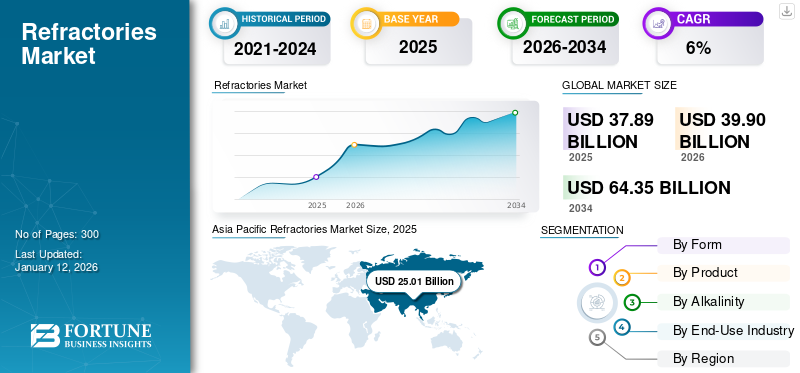

Refractories Market Size, Share & Industry Analysis, By Form (Bricks & Shaped and Monolithic & Unshaped), By Product (Clay and Non-Clay), By Alkalinity (Acidic & Neutral and Basic), By End-Use Industry (Iron & Steel, Non-Ferrous Metals, Glass, Cement, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global refractories market size was valued at USD 37.89 billion in 2025. The market is projected to grow from USD 39.9 billion in 2026 to USD 64.35 billion by 2034, exhibiting a CAGR of 6.0% during the forecast period. Asia Pacific dominated the refractories market with a market share of 66% in 2025. Moreover, the refractories market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 5.18 billion by 2032, driven by the rising demand from the cement & concrete industry for applications in kilns and furnaces.

Refractory products are technically enhanced ceramic materials that withstand extreme temperatures, chemical corrosion, and heavy thermal and mechanical abrasion. They play an important yet often overlooked role in the daily operations of almost every industry by providing mechanical strength, protection from corrosion, and thermal insulation. To develop key manufacturing processes, these products have been essential for various industries, such as iron & steel, glass, cement, other metals, pulp & paper, and petrochemicals.

While refractory product manufacturing is considered an essential service, the supply of raw materials, such as binders and non-clay sand was impacted during the COVID-19 pandemic. Moreover, many companies observed a shortage of employees during the lockdowns, which slightly hindered the market's growth rate. However, the automotive and construction industries are projected to indicate a strong recovery post the pandemic period, and this trend is projected to be followed by the global market during the forecast period.

GLOBAL REFRACTORIES MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 37.89 billion

- 2026 Market Size: USD 39.9 billion

- 2034 Forecast Market Size: USD 64.35 billion

- CAGR: 6.0% from 2026–2034

Market Share:

- Asia Pacific dominated the market in 2025 with a 66% share, rising from USD 25.01 billion in 2025 to USD 26.46 billion in 2026.

- By form, bricks & shaped products led the market due to strong usage in metal and non-metal industries.

- By product, clay-based refractories held the largest share in 2024, supported by low cost and wide availability.

- By alkalinity, acidic & neutral refractories dominated owing to their widespread application in iron & steel and non-ferrous industries.

- By end-use, the iron & steel industry accounted for the largest share, while the non-ferrous metals segment is projected to hold 10.5% of the market in 2024.

Key Country Highlights:

- China: Major contributor in Asia Pacific due to dominant iron & steel and cement industries.

- India: Rapid infrastructure development and demand for steel and cement fuels market expansion.

- United States: Market projected to reach USD 5.18 billion by 2032, driven by demand from kilns and furnaces in the cement & concrete sector.

- Germany: Growing automotive and glass industries sustain strong demand for advanced refractories.

- Brazil & Mexico: Cement and steel sectors support steady growth in Latin America.

- Middle East & Africa: Rising chemical and mining activities are pushing refractory demand across the region.

Refractories Market Trends

Recycling of Refractories to Foster Market Development

The need for recycling refractory products is increasing owing to the rise in the cost of raw materials, and environmental regulations have obliged companies to look for sustainable alternatives for refractory applications. Taxes on emissions and landfill sites are also being imposed, and tax benefits are introduced to boost the waste recycling efforts by various companies. Hence, the recycling of refractories reduces the production cost for the manufacturers, thus offering lucrative growth opportunities. Asia Pacific witnessed a refractories market growth from USD 22.54 billion in 2023 to USD 23.64 billion in 2024.

Download Free sample to learn more about this report.

Refractories Market Growth Factors

Focus on Infrastructure Development by Developing Countries to Provide Growth Opportunities for Market

The rising population, especially in developing countries, such as China, India, and Brazil, has prompted their governments to focus on development for providing safer housing, infrastructure, and related facilities. The infrastructure development activities have increased the uptake of products, such as cement, glass, steel, and other non-metallic minerals. These products require refractory during the manufacturing process, which is heat-intensive in nature. Thus, as the demand for these products is projected to expand in the future, the growth of the refractory industry is expected to mirror this swelling demand.

