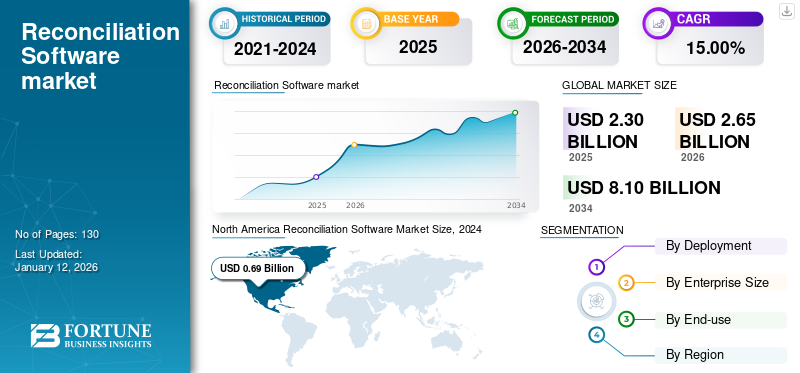

Reconciliation Software Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (Small and Medium-sized Enterprises (SMEs) and Large Enterprises), By End-Use (Banks, Financial Institutions, and Insurance), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

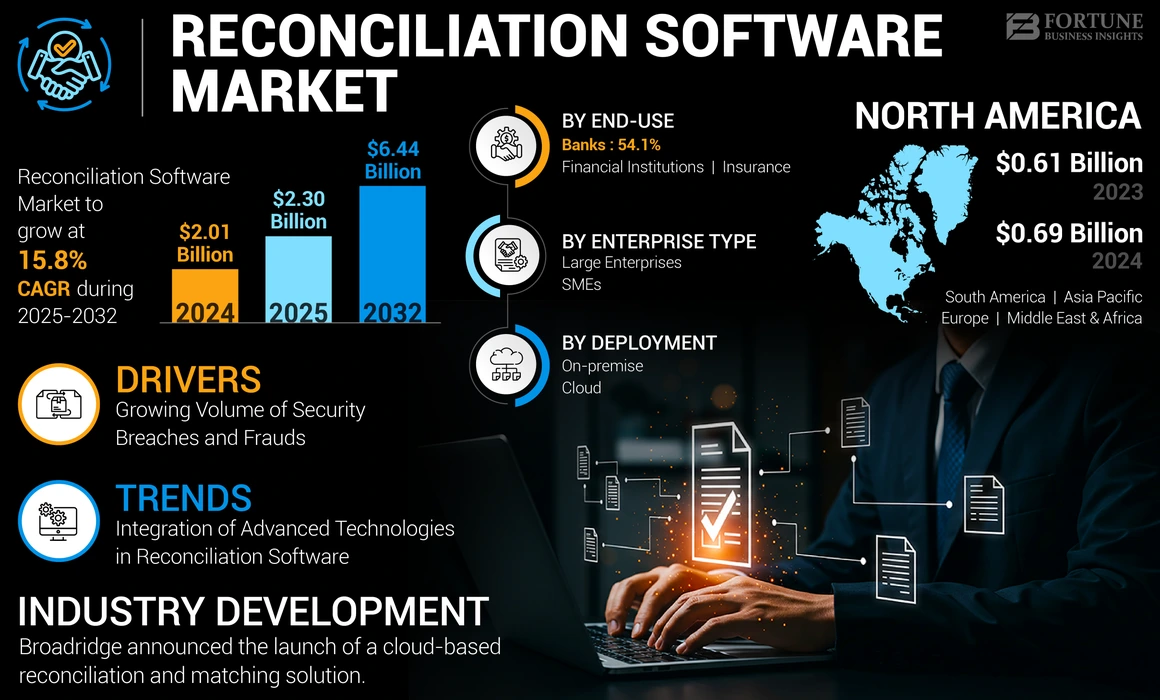

The global reconciliation software market size was valued at USD 2.01 billion in 2024. The market is projected to grow from USD 2.30 billion in 2025 to USD 6.44 billion by 2032, exhibiting a CAGR of 15.8% during the forecast period. North America dominated the global market with a share of 34.33% in 2024. Additionally, the U.S. reconciliation software market is predicted to grow significantly, reaching an estimated value of USD 1,331.8 million by 2032.

Reconciliation software streamlines and automates the financial closing procedure by matching data from the bank statements, general ledger, and invoices. It compares two financial records to confirm that they are in accordance with each other. It matches the balances in a business's accounting records to the corresponding data on a bank statement.

