Prostate Cancer Hormone Therapy Market Size, Share & Industry Analysis, By Drug Class (Androgen Receptor Inhibitors, Gonadotropin Releasing Hormone (GnRH) Agonist, Gonadotropin-Releasing Hormone (GnRH) Receptor Antagonist, and Others), By Disease State (Metastatic Castration-Resistant Prostate Cancer and Non-Metastatic Castration-Resistant Prostate Cancer), By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

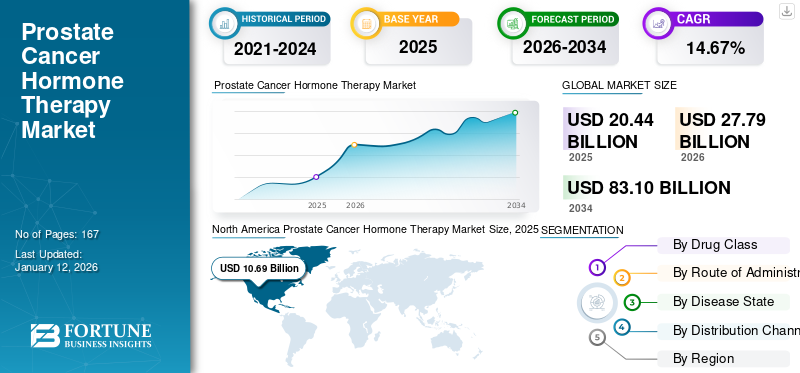

The global prostate cancer hormone therapy market size was valued at USD 20.44 billion in 2025. The market is projected to grow from USD 27.79 billion in 2026 to USD 83.1 billion by 2034, exhibiting a CAGR of 14.67% during the forecast period. North America dominated the prostate cancer hormone therapy market with a market share of 52.30% in 2025.

The prostate cancer hormone therapy market is projected to witness an upward growth due to the rising prevalence of prostate cancer and advancements in treatment methods. Hormone therapy, also known as Androgen Deprivation Therapy (ADT), is one of the prominent therapies in the management of advanced and metastatic prostate cancer. Prostate cancer growth is often fueled by specific hormones, and a reduction in these hormone levels slows the progression of the tumor. This treatment approach is commonly used as the first line of treatment for metastatic prostate cancer, where the cancer has spread beyond the prostate gland.

- For instance, according to the report published by the Global Cancer Observatory GLOBOCAN 2022, prostate cancer ranked 4 in all types of cancers with a total incidence of 1,467,854.0 (1.47 million) cases in 2022. Such a high number of cases associated with cancer drives the demand for effective hormone therapy and thus propels market growth.

Furthermore, key players such as Astellas Pharma Inc., Bayer AG, Pfizer Inc., and Johnson & Johnson Services, Inc. are extensively performing cancer research to develop therapies to reduce the resistance of hormone therapy in patients. Also, the presence of a robust product portfolio and rising regulatory approvals is expected to bolster the market's growth.

Global Prostate Cancer Hormone Therapy Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 20.44 billion

- 2026 Market Size: USD 27.79 billion

- 2034 Forecast Market Size: USD 83.1 billion

- CAGR: 14.67% from 2026–2034

Market Share:

- North America dominated the prostate cancer hormone therapy market with a 52.30% share in 2025, driven by a high prevalence of prostate cancer, well-established healthcare infrastructure, and strong reimbursement frameworks.

- By drug class, Gonadotropin-Releasing Hormone (GnRH) agonists held the largest market share in 2024 due to their effectiveness in suppressing testosterone and the rise in regulatory approvals. The GnRH receptor antagonists and androgen receptor inhibitors segments are expected to grow significantly due to increasing drug approvals and enhanced treatment efficacy.

Key Country Highlights:

- Japan: Market growth is driven by the aging male population and increasing prostate cancer awareness. The approval of advanced hormone therapies like XTANDI is improving access to modern treatments.

- United States: The U.S. remains a leader due to robust R&D investments, strong clinical trial pipelines, and a high adoption rate of novel hormone therapies. In April 2023, Johnson & Johnson launched a new strength (240mg) of ERLEADA (apalutamide), enhancing treatment options.

- China: Regulatory advancements are accelerating access to key therapies. For example, in July 2024, XTANDI (enzalutamide) received approval from China’s NMPA for treating metastatic hormone-sensitive prostate cancer.

- Europe: Europe holds the second-largest regional market share. Cost-effective treatment endorsements by health authorities, such as the NICE recommendation of ORGOVYX in the U.K. in August 2024, are boosting access and adoption.

