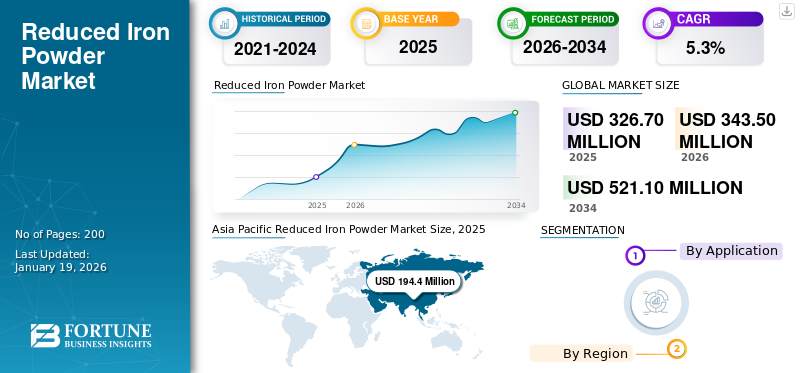

Reduced Iron Powder Market Size, Share & Industry Analysis, By Application (Powder Metallurgy, Welding, Chemical Synthesis, Filtration, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global reduced iron powder market size was valued at USD 326.7 million in 2025. The market is projected to grow from USD 343.5 million in 2026 to USD 521.1 million by 2034, exhibiting a CAGR of 5.3% during the forecast period. Asia Pacific dominated the reduced iron powder market with a market share of 60.00% in 2025.

Reduced iron powder is a highly pure form of iron produced through the direct reduction of iron ore using gases such as hydrogen or carbon monoxide. It is widely used in powder metallurgy and chemical manufacturing due to its excellent compressibility and sintering ability. This market is growing steadily, driven by increased demand for lightweight, high-precision components and the rise of additive manufacturing. Producers are placing greater importance on research to innovate and advance sustainable and cost-effective production techniques, which is expected to boost market growth. Increasing product demand from the automotive, chemical, and electronics industries will significantly drive market growth.

The companies leading the market include JFE Steel Corporation, CNPC POWDER, INDUSTRIAL METAL POWDERS INDIA PVT.LTD., Höganäs AB, and Luode Powder Metallurgy Factory.

GLOBAL REDUCED IRON POWDER MARKET TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 326.7 million

- 2026 Market Size: USD 343.5 million

- 2034 Forecast Market Size: USD 521.1 million

- CAGR: 5.3% from 2026–2034

Market Share:

- Asia Pacific led in 2026 with a 60% share, rising from USD 194.4 million in 2025 to USD 205.1 million in 2026.

- By application: The Powder metallurgy segment dominated due to high sintering efficiency and strength in automotive and electronics.

- By end-use: The Automotive sector led the market with rising demand for lightweight and high-precision components.

Key Country Highlights:

- China: Largest producer and consumer, driven by strong automotive and manufacturing industries.

- India: Rapid industrialization and infrastructure expansion are boosting demand.

- Japan: Focus on precision engineering and advanced manufacturing.

- U.S.: Increasing adoption in aerospace and additive manufacturing applications.

- Germany: High use in sustainable automotive and machinery production.

REDUCED IRON POWDER MARKET TRENDS:

Growing Product Usage in Welding Applications Can Offer New Market Trends

The product is increasingly utilized in welding electrodes and brazing alloys due to its excellent reduction properties and high purity. It enhances arc stability, weld strength, and bonding in joining applications. As construction and heavy engineering industries expand globally, the demand for high-performance welding materials is also rising. The trend is especially prominent in Asia Pacific and the Middle East, where rapid urbanization and infrastructure projects are underway. Asia Pacific witnessed a growth from USD 204 million in 2023 to USD 209.4 million in 2024.