This software aids enterprises in ensuring that their internal records are precise, reliable, and comprehensive. It also enables users to automatically authenticate and complete reconciliations, which are then directed to approvers for checking. Other prominent features of this software include an audit trail, automated data import, error reporting, and scalability as per business requirements, error reporting, and security. Such features drive the demand for this software across banking, financial, and insurance organizations. Key players are determined to seek relevant collaborations and alliances that aid them in reaching a vast customer base. For instance,

- In January 2023, Trintech, in collaboration with Jeeves, introduced a financial close and reconciliation solution. Jeeves resells Adra Suite of Trintech to aid organizations in the Nordics in streamlining and fast-tracking their financial close and reconciliation procedures.

The increase in the usage of e-commerce owing to the COVID-19 pandemic and the rise in online transactions across the globe accelerated the use of reconciliation software during the pandemic. Also, incorporating modernized mechanisms, such as Artificial Intelligence (AI) and AR/VR, among others, enhanced the solution's competencies. Thus, the after-effects of the pandemic have contributed to the market growth.

IMPACT OF GENERATIVE AI

Implementation of Enhanced Capabilities of Generative AI in the Banking Sector to Fuel Market Progress

Generative AI offers various benefits to the banking and financial sector. Generative AI can enhance productivity and minimize costs by optimizing and automating several progressions. Its capability to examine data in actuality allows banks to make data-powered decisions with better accuracy and reduce risks.

It mechanizes the reconciliation procedure by corresponding transactions and recognizing inconsistencies. It considerably decreases manual effort, permitting finance teams to emphasize exclusions and planned tasks. Thus, the implementation of generative AI in reconciliation processes helps users with improved accuracy, faster fraud detection, data-driven insights, reduced costs, and better productivity. Hence, key market players are enhancing their reconciliation offerings in the banking and financial sector with generative AI mechanisms to offer enhanced customer experience to users. For instance,

- In September 2023, Temenos announced the launch of a secure banking solution with the help of Generative AI to automatically categorize customers’ banking transactions. With the new solution, clients can interpret income from sources, such as interest, salary, rental income, and dividends, to verify their intra-year tax burden and reconcile end-of-year tax reporting.

Reconciliation Software Market Trends

Integration of Advanced Technologies in Reconciliation Software to Support Market Expansion

Digitization is on the rise across various industry verticals. Rapidly renovating financial facilities ensures a surge in customer base and progressive proficiencies of solutions. Data analysis, cloud and AI, and machine learning are the most extensively implemented technologies globally across the financial sector. Adoption levels vary broadly as per technological execution and region-wise adoption. For instance,

- According to industry experts, the cloud study covers the most widely employed technology in the banking sector, accounting for about 45%, followed by BI (Business Intelligence) at 37%.

Technologically incorporated reconciliation solutions provide various advancements, including minimizing reconciliation hours and reducing errors and the possibility of manual errors. Hence, enterprises are investing in innovative technology, such as generative AI, to use these advanced capabilities and cope with promptly changing user inclinations. For instance,

- In July 2023, Trimble announced the launch of the new cloud-based LIMS Pro (Log Inventory and Management System) to help SMBs identify growth gains and productivity. The new software streamlines the complete procedure for sawmills, taking it from days to hours over real-time reconciliation, enhanced data accuracy, reduced processing errors, and quicker truck turn times.

Such new innovations, integrating modernized technologies in the banking sector, augment the market expansion.

Download Free sample to learn more about this report.

Reconciliation Software Market Growth Factors

Growing Volume of Security Breaches and Frauds to Accelerate the Adoption of Reconciliation Solutions

The increasing volume of data fraud and security breaches has hampered various industries globally. In financial sectors, fintech-associated frauds have resulted in a higher percentage than in other industries. For instance,

- According to industry experts on economic crime and fraud, financial services accounted for a customer fraud of 44%. Along with this, 38% accounted for cybercrime in 2022.

Financial institutes and banks progressively implement reconciliation solutions to diminish these security breaches. Reconciliation tools aid in preventing bank damages and disputes owing to the absence of reconciliation of unfinished and inverted transactions. Implementing an automatic banking solution can streamline operations, ease the identification and resolution of bottlenecks, and elevate efforts. It enables standardization of processes, prioritizing and supervising important accounts, leading to actual-time information and delivery analysis, and helping strategic businesses make decisions.

Thus, a rise in financial service frauds has fueled the global reconciliation software market growth.

RESTRAINING FACTORS

Security Issues Regarding Reconciliation Software Restrain Market Growth

Businesses are predominantly concerned regarding the security of their financial data. Reconciliation software stores sensitive financial data, such as transaction histories, account balances, and other account details. Thus, maintaining privacy and safeguarding this data is essential for businesses.