Government initiatives to understand the importance of the product for making steel and cement have significantly changed the mindset of market players. Moreover, incentivizing the market will develop the local capabilities to manufacture refractories to meet the growing demand. Additionally, China and India are some of the fastest-growing economies globally; increasing demand for travel requires constant development of the transportation infrastructure in these countries.

RESTRAINING FACTORS

Carbon-Intensive Manufacturing Process to Create Environmental Concerns and Increase Implementation of Regulations

The U.S. has introduced regulations for the disposal of waste created from refractory and guidelines concerning the use of these materials to encourage recycling of chrome-based refractory, which are in high demand in the iron & steel industry. Similarly, projects, such as the Review and improvement of testing Standards for Refractory products (ReStaR) in Europe, are being executed to ensure the accuracy and reliability of the current testing standards for refractory in the region. Such stringent environmental regulations and rules on the use of refractory materials are expected to hinder the refractories market growth.

Refractories Market Segmentation Analysis

By Form Analysis

Bricks & Shaped Segment Holds the Largest Market Share Due to Strong Demand from Key Industries

Based on form, the market is classified into bricks & shaped and monolithic & unshaped. Bricks & shaped segment accounts for the largest share of 55.14% the market in 2026 on account of heavy requirements of such products from the metal and non-metal industries. Refractory bricks and blocks are refractory shapes that are stacked to form insulating furnaces, boilers, or other thermal process vessel walls. Typically, refractory bricks are cemented together with refractory mortar. Refractory shapes also include catalyst supports, which often consist of porous structures with large surface areas, or honeycomb structures that hold a metal catalyst, providing easy exposure to a stream of reactive gases or other reactants.

Similarly, the monolithic & unshaped market segment is expected to gain a significant share during the forecast period owing to higher demand for forming linings inside the reactors, wherein the positioning of shaped refractories is difficult due to space restrictions.

By Product Analysis

Low Cost Features Helps Clay Segment Dominate Market

Based on product, the market is divided into clay and non-clay. The clay segment accounts for a larger market share of 62.18% in 2026 due to its lower price compared to the non-clay section. Fireclay bricks and insulation products are made of clay materials and are heavily consumed by iron & metal product manufacturers. Furthermore, raw materials for the production of refractory clay products are easily available, which will strengthen this segment’s market dominance.

Specific production processes are relatively corrosive due to strong acids and bases, which will drive the market for non-clay refractory products. They offer superior resistance to corrosion compared to their regular clay counterparts.

By Alkalinity Analysis

Backed by Large Demand, Acidic & Neutral Segment to Gain Market Share During Forecast Period

Based on alkalinity, the market is categorized into acidic & neutral, and basic. Acidic & neutral segment holds the largest share of 69.1% in 2026, the market as the demand for these materials is expanding at a considerable rate. Acidic refractory is a type of refractory material with silica as its main component. Acidic refractory material can resist acid slag erosion, but it can easily react to alkaline slag erosion in high-temperature environments. As the properties of acidic refractory are quite different from those of basic refractory, the acidic refractory material uses are also different from those of basic refractory.

Basic refractories are those that are attacked by acid slags but stable to alkaline slags, dusts, and fumes at high temperatures. Since they do not react with alkaline slags, this refractory is quite important for furnace linings where the environment is alkaline, such as during steelmaking operations.

By End-Use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Iron & Steel Segment to Lead Market Due to Wide Applications

In terms of end-use industry, the market is segmented into iron & steel, non-ferrous metals, glass, cement, and others. The iron & steel industry is one of the largest consumers of refractory materials worldwide. the market is segmented into iron & steel with a share of 58.92% in 2026. From primary to secondary steel-making processes, a diverse range of vessels exist for the major units, such as the blast furnace and electric arc furnace, and the more maintenance-intensive components, such as launders, tapholes, and submerged entry nozzles. Moreover, the refractory lining is replaced periodically, every 30 minutes to two days, in the various steps of the steel manufacturing process, thus resulting in such heavy consumption from the iron and steel industry, driving the growth of the segment.

Refractories are the main building materials for glass furnaces. It has a decisive impact on the quality of glass, energy consumption, and the cost. The development of the glass melting technology mainly depends on the production and quality of refractory. The selection of the refractory is the most critical aspect of building a glass furnace, as the furnace's lifespan depends directly on the refractory quality. AZS (Alumina Zirconia Silica) is the main structural refractory material used in glass furnaces since it is not easily wetted by molten glass and has low reaction with them. The expanding glass industry due to the switch from plastics to sustainable solutions is driving the demand for refractories. The non-ferrous metals segment is expected to hold a 10.5% share in 2024.

REGIONAL INSIGHTS

In terms of region, the market is segmented North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Refractories Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the global market in 2024. China held a major refractories market share due to higher demand from the iron & steel industry. China and India are the world’s leading manufacturers of cement and cement-based products. The region is experiencing high demand for cement due to the rapid expansion of the building & construction industry. Additionally, both countries are major exporters of cement globally. The Japan market is valued at USD 3.19 billion by 2026, the China market is valued at USD 16.08 billion by 2026, and the India market is valued at USD 2.78 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is a well-established market for refractory. Rising demand for applications in iron & steel, construction, energy, and chemical industries is creating lucrative opportunities for manufacturers to gain a competitive edge in this market. The U.S. market is valued at USD 3.61 billion by 2026.

