Pulse Oximeter Probes Market Size, Share & Industry Analysis, By Product Type (Disposable and Reusable), By Age Group (Adults and Neonatal/Pediatric), By Measurement Site (Forehead, Finger, Ear, Nose, and Others), By End-user (Hospitals and ASCs {ICU, Ward, Operating Room (OR), Emergency Room (ER), ASCs, and Others}, Clinics, Home Healthcare, and Others), and Regional Forecast, 2026-2034

Pulse Oximeter Probes Market Size and Future Outlook

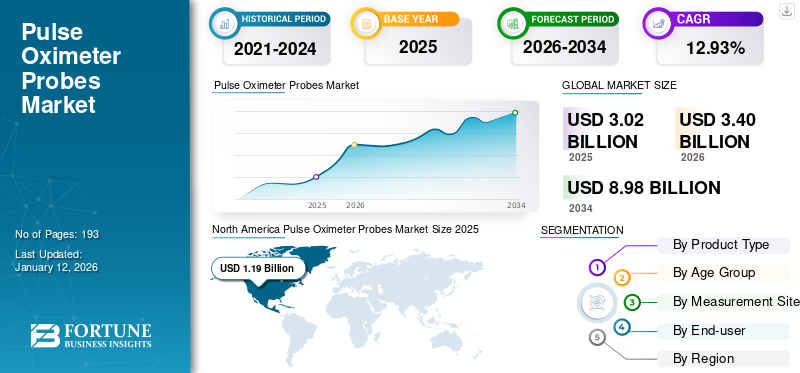

The global pulse oximeter probes market size was valued at USD 3.02 billion in 2025 and is projected to grow from USD 3.4 billion in 2026 to USD 8.98 billion by 2034, exhibiting a CAGR of 12.93% during the forecast period. North America dominated the pulse oximeter probes market with a market share of 39.34% in 2025.

Pulse oximeter probes are sensors used with pulse oximeters to non-invasively measure oxygen saturation levels (SpO2) and pulse rate. They play a crucial role in critical care, anesthesia, and surgical procedures and are essential in monitoring respiratory and cardiovascular health. These probes ensure real-time assessment of the oxygen levels, aiding in the timely detection of hypoxemia and supporting effective patient management across various medical settings. The market is consolidated with the presence of companies such as Masimo and Medtronic. However, various domestic players are entering the market and are expected to capture more market share steadily in the future.

The pulse oximeter probes market is driven by the rising prevalence of respiratory and cardiovascular diseases, increasing surgical procedures, and the growing geriatric population. Technological advancements in non-invasive monitoring and the heightened demand for portable, accurate, and user-friendly devices further boost market growth. Additionally, the rise in hospital admissions due to pandemics such as COVID-19 has significantly expanded the adoption of pulse oximeters. Awareness of home healthcare and wellness monitoring also fuels market expansion.

Global Pulse Oximeter Probes Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 3.02 billion

- 2026 Market Size: USD 3.4 billion

- 2034 Forecast Market Size: USD 8.98 billion

- CAGR: 12.93% from 2026–2034

Market Share:

- North America dominated the pulse oximeter probes market with a 39.34% share in 2025, driven by the widespread adoption of advanced patient monitoring technologies, high prevalence of chronic respiratory and cardiovascular diseases, and robust healthcare infrastructure supporting both hospital and home-based monitoring.

- By product type, Reusable segment are expected to retain the largest market share owing to their cost-effectiveness, durability, and increasing demand across high-volume healthcare settings like hospitals and ASCs.

Key Country Highlights:

- United States: Strong presence of leading market players, rising adoption of advanced monitoring technologies, and supportive regulatory framework continue to drive the demand for pulse oximeter probes.

- Europe: Growth is propelled by an aging population, high prevalence of chronic respiratory conditions, and the increasing adoption of reusable and disposable probes across hospitals and clinics.

- China: Expansion of critical care infrastructure, rising healthcare investments, and increasing demand for non-invasive monitoring devices are key factors supporting market growth.