Failure to maintain privacy can result in a target for cyberattacks. Unauthorized access to reconciliation solutions would enable attackers to make fraudulent transactions, steal businesses' financial information, and disrupt financial procedures.

It can also lead to data breaches if the software is not appropriately secured, which allows cyber attackers to steal businesses' financial information and sell it on the dark web, leading to identity theft.

Social engineering attacks can make employees reveal the company’s sensitive data or click on malicious links. This can lead to access to reconciliation software and breach the security of the firm’s sensitive data.

As this software is not entirely immune to such attacks, it can cause potential risks for businesses and hamper business growth in the market.

Reconciliation Software Market Segmentation Analysis

By Deployment Analysis

Cloud-based Deployment to Fuel Market Progress with Emerging Technologies, Such as Neo-banking

Based on deployment, the market is bifurcated into cloud and on-premises.

The cloud segment is anticipated to flourish at an accelerated rate in the coming years. Neo-banking is an emerging technology in the banking sector. The rise in popularity of neo-banking has increased considerably during the pandemic. Social distancing standards amid the pandemic and augmented dependence on technology have helped users embrace digital banking rather than traditional banking to achieve their financial necessities. This adoption has surged the demand for cloud-driven reconciliation software at a faster pace. For instance,

- In June 2023, Oracle announced the NetSuite Account Reconciliation, which helps automate and match transaction procedures. As part of the cloud ERP of NetSuite, solutions help customers automate and standardize the reconciliation procedure, reinforce internal financial controls, and generate more precise financial statements.

The on-premises segment accounts for the highest market revenue share in recent years. This demand is due to enhanced data security and a greater rate of software implementation among start-ups and small and medium-sized businesses.

By Enterprise Type Analysis

Rising Popularity of Reconciliation Software among Large Enterprises Boosted Segment Growth

The global market is bifurcated by enterprise type into Small and Medium-sized Enterprises (SMEs) and large enterprises.

The large enterprises segment held the largest market revenue share in 2024. An automated banking solution empowers large businesses to reduce human error and offer effectual reconciliation solution capabilities. Thus, the usage of the software has increased among large enterprises.

The SMEs segment is anticipated to grow at a leading CAGR during the forecast period due to the growing requirements for cloud-based reconciliation services. The powerful software can help SMEs automate tedious tasks, such as managing financial records and accounting data while saving time and minimizing errors. Also, the different pricing models and plans can help SMEs save on costs, thereby increasing the need for this software among SMEs.

For instance,

- In July 2023, Trimble introduced a new cloud-based LIMS Pro (Log Inventory and Management System) to aid SMBs in identifying growth improvements and productivity. The new software simplifies the overall procedure for sawmills, from days to hours over actual-time reconciliation, improving data accuracy, decreasing processing errors, and faster truck turn times.

By End-Use Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Preference for Automated Banking Applications over Traditional Processes to Surge Market Progress

In terms of end-use, the market is divided into banks, financial institutions, and insurance.

The banks segment accounted for the largest market share in 2024 and is also projected to grow with a leading CAGR during the studied period. Traditional manual reconciliation procedures are the most cost-challenging and inefficient in a company. Hence, various banks are shifting to reconciliation processes with emerging new solutions in the market. For instance,

- In April 2023, Modern Treasury introduced a reconciliation engine to automate reconciliation for banks and third-party credit card processors. It helps businesses to enhance productivity and financial transparency.

Implementing an automatic banking solution offers a standard, risk-built approach regardless of the number of banks, firms, businesses, and accounts. It comprises a recorded trail of every reconciliation action for the external and internal auditors, improving the reconciliation procedures and minimizing the security concerns associated with the process. Thus, these benefits over traditional progressions have surged software implementation among banking sectors. The usage of reconciliation software across financial institutions helps them accomplish enhanced accuracy and control, provides real-time insights, enhances regulatory compliance, improves fraud detection, and offers many more benefits. Hence, the adoption of this software among financial institutions is increasing, driving the market demand.

REGIONAL INSIGHTS

Based on geography, the market is subdivided into five key regions: Europe, North America, South America, Asia Pacific, and the Middle East & Africa.

North America Reconciliation Software Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the highest market revenue share for the year 2024. The region experiences strong growth due to the early adoption of progressive technologies and a vastly competitive landscape. The regional development is also attributed to the increasing rate of cloud acceptance and end-users’ willingness to implement advanced solutions. The rising demand for cloud-driven reconciliation software across the region persistently propels market growth.

