Pneumococcal Vaccines Market Size, Share & Industry Analysis, By Product Type (PCV13, PCV15, PCV20, PCV21, PPSV23, and Others), By Age Group (Pediatric and Adults), By Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

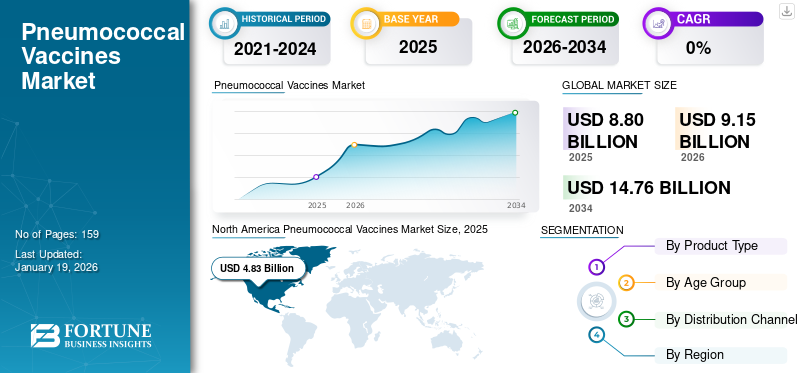

The global pneumococcal vaccines market size was valued at USD 8.8 billion in 2025. The market is projected to grow from USD 9.15 billion in 2026 to USD 14.76 billion by 2034, exhibiting a CAGR of 6.17% during the forecast period. North America dominated the pneumococcal vaccines market with a market share of 29.20% in 2025.

The global market is projected to grow with a significant CAGR during the forecast period, with an upward growth trajectory. Various established players such as GSK plc., Merck & Co., Inc., and Sanofi operating in the market are focusing on developing various pipeline candidates to support the rising demand for vaccines. These vaccines are administered to protect against infection caused by Streptococcus pneumoniae or pneumococcus and help in preventing pneumonia, meningitis, and sepsis.

The market’s growth is attributed to rising awareness of the importance of vaccination and advancements in vaccine technology. Pneumococcal whole-cell and protein-based vaccines are being studied further to offer innovative products for vaccinating against pneumococcal diseases. Moreover, key players increasingly focus on launching new products, followed by accelerated approvals from various regulatory bodies.

Increased awareness and favorable government policies also assist in market growth.

- For instance, in November 2021, India completed the national introduction of the Pneumococcal Conjugate Vaccine (PCV) into its routine immunization program 2021. The program ensured access to PCV vaccines for over 90% of children born in India annually. With the help of the GAVI Pneumococcal Advance Market Commitment mechanism, India received more than 60 million vaccine doses.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Prevalence of Invasive Pneumococcal Diseases to Drive Market Growth

A rise in the prevalence of invasive pneumococcal diseases has been observed in recent years due to underlying health conditions, such as chronic diseases, HIV infection, or social factors. Invasive Pneumococcal Disease (IPD) refers to serious infections caused by the bacteria Streptococcus pneumoniae (pneumococcus) that enters the bloodstream or other sterile parts of the body. These infections can include conditions such as bacteremia and meningitis. Due to such adverse effects, more focus on prevention than treatment resulted in more healthcare expenditure.

Furthermore, the high prevalence of pneumococcal diseases heightens the demand for vaccination. Ongoing research and development are being carried out to prevent these diseases that protect against different serotypes.

- For instance, in 2022, the ‘Annual Epidemiological Report’ by the European Centre for Disease Prevention and Control reported 17,700 confirmed cases of invasive pneumococcal disease in the European Union/European Economic Area. The rising prevalence of these infections is expected to drive the global pneumococcal vaccines market growth.

MARKET RESTRAINTS

Complexity in Manufacturing Processes to Hamper Market Growth

One of the major challenges for the market is the complex manufacturing process associated with its production. This complexity arises due to the diversity of Streptococcus pneumoniae bacteria and the need for conjugation. There are different serotypes, and vaccines need to be designed to target these multiple serotypes to be effective.

Additionally, linking the bacteria's polysaccharide components to a protein carrier to make the vaccine effective is complex and expensive. Conjugation requires specialized facilities, equipment, and expertise in polysaccharide purification, modification, and conjugation. These factors pose a challenge to the market growth.

- For instance, in August 2024, the Journal of the International Alliance for Biological Standardization published an article titled ‘Current trends in development and manufacturing of higher-valent pneumococcal polysaccharide conjugate vaccine and its challenge’ explained the complex procedures for the production of pneumococcal vaccines such as polysaccharide fermentation, purification, modification or sizing of multiple polysaccharides and conjugation between polysaccharides and carrier proteins, the stability of the conjugates, and the immunogenicity of the vaccine.