- Japan: Market growth is influenced by technological advancements, growing preference for portable and home-use devices, and initiatives to enhance patient monitoring accuracy across healthcare facilities.

Impact of COVID-19

The COVID-19 pandemic significantly boosted the pulse oximeter probes market growth as these devices became essential for monitoring blood oxygen levels in infected patients. The surge in the number of hospitalizations, increased awareness of respiratory health, and growing adoption of home monitoring devices drove the unprecedented demand for pulse oximeters globally. Furthermore, as the global healthcare scenario improved in terms of the pandemic, the pulse oximeter probes market normalized in 2021, with the market falling back to old growth levels. Furthermore, the market slowed in 2022 due to the reduced number of COVID-19 cases. However, the market began recovering by Q3 2023 and is expected to grow significantly from 2024 onwards.

MARKET DYNAMICS

Market Drivers:

Rising Prevalence of Chronic Respiratory Diseases to Drive Market Growth

Chronic respiratory diseases, including asthma, Chronic Obstructive Pulmonary Disease (COPD), lung cancer, cystic fibrosis, sleep apnea, and occupational lung diseases, remain the leading global causes of mortality. For instance, according to an article published by the American Academy of Pediatrics, in 2019, about one infant in every 100 is born with a CHD, and 25% of those are expected to have a Critical Congenital Heart Defect (CCHD). Both COPD and CCHDs emphasize the critical role of oxygen saturation monitoring in disease management.

The need for effective oxygen saturation monitoring in managing respiratory and cardiac conditions underscores the importance of pulse oximeter probes. The growing prevalence of these diseases, particularly among infants and the elderly, has driven significant demand for pulse oximeters. The COVID-19 pandemic further accelerated this demand in 2020 and 2021 as these devices became essential for tracking oxygen levels in infected patients. The rising global burden of respiratory diseases, driven by aging populations, lifestyle shifts, and environmental factors, continues to fuel market growth. Growing respiratory disease prevalence and proactive manufacturer efforts are expected to drive robust growth in the pulse oximeter probes market in the coming years.

Market Restraints:

Presence of Alternative Technologies to Restrain Market Growth

Innovations such as wearable biosensors, smartphone-based health monitoring apps, and integrated multi-parameter monitoring devices are rapidly capturing market share. These technologies offer capabilities beyond oxygen saturation monitoring, including heart rate tracking, sleep analysis, and continuous monitoring, appealing to healthcare providers and consumers. Key market players are increasingly investing in all-in-one vital signs monitoring systems, boosting adoption in hospitals, clinics, and ASCs.

Moreover, large technology companies such as Alphabet, Apple, Samsung, and others that have not historically operated in the healthcare or medical device market are also showing a keen interest in introducing smartwatches and mobile phone apps to measure blood oxygen levels. For instance, in September 2020, Apple announced the Apple Watch Series 6, which includes a blood oxygenation sensor to measure blood oxygen saturation.

- Such introduction of substitute products of monitoring devices can hamper the market growth of pulse oximeter probes in the forecast period.

Market Challenges:

Accuracy Concerns to Hamper Adoption of Pulse Oximeter Probes

Accuracy concerns pose a significant challenge to the pulse oximeter probes market. Traditional pulse oximeters may produce inaccurate readings, particularly for individuals with darker skin tones, due to the limitations of their sensor technologies. These inaccuracies can lead to misdiagnosis or delayed treatment, especially in critical conditions such as respiratory and cardiac diseases. For instance, the FDA released new guidelines in February 2021 that pulse oximeter accuracy is highest at a saturation of 90-100%, whereas it is intermediate at 80-90%, followed by the lowest below 80%. Moreover, the FDA also stated that if an FDA-cleared pulse oximeter results in 90%, the true oxygen saturation (SPO2) in the blood is generally between 86-94%.

Other Prominent Challenges:

Regulatory Scrutiny: The U.S. FDA has acknowledged the inaccuracy of pulse oximeters and plans to release new draft guidance for manufacturers by 2025.

