Graphite Market Size, Share & Industry Analysis, By Product (Synthetic and Natural), By Application (Refractories, Foundries, Batteries, Friction Products, Lubricants, Recarburizing, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

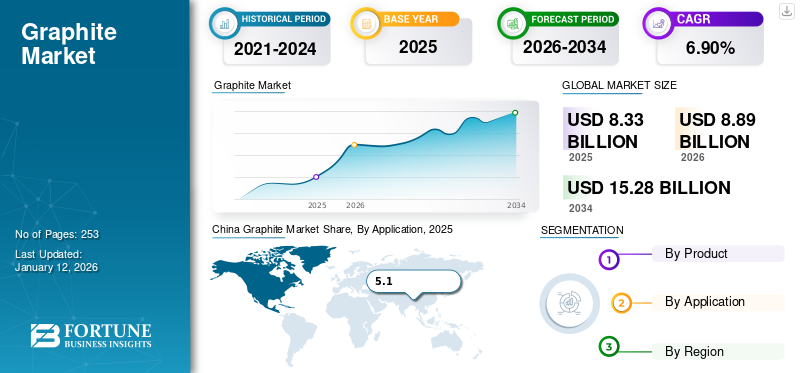

The global graphite market size was valued at USD 8.33 billion in 2025. The market is projected to grow from USD 8.89 billion in 2026 to USD 15.28 billion by 2034, exhibiting a CAGR of 6.90% during the forecast period. Asia Pacific dominated the graphite market with a market share of 56% in 2025. Moreover, the graphite market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 1,964.7 million by 2032, driven by the surging demand from battery-powered vehicles.

Graphite is a lightweight, naturally soft element with metallic and nonmetallic properties, making it ideal for various industrial applications. Its metallic properties include high thermal and electrical conductivity. In contrast, nonmetallic properties include inertia, high resistance to chemicals, corrosion, and temperature, and excellent cleavage and lubricity. With a melting point of 3,927°C, it is used in applications that require high-temperature environments. Owing to its high melting point, it is used to manufacture materials for high-temperature environments, such as kilns, incinerators, reactors, and blast furnace linings. Its high utilization in refractories and the surging demand for Electric Arc Furnaces (EAF) are expected to drive the market growth during the forecast period.

The outbreak of the COVID-19 pandemic served as a significant challenge for the industry in 2020 as supply chains were disrupted due to trade restrictions, and consumption declined due to lower demand from end-use industries. Major end-use industries, such as automotive, refractory, steel, and metallurgy, faced a similar supply chain crisis due to the pandemic. Moreover, several players in the sector reported struggling to keep their operations running. Supply chain disruptions caused by lockdown restrictions forced market players to reduce production or shutdown their manufacturing facilities. In addition, several industries suffered from labor scarcity, resulting in delays in manufacturing and massive losses.

Due to low demand from end-use industries, the market faced a significant decline in year-on-year growth in 2020. However, post-COVID-19, the market witnessed a quick recovery owing to the momentum of electric mobility. Moreover, demand from the foundry and steel industries has aided in market recovery after the relaxation of lockdowns.

Global Graphite Market Overview

Market Size and Forecast:

- 2025 Market Size: USD 8.33 billion

- 2026 Market Size: USD 8.89 billion

- 2034 Projected Market Size: USD 15.28 billion

- CAGR (2026–2034): 6.90%

Market Share:

- Asia Pacific Market Share (2025): 56%

Regional Highlights:

- Asia Pacific: 2025 Market Size: USD 4.69 billion

- North America: U.S. graphite market projected to reach USD 1.96 billion by 2032, driven by surging demand from electric vehicle (EV) battery production.

- Europe: Investments in synthetic graphite and anode production (e.g., Talga’s commercial battery anode plant in Sweden) are boosting regional competitiveness.

- Latin America and Middle East & Africa: Supportive government initiatives like Saudi Vision 2032 and Brazilian battery supply chain expansion contributing to demand.

Graphite Market Trends

Trend of Battery-Powered Vehicles to Impel Market Growth

Graphite is a solution in the automobile industry for manufacturing lithium-ion batteries, which are used to fuel new-generation electric vehicles and increase energy density while reducing charging times. It is also used to make thermally conductive polymers, which are used to replace metal in manufacturing automotive components. As per the sales data released by the International Energy Agency, the electric vehicle industry has witnessed quick growth in the past five years, expanding annually at 50%. Momentum toward clean energy has propelled humongous investments in the automotive industry electrification.

A lithium-ion battery is the heart of the electric vehicle, offering the required energy to drive it. The product is a necessary ingredient in the lithium-ion battery, and its demand is expected to rise in the coming years in line with the adoption of electric vehicles and lithium-ion battery applications.

Download Free sample to learn more about this report.

Graphite Market Growth Factors

Increasing Demand from the Refractory Industry to Propel Growth

The refractory industry is the largest end-user owing to the product’s extreme resistance to heat or higher temperatures, accounting for almost half of global demand. The steel industry is the primary market for refractories made from natural products. The refractory industry uses it to create products for high-temperature conditions, such as linings for kilns, incinerators, reactors, and furnaces. It is used in electric arc furnaces and simple oxygen furnaces, linings in limonite smelting, and crucibles in steel, non-ferrous, and precious metal processing, and in refractories, such as magnesia-carbon, alumina-carbon, and alumina-magnesia-carbon. Moreover, the steel industry is on the trajectory to become a carbon-free industry. In this transition, electric arc furnaces will play an essential role as they produce very low carbon emissions compared to traditional steel production methods. In electric furnaces, this material is a key component in the making of electrodes, which is poised to drive demand over the forecast period.

It has emerged as the best material for different applications in the automotive industry, such as to produce lithium-ion batteries and automotive components. Furthermore, the product has excellent lubricating properties and is widely used in the manufacturing of lubricants for the automotive industry. Therefore, rising applications of the product in the automotive industry are anticipated to present lucrative opportunities for graphite market growth.

RESTRAINING FACTORS

Increased Export Duties May Hinder Market Growth

Increasing demand from the refractory industry and skyrocketing demand from the battery industry are creating a supply crisis, pushing different countries worldwide to consider securing their requirements. As a result, major economies across the globe are securing their requirement of this mineral by increasing export duty on it, which is adversely affecting the supply available to the dependent countries. For instance, there is an increase in export duty on the product in China, which is stifling the market's growth by limiting the availability outside the country to promote domestic demand. For example, the tightened export controls by China have forced South Korea, which is highly dependent on imports, to secure alternative supplies of minerals for Electric Vehicle (EV) batteries. The steel industry has urged the Indian government to impose a 40% export duty on electrode refractories, one of the most essential raw materials, to boost domestic production and lower costs.

Therefore, increasing export duties by different countries, trade wars among major economies across the globe, and measures to secure domestic supply are anticipated to restrain industry growth.

Graphite Market Segmentation Analysis

By Product Analysis

Synthetic Segment Dominated Owing to High Temperature and Corrosion Resistivity

Based on product, the market is segmented into natural and synthetic.

The synthetic segment accounted for the largest graphite market share with 78.87% in 2026. This material is made from high-purity carbon and is known for its resistance to high temperatures and corrosion. These properties make this product an excellent choice for highly specialized industries requiring predictable carbon material results. As a result, the synthetic segment is poised to maintain its dominance throughout the forecast period, owing to vast adoption among consumers.

Natural product is a crystalline form of the element carbon, which consists of stacked graphene layers. It is one of the most stable forms of carbon under standard conditions found in natural deposits. The natural products are generally found in flake, amorphous, and vein. The refractory and automotive industries are the largest purchasers of this form of the product. This mineral type is expected to grow substantially owing to its increasing consumption in the automotive and refractory industries.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Refractories Segment Dominates Owing to Product’s High Melting Point

By application, the market is classified into refractories, foundries, batteries, friction products, lubricants, recarburizing, and others.

Due to the product’s high melting point, the refractory industry remains the largest consumer with 46.12 % in 2026. The rapid industrial development and increased demand from industries such as automotive, building, aerospace, and metal manufacturing, among others, are leading to the expansion of the refractories segment.

The batteries segment holds the second-largest share of the global market and has emerged as the fastest-growing application. This segment is also expected to grow at a double-digit CAGR by 2032. Massive growth is anticipated due to the rising demand for Lithium-ion Batteries (LIB). These are some of the most common rechargeable batteries for portable electronic devices and are characterized by high energy density, limited memory effects, and low self-discharge.

Apart from batteries, the product is consumed as a recarburizer for the carburization of steel and cast iron, which has driven its demand in 2023. Owing to the moderate demand for recarburizing from mechanical engineering applications, this segment is set to grow at a CAGR of 4.4% from 2024 to 2032.

Other uses include lubricants, such as oils, greases, and fluid dispersions in manufacturing and consumer applications. In addition, it finds application in molded products for the automobile, aerospace, electronics, and industrial machinery industries, in friction materials such as brake pads and clutches for the automotive and aviation sectors, and building materials.

