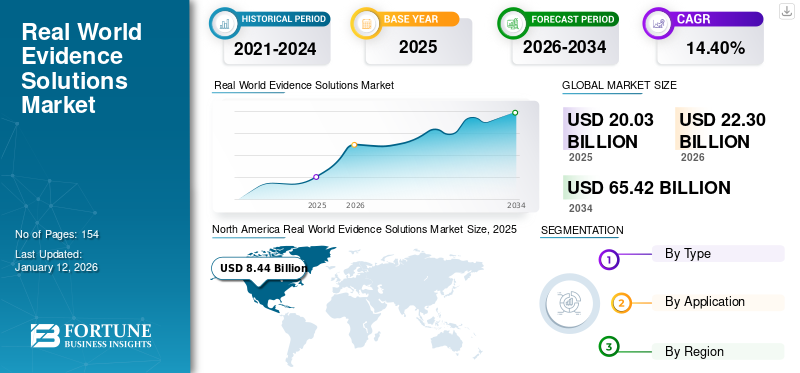

Real World Evidence Solutions Market Size, Share & Industry Analysis, By Type (Clinical Setting Data, Claims Data, Pharmacy Data, Patient Powered Data, and Others), By Application (Pharmaceutical and Medical Device Companies, Healthcare Payers, Healthcare Providers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global real world evidence solutions market size was valued at USD 20.03 billion in 2025 and is projected to grow from USD 22.3 billion in 2026 to USD 65.42 billion by 2034, exhibiting a CAGR of 14.40% during the forecast period. North America dominated the real world evidence solutions market with a market share of 42.11% in 2025. Moreover, the U.S. real-world evidence solutions market size is projected to grow significantly, reaching an estimated value of USD 17.79 billion by 2032, driven by increasing usage of real-world evidence solutions by biopharmaceutical companies.

As per the U.S. FDA definition, Real World Evidence (RWE) is the clinical evidence derived from the analysis of Real World Data (RWD) regarding the potential benefits and usage of medical products. In recent years, insights from real-world evidence have gained significant attention, particularly as they play an important role in the decision-making across the product life cycle. The increasing usage of these solutions among end-users is anticipated to surge the demand for studies based on real world evidence in the coming years.

Biopharmaceutical companies increasingly use these solutions to bolster their clinical understanding and achieve product approval and reimbursement more effectively and efficiently. For instance, in September 2022, Verantos announced the launch of the Verantos Evidence Platform. This system has allowed pharmaceutical companies to generate real-world evidence solutions with highly defined standards, which the U.S. FDA approves. Moreover, to support the usage of real world data and evidence in drug development, in August 2023, the U.S. FDA issued a final draft of recommendations which provides guidance on how pharmaceutical companies should use data collected from real world studies to support the regulatory review process for new therapies.

In addition, the introduction of advanced real-world evidence solution analytics has made real-world data an even more powerful resource for pharmaceutical and medical device companies. Advanced real-world evidence solution analytics include predictive models, probabilistic causal models, machine learning, and unsupervised algorithms to extract meaningful data from rich data sets.

Furthermore, these solutions efficiently fill the gap between the information stored among stakeholders and the information available to the healthcare payer and providers by offering real-world scenarios. These solutions allow all parties to derive new insights, deliver better health outcomes, and support value-based care.

- For instance, according to an article published by the National Center for Biotechnology Information (NCBI) in January 2021, healthcare payers in the U.S. are increasingly implementing outcomes-based contracts with healthcare providers and prescribers by recognizing the value of RWE service in decision-making. Such developments are driving the global market.

The outbreak of COVID-19 had a positive impact on the market in 2020. An increasing number of clinical trials and growth in demand for novel and effective drugs as well as vaccines have driven the demand for real world evidence services. Many pharmaceutical and biopharmaceutical companies increased the usage of real world evidence solutions for the development of vaccines and drugs against the SARS-CoV-2 virus. Furthermore, to accelerate the R&D process, many pharmaceutical and biotechnology companies have collaborated with Contract Research Organizations (CROs) worldwide to generate real-world evidence.