- June 2022 - DUCO expanded its presence by opening an office in Boston to serve a rising client base in North America. The company has been growing promptly in the region, representing approximately 50% of the firm’s revenues. It is also one of the main growth drivers that has been rising levels of customer satisfaction.

Asia Pacific is anticipated to record the highest CAGR during the forecast period. This growth is attributed to the growing number of startups adopting modernized reconciliation solutions. One of the principal factors is that several regional governments are proactively supporting evolving nations in implementing reconciliation solutions, which aids the region’s market in leading the growth rate in every aspect.

- In April 2022, ReconArt extended its alliance across Asia Pacific. The firm’s technologically progressive account reconciliation and operation matching platform is gaining acclamation and visibility across financial management consultants and technology integrators in Indonesia, Hong Kong, India, and Vietnam.

Europe is projected to grow significantly in the coming years. As per European administrations, over 70% of European enterprises are shifting their workloads to the cloud. It is predominantly due to optimizing costs over cloud usage, and approximately 50% of organizations have built a cloud-driven approach to increase business proficiency. It would generate various market opportunities for market players to expand their presence in core banking software offerings across Germany, the U.K., France, Italy, Spain, and other countries.

The growth in the implementation of technical solutions has generated opportunities for digitalization across the Middle East & Africa and South American regions. Multiple factors, such as the shift to digitization in banking after the pandemic, the expansion of market players, and the adoption of cloud-based solutions, have influenced the reconciliation software market share in these regions' banking and financial sectors.

Key Industry Players

Soaring Emphasis on Strategic Acquisition and Partnerships among Market Players to Impact Market Positively

The global market is consolidated with leading players, such as BlackLine Inc., Broadridge Financial Solutions, Inc., Tata Consultancy Services Limited, Xero Limited, Gresham Technologies plc, SmartStream Technologies Ltd, and DUCO. These market players are expanding by adopting business strategies, such as acquisitions, mergers, product launches, partnerships, and collaborations. For instance,

LIST OF TOP RECONCILIATION SOFTWARE COMPANIES

- BlackLine Inc. (U.S.)

- Broadridge Financial Solutions, Inc. (U.S.)

- Tata Consultancy Services Limited (India)

- Xero Limited (New Zealand)

- Gresham Technologies plc (U.K.)

- SmartStream Technologies ltd (U.K.)

- DUCO (U.K.)

- ReconArt, Inc. (U.S.)

- SolveXia (Australia)

- StatementMatching.com Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS

- October 2023: ReconArt completed API incorporation with Mambu by augmenting its reconciliation solution for banking, fintech, and financial services customers. The API integration with ReconArt enhances the efficiency and speed of crucial account reconciliation procedures.

- September 2023: Broadridge announced the launch of a cloud-based reconciliation and matching solution. The platform mechanizes the complete reconciliation procedure from the initial point, resulting in enhanced efficiency, accuracy, and transparency while minimizing risk and overall cost of ownership.

- July 2023: Trintech announced the acquisition of Accurate Reconciliation and Frontier Reconciliation from Fiserv. With the acquisition, the company gains two top reconciliation solutions, further advancing the company’s product line of competencies.

- June 2023: Shiji and Evention announced a strategic alliance to improve hotel financial operations. This partnership aims to enhance economic progress within the hospitality sector, providing improved accuracy and efficiency to hotel finance teams.

- April 2023: Duco announced its reconciliation support to JBWere NZ. JBWere NZ uses Duco to reconcile securities and cash detained with their sub-custodians, banks, and share registries. Duco helps companies enhance their data management procedures, from reconciliation to data quality.

REPORT COVERAGE

The report analyzes prime regions globally to provide a better understanding of the prominent aspects driving industry growth. Furthermore, the report highlights the latest industry and market trends at a global level. Along with this, it also highlights some of the growth-stimulating factors and restraints, helping the reader to gain an overview of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By End-Use

By Region

|

Frequently Asked Questions

The market is projected to reach USD 6.44 billion by 2032.

In 2024, the market size stood at USD 2.01 billion.

The market is projected to grow at a CAGR of 15.8% over the forecast period.

By end-use, the banks segment is set to lead the market during the forecast period.

The growing volume of security breaches and frauds is estimated to accelerate the adoption of reconciliation solutions, driving market growth.

The top companies are BlackLine Inc., Broadridge Financial Solutions, Inc., Tata Consultancy Services Limited, Xero Limited, Gresham Technologies plc, SmartStream Technologies Ltd, and DUCO.

North America is expected to hold the highest market share.

Asia Pacific is expected to grow at the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us