MARKET OPPORTUNITIES

Rising Investment for Pipeline Candidates to Venture into Prominent Opportunities for Market

Various established players in the market are streamlining their research capital toward the development of novel pipeline candidates. Despite decades of public health vaccination programs, Invasive Pneumococcal Disease (IPD) continued to inflict a substantial burden of disease, primarily due to Streptococcus pneumoniae serotypes that are not included in currently available conjugate vaccines.

Next-generation PCVs have the potential to extend vaccine coverage of disease-causing serotypes. Therefore, many established players focus on developing larger covalent vaccines that provide wide-spectrum protection.

- For instance, in December 2024, Sanofi initiated a phase 3 program for PCV21 and expanded collaboration with SK Bioscience for next-generation PCV. These next-generation PCVs have the potential to extend vaccine coverage of disease-causing serotypes.

MARKET CHALLENGES

Unavailability of Cold Storage Infrastructure to Pose a Significant Challenge for Market

The pneumococcal vaccines are stored at a temperature between 2°C and 8°C. When not stored properly, these vaccines are likely to provide very low efficacy. Additionally, distribution and supply shortages in lower and middle-income countries result in limited availability of pneumococcal vaccines in remote areas. A break in cold chain vaccine transport is also a challenge.

Cold chain systems are struggling to efficiently support national immunization programs to ensure the availability of safe and potent vaccines.

- For instance, in November 2022, an article by the International Trade Organization reported that twenty-five percent of liquid vaccines spoiled globally, primarily because of broken cold chains. Such wastage of vaccines due to the unavailability of cold storage may hamper the market growth.

PNEUMOCOCCAL VACCINES MARKET TRENDS

Focus on Adult Vaccination Programs is a Prominent Trend in Market

The global pneumococcal vaccine market witnessed a shift in adult vaccination programs. Pneumococcal diseases cause fatal loss and high mortality in adults, especially in patients over 65 years. These vaccination campaigns protect against these pneumococcal-borne diseases.

Additionally, various government initiatives and updates in vaccine administration recommendations are some factors influencing adult vaccination programs.

- For instance, in October 2024, The Centers for Disease Control and Prevention’s (CDC’s) Advisory Committee on Immunization Practices (ACIP), an arm of the U.S. Department of Health and Human Services, expanded the current age-based recommendations for PCV for all PCV-naive adults aged 50 years or older.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

Growing Number of Pipeline Candidates to Highlight Growth of PCV20 Segment

In terms of product type, the market is segmented into PCV13, PCV15, PCV20, PCV21, PPSV23, and others.

The PCV20 segment accounts for a leading market share in the market. The dominant market share is attributed to its wide application against protection from a broad range of pneumococcal serotypes. PCVs attach the bacterial polysaccharides to a protein carrier that helps recognize and respond to the bacteria more effectively. Moreover, the segment is accompanied by many new product launches with various pipeline candidates to augment the market further.

- For instance, in December 2024, Pfizer announced the approval of the company’s 20-valent Pneumococcal Conjugate Vaccine (PCV20) by the Hong Kong Department of Health (DoH).

The PPSV23 segment is expected to grow with a stable CAGR during the forecast period. These PPSV vaccines induce type-specific antibodies that enhance opsonization, phagocytosis, and killing of pneumococci by leukocytes and other phagocytic cells. These vaccinations exhibit limited immune response solely with a simple regime. Still, they are largely used in combination doses a year after administering conjugation vaccines to elicit a broader immune response. Due to these factors, various emerging economies are introducing pneumococcal vaccines.

For instance, in June 2025, the National Centre for Infectious Diseases announced that Singapore would be the first Asian country to receive Pfizer’s new pneumococcal vaccine, which would replace the existing vaccines.

By Age Group

Novel Product Launches for Young Children to Propel Pediatric Segment Growth

On the basis of age group, the market is segmented into pediatric and adults.

The pediatric segment is expected to account for a leading share of the global market and grow with a substantial CAGR in the forecast period. The segment’s market share is attributed to the high risk of pneumococcal diseases in pediatric patients. Children are considered vulnerable populations for infectious diseases caused by Streptococcus pneumoniae. This drives the need for high volumes of pneumococcal disease vaccination programs to prevent fatal diseases. Moreover, established players focus on new product launches which further drives segment growth.

- For instance, in November 2024, Abbott launched its new vaccine, PneumoShield 14, designed for young children in India over six weeks of age. The regulatory filing reported broader protection against pneumococcal disease, covering 14 different serotypes of the bacteria. Such factors influence the growth of pneumococcal disease vaccination programs.