Thus, with the increasing usage of these solutions in the development of effective drugs during the pandemic, the market witnessed significant growth in 2020. The market is expected to witness steady growth prospects henceforth.

Global Real World Evidence Solutions Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 20.03 billion

- 2026 Market Size: USD 22.3 billion

- 2034 Forecast Market Size: USD 65.42 billion

- CAGR: 13.3% from 2026–2034

Market Share:

- Region: North America dominated the market with a 42.11% share in 2025. This leadership is driven by the high adoption of RWE solutions by major pharmaceutical companies, increased R&D spending to improve drug development, and the widespread use of advanced health record systems.

- By Application: The Pharmaceutical and Medical Device Companies segment accounted for the highest market share. This dominance is due to the increasing use of these solutions to support drug and device development, gain regulatory approvals, and inform strategic marketing decisions, as seen with the real-world data used for COVID-19 vaccines.

Key Country Highlights:

- Japan: As a key country in the fast-growing Asia Pacific region, market growth is propelled by a significant number of contract research organizations and an increasing number of clinical trials leveraging real-world data.

- United States: Growth is fueled by high adoption among pharmaceutical companies, increased R&D spending, and a supportive regulatory environment, including specific guidance from the U.S. FDA on using RWE for regulatory decision-making.

- China: The market is driven by its prominent role in the Asia Pacific region, which is experiencing a rise in clinical trials and a growing number of contract research organizations that utilize real-world data for drug development.

- Europe: The market is advanced by strong regulatory support, with bodies like the European Medicines Agency (EMA) investing significantly in real-world data access. Initiatives such as the DARWIN EU network are being established to facilitate the use of this data across the EU.

Real World Evidence Solutions Market Trends

Shift from Volume-to-Value Based Healthcare to Escalate the Market Growth

In recent years, the healthcare marketplace witnessed a shift from volume-based care to value-based care. The latter one has emerged as a potential alternative in the healthcare infrastructure.

This model offers efficient and high-quality care with the aspect of cost-effective treatment.

- For instance, in June 2022, Dubai Health Authority (DHA) and its health insurance regulatory body launched a “first-of-its-kind” digital-led program to adopt value-based healthcare in the state.

Moreover, several government entities have introduced various value-based healthcare models, which the market has witnessed growing adoption of in recent years. Additionally, private payers have also adopted similar models of accountable, value-based care.

On the other hand, emerging countries, such as India, Brazil, Saudi Arabia, and others, are also shifting their focus toward value-based healthcare models. Various events, discussions, and conferences are being held on value-based care across the globe to increase the adoption of value-based healthcare. This is expected to boost the global real world evidence solutions market growth.

Download Free sample to learn more about this report.

Real World Evidence Solutions Market Growth Factors

Increasing Usage of these Solutions in the Improvement of Drug Development & Approvals and Reduction of Drug Development Costs to Boost Market Growth

During the drug life cycle, pharmaceutical companies can use real world evidence solutions for real-time decision-making related to clinical trials in order to make it more effective and efficient. The proper criteria for clinical trials and identification of potential patients can be done with the help of these solutions. These solutions have a wide range of applications in the areas of the testing of medications, the vaccine development process, and the designing of digital therapeutics.

- For instance, in May 2022, Pfizer Inc. presented positive real-world evidence for its combination therapy to treat metastatic breast cancer at ESMO Breast Cancer 2022. The therapy includes IBRANCE (palbociclib) and an aromatase inhibitor.

Recently, amidst the COVID-19 pandemic, operating players have been focusing on expanding the use of these solutions to develop drugs and vaccines to fight the virus.

- For instance, in March 2021, the Centers for Disease Control and Prevention (CDC) study used real world evidence to find that Pfizer, Inc. and Moderna, Inc. COVID-19 vaccines reduced the risk of infection by 90% two or more weeks after the second dose.

