Polyurethane Elastomers Market Size, Share & Industry Analysis, By Application (Furniture, Construction, Electronics, Automotive & Transportation, Packaging, Footwear, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

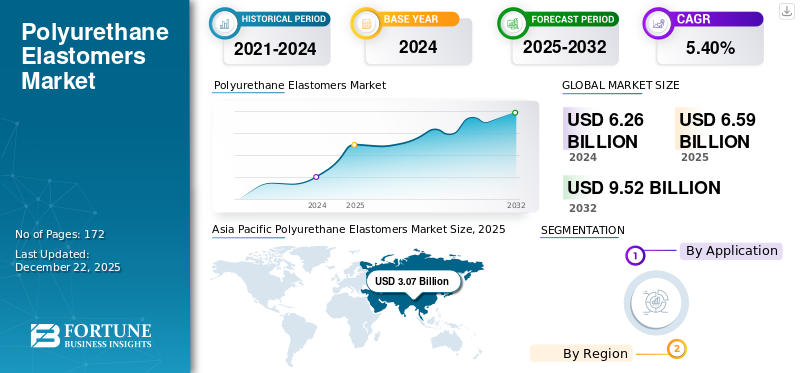

The global polyurethane elastomers market size was valued at USD 6.59 billion in 2025. The market is projected to grow from USD 6.95 billion in 2026 to USD 10.57 billion by 2034, exhibiting a CAGR of 5.40% during the forecast period. Asia Pacific dominated the polyurethane elastomers market with a market share of 47% in 2025.

Polyurethane elastomers are a class of elastic polymers, often referred to as urethane elastomers-belonging to the broader family of rubber-like materials. They are specifically characterized by their ability to undergo significant elastic or reversible deformation and quickly return to their original shape when the stress is released.

Polyurethane elastomers are widely used in automotive components such as bushings, gaskets, seals, bumpers, wheels, and tires. The demand for lightweight, durable, and high-performance materials in automotive manufacturing is a significant growth driver, especially as automakers seek to improve fuel efficiency and reduce emissions. The major companies operating in the market include Covestro AG, Nordmann, American Urethane, Inc., Argonics, and DOW.

Polyurethane Elastomers Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 6.59 billion

- 2026 Market Size: USD 6.95 billion

- 2034 Forecast Market Size: USD 10.57 billion

- CAGR: 5.4% from 2026–2034

Market Share:

- Asia Pacific dominated the polyurethane elastomers market with a 47% share in 2025, driven by rapid industrialization, urbanization, and strong manufacturing activity in China, India, and Japan.

- By application, the furniture segment is expected to hold the largest market share in 2025 due to its versatility, durability, and widespread use in cushions, mattresses, ergonomic components, and structural parts.

Key Country Highlights:

- United States: Demand is driven by applications in electric mobility, construction, and cold storage, supported by steady growth in vehicle production and advanced technologies.

- China: Strong industrial base and rapid urbanization make it the leading consumer of polyurethane elastomers across automotive, construction, and consumer goods sectors.

- Japan: Growth is supported by high-tech manufacturing, automotive production, and demand for durable lightweight materials.

- Europe: Growth is underpinned by the automotive industry’s adoption of lightweight and durable components, as well as steady demand from footwear and construction industries.

- Brazil: Expanding footwear production and automotive manufacturing drive polyurethane elastomers demand, supported by rising industrialization and investments in construction.

POLYURETHANE ELASTOMERS MARKET TRENDS

Rising Trend toward Electric Vehicles is Propelling Market Growth

The rise in electric vehicle production and increasing vehicle registrations globally are accelerating the product demand. For example, major automakers are investing in new facilities and technologies to expand electric vehicle production, directly increasing the consumption of products for both structural and performance parts.

As EVs rely on heavier battery packs, manufacturers are increasingly turning to lightweight, high-performance materials such as polyurethane elastomers to offset weight, improve energy efficiency, and extend driving range. PU elastomers are used in battery seals, thermal insulation, body panels, bumpers, and various interior and exterior components due to their exceptional strength-to-weight ratio, durability, and design flexibility.

MARKET DYNAMICS

MARKET DRIVERS

Growing Application in Automotive and Consumer Goods Industries Drives Global Market

The automotive sector is a dominant force in the global market. The product is extensively used in automotive components such as tires, body panels, suspension bushings, seals, gaskets, anti-vibration mounts, and interior parts. Its high tensile strength, abrasion resistance, flexibility, and durability make it ideal for demanding automotive applications. The industry's focus on lightweight materials to improve fuel efficiency and reduce emissions further boosts the adoption of polyurethane elastomers, as these materials help manufacturers meet regulatory and performance standards.

The product is also gaining traction in the consumer goods sector, especially in products requiring flexibility, comfort, and durability. They are used in footwear soles, sporting goods, furniture, electronics housings, and a variety of household items. The footwear industry, in particular, is experiencing significant growth due to consumer demand for lightweight, comfortable, and long-lasting shoes.

MARKET RESTRAINTS

Health Concerns Regarding Exposure to Polybutadiene May Restrain Market Growth

The lower durability of the product is a significant factor restraining the polyurethane elastomers market growth. This limitation affects their performance and longevity in various applications, leading to a preference for alternative materials that may offer better durability and reliability. Addressing these durability issues could enhance the adoption of the product in more demanding environments and positively impact the market.

MARKET OPPORTUNITIES

Bio-Based and Environmentally Friendly Polyurethane Elastomers Create an Opportunity for Market Growth

Bio-based and environmentally friendly polyurethane elastomers offer significant potential to address growing sustainability demands in various industries. These materials help to reduce dependence on petroleum-based feedstock by incorporating renewable resources including vegetable oils, lignin, and other bio-derived polyols. Also, it lowers the overall carbon footprint compared to conventional polyurethane production. The product offers end-of-life advantages through improved biodegradability or recyclability options.

MARKET CHALLENGES

Environmental Concerns Caused by Polyurethane Challenging Market Growth

Conventional products are largely non-biodegradable, leading to long-term waste accumulation in landfills. Disposal of polyurethane products poses environmental hazards due to their persistence.

The production of polyurethane involves isocyanates, which are hazardous and pose health risks to workers and the environment. Furthermore, some additives and solvents used in manufacturing can release Volatile Organic Compounds (VOCs), contributing to air pollution. These factors negatively impact the market growth.

TRADE PROTECTIONISM

Many countries have implemented tariffs on imported polyurethane elastomers to protect domestic manufacturers. The US-China trade tensions have resulted in significant tariffs on polyurethane raw materials and finished products.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

Furniture Segment to Hold Largest Market Share due to Increased Product Adoption on Account of Its Versatility & Durability

Based on application, the market is classified into furniture, construction, electronics, automotive & transportation, packaging, footwear, and others.

Furniture segment is expected to hold the dominant polyurethane elastomers market shares due to their versatility, durability, comfort, and ability to be tailored to specific performance requirements. Their widespread use in cushions, mattresses, ergonomic components, and structural parts underscores their importance in creating high-quality, long-lasting furniture.

Apart from furniture, the product is also utilized in various construction applications. The product is widely used as a sealant and adhesive, providing strong, flexible, and durable bonds for joints, expansion gaps, and structural elements. They offer superior stress recovery, environmental resistance, and longevity compared to many traditional materials.

The product is also used in the automotive & transportation industry, particularly in the bushings, suspension components, engine & motor mounts, body panels & tires, and more. The product is used in lightweight body panels and automotive tires, offering high tensile strength and excellent resistance to tear, wear, and abrasion. Their use helps reduce vehicle weight, which improves fuel efficiency and performance.

Polyurethane Elastomers Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Polyurethane Elastomers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific leads the global market with a size of 3.26 in 2026, both in terms of current market share and projected growth rate. This dominance is fueled by rapid industrialization, urbanization, and robust manufacturing activity, especially in China, India, Japan, and other countries.

North America

North America is a mature market with steady demand, driven by the automotive, construction, and consumer goods sectors. Continued growth in vehicle production, technological advancements, and the presence of major manufacturers sustain demand for polyurethane elastomers in the region. The U.S. market is poised for significant growth, driven by the increasing demand from key applications including electric mobility, construction, and cold storage.

Europe

Europe will register significant growth during the forecast period. High demand from the automotive industry, especially for lightweight and durable components, as well as steady demand from the footwear and construction industries, underpin regional growth.

Latin America

Latin America shows growing demand, particularly in Brazil, where footwear production and automotive manufacturing are expanding. Rising industrialization and increasing investments in construction and consumer goods contribute to market growth.

Middle East & Africa

The Middle East & Africa is witnessing gradual growth in the product market. Growth is supported by infrastructure development, rising construction activity, and gradual expansion of automotive assembly and consumer goods manufacturing.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in their Dominating Position

The polyurethane elastomers market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include Covestro AG, Nordmann, American Urethane, Inc., Argonics, and DOW. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY POLYURETHANE ELASTOMERS COMPANIES PROFILED

- Covestro AG (Germany)

- Nordmann (Germany)

- American Urethane, Inc. (U.S.)

- Argonics (U.S.)

- DOW (U.S.)

- Huntsman International LLC (U.S.)

- INOAC CORPORATION (Japan)

- LANXESS (Germany)

- Mitsui Chemicals, Inc. (Japan)

- The Lubrizol Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2024: BASF and STOCKMEIER Urethanes USA, Inc. partner to offer more sustainable polyurethane playground and recreational surfacing products. STOCKMEIER Urethanes produces a wide range of products including coatings, adhesives, sealants, and elastomers that cater to diverse industries such as automotive, construction, electronics, and sports & recreational surfaces.

- August 2023: Covestro has started operations at its new facility for polyurethane elastomer systems located in its integrated site in Shanghai, China. This new plant in Shanghai aims to address the increasing demand for the material in Asia Pacific, particularly in renewable energy applications such as offshore cable protection and silicon wafer cutting rollers for photovoltaic panels, among other uses.

- July 2023: Multinational chemical distributor Nordmann has entered a partnership with Era Polymers (Sydney, Australia) for the distribution of polyurethane elastomers, effective immediately in Belgium, Finland, Germany, Italy, the Netherlands, Sweden, and Switzerland.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on polyurethane elastomers in key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.40% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.59 billion in 2025 and is projected to reach USD 10.57 billion by 2034.

In 2025, the market value stood at USD 3.07 billion.

The market is expected to exhibit a CAGR of 5.40% during the forecast period of 2026-2034.

The furniture segment led the market by application.

Growing application in the automotive and consumer goods industries is expected to drive the market.

Covestro AG, Nordmann, American Urethane, Inc., Argonics, and DOW are some of the leading players in the market.

Asia Pacific dominated the polyurethane elastomers market with a market share of 47% in 2025.

Rising preference for electric vehicles and increasing demand for bio-based and environmentally friendly products are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us