On the other hand, the adult segment is expected to grow with a stable CAGR in 2024. This growth is attributed to increased awareness programs and various government financial aids, which are expected to propel the market expansion opportunity.

- For instance, in April 2025, the American Lung Association collaborated with Pfizer to raise public awareness about updated pneumococcal vaccine recommendations from the CDC in adults. It was reported that adults with chronic health conditions such as Obstructive Pulmonary Disease (COPD), asthma, diabetes, or chronic heart disease were at increased risk for pneumococcal pneumonia.

By Distribution Channel

Increasing Collaboration with Government Agencies to Propel Growth of Government Suppliers Segment

The market is segmented based on distribution channel into hospital & retail pharmacies, government suppliers, and others.

The government suppliers segment is expected to dominate the pneumococcal disease vaccine market in the forecast period. This significant share is attributed to the strategic collaboration of companies with the government and government agencies to extend their presence in remote areas.

- For instance, in June 2020, UNICEF, Gavi’s procurement partner, and the Serum Institute of India (SII) entered a supply agreement to provide pneumococcal conjugate vaccines for USD 2 per dose.

The hospital & retail pharmacies are expected to grow substantially during the forecast period. The ease of access and vast distribution network in remote areas are some factors driving the segment's growth.

- For instance, in June 2025, the Plan-Do-Study-Act (PDSA) cycle implemented in the retail pharmacies of the U.S. witnessed a notable increase in the administration of the 20-valent PCV among eligible adults. This approach focused on identifying and engaging individuals who met vaccination criteria, resulting in improved uptake rates.

- Similarly, in March 2022, LloydsPharmacy and Pfizer UK’s Vaccines business collaborated to develop an enhanced Pneumococcal vaccination service across the Lloyds Pharmacy estate to respond to increasing demand, improve consumer choice, and help protect against respiratory infection. Such developments aims to propel the adoption of these vaccines via hospital & retail pharmacies to boost the segment’s growth in the market.

PNEUMOCOCCAL VACCINES MARKET REGIONAL OUTLOOK

By region, this market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Pneumococcal Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 4.83 billion in 2025 and USD 4.87 billion in 2026, and is anticipated to dominate the global market during the forecast period. This significant share is attributed to the developed infrastructure and presence of key regional companies. Furthermore, these established players invest heftily in new product development to further support regional growth.

- For instance, in November 2024, The Infection Innovation Consortium (iiCONSearch organization) acquired a Medical Research Council fund of USD 3.5 million for a trial to advance the development of PnuBioVaxView, a novel vaccine against pneumococcal diseases. This disease exhibited high rates of antibiotic resistance and remained a major global health concern. The trial aimed to establish a low-cost vaccine that can be manufactured and distributed in Africa, potentially blocking community transmission of multiple serotypes.

U.S.

The U.S. is dominating the market in the North American region. The significant market share is attributed to the major public health burden of Pneumococcal diseases in the U.S., particularly among older adults and those with underlying medical conditions.

- For instance, in March 2022, the Delaware Journal of Public Health published an article titled ‘Pneumococcal Immunization for Adults in 2022’ reported that in the U.S., pneumococcal pneumonia is estimated to result in approximately 150,000 hospitalizations yearly. Such a high prevalence of pneumonia-causing bacteria augments the demand for effective pneumococcal vaccines for prevention.

Europe

Europe held the second-highest position in terms of revenue share in 2024. The region's high market share is attributed to intensive research and development activities and fast-track approvals by regulatory bodies.

- For instance, in March 2025, Merck & Co., Inc., received approval from the European Commission for CAPVAXIVE (Pneumococcal 21-valent Conjugate Vaccine) for active immunization for the prevention of invasive disease and pneumonia caused by Streptococcus pneumoniae in individuals 18 years of age and older.

Asia Pacific

The Asia Pacific pneumococcal vaccine market is projected to witness the highest CAGR during the forecast period 2024-2032. Developing countries such as China, Japan, and India are increasing their investment in research capabilities. The region's market share is attributed to a rising patient pool and increasing development of indigenous vaccines to offer affordable vaccines. Furthermore, regional companies are indulging in strategic investments to develop pneumococcal vaccines.

- For instance, in December 2020, India’s first pneumococcal conjugate vaccine, Pneumosil, was launched. The Serum Institute of India developed the 10-covalent PCV, and received pre-qualified for its procurement by United Nations Agencies and GAVI, the Vaccine Alliance.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa accounted for moderate market revenue during the forecast period. The region has observed increased vaccination drives and strategic collaboration to heighten access, which offer growth opportunities to the global pneumococcal vaccines market.