MARKET DYNAMICS

MARKET DRIVERS:

Increasing Product Demand from Automotive Sector Boosts Market Growth

The automotive industry is a major driver of the market due to its extensive use of powder metallurgy components. As automakers increasingly focus on producing lightweight, high-strength, and fuel-efficient vehicles, the product has emerged as an important raw material. It is used in sintered parts such as gears, bearings, and structural components, which offer superior dimensional accuracy and cost savings compared to conventionally manufactured parts. Hence, increasing product demand from the automotive industry is expected to drive the reduced iron powder market growth in the coming years.

MARKET RESTRAINTS:

Environmental Concerns Related to Traditional Manufacturing Methods Could Limit Market Expansion

Significant restraint in the reduced iron industry is the environmental concerns regarding traditional methods of producing the powder. Traditional manufacturing processes of making the product involve using carbon-rich reducing agents or fossil fuels, which emit significant amounts of harmful gases such as carbon dioxide. These emissions lead to air contamination and contribute to climate change, raising regulatory issues over the industry’s environmental footprint. Moreover, this type of production process generates heat and potentially harmful waste byproducts that must be managed responsibly.

MARKET OPPORTUNITIES:

Expansion in Chemical and Water Treatment Applications Could Bring Opportunity for Market

The significant opportunities in the reduced powder industry lie in the growing chemical and water treatment industries. In chemical processing, iron-based powder catalyzes various reactions. Its high surface area and reactive nature make it particularly effective for chemical applications. Additionally, in environmental engineering, the product is increasingly being used for groundwater remediation and wastewater treatment. As governments and industries place greater emphasis on environmental sustainability and stricter water quality standards, the demand for effective and reasonable treatment solutions is growing.

- According to the Development Aid article, in 2022, 42% of household wastewater was untreated, which means 113 billion cubic meters of water will go back into the environment, which is polluted. Around 4.4% of the world’s population in low-and middle-income nations do not have access to drinking water; this creates a better opportunity for the reduced iron powder industry as it is used in the treatment of wastewater.

MARKET CHALLENGES:

Instability in Raw Material Prices Could Pose a Challenge to Market

One of the significant challenges faced by the market is the volatility in raw material prices, especially iron ore and energy sources. Since the production of reduced iron powder heavily relies on high-purity iron ore and consistent energy supply, any fluctuation in these input costs directly affects overall production expenses and, ultimately, the profitability of manufacturers. Geopolitical tensions, supply chain disruptions, export restrictions, and market assumptions often cause unpredictable hikes in raw material prices.

Trade Protectionism

Trade protectionism has a notable impact on the market. Countries, including the U.S., have imposed anti-dumping tariffs on certain imports, including metal powders, to protect their domestic industries. These tariffs can affect the global flow of the market, potentially disturbing supply chains and driving up costs. Furthermore, such trade policies can influence the competitive landscape in various regional markets.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

Powder Metallurgy Segment Leads Market Due to Its High Sintering Efficiency

Based on application, the market is classified into powder metallurgy, welding, chemical synthesis, filtration, and others.

The powder metallurgy segment holds the largest reduced iron powder market share due to its high sintering efficiency. This method involves compacting iron powder into desired shapes and heating it to form solid parts without melting it. It is favored for producing structural components such as gears, bushings, and bearings due to its strength and wear resistance. Automotive, machinery, and consumer electronics sectors heavily utilize powder metallurgy for cost-effective and lightweight part production.

The product plays a crucial role in the welding industry, particularly in shielded metal arc welding and submerged arc welding. It is used in the formulation of welding electrodes to stabilize arcs, improve deposition rates, and enhance the mechanical strength of welds. The use of iron powder in welding electrodes ensures deeper penetration and better fusion between the base materials.

The product is also an effective reducing agent and catalyst in various chemical synthesis processes. Its high reactivity and surface area enable it to participate in reactions such as the reduction of nitro compounds to amines, a vital step in producing dyes, agrochemicals, and pharmaceuticals. The chemical industry relies on its ability to maintain stability under different processing conditions, enhancing safety and efficiency.