MARKET DYNAMICS

MARKET DRIVERS

Advancements in Hormonal Therapy is Driving Market Growth

The rising prevalence of prostate cancer and advancement in the management of advanced prostate cancer often result in resistance to conventional therapies. Thus, to address such challenges associated with conventional therapy, there is a significant shift of key pharmaceutical players to launch novel hormonal therapy, such as androgen receptor inhibitors that diminish the cancer cell's capacity to proliferate, thus improving overall survival rates in patients and quality of life.

- For instance, in November 2023, Astellas Pharma Inc. and Pfizer Inc. collaboratively announced that the U.S. Food and Drug Administration (FDA) approved a supplemental New Drug Application for XTANDI (enzalutamide). XTANDI is an androgen receptor signaling inhibitor approved for non-metastatic Castration-Sensitive Prostate Cancer (nmCSPC) indications. Such approvals and launches are expected to drive the global prostate cancer hormone therapy market growth.

MARKET RESTRAINTS

Resistance to Hormonal Therapy is a Significant Factor Hindering Prostate Cancer Hormone Therapy Market Growth

Hormone therapy, particularly Androgen Deprivation Therapy (ADT), is designed to lower testosterone levels, which prostate cancer cells rely on for their proliferation. However, over time, these cancer cells can adapt and develop resistance to such treatments. Mutations in the androgen receptor or related pathways may reduce the effectiveness of hormone therapy. As a result, patients often require alternative treatment options. Researchers are actively investigating the mechanisms behind treatment-resistant prostate tumors to create more effective therapies.

- For instance, in January 2024, researchers at Sylvester Comprehensive Cancer Center, University of Miami, studied prostate cancer progression related to ADT. They focused on the enzyme 3βHSD1, which is present in various peripheral tissues such as the prostate, placenta, skin, and mammary glands. Their findings revealed that the stabilization of 3βHSD1 increased androgen production and promoted prostate cancer progression after patients had been on androgen deprivation therapy. 3βHSD1 enzyme enables tumors to regenerate androgens at an accelerated rate. This complex situation, due to resistance in the prostate cancer cells to the ADT, may decrease its adoption and limit the market growth.

MARKET CHALLENGES

Adverse Effects Associated with Androgen Deprivation Therapy Challenge Market Growth

Hormone therapy lowers the level of testosterone. Thus, the reduction of testosterone levels decreases the desire for sex or loss of it altogether.

- For instance, in September 2020, as per the data published in Elsevier B.V. journal, the sexual side effects, specifically Erectile Dysfunction (ED) and loss of sexual desire are commonly experienced by prostate cancer patients on ADT, and around 82.0% of patients on ADT reported erectile problems and 64.0% experienced loss of sexual desire. Thus, the adverse effects associated with the therapy face significant challenges.

These adverse effects can significantly diminish a patient's quality of life and may lead to the discontinuation of treatment.

MARKET OPPORTUNITIES

Research and Development Activities to Launch New Combination Therapy, Catering Market Growth

Key players are focusing on research and development activities to launch new combined therapies in the prostate cancer hormone therapy market with the aim of enhancing treatment efficacy and reducing resistance. These efforts involve clinical trials to evaluate the safety and effectiveness of combining existing hormonal agents with novel drugs, such as targeted therapies or immunotherapies. Collaborations between pharmaceutical companies and academic institutions are crucial for leveraging innovative approaches and technologies.

Many key pharmaceutical companies are developing combination therapy by pairing Poly ADP-Ribose Polymerase (PARP) inhibitors with ADT and androgen receptor inhibitors to reduce resistance and offer effective treatment significantly.

- For example, in February 2025, data from the TALAPRO-2 trial was showcased at the 2025 Genitourinary Cancers Symposium. The findings demonstrated that the combination of talazoparib (Talzenna) and enzalutamide (Xtandi) significantly improves survival outcomes for patients with metastatic Castration-Resistant Prostate Cancer (mCRPC). Specifically, the combination therapy resulted in a 14-month increase in overall survival for Homologous Recombination Repair (HRR)-deficient tumors patients, along with a 38.0% reduction in the risk of death. Such positive results of the development offer a significant opportunity for market growth during the forecast timeframe.

PROSTATE CANCER HORMONE THERAPY MARKET TRENDS

Regulatory Approvals and Advancements in Prostate Cancer Hormone Treatment is a Prominent Trend

The increasing adoption and regulatory approvals for sustained-release formulation therapy is a key trend shaping the market. The market is driven by the increasing prevalence of prostate cancer and rising demand for continuous treatment to stop the spread of cancer, coupled with dosing errors and missed doses of hormonal drugs in elderly patients, which lead to hormonal fluctuations. Such factors increase the demand for extended dosing formulations, such as depot, to improve treatment adherence and reduce hormonal fluctuations compared to daily oral medication.