Furthermore, this data can reduce the cost of drug development, which in turn is increasing the demand for this type of data. For instance, as per an article published in October 2020 by The Professional Society for Health Economics and Outcomes Research (ISPOR), the use of real-world evidence can reduce clinical trial costs by 5-50%.

In addition, using real world evidence solutions, the medication brand can be supported by real-time strategic decision making. The data held by regulatory authorities or Internet of Things (IoT) data can be used to identify weaknesses in competitors’ products, in turn offering an edge over the competitors. Thus, these factors, together with the growing focus of the operating players on the development and introduction of novel drugs and therapies for the treatment of various conditions, are expected to boost the demand for these solutions during the forecast period.

Increasing R&D Spending and Rising Number of Clinical Trials to Augment Market Growth

The drug development process is quite long and costly, from research to the final drug approval. According to the Tufts Center for the Study of Drug Development, on average, the complete drug development process costs USD 2.60 billion to develop a new medicine, which also includes the cost of failures.

Moreover, only 12.0% of new drug candidates that enter clinical trials get U.S. FDA approval. Thus, owing to the advantages offered by real-world evidence, several pharmaceutical companies are partnering with real-world evidence solution providers to overcome critical challenges and provide greater competencies across the drug development continuum.

According to an article published in September 2022, R&D is one of the top functions for which pharmaceutical & biopharmaceutical companies generate real world evidence. Thus, with the increasing R&D spending, a growing number of companies are likely to adopt and accelerate the usage of these solutions in the R&D process.

RESTRAINING FACTORS

Lack of Presence of Standardized Regulations to Impede Market Growth Prospects

With the increasing demand and usage of real-world evidence solutions, there is an urgent need for standardized regulations for these solutions across the world. Lack of global harmonization in regulatory, legal, and ethical requirements is one of the significant threats to market growth. Lack of standardization in terms of analytics relating to real-world data and real-world evidence can generate an analysis of substandard quality, lack of transparency in terms of techniques, inability to integrate data from disparate sources, and unreliable results.

Moreover, data standardization is necessary, which includes data collection, quality, processing, terminology, design principles, and real world evidence solutions reporting. There is a huge gap in data standardization across all regulatory institutions. The gap reduces the quality of Real World Data (RWD) compared to the data originating from Randomized Clinical Trials (RCTs). Thus, the confluence of the above-mentioned factors is anticipated to limit the market growth to a certain extent.

Real World Evidence Solutions Market Segmentation Analysis

By Type Analysis

Clinical Settings Data Dominated the Market Owing to Growing Number of Clinical Trials across the Globe

The market is divided by type into clinical setting data, claims data, pharmacy data, patient-powered data, and others.

The clinical setting segment is projected to dominate the market with a share of 67.48% in 2026 owing to various factors, such as increased electronic health records (EHR) adoption, value-based reimbursements in key regions, and continuous growth in the number of clinical trials.

- For instance, as per the International Clinical Trials Registry Platform (ICTRP), the annual number of registered clinical trials by high-income countries increased from 21,028 in 2010 to 29,538 in 2020.

- Additionally, as of May 2023, the number of registered clinical trials was 452,604, a significant increase from 2021.

Moreover, supportive regulatory bodies, the development of new platforms by operating players, and increasing government initiatives are also expected to support segmental growth.

- For instance, in October 2021, ISPOR—The Professional Society for Health Economics and Outcomes Research (HEOR), launched the Real World Evidence Registry as a part of the Real World Evidence Transparency Initiative.

On the other hand, the claims data segment held the second-largest share of the market in 2024 and is expected to grow significantly throughout the forecast period. Claims data is witnessing growing demand from healthcare payers as it can be used to understand the current payment for care. Additionally, this type of data also helps in deciding government and commercial healthcare payment programs.

