Co. KG, and Parker Hannifin. Key players compete by focusing on product innovation, expanding global distribution, and increasing demand for energy-efficient and smart technologies (IoT). For instance, in February 2025, Milton announced the acquisition of Arrow Pneumatics to enhance productfolio in air preparation and pneumatic systems. Strategic acquisitions, partnerships, and catering to niche applications are also vital for growth and market presence.

List of the Key Pneumatic Components Market Companies Profiled

- SMC Corporation (Japan)

- Festo SE & Co. KG (Germany)

- Emerson Electric Co. (U.S.)

- Janatics (India)

- Siemens AG (Germany)

- Parker US (U.S.)

- Eaton Corporation (Ireland)

- Chicago Pneumatics (France)

- Ross Controls (U.S.)

- Koki Holdings (Japan)

- IMI Norgren (U.K.)

- AirTAC International Group (Taiwan)

KEY INDUSTRY DEVELOPMENTS

- In June 2024, GEMÜ developed new products in valves and an innovative position indicator category to increase efficiency and safety in the process. The GEMÜ P40 represents a newly developed, innovative tank bottom valve designed specifically for sterile applications. A key element of this new product line is the GEMÜ 12A0, an intelligent electrical position indicator engineered for pneumatic process valves of the latest generation.

- In July 2024, Premier Tech Systems and Automation launched the VPF Series air valve bag filling machine, which is a fully automatic system designed to enhance productivity and handle precise materials mainly for the chemicals and food, and beverage industry.

- In February 2024, Valmet launched the X-series ball valve series with enhanced safety, high-cycle shut-off, and throttling services with high-pressure differentials for industries such as the petrochemical and chemical industries.

- In January 2024, Emerson launched the Fisher easy-Drive 200R electric actuator with application in Fisher butterfly and ball valves under extreme conditions in heavy industries, mainly in oil & gas facilities in remote locations.

- In August 2024, SMC introduced a top-ported plug-in solenoid valve to simplify installation and enhance flexibility. Moreover, the JSY3000 valve series also provides access to optional pressure sensor compatibility, making the solution well-suited for modern industrial automation requirements.

Investment Analysis and Opportunities

The developing economies present a significant investment opportunity to the Pneumatic Components market:

- In November 2024, Bray Controls announced the opening of the Valve Automation Centre (VAC) in Glasgow, Scotland. The VAC offers comprehensive services encompassing valve and actuator selection, sizing, system integration, and calibration, as well as the testing and delivery of fully automated valve assemblies. In addition, it provides technical support, training, installation, commissioning, maintenance, and repair services to ensure reliable operation.

- In February 2024, Bürkert launched direct-acting solenoid valves and a range of easy-to-service liquid and steam and controlling. Moreover, this product range also achieved approval for food and beverage applications.

REPORT COVERAGE

The market report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies in the market. Besides, the report offers regional insights and global market trends & technology, and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.46% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type · Actuators · Valves · Pneumatic Fittings & Tubing · Others |

|

By Application · Industrial Machinery · Construction · Medical · Automotive · Others |

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 14.81 billion in 2025.

The market is likely to grow at a CAGR of 6.46% over the forecast period (2026-2034).

The Industrial Machinery segment is expected to lead the market over the forecast period.

The market size of the Asia Pacific stood at USD 6.32 billion in 2025.

Accelerating the Adoption of Automation and Smart Manufacturing is Driving the Market Growth

Some of the top players in the market are SMC Corporation, Festo SE & Co. KG, Emerson Electric Co., and others.

The global market size is expected to reach USD 25.42 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us