Thus, regulatory agencies across the regions are increasingly approving newer and improved depot formulations to enhance patient-centric care, as longer injection intervals include minimal disruption to patient lifestyle during treatment and a decreased cost to the healthcare system.

- For instance, in October 2024, Foresee Pharmaceuticals Co., Ltd. announced the submission of a New Drug Application for the 3-month version of CAMCEVI. It is a ready-to-use leuprolide mesylate 3-month depot formulation used for the palliative treatment of advanced prostate cancer.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a slight positive impact on the prostate cancer hormone therapy market. This was due to the presence of telemedicine for consultation of chronic diseases such as cancer and the distribution of drugs with online delivery channels.

Additionally, continuous research and development activities were going on to develop new treatments for prostate cancer, and such scenarios propelled the growth of the market during the pandemic. Moreover, the emphasis of key players on new clinical studies, approvals, and expansion in different regions is collectively expected to propel the market growth during the forecast period.

SEGMENTATION ANALYSIS

By Drug Class

Increasing Prevalence and Rising Approvals to Lead Gonadotropin-Releasing Hormone (GnRH) agonist Segment's Growth

Based on drug class, the global market is segmented into Gonadotropin-Releasing Hormone (GnRH) receptor antagonists, Gonadotropin-Releasing Hormone (GnRH) agonists, androgen receptor inhibitors, and others.

The Gonadotropin-Releasing Hormone (GnRH) agonist held a significant share of the market in 2024. GnRH agonist is one of the most prominent treatments for prostate cancer, which is effective in suppressing testosterone levels. GnRH agonists are also known as Luteinizing Hormone-Releasing Hormone (LHRH), which controls the amount of testosterone in the body. Thus, these drugs mimic the hormone and reduce testosterone production. Moreover, increasing product launches by key players are expected to boost the growth of the segment in the market.

- For instance, in March 2022, Accord BioPharma announced the U.S. launch of CAMCEVI (leuprolide) 42mg injection emulsion. It is used for the treatment of advanced prostate cancer in adults.

The Gonadotropin-Releasing Hormone (GnRH) receptor antagonist is expected to grow exponentially during the forecast period. GnRH (gonadotrophin-releasing hormone) produces the male hormone testosterone. Consequently, inhibiting this hormone leads to a decrease in testosterone levels. Moreover, the focus of key players offering (GnRH) receptor antagonists to receive regulatory approvals for expanding in different regions is a prominent factor augmenting the segment's growth.

- For instance, in October 2023, Sumitomo Pharma Co., Ltd. announced the approval of ORGOVYX by Health Canada. This approval expanded treatment options for Canadian men living with advanced prostate cancer. Such approvals are expected to bolster the segment's growth.

The androgen receptor inhibitors segment is expected to grow with a substantial CAGR during the forecast period. Anti-androgens work by blocking the action of testosterone in the reproductive organs and stopping testosterone from reaching the cancer cells. Increasing trials for expanding the indication areas of the available androgen receptor inhibitors would also boost the segment’s growth in the market.

The others segment comprises CYP17 inhibitors and generation of androgen receptor inhibitors, which are projected to grow during the forecast period. Increasing research and development and demand for new drugs to combat castration resistance are expected to bolster the segment's growth during 2025-2032.

By Disease State

Rising Number of Approvals for Metastatic Castration-Resistant Prostate Cancer Therapy to Boost Segment's Growth

Based on disease state, the market is divided into metastatic castration-resistant prostate cancer and non-metastatic castration-resistant prostate cancer.

The metastatic castration-resistant prostate cancer segment captured the maximum global prostate cancer hormone therapy market share. The disease burden of Metastatic Castration-Resistant Prostate Cancer (mCRPC) is due to resistance to androgen deprivation therapy, and rising approvals by regulatory bodies, which are contributing to the growth of the segment.

The non-metastatic castration-resistant prostate cancer segment is anticipated to experience substantial growth during the forecast period, with the highest CAGR. This growth is primarily driven by the increasing efforts of leading companies to expand the indications of their major prostate cancer medications for the treatment of non-metastatic castration-resistant prostate cancer.

- For example, in August 2023, Astellas Pharma Inc. announced that the U.S. FDA had accepted a supplemental New Drug Application for XTANDI aimed at treating patients with non-metastatic castration-sensitive prostate cancer.