REGIONAL INSIGHTS

By region, the market is segregated into Europe, North America, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific

Asia Pacific Graphite Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in the Asia Pacific stood at USD 5.3 billion in 2026 and is identified as the dominating region in the global market. Sales in the region are primarily driven as it is the hub of many industries where the product is utilized. In addition, it is the production hub of steel, lithium-ion batteries, and automotive. The product is highly consumed in these three industries. It makes up for more than 50% of the regional consumption, making Asia Pacific the most lucrative market. In the region, China registered the largest share in 2024, owing to the huge presence of steel and battery production plants. The Japan market is projected to reach USD 0.76 billion by 2026, the China market is projected to reach USD 3 billion by 2026, and the India market is projected to reach USD 0.53 billion by 2026.

Europe

China Graphite Market Share, By Application, 2025

To get more information on the regional analysis of this market, Download Free sample

Several graphite and battery manufacturers invest in strategic initiatives to improve their production capability. For instance, in August 2021, Vianode established its industrial pilot in Kristiansand, Norway, with an annual production capacity of 200 tons of battery-grade synthetic graphite. In June 2023, Talga, a battery material developer, received an environmental permit for its commercial battery anode plant in Lulea, Sweden. The efforts mentioned above are expected to enhance the overall value chain of the European market, creating lucrative opportunities for manufacturers. The UK market is projected to reach USD 0.22 billion by 2026, while the Germany market is projected to reach USD 0.48 billion by 2026.

North America

North America is also planning to expand its battery production capacity, which is slated to cause the market growth to flourish. The U.S. market is projected to reach USD 1.36 billion by 2026.

Middle East & Africa and Latin America

The Middle East & Africa and Latin America markets are anticipated to expand moderately during the forecast period. Saudi Vision 2032 and other significant efforts by the Brazilian government to expand its battery production capability are poised to result in additional demand in the market.

List of Key Companies in Graphite Market

Key Players Leverage Collaborations to Expand Their Footprints

AMG, Asbury Carbons, EagleGraphite, Grafitbergbau Kaisersberg GmbH, BTR NEW Material Group Co., Ltd., Imerys S.A., Nacional de Grafite, SGL Carbon, and Mineral Commodities Ltd. are identified as prominent manufacturers in the global market study. Major players have used a variety of strategies to expand their footprints in this sector, including new product releases, alliances, collaborations, and acquisitions, which are some of the prominent strategies. Companies such as SGL Carbon, EagleGraphite, and Imerys are involved in some of the strategic activities mentioned above.

LIST OF KEY COMPANIES PROFILED:

- AMG (Germany)

- Asbury Carbons (U.S.)

- Eagle Graphite (Canada)

- Grafitbergbau Kaisersberg GmbH (Austria)

- Imerys S.A. (France)

- Stoker Concast Pvt. Ltd. (India)

- BTR NEW Material Group Co., Ltd. (China)

- Nacional de Grafite (Brazil)

- SGL Carbon (Germany)

- Mineral Commodities Ltd. (Australia)

- Superior Graphite (U.S.)

- Tirupati Carbons & Chemicals Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Graphite One Inc. Company announced that the company’s wholly owned subsidiary, Graphite One (Alaska), Inc., was awarded USD 37.5 million in technology investment agreement grant by the U.S. Department of Defense (DoD). Through this investment fund, DoD is planning to build the necessary production capacity and supply of graphite materials to meet the growing demand for graphite battery anodes for electric vehicles and other energy storage applications.

- June 2023: Superior Graphite, one of the leading manufacturers, announced its plan to construct a new anode materials facility with an investment of USD 180 million. The move will enable the company to meet the rising demand for its product from electronic vehicles and energy storage industries in Europe and North America.

- March 2022: EagleGraphite announced its partnership with British Columbia to develop silicon-modified battery anodes made with high-performance graphite from the company. The company issued USD 290,000 for the project.

- October 2020: Imerys announced plans to increase synthetic graphite production at its Bodio plant in Switzerland to satisfy growing demand from the lithium-ion battery market in Asia, Europe, and North America.

REPORT COVERAGE

An Infographic Representation of Graphite Market

To get information on various segments, share your queries with us

The research report provides detailed market analysis and focuses on crucial aspects such as leading companies, products, and applications. In addition, it provides quantitative data regarding volume and value, market analysis, research methodology for market data, insights into market trends, and highlights vital industry developments and competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.90% during 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kilotons) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 8.33 billion in 2025 and is projected to reach USD 15.28 billion by 2034.

Growing at a CAGR of 6.90%, the market is expected to exhibit rapid growth during the forecast period (2026-2034).

By application, the refractories segment leads the market.

Refractory and lithium-ion battery industries are poised to act as a growth engine for the market expansion.

Imerys S.A., SGL Carbon, AMG, Nacional de Grafite, and Mineral Commodities Ltd. are the top players in the market.

The trend of vehicle electrification is poised to create remunerative opportunities for the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic