Position Sensor Market Size, Share & Industry Analysis, By Type (Linear, Rotary, Photoelectric, Proximity, Potentiometric, and Others), By Output Type (Digital and Analog), By Application (Automotive, Industrial Automation, Medical, Military and Aerospace, Packaging, and Others), and Regional Forecast, 2025 – 2032

Position Sensor Market Analysis

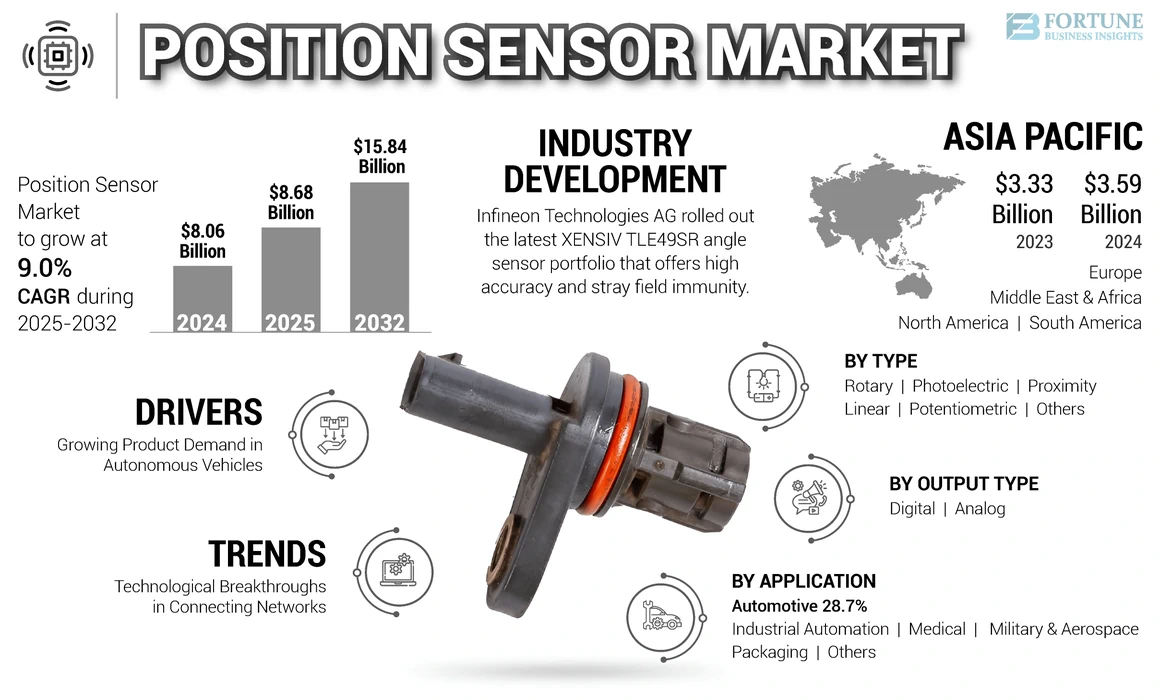

The global position sensor market size was valued at USD 8.06 billion in 2024 and is projected to grow from USD 8.68 billion in 2025 to USD 15.84 billion by 2032, exhibiting a CAGR of 9.0% during the forecast period. Asia Pacific dominated the global position sensor market with a share of 44.54% in 2024.

A position sensor is a type of sensor that can detect the movement of an object and convert it into signals that can be transmitted, controlled, or processed. These sensors are usually used for measuring body distance from a reference point.

GLOBAL POSITION SENSOR MARKET OVERVIEW

Market Size:

- 2024 Value: USD 8.06 Billion

- 2025 Value: USD 8.68 Billion

- 2032 Forecast Value: USD 15.84 Billion, with a CAGR of 9.0% from 2025–2032

Market Share:

- Regional Leader: Asia Pacific led the market in 2024 due to strong growth in automotive and electronics manufacturing.

- Fastest-Growing Region: Europe is projected to grow at the highest CAGR, driven by industrial automation and advanced robotics.

- End-User Leader: Automotive segment held the largest share in 2024, fueled by rising demand for position sensing in EVs and ADAS systems.

Industry Trends:

- Smart Sensor Integration: Adoption of intelligent, digital output position sensors in next-gen industrial and consumer devices.

- Miniaturization & Precision: Development of compact sensors offering high resolution and low power consumption.

- Robotics & Automation Demand: Position sensors increasingly used in robotic arms, conveyors, and motion control systems.

Driving Factors:

- Automotive Innovation: Growing use of sensors in steering, throttle control, and gear shift mechanisms.

- Industrial Modernization: Accelerated automation in manufacturing and logistics driving sensor installations.

- Electronics & Medical Applications: Surge in demand from touch screens, wearable devices, and diagnostic equipment.

- Technology Advancements: Continuous evolution in sensor materials, sensitivity, and connectivity features.

- Global Production Expansion: Increased manufacturing activities across emerging economies expanding market size.

The market growth is expected to be driven by the increasing product demand in the automotive industry for autonomous vehicles and the proliferation of electronic devices. The rise in market demand is attributed to the growing inclination toward automation and Industry 4.0 in industrial facilities. According to the recent 2022 Survey of Industry 4.0 adoption, businesses have made significant strides. With numerous ongoing initiatives and some already finalized, 72% of survey participants state that they are actively working on implementing Industry 4.0. Moreover, the enhancements in predictive maintenance solutions are fostering a growing potential for market share.

The market growth was significantly affected by the COVID-19 pandemic. Many companies in the industry were trying to compensate for the losses caused by disruptions in the supply chain and decreased sales. Post-pandemic, major players in the market have started investing and expanding their production capabilities to capitalize on advanced sensors.

Position Sensor Market Trends

Technological Breakthroughs in Connecting Networks is a Key Trend

Manufacturers of consumer electronic devices such as tablets and smartphones are being pushed to integrate wireless communication, sensory capabilities, and localization technologies due to continuous advancements in connecting networks and technology.

The incorporation of advanced positioning-based systems is on the rise in these devices due to their increased processing memory and battery power, benefiting users in applications such as healthcare, industrial automation, and packaging.

Download Free sample to learn more about this report.

Position Sensor Market Growth Factors

Rising Product Demand in Automotive Industry for Autonomous Vehicles to Aid Market Growth

The increasing focus of the consumers in the automotive sector is pushing the demand for position sensors on Advanced Driver Assistance Systems (ADAS) and autonomous vehicles. These sensors play a crucial role in determining the positions of various vehicle components such as steering wheels, seats, pedals, valves, knobs, and actuators. ADAS, including lane departure warnings, automated emergency braking, and drowsiness & attentiveness monitoring, is heavily relied upon by autonomous vehicles. According to the European Automobile Manufacturers Association, in 2022, around 85 million automobiles were manufactured globally, an increase of 5.7% compared to 2021.

To ensure precise and reliable performance, these systems require advanced sensors. The accurate position decision-making of autonomous vehicles heavily relies on the integration of data from sensors used for positioning. This data fusion enhances the overall performance and safety of autonomous vehicles and contributes to the growing demand for these sensors.

RESTRAINING FACTORS

High Manufacturing and Implementation Cost of Position Sensors to Hinder Market Expansion

Determining the profitability of a product depends on the availability and pricing of components and raw materials, along with the time needed to introduce the final product to the market. Companies are encountering significant obstacles, such as the high costs associated with implementation and the increasing pressure to reduce overall production expenses without compromising quality. These factors are set to hamper the position sensor market growth.

Position Sensor Market Segmentation Analysis

By Type Analysis

Major Role of Linear Position Sensors in Automotive Industry to Boost the Market Growth

Based on type, the market is segmented into linear, rotary, photoelectric, proximity, potentiometric, and others.

In terms of market share, the linear segment dominated the market in 2024. Linear sensors find widespread usage in vehicles for tasks such as throttle position sensing, pedal position sensing, and suspension control. Expanding automotive industry, encompassing electric and autonomous vehicles, is fueling the need for these sensors.

The proximity segment is anticipated to register the highest CAGR during the forecast period. Proximity sensors are increasingly being used in smartphones to identify unintended touchscreen taps. Additionally, these sensors play a crucial role in automation by gathering data on specific process variables to inform controllers.

By Output Type Analysis

Fulfillment of Accurate Measurement Requirements by Analog Sensors Boosted the Market Growth

Based on output type, the market is segmented into digital and analog.

In terms of market share, the analog segment dominated the market in 2024. Output sensors of the analog type produce a voltage or current signal that changes continuously in proportion to the position being measured. This kind of output is appropriate for situations that demand accurate measurement and instantaneous analog feedback.

The digital segment is anticipated to register the highest CAGR during the forecast period. Digital output sensors give position information through digital signals, usually binary or pulse-width modulated (PWM) signals. Digital output is commonly chosen due to its resistance to noise and its ease of connection with digital systems.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive Segment Dominated the Market Due to Rapidly Developing Technologies Used in Vehicle Components

Based on application, the market is categorized into automotive, industrial automation, medical, military and aerospace, packaging, and others.

In terms of market share in 2024, the automotive segment dominated the market. The advances in automotive technologies, including climate control, autonomous driving, advanced electronic cruise controls, electric vehicles, and temperature monitoring, are the main factors driving this segment. Several position sensors are used in the automotive industry, such as crankshaft, throttle, accelerator pedal, and others. The rapidly developing technologies used in various vehicle components have led to a requirement for standardized, dependable, durable, and cost-effective sensors. Significant advancements have been made in the highly networked, microprocessor-controlled systems present in modern cars. Consequently, the dependability of electrical connections and equipment is increasingly crucial.

The medical segment is expected to grow at the highest CAGR during the forecast period. The sensors are essential in a wide range of medical devices and equipment, playing a key part in improving patient care, diagnostics, and treatment. The increasing emphasis on innovation and technological progress within the medical sector is leading to a greater need for these sensors. Ongoing advancements in sensor technology, along with changing healthcare requirements and regulations, are predicted to drive further expansion in this market sector.

REGIONAL INSIGHTS

Based on geography, the market is fragmented into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific Position Sensor Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held a majority part in the position sensor market share in 2024. The demand for high-quality sensors and precision equipment in Asia is anticipated to increase due to the outsourcing of manufacturing activities to low-cost developing countries. The regional growth is expected to be boosted by the strong progress of the manufacturing division and the growing need for new machine tools in the Indian market over the forecast period. Such factors have contributed to the growth of this market in the region.

The Europe market is estimated to grow at the highest rate during the forecast period. Vehicles in the region are being equipped with more safety features, such as sensors, as a response to the growing number of accidents caused by advancements in road and vehicle designs. The industry's changing requirements fuel the need for advanced sensors for positioning that align with Europe's ongoing dedication to technical advancement.

North America is expected to register the second-highest growth rate in the market during the forecast period. The region's market demand is increasing due to a high rate of mobile penetration, China's trade wars, the rising use of 5G technology, the Internet of Things (IoT), and intelligent devices.

The Middle East & Africa market is expected to register a significant growth rate during the forecast period. The increase is due to the widespread use of smartphones, an increase in online shopping websites, and the shift toward digitalization.

South America is poised for significant growth during the forecast period. This growth is driven by the increasing demand for high-speed data transmission, the emergence of 5G technology, and the widespread adoption of IoT.

KEY INDUSTRY PLAYERS

Market Players Use Mergers & Acquisitions, Partnerships, and Product Development Strategies to Increase their Business Reach

Leading industry players are providing advanced sensors to help users in their safety and monitoring. These sensor companies prioritize the acquisition of small and local firms to expand the reach of their businesses. Moreover, leading investments, mergers & acquisitions, and strategic collaborations contribute to an increase in product demand.

List of Top Position Sensor Companies:

- Monolithic Power Systems, Inc. (U.S.)

- Renesas Electronics Corporation (Japan)

- TE Connectivity (Switzerland)

- Analog Devices Inc. (U.S.)

- Microchip Technology Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Texas Instruments Inc. (U.S.)

- Vishay Intertechnology, Inc. (U.S.)

- Infineon Technologies AG (Germany)

- CTS Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Infineon Technologies AG launched the latest XENSIV TLE49SR angle sensor portfolio that combines stray field immunity with high accuracy. The sensors are supreme for applications such as vehicle height balancing and electric power steering, where safety-conscious automotive chassis systems are used.

- February 2023: Continental expanded its sensors portfolio to meet rapidly increasing demand in the EV market with the unveiling of a new innovative sensor. To improve efficiency and enable smooth operation, the High-Speed inductive eMotor Position Sensor OCTRSYS is capable of detecting the precise position of the rotors in synchronous electrical machines.

- January 2023: CTS Corporation announced the release of a new multiturn, noncontact, 286 rotary position sensor series. Multiturn, Hall Effect rotary position sensors are designed for the most demanding applications in the industrial, medical, transport, and other markets.

- January 2023: Infineon Technologies AG combined its proven experience in magnetic sensing with an established linearized tunnel magnetoresistor technology to launch the XENSIV TLI5590-A6W magnetic position sensor.

- April 2022: Vishay Intertechnology, Inc., developed a new micro position sensor that provides more resolution and accuracy than challenging devices of the same size. The solution also offers increased durability and reliability in demanding industrial and military environments.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, leading types, output type, and application. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.0% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Output Type

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 15.84 billion by 2032.

In 2024, the market value stood at USD 8.06 billion.

The market is projected to grow at a CAGR of 9.0% during the forecast period.

In 2024, the automotive segment led the market.

Rising demand in the automotive industry for autonomous vehicles is anticipated to aid market growth.

Monolithic Power Systems, Inc., Renesas Electronics Corporation, TE Connectivity, Analog Devices Inc., Microchip Technology Inc., NXP Semiconductors, Texas Instruments Inc., Vishay Intertechnology, Inc., Infineon Technologies AG, and CTS Corporation are the top companies in the global market.

In 2024, Asia Pacific held the largest market share.

Europe is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us