By Route of Administration

Generic Launches of Oral Drugs to Contribute to Segmental Dominance

On the basis of the route of administration, the market is categorized into oral and parenteral.

The oral segment held a major portion of the market due to convenience and ease of administration, thus leading to higher treatment adherence and improved patient outcomes with the treatment. Furthermore, rising generic product launches of oral medications are further driving the expansion of this segment.

- For instance, in January 2021, Amneal Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration approved 500mg of Abiraterone Acetate Tablets, the generic version of Zytiga used for the treatment of metastatic prostate cancer. Such approvals increase the adoption of oral drugs for the treatment.

The parenteral segment held a comparatively lower share of the market owing to its invasive nature, higher costs, and inconvenience of frequent clinic visits for injections or infusions. Additionally, increasing clinical trials to launch new parenteral formulations will propel the segment's growth in the market.

- For instance, in April 2024, the Research Institute of McGill University Health Centre (RI-MUHC) initiated enrollment for a groundbreaking Phase 1 multi-center clinical trial evaluating Actinium-225, a radioactive isotope developed by POINT Biopharma, as a treatment for metastatic prostate cancer. This experimental therapy was administered intravenously to 50 patients suffering from Metastatic Castration Resistance (mCRPC).

By Distribution Channel

Shift of Patient Toward Hospital Settings to Boost Growth of Hospital Pharmacies Segment

On the basis of distribution channel, the global market is categorized into drug stores & retail pharmacies, hospital pharmacies, and online pharmacies.

The hospital pharmacies segment is projected to maintain a significant market share, driven by the availability of advanced healthcare facilities and skilled professionals in hospital settings. This has led to a shift in patient focus toward these settings. Additionally, the distribution of medications for major disease treatments, as prescribed by healthcare providers, is expected to enhance the role of hospital pharmacies further.

The drug stores & retail pharmacies segment is also anticipated to experience growth during the forecast period. Their widespread availability allows patients to access prescriptions, often with personalized assistance from pharmacists, conveniently.

Conversely, the online pharmacy segment is expected to witness substantial growth as well, fueled by the increasing internet penetration and consumers' growing preference for purchasing medications online during the projected timeframe.

PROSTATE CANCER HORMONE THERAPY MARKET REGIONAL OUTLOOK:

By geography, the market is divided into North America, Europe, Asia Pacific, and Latin America, and the Middle East & Africa.

North America

North America Prostate Cancer Hormone Therapy Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America prostate cancer hormone therapy market size was valued at USD 10.69 billion in 2025. The growth of the region is driven by the increasing prevalence of prostate cancer, the availability of advanced healthcare infrastructure, and strong reimbursement policies that facilitate the adoption of cancer treatments.

U.S.

In North America, the U.S. commands a significant market share. The country invests heavily in research and development and engages in collaborative efforts to develop and launch innovative therapeutic products, which further support its market expansion.

- In April 2023, Johnson & Johnson Services Inc. announced the availability of an additional 240mg tablet strength of ERLEADA (apalutamide) in the U.S. It is an androgen receptor inhibitor approved for the treatment of patients with non-metastatic Castration-Resistant Prostate Cancer (nmCRPC) and for metastatic Castration-Sensitive Prostate Cancer (mCSPC).

Europe

Europe captured the second-largest share of the market. The presence of key players in the market and increasing approval of cost-effective medication by healthcare authorities propel the market’s growth in the region.

- For instance, in August 2024, Accord Healthcare announced that the National Institute for Health and Care Excellence (NICE) had recommended ORGOVYX (relugolix) for the treatment of hormone-sensitive prostate cancer and was recognized as a cost-effective treatment option in England.

Asia Pacific

As per the global prostate cancer hormone therapy market forecast, Asia Pacific is projected to be the fastest-growing region. The rising aging population and increasing prevalence of prostate cancer in adult males in the region is one of the significant factors for the growth of the market. Also, the rising number of approvals for key hormone therapy products for commercialization is expected to propel market growth.

- For instance, in July 2024, Astellas Pharma Inc. announced the approval of XTANDI (enzalutamide) by the Center for Drug Evaluation (CDE) of the China National Medical Products Administration (NMPA) for the treatment of patients with metastatic Hormone-Sensitive Prostate Cancer (mHSPC).

Latin America and the Middle East & Africa

The markets in Latin America and the Middle East & Africa are expected to continue to grow at a slower rate during the forecast period. The rising collaboration among the key players to expand their product offerings for prostate cancer treatment in the region is one of the prominent factors for the region’s upcoming growth.