The segments of pharmacy data, patient-powered data, and others are anticipated to witness considerable growth over the forecast period. Factors such as increased adoption of patient powered data by healthcare payers and providers, and increasing prevalence of various chronic diseases, leading to increasing pharmacy data, have supported the growth of these segments.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Pharmaceutical and Medical Device Companies Segment Projected to Dominate Owing to Increasing Usage of Real World Evidence Solutions in Drug Development

The market is segmented by application into pharmaceutical and medical device companies, healthcare payers, healthcare providers, and others.

Pharmaceutical and medical devices companies segment is expected to account for 62.45% of the market share in 2026. This dominance is majorly attributed to the increasing adoption of these solutions in drugs as well as medical device development and approvals. Pharmaceutical companies have used these solutions for many years now to support their decision-making and improve their product marketing. Recently, various vaccine manufacturers have also used real world data to supplement their COVID-19 vaccine manufacturing and marketing workflow.

- For instance, in June 2021, a real world evidence solutions trial found that AstraZeneca’s COVID-19 vaccine was 92% effective against severe disease and 86% effective against the Alpha variant.

Alternatively, healthcare payers contributed to the second-largest revenue generation in 2024. Increasing adoption of these solutions by insurance firms and favorable reimbursement scenarios, especially in developed countries, is anticipated to drive segment growth over the forecast period.

- For instance, in March 2022, ISPOR—The Professional Society for Health Economics and Outcomes Research (HEOR), in partnership with the Bristol Myers Squibb-Pfizer Alliance, announced the launch of a new “About Real World Evidence” microsite.

On the other hand, healthcare providers are expected to be benefitted from the use of these solutions by offering improved delivery of care. Healthcare providers use the solutions to support their care decisions as well as for the development of tools and guidelines to help in clinical practices.

REGIONAL INSIGHTS

The global market can be segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America Real World Evidence Solutions Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market and generated a revenue of USD 7.57 billion in 2023. The dominance of the market can be attributed to the high adoption of real world evidence solutions by key pharmaceutical companies, increased spending on R&D to improve drug development, and high adoption of advanced health record systems in the region. The U.S. market is projected to reach USD 8.68 billion by 2026.

Additionally, the robust presence of service providers and supportive regulatory bodies in the region further supports its dominance. In January 2022, the U.S. FDA issued draft guidance on real-world evidence solutions in regulatory decision-making. It includes topics related to data standards, data sources, and regulatory considerations for real-world solutions.

Europe

On the other hand, Europe accounted for a substantial share of the market. The region is witnessing an increasing adoption of these solutions by regulatory bodies, which in turn, is driving the growth. The European Medicines Agency (EMA), along with other national regulatory bodies, has been significantly investing in accessing real world data. The EMA has launched the Data Analytics and Real World Interrogation Network (DARWIN EU) – an EU-wide network of RWD. Such initiatives have supported regional market growth. The UK market is projected to reach USD 1.06 billion by 2026, while the Germany market is projected to reach USD 0.99 billion by 2026.

Asia Pacific

The market in the Asia Pacific region is estimated to grow at a comparatively higher CAGR during the forecast period owing to the significant number of contract research organizations and an increasing number of ongoing clinical trials in Southeast Asian countries. In this region, emerging countries such as China and Japan are anticipated to be the foremost in terms of growth prospects. The Japan market is projected to reach USD 1.4 billion by 2026, the China market is projected to reach USD 2.12 billion by 2026, and the India market is projected to reach USD 0.98 billion by 2026.

Furthermore, the Latin America and Middle East Africa regions are anticipated to witness moderate growth over the forecast period. Rising involvement in real world research in the Latin America region, the growing interest of researchers in this space, and increasing partnerships between domestic and global players in these regions have contributed to market growth.

- For instance, in November 2020, Clarivate Plc announced the partnership with Techtrials Pesquisa e Tecnologia Ltda (Techtrials) in Brazil to expand its international real world data offerings. The new partnership provided comprehensive real world evidence solutions to customers accounting for about 80% of the Brazilian population.