Reduced Iron Powder Market Regional Outlook

By region, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific:

Asia Pacific Reduced Iron Powder Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 194.4 billion in 2025 and USD 205.1 billion in 2026, driven by fast industrialization and strong manufacturing bases in countries such as China, India, and Japan. China, being the largest maker and consumer of the product, significantly influences global demand, particularly in sectors such as automotive, construction, and electronics. Additionally, India’s growing infrastructure projects and expanding industrial base contribute to increased demand for welding and powder metallurgy applications.

North America:

North America remains one of the important regions in the market due to its advanced manufacturing sector, which heavily relies on precision engineering and high-quality materials. The U.S. and Canada, in particular, have well-established industries in aerospace, automotive, and electronics, where the product is essential for powder metallurgy and additive manufacturing applications.

Europe:

Europe has seen an increasing demand for reduced iron powder, particularly in industries such as automotive, machinery, and environmental technologies. European manufacturers highlight sustainability, which makes the product an ideal material due to its recyclability and low environmental impact. The region’s robust automotive sector, especially in Germany and France, utilizes the product in powder metallurgy to produce durable parts, including gears and bearings.

Latin America:

Latin America includes countries such as Brazil and Mexico, experiencing slow but steady growth in the market. The region benefits from the ongoing industrialization and the adoption of cutting-edge technologies in manufacturing.

Middle East & Africa:

As global trade continues to expand, countries in the Middle East & Africa are increasingly turning to sustainable materials, including reduced iron powder, which are cost-effective and environmentally friendly. Heavy investment in infrastructure and industrial diversification is driving the product demand.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Positions in Market

The market for reduced iron powder is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include JFE Steel Corporation, CNPC POWDER, INDUSTRIAL METAL POWDERS INDIA PVT.LTD., Luode Powder Metallurgy Factory, and Höganäs AB, among others. These companies compete based on product innovation, cost efficiency, and regional dominance as the automotive and electronics industries are growing. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY REDUCED IRON POWDER COMPANIES PROFILED:

- JFE Steel Corporation (Japan)

- CNPC POWDER (Canada)

- INDUSTRIAL METAL POWDERS INDIA PVT.LTD. (India)

- Khorasan Powder Metallurgy Company (Iran)

- Luode Powder Metallurgy Factory (China)

- SLM Metal Private Limited. (India)

- Höganäs AB (Sweden)

- LWPM Co., LTD. (China)

- Shanghai Knowhow Powder-Tech Co., Ltd. (China)

- Sree Metaliks Ltd (India)

KEY INDUSTRY DEVELOPMENTS:

- March 2025: Höganäs AB and Porite TAIWAN Co., Ltd announced a strategic partnership to advance their sustainable manufacturing practices. As part of a partnership agreement, Höganäs will supply Porite TAIWAN Co., Ltd, its newly developed near-zero sponge iron powder, a product designed to achieve minimal carbon emissions during its production and lifecycle.

- May 2023: Sree Metaliks Ltd announced that it is doubling its iron ore mine production capacity from 0.702 Mt to 1.50 Mt to meet the increasing demand.

REPORT COVERAGE

The global reduced iron powder market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market over the forecast period. It offers information about key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and a number of reduced iron powder manufacturers in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.3% from 2026-2034 |

|

Unit |

Value (USD Million) Volume (Kilotons) |

|

Segmentation |

By Application and Region |

|

By Application |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 326.7 million in 2025 and is projected to reach USD 521.1 million by 2034.

In 2025, the market value stood at USD 37.7 million.

The market is expected to exhibit a CAGR of 5.3% during the forecast period of 2026-2034.

The powder metallurgy leads the market by application.

Increasing product demand from the automotive sector is expected to boost market expansion.

JFE Steel Corporation, CNPC POWDER, INDUSTRIAL METAL POWDERS INDIA PVT.LTD., Luode Powder Metallurgy Factory, and Höganäs AB. are some of the leading players in the market.

Asia Pacific dominated the market in 2025.

Increasing demand for lightweight, high-performance components for vehicles is one of the factors that is expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us