Supply Chain Disruptions: In 2020, during COVID-19, a few companies encountered disrupted supply chains, affecting the distribution of medical devices, including the pulse oximeter probes.

Market Opportunities:

Improvement in Healthcare Infrastructure Across Developing Countries to Provide Long-term Opportunity for Market Growth

The growing emphasis on enhancing healthcare infrastructure in developing countries is creating substantial opportunities for the pulse oximeter probes market. With the rising prevalence of chronic diseases and increasing demand for advanced medical devices, governments and private sectors are making significant investments.

For instance, in June 2021, the Indian government announced plans to introduce a credit incentive program worth USD 6.8 billion for the improvement of the country’s healthcare infrastructure. The program will allow firms to leverage the fund to expand hospital capacity or medical supplies. This expansion is expected to drive the demand for pulse oximeters and related accessories, including probes.

These infrastructure enhancements are anticipated to drive demand for devices such as table-top pulse oximeters. Moreover, increased government funding presents opportunities for domestic players to scale up manufacturing and compete in global markets.

PULSE OXIMETER PROBES MARKET TRENDS

Technological Advancements in Pulse Oximeter Probes Market

The integration of smart technologies and wireless connectivity has significantly improved device functionality and user convenience. Technological advancements in pulse oximeters and the associated probes, such as enhanced accuracy, real-time data transmission, and compatibility with smartphones and other mobile devices, enable seamless monitoring and data sharing.

These advancements cater to the growing demand for remote patient care and home healthcare solutions. Furthermore, advanced sensors and algorithms also ensure more reliable readings, even in challenging conditions such as motion or low perfusion. These technological advancements stimulate the key players to accelerate the development and launch of novel pulse oximeter probes across various healthcare settings.

- For instance, in November 2022, BioIntelliSense, Inc. launched its patented, FDA-cleared pulse oximeter (SpO2) sensor chipset and integrated processing technology. This advancement allows users to accurately measure blood oxygen levels across the full range of light to very dark skin pigmentations, as well as during movement and activity. Moreover, SpO2 monitoring can be conducted anywhere and at any time, whether in clinical settings, at home, or beyond.

Other Technological Advancements:

Increased Home Healthcare Adoption: The growing prevalence of chronic respiratory illnesses and an aging population has driven increased adoption of home-based monitoring, fueling demand for portable and user-friendly pulse oximeter probes.

Regulatory Approvals: Market players are obtaining regulatory clearances to broaden their range of products.

Download Free sample to learn more about this report.

Trade Protectionism

Trade policies and protectionist measures have a notable impact on the pulse oximeter probes market. Factors such as tariffs, import restrictions, and regulatory hurdles can significantly influence the cost structure and availability of these medical devices across various regions. These complexities can lead to increased production and distribution costs, which may ultimately affect the affordability and adoption rates of pulse oximeter probes in global markets.

Research and Development

Ongoing research and development efforts in the pulse oximeter probes market are directed toward enhancing device accuracy and reliability. One key focus is addressing the variations in readings caused by different skin tones, as studies have shown that traditional pulse oximeters can be less accurate for individuals with darker skin pigmentation. Researchers are working on developing advanced algorithms and sensor technologies to provide consistent and accurate readings for diverse populations. Additionally, integrating Artificial Intelligence (AI) and Machine Learning (ML) into pulse oximeter systems represents a transformative innovation. Such advancements will improve device performance and also expand the clinical applications of pulse oximeters, making them indispensable in modern healthcare.

Pulse Oximeter Probes Market Segmentation Analysis

By Product Type Analysis

Reusable Segment to Lead Market Growth Owing to their Rising Adoption in Hospitals

Based on product type, the global market is segmented into disposable and reusable.

The reusable segment held the dominant global pulse oximeter probes market with a share of 76.31% in 2026. Reusable probes are durable and can be used for extended periods with proper care, making them a preferred choice for healthcare facilities with high patient volumes. Additionally, advancements in the materials and technology have improved their performance, making them a reliable option. Their ability to withstand frequent use while maintaining accuracy contributes to their dominant market share.