List of Key Companies in Real World Evidence Solutions Market

IQVIA Inc. to Lead the Market in 2024 with Strong Product & Service Offerings

The competitive landscape of this market space reflects a consolidated structure with key players such as IQVIA Inc., IBM Corporation, Cognizant, and Optum Inc. accounting for a significant share in 2024. These major players are constantly focusing on diversifying their service offerings and entering into strategic partnerships with pharmaceutical companies and healthcare payers & providers in order to expand their customer base.

- For instance, in September 2021, IQVIA Inc. and HealthCore Inc. entered into a collaborative agreement in order to improve real world evidence studies with increased quality & efficiency.

Apart from these players, other prominent players, such as Oracle Corporation, PerkinElmer Inc., Parexel International Corporation, and Syneos Health are also focused on introducing services with the aim of strengthening their market presence. Additionally, these companies are also undertaking various strategic initiatives, such as collaborations, to offer easy access to real world data.

LIST OF KEY COMPANIES PROFILED:

- IQVIA Inc. (U.S.)

- IBM (U.S.)

- Cognizant (U.S.)

- Syneos Health (U.S.)

- Oracle (U.S.)

- Clinigen Limited (U.K.)

- Icon plc (Ireland)

- Optum Inc. (United Health Group) (U.S.)

- Flatiron Health (F. Hoffmann-La Roche) (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Parexel International Corporation (U.S.)

- SAS Institute Inc. (U.S.)

- Perkin Elmer Inc. (U.S.)

- Cegedim Health Data (France)

KEY INDUSTRY DEVELOPMENTS

- December 2023: The U.S. FDA renewed the collaboration agreement between Syapse, a real-world-data-focused healthcare company, and the Oncology Center of Excellence. This collaboration is focused on evaluating Real-World Data (RWD) study designs and methods.

- November 2022: Castor, a provider of hybrid and decentralized clinical trial technology solutions, launched a new offering to simplify post-marketing clinical trials.

- November 2022: The U.S. FDA launched a real world evidence program. The program aimed to advance the acceptability and quality of RWE-based approaches in support of new intended labeling claims.

- September 2022: Lumanity, Inc. announced the creation of a new global practice composed of the U.S. and Europe-based experts in real world evidence. The aim was to help clients identify the correct real world data (RWD) and methodologies.

- May 2022: Komodo Health, Inc. demonstrated the usefulness of its new technology platform, accelerating real world evidence for life sciences

- August 2021: Syneos Health and Aetion, Inc. announced their partnership to provide analytics-driven solutions and regulatory-grade data to advance drug development and improve patient outcomes.

REPORT COVERAGE

An Infographic Representation of Real World Evidence Solutions Market

To get information on various segments, share your queries with us

The research report provides an in-depth analysis of the market. It focuses on market segments such as type and application. Besides this, it offers insights related to the market overview, and market trends. Additionally, the report consists of several factors that contribute to the global market growth. The report also provides the competitive landscape of the global market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.40% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 20.03 billion in 2025 and is projected to reach USD 65.42 billion by 2034.

In 2025, the market value in North America stood at USD 8.44 billion.

The market will exhibit steady growth at a CAGR of 14.40% during the forecast period of 2026-2034.

Currently, the clinical setting data segment is leading the market by type and is expected to continue its dominance during the forecast period.

The potential of real world evidence solutions in the improvement of the drug development process & reduction of drug development costs, increasing usage of these solutions by biopharmaceutical companies, growing demand among healthcare payers and providers, increasing R&D spending & rising number of clinical trials, and the emergence of real world evidence service providers offering end-to-end services are the key drivers of the market.

IQVIA Inc., UnitedHealth Group, IBM, and Cognizant are the major players operating in the market.

North America dominated the market in 2025.

The surge in demand for effective treatment of various diseases, increased adoption of technologically advanced record systems, and a considerable patient population base are some of the factors expected to drive the adoption of these solutions.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic