Process Analyzer Market Size, Share & Industry Analysis, By Component (Hardware, Software & Services, and Consumables), By Type (Gas Analyzers, Liquid Analyzers, and Others), By End-user (Oil & Gas, Water & Wastewater, Chemicals, Food & Beverage, Pharmaceuticals, and Others), and Regional Forecast, 2026 – 2034

PROCESS ANALYZER MARKET SIZE AND FUTURE OUTLOOK

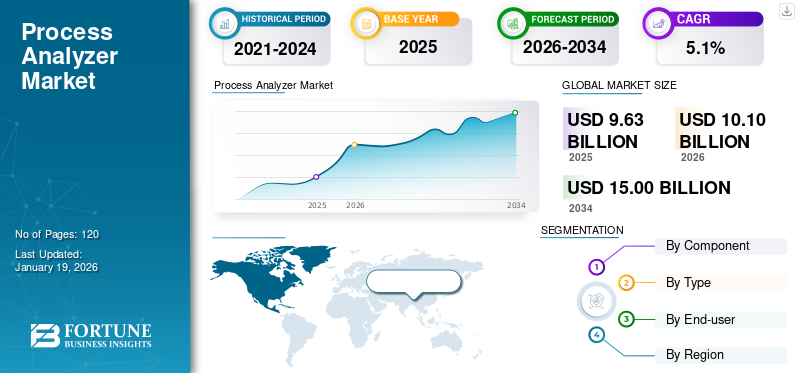

The global process analyzer market size was valued at USD 9.63 billion in 2025 and is projected to grow from USD 10.10 billion in 2026 to USD 15.00 billion by 2034, exhibiting a CAGR of 5.1% during the forecast period. North America dominated the global market with a share of 36.10% in 2025.

The process analyzer market comprises solutions & services designed to monitor, measure, and analyze chemical, physical, and biological properties within industrial processes in real time. These analyzers are widely deployed across industries such as oil & gas, water & wastewater, chemicals, food & beverage, pharmaceuticals, and others to ensure safety, regulatory compliance, and operational efficiency. The market is driven by increasing demand for digital integration, automation, and advanced analytical technologies to optimize production and reduce downtime. Further, generative AI is enhancing predictive analytics and process optimization, while reciprocal tariffs are increasing supply chain costs and creating trade uncertainties in the process analyzer industry.

ABB Ltd., Endress Hauser, Emerson Electric Co., Siemens AG, Yokogawa Electric Corporation, Thermo Fisher Scientific Inc., AMETEK Inc., Applied Analytics Inc., Mettler-Toledo, and Horiba Ltd. are recognized as the major players operating in the market. These companies are actively involved in developing advanced analytical solutions, expanding their product portfolios, and leveraging digital technologies to enhance real-time monitoring, regulatory compliance, and process optimization across industries.

For instance, In July 2025, Emerson introduced the Ovation AI-enabled Virtual Advisor, a GenAI tool within its Ovation 4.0 Platform that helps power and water industries improve efficiency, detect issues, and predict maintenance.

MARKET DYNAMICS

Download Free sample to learn more about this report.

MARKET DRIVERS:

Rising Demand for Real-Time Monitoring Accelerates Growth of Market

The market is witnessing significant growth driven by the increasing demand for real-time monitoring across critical industries. For instance,

Techstack estimates the global energy control systems market at USD 40.7 billion in 2023, projected to reach USD 75.6 billion by 2028 at a 13.2% CAGR.

Real-time monitoring enables industries to optimize operational efficiency, enhance product quality, and minimize downtime by providing actionable insights instantly. It also plays a vital role in ensuring workplace safety and meeting stringent regulatory requirements in sectors such as oil & gas, chemicals, and pharmaceuticals. As industries continue to adopt automation and digital technologies, the reliance on real-time process analyzers is expected to expand further, driving the process analyzer market growth.

MARKET RESTRAINTS:

High Costs, Skilled Workforce Shortage, and Trade Barriers Restrain Market Growth

The market faces restraints primarily due to the high initial investment and maintenance costs associated with advanced analytical equipment. Complex installation procedures and the need for skilled professionals to operate and maintain these systems further limit widespread adoption, especially among small and medium enterprises. Additionally, supply chain disruptions and tariff-related trade barriers create uncertainties in timely product availability and pricing. Further, data security concerns arising from the integration of digital technologies and IoT also pose challenges to market expansion.

MARKET OPPORTUNITIES:

Industrial IoT and Advanced Analytics Unlock New Growth Opportunities in Market

The integration of Industrial IoT and advanced analytics presents a significant opportunity for the market by enabling intelligent, connected systems. For instance,

As per IoT Analytics, the number of connected IoT devices reached 16.6 billion by the end of 2023, reflecting a 15% increase compared to 2022.

These technologies allow real-time data collection, predictive maintenance, and advanced process optimization, reducing downtime and operational costs. Industries such as oil & gas, chemicals, and pharmaceuticals are increasingly adopting IoT-enabled analyzers to improve efficiency and regulatory compliance. As digital transformation accelerates across industrial sectors, the demand for process analyzers is expected to rise substantially.

PROCESS ANALYZER MARKET TRENDS:

AI-Powered and Cloud-Based Analyzers Emerge as a Key Trend in Market

The growing adoption of AI-powered and cloud-based analyzers is emerging as a key trend fueling the market. These solutions enable advanced data analytics, predictive insights, and enhanced accuracy in real-time monitoring across industrial processes. For instance,

LeewayHertz reports that around 30% of large organizations are already leveraging AI to monitor over half of their business data.

Cloud integration further supports remote accessibility and scalability, allowing end-users to optimize operations with greater flexibility. As industries embrace digital transformation, the demand for AI-driven and cloud-enabled analyzers is expected to accelerate significantly.

SEGMENTATION ANALYSIS

By Component

Hardware Dominates Market for Its Core Measurement Role

Based on the component, the market is divided into hardware and software & services, and consumables.

Hardware dominates the market with 58.37% in 2026, due to its essential role in measurement and monitoring equipment. Software & services are projected to grow at a CAGR of 6.2% owing to rising demand for digital integration, predictive analytics, and maintenance support.

By Type

Gas Analyzers Lead on Strong Demand for Emissions Monitoring

Based on the type, the market is divided into gas analyzers, liquid analyzers, and others.

Gas analyzers lead the market with 47.27% in 2026, driven by their critical use in emissions monitoring, safety, and process control. They are also expected to grow at a CAGR of 5.9%. Liquid analyzers hold the second-largest share due to their widespread application in water & wastewater treatment and chemical industries.

By End-user

Oil & Gas Holds Largest Share Due to Safety and Compliance Needs

The end-user segregates the market into oil & gas, water & wastewater, chemicals, food & beverage, pharmaceuticals, and others.

Oil & gas holds 27.72% in 2026, of the market because of extensive reliance on analyzers for safety, compliance, and efficiency in exploration and refining. Pharmaceuticals are expected to grow at a CAGR of 7.5% supported by stringent quality standards and increasing adoption of advanced analyzers in drug manufacturing.

To know how our report can help streamline your business, Speak to Analyst

Process Analyzer Market Regional Outlook

By geography, the market is categorized into North America, South America, Europe, Middle East & Africa, and Asia Pacific.

NORTH AMERICA

North America process analyzer market held the dominant share in 2025, valued at USD 3.47 billion, and also took the leading share in 2026, with USD 3.66 billion. North America holds the largest share in the market due to strong industrial infrastructure, stringent regulatory compliance, and high adoption of advanced analytical technologies. The presence of leading market players and significant investments in oil & gas, chemicals, and pharmaceuticals further reinforces its dominance. The U.S. market is projected to reach USD 2.15 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

ASIA PACIFIC

During the forecast period, the Asia Pacific process analyzer market is growing at a CAGR of 6.2%, which is the highest among all the regions, and will reach the valuation of USD 3.07 billion in 2025. It is expected to grow at the highest CAGR, driven by rapid industrialization, expanding manufacturing base, and increasing investments in sectors such as chemicals, energy, and water treatment. Rising digital transformation initiatives and supportive government policies in countries including China and India also accelerate market growth. The Japan market is projected to reach USD 0.76 billion by 2026, the China market is projected to reach USD 0.94 billion by 2026, and the India market is projected to reach USD 0.62 billion by 2026.

EUROPE

The European market is expected to grow at a CAGR of 4.4% and is projected to reach USD 2.17 billion in 2025. Europe holds a significant process analyzer market share in the market, owing to strict environmental and safety regulations and well-established industrial sectors. Continuous innovation in automation and sustainability initiatives further supports steady market demand. The UK market is projected to reach USD 0.55 billion by 2026, and the Germany market is projected to reach USD 0.46 billion by 2026.

MIDDLE EAST & AFRICA and SOUTH AMERICA

Middle East & Africa and South America are expected to grow more slowly in the market, with the CAGR of 1.7% and 3.0% respectively, due to limited industrialization and lower adoption of advanced technologies. Economic and political uncertainties in several countries also restrain large-scale investments in process automation solutions.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Launch New Products to Strengthen Market Positioning

Players launch new product portfolios to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving landscape.

LIST OF KEY PROCESS ANALYZER COMPANIES PROFILED:

- ABB Ltd. (Switzerland)

- Endress+Hauser (Switzerland)

- Emerson Electric Co. (U.S.)

- Siemens AG (Germany)

- Yokogawa Electric (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- AMETEK, Inc. (U.S.)

- Applied Analytics, Inc. (U.S.)

- Mettler-Toledo (Switzerland)

- Horiba Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- In June 2025, Thermo Fisher Scientific introduced the MarqMetrix X Process Raman Analyzer for safe, real-time, in-line chemical analysis. It is designed for hazardous environments in industries such as oil & gas, chemicals, polymers, and pharmaceuticals.

- In May 2025, BD announced the global launch of the first cell analyzer with spectral and real-time cell imaging technologies. This innovation enables deeper cellular insights with greater ease and throughput in flow cytometry.

- In January 2025, Evident introduced the next-generation Vanta Element handheld XRF analyzer series for fast, accurate alloy identification. The affordable models improve speed, comfort, and accuracy in metal manufacturing, scrap sorting, and precious metals testing.

- In January 2025, QuidelOrtho Corporation launched the Certified Analyzer Program to expand access to diagnostic testing in rural and community hospitals across the U.S. The program provides certified VITROS analyzers with proven reliability and service at lower costs for smaller healthcare facilities.

- In December 2024, ABB launched ChloroStar, a new range of chlorine sensors and transmitters for accurate and reliable chlorine measurement. The solution helps water and wastewater industries improve efficiency, treatment, and process uptime.

REPORT COVERAGE

The global market analysis provides an in-depth study of the size & forecast by all the market segments included in the process analyzer market report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

| ATTRIBUTE | DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Growth Rate | CAGR of 5.1% from 2026-2034 |

| Unit | Value (USD Billion) |

| Segmentation | By Component, By Type, By End-user, and By Region |

| By Component |

|

| By Type |

|

| By End-user |

|

| By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 10.10 billion in 2026 and is projected to reach USD 15.00 billion by 2034.

In 2025, the market value stood at USD 9.63 billion.

The market is expected to exhibit a CAGR of 5.1% during the forecast period of 2026-2034.

The hardware led the market by component.

The growing need for real-time monitoring drives the market.

ABB Ltd., Endress+Hauser, Emerson Electric Co., and Siemens AG are some of the prominent players in the market.

North America dominated the market in 2025.

Major factors favoring product adoption are stringent regulatory requirements, rising demand for real-time monitoring, digital integration, and the need for efficiency and cost optimization across process industries.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us