- For instance, in July 2023, Unimed Medical mentioned that reusable SpO2 sensors are much more environmentally friendly than disposable ones and allow healthcare providers to promote sustainability, lower operating costs, and improve long-term performance.

The disposable segment is anticipated to expand at a significant CAGR during the forecast period. The segmental growth is due to increasing demand for cost-effective, hygienic, and single-use solutions. They are particularly beneficial in environments where cleanliness and infection control are critical. Additionally, their affordability and ease of use, combined with growing awareness of healthcare-associated infections, drive the shift toward disposable pulse oximeter probes, contributing to their rapid market growth.

To know how our report can help streamline your business, Speak to Analyst

By Age Group Analysis

Adult Segment to Lead Market Growth Owing to Rising Demand for Probes

Based on age group, the global market is segmented into adults and neonatal/pediatric.

The adults segment held the dominant pulse oximeter probes market with a share of 77.70% in 2026, due to the increasing prevalence of chronic respiratory and cardiovascular diseases among the adult population. Chronic diseases, such as COPD, asthma, and heart failure, require regular oxygen saturation monitoring, driving demand for accurate and reliable pulse oximeter probes. Additionally, the growing adoption of remote patient monitoring solutions for adults contributes to the market expansion.

- For instance, according to the data published by Lung India in December 2021, out of the eight studies performed, the gender-wise prevalence of COPD was reported in five studies, which further stated that the prevalence of COPD among males and females was 11.4% and 7.4%, respectively.

The neonatal/pediatric segment is anticipated to expand at a significant CAGR during the forecast period. The segmental growth is due to the critical need for accurate oxygen saturation monitoring in infants and young children, particularly those with respiratory conditions such as asthma, bronchiolitis, and congenital heart defects. Additionally, the growing prevalence of pediatric respiratory illnesses and the increasing adoption of non-invasive monitoring technologies in hospitals and clinics contribute to the pediatric segment in the market.

By Measurement Site Analysis

Finger Measurement Site Dominates with its Increasing Demand in Healthcare Facilities

Based on measurement site, the global market is segmented into forehead, finger, ear, nose, and others.

In 2024, the finger segment held the dominant global pulse oximeter probes market share. The segmental growth is due to its widespread use, convenience, and compatibility with various patient demographics. Finger probes are non-invasive, easy to use, and provide accurate and quick readings of oxygen saturation and pulse rate, making them ideal for both clinical and home settings. Their portability and affordability further contribute to their popularity, alongside their effectiveness in monitoring patients with chronic conditions or during critical care scenarios.

- For instance, according to the article published in European Respiratory Journal 2021, in 2020, an estimated 36,580,965 Europeans were living with COPD. By 2050, the number is projected to rise to 49,453,852, with a prevalence of 9.3%, reflecting a 35.2% relative increase in patients.

The ear segment is anticipated to expand at a significant CAGR during the forecast period. Ear probes are particularly advantageous in critical care and anesthesia monitoring, where consistent readings are crucial. Their ability to maintain stable contact and deliver precise measurements in challenging conditions, such as cold environments or during surgeries, enhances their preference in clinical settings, contributing to their significant market share.

By End-user Analysis

Hospitals & ASCs Dominate Due to High Volume of Patient Admissions

On the basis of end-user, the market is segmented into hospitals & ASCs, clinics, home healthcare, and others.

Hospitals & ASCs accounted for the largest market share of 80.29% in 2026 and are expected to drive the market growth during the forecast period. This is primarily due to the rising need for continuous patient monitoring during surgeries, critical care, and post-operative recovery. These healthcare settings require reliable and accurate oxygen saturation readings to manage patient health, especially for those with respiratory or cardiovascular conditions. The increasing volume of surgeries, along with the adoption of advanced monitoring technologies in hospitals and ASCs, is driving the demand for pulse oximeter probes, contributing to the segment's rapid growth.