Europe

In Europe, refractory plays the triple role of providing mechanical strength, protection against corrosion, and thermal insulation. They are adapted to each specific application through fine-tuning and careful choice of raw materials and processing. This, along with the major presence of the automotive industry in the region, is creating significant growth opportunities for the refractories market. The Germany market is valued at USD 1.05 billion by 2026.

Middle East & Africa

The market in the Middle East & Africa consists of rich oil-producing and mining countries that have doubled their demand for refractory in the past few years. This trend is expected to continue during the forecast period as well. Moreover, this has boosted the expansion of the chemical industry, which also uses refractory for solution erosion areas in chemical furnaces.

Brazil and Mexico

Brazil and Mexico currently hold prominent positions in cement and steel production, respectively. They are expected to showcase promising growth as the end-use industries are increasing their focus on Latin America’s emerging economies. Thus, the market in this region is expected to show steady growth during the forecast period.

List of Key Companies in Refractories Market

Key Players to Expand Their Market Share with Acquisitions and Capacity Expansions

This market is fragmented, with many global and local players operating in the market. To gain a competitive edge in the market, companies are continuously investing in emerging and developed economies to launch new products, expand their production capacities, collaborate with distributors, and engage in strategic acquisitions. However, increasing the production capacity to reach the maximum number of consumers and cater to diversified applications is the primary strategy being adopted by most players in this industry. Companies such as Imerys, Intocast Group, and Posco Chemical are heavily investing in strengthening their capabilities and enhancing their market positions.

LIST OF KEY COMPANIES PROFILED:

- Saint-Gobain (France)

- Imerys (France)

- RHI Magnesita (Austria)

- POSCO Future M Co., Ltd. (South Korea)

- KAEFER SE & Co. KG (Germany)

- Beijing Lier High-Temperature Materials Co., Ltd. (China)

- HarbisonWalker International (U.S.)

- Intocast Group (Germany)

- Alsey Refractories Co. (U.S.)

- Magnezit Group (Russia)

- Vesuvius (U.K.)

- Puyang Refractories Group Co., Ltd. (China)

- Refratechnik Holding GmbH (Germany)

- Ruitai Materials Technology Co., Ltd. (China)

- Plibrico Company, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023 – INTOCAST AG announced its decision to acquire EXUS Refractories S.p.A, an Italy-based company. This acquisition will help the company strengthen its portfolio of refractory products.

- April 2023 – RHI Magnesita announced its plans to acquire the U.S., India, and Europe operations of Seven Refractories, a specialist supplier of non-basic monolithic refractory with a recorded revenue of USD 110 million and PBT of USD 12 million in 2022. The company has a vast portfolio of various end-use applications across the global market. This acquisition will bring innovative product categories and technological advancements to deliver a major change in consumer offerings.

- February 2023– Vesuvius Group announced its plans to invest USD 61 million to expand its refractory manufacturing bases across India within three to five years. These investments will bring a 35% increase in the company’s monthly production capacity with the expansion of its plant at the Taratala unit in Kolkata.

- October 2022– Imerys announced that it would be expanding its production volume, R&D, and sustainability efforts in its manufacturing plant at Visakhapatnam, Andhra Pradesh, India. The company planned to expand its manufacturing capacity from 30,000 to 50,000 tons by 2030. It also continued to invest an additional USD 1.4 million in streamlining its operations to produce the Secar 71. This investment aimed to increase the production of calcium aluminate binder due to the increased demand for this material from the Indian refractory and construction sites.

- September 2021– Plibrico Company, LLC announced its decision to complete the acquisition of Redline Industries, Inc., a leader in manufacturing innovative products to safeguard furnaces in high-temperature processing and promote higher energy efficiency. This acquisition was expected to support the customers with trusted refractory solutions and allowed Plibrico to expand its product portfolio in the competitive market.

REPORT COVERAGE

This research report provides both qualitative & quantitative insights of the market. Quantitative insights include market sizing in terms of value (USD billion) and volume (kiloton) across each segment, sub-segment, and region profiled in the scope of the study. Also, it provides market analysis and growth rates of segments, sub-segments, and key counties across each region. Qualitative insights cover the elaborative analysis of key market drivers, restraints, growth opportunities, and trends related to the market. The competitive landscape section offers detailed profiling of the key players operating in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Volume (Kiloton), Value (USD Billion) |

|

Growth Rate |

CAGR of 6.0% from 2026 to 2034 |

|

Segmentation |

By Form

By Product

By Alkalinity

By End-Use Industry

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 37.89 billion in 2025 and is projected to reach USD 64.35 billion by 2034.

The global market is expected to record a CAGR of 6% during the forecast period.

The iron & steel segment is expected to be the leading segment in this market during the forecast period.

The increase in demand for metals and glass from various end-use industries is the key driving factor of the market.

Asia Pacific held the highest market share in 2025.

Saint-Gobain, Imerys, RHI Magnesita, POSCO Future M Co., Ltd., and KAEFER SE & Co. KG are the key players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us