- For example, in February 2022, Debiopharm partnered with Aspen, a multinational pharmaceutical company based in South Africa, to introduce Trelstar (Triptorelin), a synthetic analog of Gonadotropin-Releasing Hormone (GnRH) in South Africa. This medication is intended for the treatment of locally advanced and metastatic hormone-dependent prostate cancer.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Firms are Diversifying their Product Portfolio to Capturing Substantial Market Share

Bayer AG, Astellas Pharma Inc., and Pfizer Inc. are some of the prominent players in the prostate cancer hormone therapy market. Strong initiatives for research and development, regulatory approvals, and new product launches assist key players in holding their share of the market. Furthermore, strategic initiatives to expand their geographic foothold are also enhancing their position in the industry.

- For instance, in November 2024, Bayer AG announced that the U.S. Food and Drug Administration (FDA) accepted a supplemental New Drug Application (sNDA) for NUBEQA (darolutamide), an oral androgen receptor inhibitor in combination with Androgen Deprivation Therapy (ADT) for the treatment of patients with metastatic Hormone-Sensitive Prostate Cancer (mHSPC).

AbbVie Inc., AstraZeneca, Sumitomo Pharma Co., Ltd. (Myovant Sciences GmbH), and Johnson & Johnson Services, Inc. are other prominent players in the market. The players’ focus on product launches and strategic activities, such as collaboration and research initiatives aids in the expansion of their share in the market.

LIST OF KEY PROSTATE CANCER HORMONE THERAPY COMPANIES

- Astellas Pharma Inc. (Japan)

- Pfizer Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Ferring Pharmaceuticals Inc. (Switzerland)

- Sumitomo Pharma Co., Ltd. (Myovant Sciences GmbH) (Japan)

- AbbVie Inc. (U.S.)

- AstraZeneca (U.K.)

- Accord BioPharma, Inc (U.S.)

- Bayer AG (Germany)

KEY INDUSTRY DEVELOPMENTS

- August 2023: Johnson & Johnson Services, Inc. announced that the U.S. Food and Drug Administration (FDA) had approved AKEEGA (a combination of niraparib and abiraterone acetate for metastatic Castration-Resistant Prostate Cancer (mCRPC).

- June 2023: AstraZeneca revealed that Lynparza (olaparib), a poly (ADP-ribose) polymerase inhibitor, in combination with abiraterone and prednisone or prednisolone, has been approved in the U.S. for treating adult patients with metastatic Castration-Resistant Prostate Cancer (mCRPC).

- March 2023: Sumitomo Pharma Co., Ltd. acquired Myovant Sciences GmbH to strengthen its capabilities and address unmet needs in women's health and prostate cancer. Also, the company acquired commercialization rights for ORGOVYX and MYFEMBREE, which have deleterious or suspected deleterious BRCA mutations.

- February 2023: Johnson & Johnson Services, Inc., participated in the American Society of Clinical Oncology (ASCO) Genitourinary (GU) Cancers Symposium to showcase an update on the Phase 3 MAGNITUDE study of niraparib in combination with abiraterone acetate for mCRPC

- April 2022: Myovant Sciences GmbH announced that the European Commission (EC) had approved the marketing authorization application for ORGOVYX for the treatment of advanced hormone-sensitive prostate cancer.

- May 2022: Foresee Pharmaceuticals Co., Ltd. announced the approval of the Marketing Authorization Application (MAA) for CAMCEVI 42 mg prolonged-release suspension for injection by the European Commission (EC) for the treatment of hormone-dependent advanced prostate cancer.

REPORT COVERAGE

The global prostate cancer hormone therapy market report provides market size & forecast by all the segments included. It comprises details on the market dynamics and market trends expected to drive the market growth in the forecast period. It offers information on key industry developments, new product launches, prevalence of cancer in key regions/countries, and details on partnerships, mergers & acquisitions. It covers a detailed competitive landscape with information on the market share and profiles of key players and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 14.67% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug Class

|

|

By Route of Administration

|

|

|

By Disease State

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 27.79 billion in 2025 and is projected to record a valuation of USD 83.1 billion by 2034.

In 2025, the North America market value stood at USD 10.69 billion.

The market is expected to exhibit a CAGR of 14.67% during the forecast period of 2026-2034.

Among the drug clas, the androgen receptor inhibitors segment led the market.

Robust drug pipelines and new product launches are the key factors driving market growth.

Astellas Pharma Inc., Pfizer Inc., and Bayer AG are the top players in the market.

North America dominated the market in 2025 by holding the largest share.

Increasing prevalence and demand for combination therapy and rising research and development activities are expected to favor product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us