Professional Beauty Services Market Size, Share & Industry Analysis, By Service (Hair Service, Skin Service, Nail Service, and Merchandise Sales), By End-User (Men and Women), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

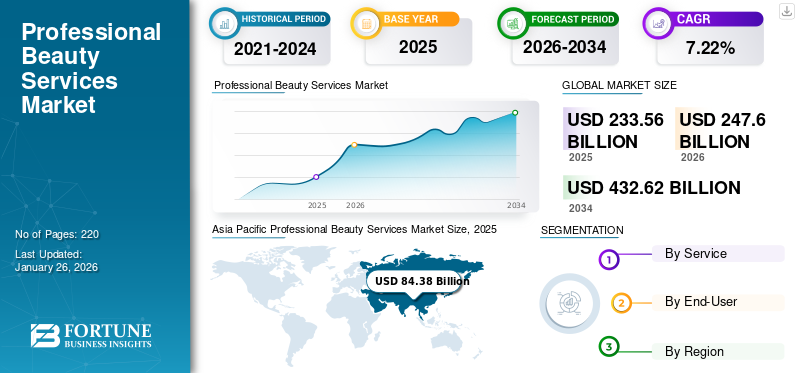

The professional beauty services market size was valued at USD 233.56 billion in 2025. The market is projected to grow from USD 247.6 billion in 2026 to USD 432.62 billion by 2034, exhibiting a CAGR of 7.22% during the forecast period. Asia Pacific dominated the professional beauty services market with a market share of 36.13% in 2025. Moreover, the professional beauty services market in the U.S. is expected to grow significantly, reaching USD 75.87 billion by 2032. The rising demand for salon treatments, aesthetic procedures, and premium skincare services is fueling industry expansion.

Professional beauty services refer to diversified specialized services that provide cosmetic treatments to men and women. Professional beauty service plays a vital role in the personal grooming of individuals. In the last couple of years, the professional beauty service industry has observed significant growth owing to increasing disposable income, evolving consumer lifestyles, growing consumer awareness regarding personal grooming, and the rise in influence from social media platforms. At a macro level, innovations in professional beauty salon equipment will create a significant demand for professional beauty services throughout the forecast period. In this respect, industry participants operating in the high-end salon services category, including Karizma Professional Beauty Services, will emphasize more customer-focused services to stay competitive in the coming years.

The COVID-19 pandemic negatively impacted the global market. Stringent restrictions on travel and tourism, social distancing, quarantine & gathering restrictions, and closure of national and international borders significantly hampered the demand for professional beauty services during the COVID-19 phase, notably throughout 2020.

GLOBAL PROFESSIONAL BEAUTY SERVICES MARKET KEY TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 233.56 billion

- 2026 Market Size: USD 247.6 billion

- 2034 Forecast Market Size: USD 432.62 billion

- CAGR: 7.22% from 2026–2034

Market Share:

- Asia Pacific led with a 36.13% share in 2025, driven by rising consumer spending on personal hygiene, growing urbanization, and an expanding working women population across India, China, and Australia.

- Hair services dominate due to rising demand for fashionable haircuts, scalp health concerns, and hair loss treatments.

- Women remain the primary consumers of professional beauty services, fueled by self-care trends, skin/hair health awareness, and rising salon visits.

Key Country Highlights:

- U.S.: Expected to reach USD 75.87 billion by 2032; increasing use of high-quality salon products and services drives growth.

- India & China: Surge in working women and disposable income boosts market demand; salons cater to urban grooming needs.

- Germany & U.K.: Sustainable salon practices and growing demand for eco-friendly treatments contribute to European market momentum.

- Brazil & UAE: Growing influence of digital beauty marketing and rising disposable income fuel demand for modern grooming services.

Professional Beauty Services Market Trends

Rapidly Evolving Social Media Marketing Trend to Boost Market Growth

Social media marketing is a part of digital marketing, which employs social media platforms, such as YouTube, Instagram, Facebook, and LinkedIn, to advertise services. Social media platforms cater to a large user base, allowing brands to increase their visibility. In addition, the rapidly evolving trend of posting engaging content, such as hairstyling tips, before-and-after pictures, and client testimonials, offers lucrative business opportunities for both established and prospective market players. Social media platforms also provide advanced targeting options, which allows beauty salons to reach specific demographics and target their ideal customer base. Service providers also emphasize customized advertisements based on age, gender, location, interest, and other demographic factors, favoring global market expansion.

- Asia Pacific witnessed professional beauty services market growth from USD 84.38 billion in 2025 and USD 89.14 billion in 2026.

Download Free sample to learn more about this report.

Professional Beauty Services Market Growth Factors

Rising Consumer Awareness Regarding Personal Grooming to Fuel Market Growth

Personal grooming plays a major role in maintaining high self-esteem and self-confidence. It is the technique of maintaining parts of the body, such as the hair, face, skin, and nails. Personal grooming is important in enhancing the appearance and personal hygiene of the individual. In addition, it also helps positively influence mental activity and establish a unique personality. Furthermore, the growing awareness regarding personal grooming among both men and women fuels the global professional beauty services market growth. The rising trend of men toward effective skincare and personal grooming routines and the growing popularity of specialized professional beauty salons encourage the male population to opt for beauty salon services. At a macro level, the increasing consumer awareness regarding physical appearance and the rising demand for advanced beauty treatments favor the global market growth.

Technological Advancements in Beauty Salons to Boost Market Growth

The integration of technology in beauty salons enhances shopper footfall. In professional beauty salons, the use of Augmented Reality (AR) and Virtual Try-Ons has increased significantly. Individuals can use augmented reality to visually try on various hairstyles, cosmetics, looks, and colors before committing. In addition, with advanced tools and software, professional beauty salons can recognize a client's hair and skin type and propose personalized treatments that are tailored to their specific needs. Furthermore, the rise in the adoption of advanced salon management software by modern beauty service providers has simplified inventory management, appointment scheduling, and client relationship management. Thus, technological advancements in the beauty salon industry provide new opportunities for businesses and customers.

RESTRAINING FACTORS

Increasing Consumer Awareness Regarding Presence of Harmful Chemicals in Beauty Products to Restrict Market Growth

The rising consumer awareness regarding the presence of chemicals in skin care, nail care, and hair care products, which pose various health risks, from cancer to reproductive harm, restrains the market growth. In this respect, the use of hazardous chemicals, such as acetone, acetonitrile, butyl acetate, toluene, Methyl methacrylate (MMA), and quaternary ammonium compounds in nail care products hampers the demand for professional beauty services. Furthermore, professional beauty service companies need help with the shortage of skilled workforce. The shortage of skilled workforce can decrease the productivity and revenue of the company. Thus, the rise in the use of hazardous chemicals in beauty products and the need for a skilled workforce to be available restrains global market growth.

Professional Beauty Services Market Segmentation Analysis

By Service Analysis

Emerging Trend of Fashionable Hair Cutting Boosted Demand for Hair Services

The market for professional beauty services is segmented by service into nail service, skin service, hair service, and merchandise sales.

The hair service segment dominated the global market share of 52.79% in 2026. Growing consumer concerns regarding scalp health and issues related to hair loss, hair thinning, and dandruff create a significant demand for hair services. Furthermore, the growing popularity of hair coloring, fashionable haircuts, and the evolving trend of long hair among men contribute to the demand for hair care services. The segment held 53% of the market share in 2024.

The skin service segment is anticipated to grow rapidly throughout the market forecast period. Growing consumer concerns regarding skin disorders boost the demand for skincare services globally. Furthermore, the growing consumer consciousness about looks and skin health and the increase in spending on skin health propel the segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Growing Emphasis on Personal Grooming Fueled Demand for Beauty Services among Women

The market for professional beauty services is segmented into men and women based on end-user.

The women segment dominated the global market share of 57.88% in 2026. The rising awareness among women regarding skin and hair issues and treatments related to them fuels the demand for professional beauty services market. Furthermore, in the last couple of years, the importance of self-care has increased, encouraging women to proactively create self-care experiences by visiting beauty salons. The segment is estimated to capture 58% of the market share in 2025.

The men segment is growing significantly due to the growing awareness regarding personal hygiene and regular grooming. Furthermore, increasing expenditure capacity and the rising influence of social media platforms are making men more self-conscious, increasing their preference for beauty services. This segment is anticipated to grow with a considerable CAGR of 7.36% during the forecast period (2024-2032).

REGIONAL INSIGHTS

The global market report analyzes North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Professional Beauty Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 84.38 billion in 2025 and USD 89.14 billion in 2026. Asia Pacific dominated the market with a valuation of USD 76.33 billion in 2023 and USD 80.14 billion in 2024. The Asia Pacific region dominates the global market. Rising consumer spending on personal hygiene and grooming, growing urbanization, rapidly expanding population, evolving consumer lifestyles, and increasing consumer disposable incomes contribute to market growth in the region. Furthermore, the surging working women population in India, China, and Australia contributes to consumer purchase power. The Japan market is valued at USD 11.89 billion by 2026, the China market is valued at USD 32.32 billion by 2026, and the India market is valued at USD 19.03 billion by 2026.

North America

North America is the third largest market set to be worth USD 55.13 billion in 2025. The North American professional beauty services market is growing at a significant rate owing to the rising consumer awareness regarding physical appearance. Furthermore, the use of superior quality products across beauty salons based on the skin and hair health of consumers encourages individuals to visit beauty salons more frequently. In addition, the rising trend of healthy grooming habits such as threading, waxing, and manicures & pedicures, notably among women, fuels the regional market growth. The U.S. market is valued at USD 49.26 billion by 2026.

Europe

Europe is the second leading region. The market in Europe is projected to grow at the highest CAGR of 7.79% during the forecast period and is expected to be valued at USD 72.48 billion in 2025. The growing facial and skin-related issues, including skin dryness, dark circles, dullness, sunburn, and large pores, encourage European consumers to frequent beauty salons. Furthermore, the increasing consumer awareness regarding physical appearance and personal hygiene boosts the regional market growth.The growing trend of social media influencers related to beauty products, fashionable hairstyles, and proper grooming of individuals will further enhance consumer footfall in professional beauty salons. Led by Germany and the U.K., the increasing popularity of sustainable salons also fuels the demand for salon services across Europe. Professional beauty services in Germany are characterized by increasing consumer awareness regarding environmentally friendly treatments. while France is expected to hold USD 9.88 billion in the 2025. The UK market is valued at USD 8.9 billion by 2026, while the Germany market is valued at USD 18.25 billion by 2026.

South America is the fourth largest market anticipated to reach USD 13.11 billion in 2025. South America and the Middle East & Africa markets are witnessing a significant demand for professional beauty services owing to growing disposable income, a growing working population, changing lifestyles, and urbanization. Furthermore, the rise in digital advertisements by professional beauty salons attracts a large consumer base across the region, increasing the global professional beauty services market share. The UAE market is predicted to stand at USD 1.49 billion in 2025.

KEY INDUSTRY PLAYERS

Key Companies Adopt Innovative Strategies to Gain Competitive Edge

The global professional beauty services market is highly competitive, and prominent companies, including L'Oréal Professionnel Paris Inc., Lakme Salon, Drybar, and Beauty Connection Spa, focus on technological innovations, partnerships, acquisition, and business expansions to stay competitive. They also emphasize promotions and marketing strategies to create strong brand awareness. In addition, the companies operating in professional beauty services are promoting their business by partnering with bloggers, influencers, and creators to promote the products by creating engaging content for both men and women and also to reach a broader audience through their popularity.

List of Top Professional Beauty Services Companies:

- L’Oréal Professionnel (France)

- Lakme Salon (India)

- Drybar (U.S.)

- Dekalash (U.S.)

- Beauty Connection Spa (UAE)

- TONI&GUY (U.K.)

- JOHN BARRETT (U.S.)

- Regis Corporation (U.S.)

- THE LASH LOUNGE (U.S.)

- Tommy Gun's Original Barbershop (Canada)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 – Franck Provost, a European hair salon brand, opened its beauty salon in Bengaluru, India. The new launch salon will likely help the company expand its global footprint.

- June 2022 – Regis Corporation, a U.S.-based hair salon operator, partnered with Zenoti, a U.S.-based software provider, to launch salon software solutions across all brands. The partnership will likely help in talent retention and business automation in the near term.

- April 2022 – Nykaa, an Indian beauty and wellness retailer, partnered with Estee Lauder Inc. and opened a Nykaa-Aveda branded salon in Bengaluru, India.

- February 2021 – TONI&GUY, a U.K.-based hairdressing salon chain, launched its 8th beauty salon in the Netherlands. The newly launched salon is expected to improve the company's service depth and sales figures in the coming years.

- October 2020 - Lakme Salon, an Indian professional salon chain, launched its unisex salon in Goa, India, to increase its revenue and customer reach.

REPORT COVERAGE

The report provides a detailed professional beauty services market analysis and focuses on key aspects, such as competition landscape, regional analysis, service, and end-user. Besides this, it offers insights into various market trends and highlights key industry developments. In addition to the above-mentioned factors, the market report encompasses several other factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.22% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Service

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market size was valued at USD 233.56 billion in 2025 and is projected to reach USD 432.62 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 84.38 billion.

Recording a CAGR of 7.22%, the market will exhibit steady growth over the forecast period of 2026-2034.

Based on service, the hair service segment leads the global market.

The rising consumer awareness regarding personal grooming favors market expansion.

L'Oréal Professionnel Paris Inc., Lakme Salon, Drybar, and Beauty Connection Spa are the major market players.

Asia Pacific dominated the market in terms of share in 2026.

The introduction of advanced technologies is a major factor fueling the market growth.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us