- For instance, in January 2025, The Pan American Health Organization (PAHO), the Government of Argentina, Pfizer Inc., and Sinergium Biotech collaborated to facilitate local production and regional access to the 20-valent Pneumococcal Conjugate Vaccine (PCV20) in the region—such developments bolster the regional growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Focus on Strategic Expansion Opportunities by Key Players to Propel Market Progress

The global pneumococcal vaccines market holds a semi-consolidated structure featuring prominent players such as Sanofi, Merck & Co., Inc., and GSK plc. The substantial share of these companies is due to strategic activities such as new product launches, mergers, and acquisitions for robust product offerings.

- For instance, in November 2024, Abbott launched its pneumococcal conjugate vaccine, PneumoShield 14, for children over 6 weeks of age. The vaccine provides broad protection, covering the highest number of serotypes or strains compared to existing PCV-10 and PCV-13 vaccines.

Other notable players in the global market include Inventprise, Vaxcyte, Walvax Biotechnology Co., Ltd. These companies are anticipated to prioritize regulatory approvals and collaborations to boost their global pneumococcal vaccines market share.

LIST OF KEY PNEUMOCOCCAL VACCINES COMPANIES PROFILED

- GSK plc. (U.K.)

- Merck & Co., Inc. (U.S.)

- Abbott (U.S.)

- Sanofi (France)

- Pfizer (U.S.)

- Inventprise (U.S.)

- Vaxcyte (U.S.)

- Walvax Biotechnology Co., Ltd. (China)

- SK Bioscience (South Korea)

KEY INDUSTRY DEVELOPMENTS

- June 2025: SK Bioscience, a biotech company, expanded its L HOUSE production facility in Andong to support the global supply of its 21-valent Pneumococcal Conjugate Vaccine (PCV) candidate, GBP410. The facility received official building use approval from the City of Andong.

- October 2024: Chad became the first Gavi-supported country to launch routine pneumococcal disease, malaria, and rotavirus immunizations.

- October 2023: Vaxcyte, Inc. partnered with Lonza, a global manufacturing partner, and signed a manufacturing agreement. This agreement aligned with the company’s strategic plans to utilize the infrastructure of Lonza to advance clinical development for the launch of VAX-24, a PCV candidate for the adult population.

- April 2023: Pfizer Inc. received FDA approval for Prevnar 20 (20-valent Pneumococcal Conjugate Vaccine) for the prevention of Invasive Pneumococcal Disease (IPD) and otitis media in infants six weeks through five years of age caused by the serotypes contained in PREVNAR.

- November 2022: Walvax Biotechnology Co., Ltd signed a memorandum of understanding with PT Etana Biotechnologies Indonesia at the signing ceremony. Under the MOU, Walvax and Etana collaborated on the localization of the Pneumococcal Polysaccharide Conjugate Vaccine (PCV) and Recombinant Human Papillomavirus Vaccine (HPV) in Indonesia.

- March 2025: Vaxcyte shared positive topline results from its Phase 2 dose-finding study evaluating the safety, tolerability, and immunogenicity of VAX-24, the company’s 24-valent PCV candidate designed to prevent invasive pneumococcal disease (IPD), compared to Prevnar 20 (PCV20) in healthy infants.

- January 2024: Inventprise Inc. completed the vaccination in its Phase 2 dose-ranging study of its 25-valent pneumococcal conjugate vaccine (IVT PCV-25) in young adults. The vaccine is designed to help prevent pneumococcal disease caused by serotypes not covered in the current PCVs and to help protect people globally.

REPORT COVERAGE

The global pneumococcal vaccines market report comprises a global analysis emphasizing key aspects such as pipeline candidates, regulatory environment, and product launches. The report also examines the technological advancements in vaccine development alongside notable industry developments, including mergers, partnerships, and acquisitions. Furthermore, the report provides a detailed regional analysis of various segments, and the trends associated with the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.17% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Product Type

|

|

By Age Group

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 8.8 billion in 2025 and is projected to reach USD 14.76 billion by 2034.

In 2025, North America stood at USD 4.83 billion.

Registering a CAGR of 6.17%, the market will exhibit rapid growth over the forecast period (2026-2034).

Based on type, the PCV13 segment is expected to lead the market during the forecast period.

The rising prevalence of pneumococcal infections and new product launches of pneumococcal vaccines are some factors driving the market.

Sanofi, Merck & Co., Inc., and GSK plc. are major players in the global market.

North America dominated the market in terms of share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us