- For instance, according to the MedPAC Ambulatory Surgical Center Services: Status Report published in March 2024, the number of ASCs and operating rooms in the U.S. grew significantly in the first quarter of 2022 and also witnessed a growth of 2.1% between 2017–2021.

In 2024, clinics held a significant share of the market and are expected to grow at a substantial CAGR during the forecast period. The growth of the segment can be mainly attributed to the increasing preference for both disposable and reusable pulse oximeters by pulmonologists due to the rising number of COPD patient visits to clinics. The home healthcare segment is set to grow at a moderate CAGR during the forecast period of 2025-2032.

PULSE OXIMETER PROBES MARKET REGIONAL OUTLOOK

On the basis of region, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America:

North America Pulse Oximeter Probes Market Size 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market value of North America stood at USD 1.19 billion in 2025 and is anticipated to dominate the global market during the forecast period. The growth is due to advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and a strong focus on patient monitoring in hospitals and home healthcare. The region has a significant prevalence of chronic diseases such as COPD and heart disease, driving the demand for continuous oxygen saturation monitoring.

The U.S. had the highest share of the North America pulse oximeter probes market in 2024. The highest share is due to the presence of key market players, along with well-established reimbursement policies and healthcare systems, further supporting the widespread use of pulse oximeter probes, contributing to the country’s dominant market position. The U.S. market is projected to reach USD 1.23 billion by 2026.

- For instance, in November 2020, the U.S. FDA granted substantial equivalence for the SpO2 sensor device (K202851), allowing it to be marketed as a Class II device. This device is intended for continuous non-invasive monitoring of oxygen saturation and pulse rate in patients over 3 kg. The FDA determined that the new sensor is substantially equivalent to previously marketed devices, confirming its safety and effectiveness.

Europe:

Europe is estimated to hold a significant market share in 2024 due to the region's well-established healthcare systems, advanced medical technologies, and a high prevalence of chronic respiratory and cardiovascular conditions. The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.24 billion by 2026.

- For instance, as of November 2024, Drägerwerk AG & Co. KGaA is offering a broad portfolio of reusable and disposable SpO2 sensors for adults as well as pediatrics in the region.

Asia Pacific:

Asia Pacific region is growing at the highest CAGR in the market due to the increasing prevalence of respiratory and cardiovascular diseases, especially in aging populations. Rapid urbanization, rising healthcare awareness, and improvements in healthcare infrastructure also contribute to market growth. These factors, combined with government initiatives to improve healthcare access, drive the region's strong market expansion. The Japan market is projected to reach USD 0.16 billion by 2026, the China market is projected to reach USD 0.31 billion by 2026, and the India market is projected to reach USD 0.13 billion by 2026.

- For instance, according to the article published by the Indian Journal of Critical Medicine (IJCCM) in April 2023, there has been a significant rise in critical care in India along with the increased number of Intensive Care Unit (ICU) beds and also trained professionals, which surged the use of pulse oximeter probes.

Latin America:

Latin America is expected to witness significant growth during the forecast period owing to increasing awareness of patient monitoring benefits and the focus of government and key companies to enhance the healthcare infrastructure in these regions.

- According to the OECD, in 2022, Chile's healthcare expenditure was USD 5,241 million, which was 3,828 in 2019. Such considerable expansions in healthcare expenditure are expected to increase the adoption of patient monitoring products, such as pulse oximeter probes.

Middle East & Africa:

The Middle East & Africa region accounted for a comparatively limited share of the global market in 2024. However, the region is projected to witness growth prospects due to several factors, including an increasing number of hospitalizations, improvements in health infrastructure, and others.

- For instance, in January 2024, the International Trade Administration reported that the Saudi Arabian government planned to invest over USD 65.0 billion to develop the country’s healthcare infrastructure under Vision 2030. Such high investment in healthcare infrastructure is expected to drive the usage of pulse oximetry probes in new healthcare settings, propelling the segment growth.

KEY INDUSTRY PLAYERS

Dual Companies, Masimo and Medtronic to Exercise Dominance on Global Market

With respect to the global competitive landscape, the scenario reflects a consolidated market structure with the dominance of major players Masimo and Medtronic. Masimo Corporation leads the industry with advanced pulse oximetry technologies, while Medtronic plc enhances its portfolio with FDA-cleared products such as the Nellcor OxySoft neonatal-adult SpO2 Sensor.

Other market players with a significant presence in the global market include Koninklijke Philips N.V., which provides comprehensive patient monitoring solutions, including pulse oximeters and probes. Nonin Medical, Inc. specializes in non-invasive monitoring devices, contributing significantly to market expansion. Nihon Kohden Corporation, a major provider of medical electronics, also offers reliable pulse oximeters. Collectively, these companies shape the market through continuous innovation and a commitment to meeting healthcare needs.

FUTURE OUTLOOK

The pulse oximeter probes market is poised for significant growth in the coming years, driven by advancements in technology, increased awareness of healthcare monitoring, and the expansion of home-based healthcare services. The rising prevalence of chronic diseases, coupled with an aging population, further amplifies the demand for reliable and portable monitoring devices. However, the market's growth trajectory is not without challenges. Addressing accuracy concerns, particularly related to skin tone variations, and ensuring compliance with stringent regulatory standards will be essential for manufacturers. Furthermore, collaboration among key stakeholders, manufacturers, healthcare providers, and regulatory bodies will be instrumental in overcoming these hurdles.

List of Key Companies in the Pulse Oximeter Probes Market

- CONTEC MEDICAL SYSTEMS CO.,LTD (China)

- Koninklijke Philips N.V. (Netherlands)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Masimo (U.S.)

- Medtronic (U.S.)

- VYAIRE (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- Nonin (U.S.)

- Drägerwerk AG & Co. KgaA (Germany)

- EDAN Instruments, Inc. (China)

- Shenzhen Comen Medical Instruments Co., Ltd. (China)

- Konica Minolta, Inc. (Japan)

- FUKUDA DENSHI (Japan)

KEY INDUSTRY DEVELOPMENTS:

October 2024: Nonin partnered with Tenovi to provide its advanced pulse oximetry technology to Tenovi’s remote monitoring clients.

November 2023: NIHON KOHDEN CORPORATION established a new sub-subsidiary of Nihon Kohden Singapore in Vietnam to expand its overseas business, including SpO2 probes.

September 2024: Nonin partnered with Corscience to co-promote each other’s OEM product offerings, including pulse oximetry and capnography accessories such as probes.

May 2023: Shenzhen Mindray Bio-Medical Electronics Co., Ltd. partnered with Vithas to integrate the latest innovative patient monitoring technology across 20 hospitals of Vithas.

April 2023: Koninklijke Philips N.V. and Northwell Health., in the U.S., entered into seven years collaboration to standardize patient monitoring across Northwell Health.

REPORT COVERAGE

The global pulse oximeter probes market report provides qualitative and quantitative insights into the market’s forecast and a detailed analysis of the market’s size & growth rate for all possible segments in the market. The report also provides an elaborative analysis of the global market’s dynamics and competitive landscape. Various key insights presented in the report are an overview of technological advancements, the prevalence of pulmonary-related disease in key countries in 2024, pricing analysis, key recent industry developments such as mergers, acquisitions, and partnerships, new product launches, and the impact of COVID-19 on the global market

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.93% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Units) |

|

Segmentation |

Age Group, End-User, Measurement Size, End-user, and Region |

|

By Product Type |

|

|

By Age Group |

|

|

By Measurement Site |

|

|

By End-user |

|

|

By Geography |

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 3.4 billion in 2026 and is projected to record a valuation of USD 8.98 billion by 2034.

In 2025, the North America market size stood at USD 1.19 billion.

Recording a CAGR of 12.93%, the market will exhibit steady growth during the forecast period of 2026-2034.

By age group, the adult segment is expected to be the leading segment in this market during the forecast period.

Masimo and Medtronic are some of the major players in the global market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us